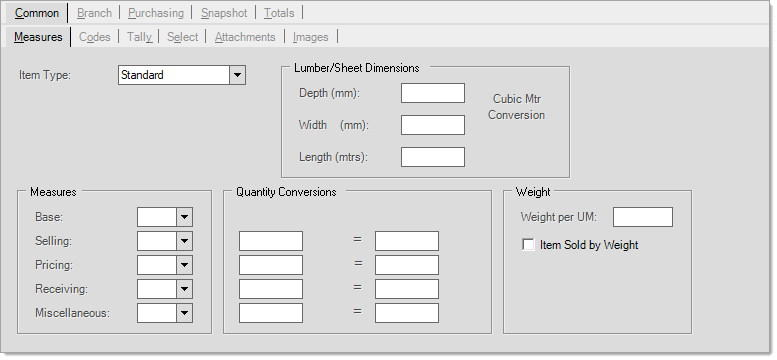

Common > Measures

The Measures (ALT-M) tab is used to select the item type, dimensions (when applicable), and measures to be used with the item (as well as their numeric relationships).

Lumber (or Timber)/Sheet Dimensions

For some item types, dimensions are used to calculate volume or area based measurements such as either board or square footage (or the metric equivalents for these). These dimensions are used for determining default measures for Lumber/Timber, Hardwoods, and Sheet Goods type items, but are also used for volume or area calculations in some other areas as well. If dimensions are not specified, volume or area measurements won't be applied or considered for the item in many areas (purchasing adjustments can be applied by volume and some documents record volume/area totals if dimensions are present). If you plan on or would like to use any volume or area based measurements, it's best to populate the dimensions for items where appropriate.

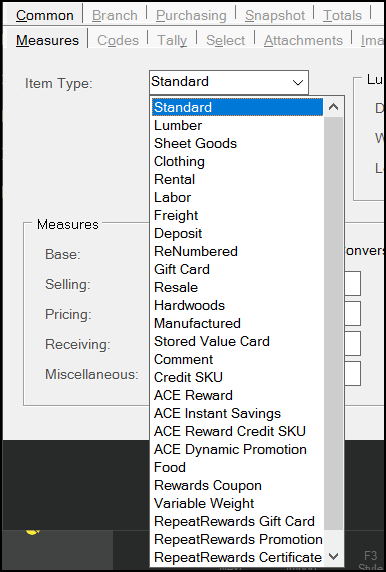

Item Types

Begin by selecting an item type from the drop down. Types can alter the functionality of the item and may disable/enable certain fields and options found on the Item Maintenance form.

Click on the links (when available) to read more about a particular type. Each item type can have many variations based upon the settings a user selects. For example, a "standard" item might be stocked and track on-hand quantities, but another "standard" item might instead be non-stocked, require description entry, and not track on-hand.

Item Types (Aggregator Item Type is Not Shown)

Item Types

Every item added to inventory is assigned a "type." The type usually indicates some sort of functional difference. Item type must be the same across all branches for the same item. Some item types require enabled parameters to display in this list:

Standard

The standard type is used for any item that does not require use of another of the listed types and is the most common type used. It's important to realize that "standard" items can have many variations. Other item settings can change the function of a "standard" item in significant ways. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Standard" type items have an ItemType value of zero (0).

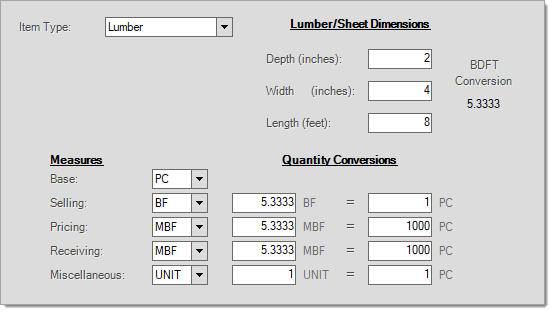

Lumber

This type can be used to designate products classified as Lumber (US/CA) or Timber (UK). Lumber/Timber items provide access to the depth, width, and length fields for calculating board-footage (or cubic metre in the UK). Board Footage (US/CA) and Cubic Metre (UK) are volume-based measurements that consider 3 dimensions unlike the "sheet goods" item type that measure just area (width x length). Default units of measure can be defined for use when adding new lumber and timber items. These defaults are located in the Code Definitions database (Inventory area) on the Units of Measure tab. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Lumber" type items have an ItemType value of one (1).

Sheet Goods

Sheet goods are typically sold by area rather than volume. In Canada and the United States, square footage is used rather than board footage. In the United Kingdom, square metre (meter) would be used. You can enter width for sheet goods items, but it is not considered when making area calculations. Default units of measure can be defined for use when adding new sheet good items. These defaults are located in the Code Definitions database (Inventory area) on the Units of Measure tab. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Sheet Goods" type items have an ItemType value of two (2).

Clothing

In some areas, clothing items may be non-taxable either all the time or during specified time periods (such as "tax free weeks"). This type can be used to separate these items from other inventory making global changes and reporting easier. Note: setting an item to a "clothing" type does not alter taxable status or any other settings automatically.

In the United States, a "clothing exempt" check box is located on the Sales Tax Maintenance form that indicates whether the tax location levels are clothing exempt or not (this is by level because clothing may be exempt at the state level but not county, for example). This setting is not available for use in the UK or Canada. In most cases, the clothing items remain "taxable" in Item Maintenance, but are treated as exempt due to the "clothing exempt" check boxes found on the Sales Tax Maintenance form. If, in your area, clothing items are always exempt and you don't have to report them separately, you can just make the items "taxable=N" in Item Maintenance. The clothing distinction is more for use in areas where the tax status of clothing changes (tax free weeks) or where clothing items are partially taxable (tax free at the state but not local levels, for example).

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Clothing" type items have an ItemType value of three (3).

If you need the total sales for clothing items, you can use the Sales Tax Inquiry. Standard sales tax reports don't include clothing sales. Typically,

Rental

A rental-type item is used with the standard Rental feature If used with the standard application rental feature, you may define many different rental products. Rental products can be assigned rates on the Branch and Pricing tabs. These items must allow returns (see the Branch and Codes tab) and track on-hand (see the Common and Codes tab). Please see the rental help topic for further information regarding Item related settings.

When used with the Enfinity by Solutions software, there is typically one generic rental item. This item can be given any code (SKU). Users don't enter or select the "rental" item, so there's no need for this item to be easy to remember, but it's probably best to distinguish it from other items so that it isn't used accidentally outside of an actual rental transaction. The rental item is automatically associated with the selected rental ticket when using the Import (F3) function and selecting Rental Contract in Point of Sale, Sales.

If the Commission Inquiry is used, this type of item is considered an "adjustment item" and is backed out of the adjusted subtotal and adjusted total cost.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Rental" type items have an ItemType value of four (4).

Labor

This item type may be used by companies wanting to use an item to track labor charges. Adjustments can be used in place of an item to add labor charges to most Point of Sale transactions.

If the Commission Inquiry is used, this type of item is considered an "adjustment item" and is backed out of the adjusted subtotal and adjusted total cost.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Labor" type items have an ItemType value of five (5).

Freight

This item type may be used by companies wanting to use an item to track freight charges. Adjustments can be used in place of an item to add freight charges to a sale, order, etc. When using an item for freight or other non-inventory purposes, it's important to realize that the item may be treated like any other inventory item on reports, etc. Item types don't typically modify other item settings automatically.

If the Commission Inquiry is used, this type of item is considered an "adjustment item" and is backed out of the adjusted subtotal and adjusted total cost.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Freight" type items have an ItemType value of six (6).

Deposit

This item is used for tracking deposits and is usually linked with another item; however, there is no restriction on using them independently. A common example of how this item type would be used is bottle deposits. If your company sells beverages, a deposit item would be useful for tracking the amount of bottle deposits collected. This item type may also be used along with the standard application's Rental feature.

A deposit item can be automatically associated with another item by designating the deposit item as an "Add-on SKU" item (this is found on the Branch and Codes tab in the Item Maintenance database form).

A deposit may not involve sales tax. If no tax is charged, the deposit item would need to be set up as a non-taxable item. Consult the tax departments in your area regarding any sales tax rules that may apply.

If the Commission Inquiry is used, this type of item is considered an "adjustment item" and is backed out of the adjusted subtotal and adjusted total cost.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Deposit" type items have an ItemType value of seven (7).

ReNumbered

Non-stocked or manufactured non-stock items generate a unique item when placed on an order or purchase order. When an item has been generated in this fashion, the type is modified to "renumbered."

Users cannot designate an item as "renumbered" manually. Non-stocked items remain a "renumbered" type until they are sold. After sale, the type on the renumbered item is modified to "resale" (see "resale" below). This is done because, after being sold, an assumption is made that any further activity for the specific non-stocked renumbered item would be limited to a return. Renumbered items may not be sold unless linked with a customer order.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Renumbered" type items have an ItemType value of eight (8).

Gift Card

To use "gift cards" as a payment method during sales, one or more "gift card" items are required. All gift card items should be placed in a unique group. Financially, this group will then be defined using detailed mapping for the various inventory sales types (cash sales, charge sales, exempt sales, etc.) ensuring that sales of the card are mapped in the ledger to a gift card account (typically a liability type).

If the Commission Inquiry is used, this type of item is considered an "adjustment item" and is backed out of the adjusted subtotal and adjusted total cost.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Gift Card" type items have an ItemType value of nine (9).

Resale

Resale type items are special orders that were received and then either not sold to the intended customer or were returned. A company may decide to keep such items and attempt to sell them to another customer.

The "resale" type is automatically assigned to "renumbered" items after they have been sold. New resale items may not be added nor can existing items be modified to the resale type manually.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Resale" type items have an ItemType value of ten (10).

Hardwoods

This item type is used for items classified as "hardwoods" which are typically exotic or less common woods sold in smaller quantities to hobbyists, woodworkers, etc. These items are sold in increments of board feet. Only a depth dimension is allowed for Hardwoods items (defaults to widths of 12" and lengths of 1'). Quantity Conversion values may not be manually set on hardwood type items. Use either the lumber or sheet goods types for any items requiring more flexible measurements and dimensions. Hardwoods items function similar to a tally item during Point of Sale use allowing quantity, length, and width entry.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Hardwoods" type items have an ItemType value of eleven (11).

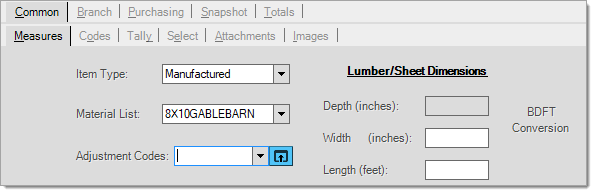

Manufactured

A manufactured item type is the output product of manufacturing. Manufacturing involves removal of "use" items (either from inventory and/or goods special ordered from a vendor) and applying expense-type adjustments such as labor to the price of the goods. The end result is some new product that can be sold. What this end "product" of manufacturing winds up being is extremely flexible.

Manufactured items may be either stocked or non-stocked; however, there are some functional differences between the two (discussed more below). In addition, a "manufactured" type item may optionally be linked with a "material list." This list may contain "use" items, comments, prompts, and lists (of items, comments, and/or prompts) relevant to manufacturing.

With release 12 (January 2017), we have added the ability to create and associate a list of adjustment codes with a manufactured SKU so that adjustments can be considered when ordering and pricing a manufactured product at Point of Sale.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Manufactured" type items have an ItemType value of twelve (12).

Stored Value Card

Stored Value Cards are gift cards but they are managed by an outside source (such as an affiliated co-op or supplier). For example, Do it Best Corp. has a stored value (gift card) program that may be used with what we refer to as "stored value cards." What we refer to as "gift cards" would instead be cards that your company manages internally, not via a 3rd party, hence the distinction.

If the Commission Inquiry is used, this type of item is considered an "adjustment item" and is backed out of the adjusted subtotal and adjusted total cost.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Stored Value Card" type items have an ItemType value of thirteen (13).

For more information about stored value cards, please click here.

|

Stored Value Cards are a type of gift card that are managed by an outside source (such as an affiliated co-op or supplier). For example, Do it Best Corp. has a stored value (gift card) program that may be used with what we refer to as "stored value cards." What we refer to as "gift cards" in the Help and application are cards that your company manages internally, not via a third party, hence the distinction.1 This same item type is used for True Value® gift cards. Please use the ACE Gift Card item type for ACE Hardware Corporation's gift cards, not "stored-value." ACE brand gift cards can be activated without integrated card processing. If your company uses a stand-alone terminal to do card activations, you should use a standard item type instead of the stored-value type (the item should be non-taxable and you might consider using either the miscellaneous description option or tag ID (serial number) features to record the card number being activated).

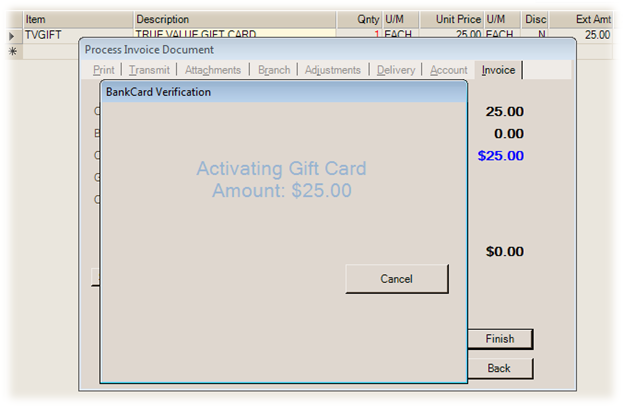

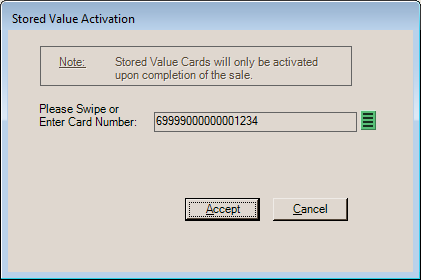

These cards operate similar to a credit card in a number of ways: •Stored Value Card balances are maintained by a third party provider company, not our software. •Stored Value Cards must be authorized during sale by some third party in order to be activated and hold a balance. •Stored Value Cards are used like a credit card and must be authorized electronically during sale; however, there are differences. It is common that a specific processor be required by the company issuing the card (RBS must be used for Do it Best® gift cards, for example). This is important since your company must select one card processor if you integrate card processing with the software. •Stored Value Cards do not usually have a preset dollar amount. •True Value Gift Cards have a minimum activation of $5.00. If testing gift card functionality, only amounts equal to or greater than $5.00 will result in a successful activation. Other providers may also have minimum and maximum limits. 1This topic does not refer to Do it Best Private Label Credit Cards. These are credit cards that are processed via a specific and different processor and not considered a "stored value" gift card. There is currently no specific function to handle these types of card other than standard credit card processing IF your selected processor accepts these cards. Requirements & SetupThere are some conditions to using a stored value type card with the application. Credit Card Processing Software First, because this type of gift card must be processed by a third party, it's treated similar to a credit card in regard to processing. If your company is not already processing stored-value cards from the application, your company must implement integrated card processing. For Do it Best gift cards, VeriFone PAYware Connect™ transaction bundle and TSYS Cayan are supported. For True Value gift card processing, TSYS Cayan is required. The card device (if any), PC, and PAYware Connect web server handles the all transmitting and authorizing of transactions between your company 's selected card processor. Important! Verify that your selected card processor accepts your stored value cards, not all processors do (RBS can be used for Do it Best gift cards, for example). Item Setup Just as with gift cards managed locally, stored value cards use a special item type. In this case, the type is named "stored value card," not "gift card." This item can be given any item SKU. There's no need to specify pricing; however, gift cards are usually non-taxable. You may also want to consider them non-discountable (net) so that gift card sales aren't eligible for statement discounts, etc. Stored value cards are not considered inventory, so they are typically mapped to different accounts than your inventory would be. Doing this requires that the item be placed in a unique product group so that detailed mapping with the proper accounts can be specified for the item. If this is not done, gift cards will be treated as "inventory." Gift card sales are typically backed out of sales totals so that they aren't reflected more than once. Gift cards and stored value cards are considered tender amounts and sales are recorded once the card as payment. Activation Activation requires integrated card processing with Verifone (PAYware or Verifone Point) or TSYS Cayan, and the Point of Sale station must have a supported card device. TSYS Cayan is required for True Value gift card processing. For Do it Best gift cards, you must be using either Verifone PAYware Connect or TSYS Cayan. There are two dialog boxes that might appear when attempting to sell a stored value card depending upon whether or not your company has integrated card processing. For companies that do not have integrated card processing, the following dialog appears:

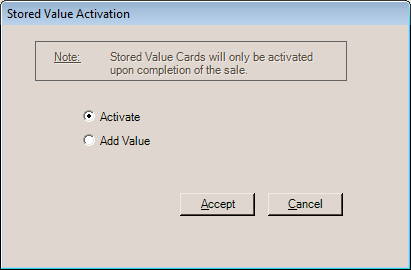

Stored Value Activation (Card Entry) Validation on the card number entered is performed only in this first case (above). With integrated card processing, and a stored-value type item is entered into a Point of Sale, Sales transaction, a different dialog appears asking whether the card is being activated or re-charged (add value). Choose the proper action and then select Accept to continue. Cards are not activated until after any tender amounts are processed. If the stored-value card is being paid for using another card, the card transaction paying for the gift card will be processed first (before the stored-value card is activated) to ensure payment. Even if a cashier chooses "activate" and the card already holds a value, the card's existing value will be added to during processing.

Stored Value Activation Once tender is processed, the message "Activating Gift Card Amount" will be presented to the cashier. The card device will prompt for the card to be swiped.

Once the card is swiped, it will be activated. The card device may display the amount of the card at this time. Card Numbering In some cases, rules apply to stored value card numbers that do not apply to self-managed gift cards. Certain types of cards may be activated without integrated card processing. For companies using integrated card processing to activate cards, this logic is not applied. These rules do not apply to True Value gift cards being processed with TSYS Cayan, for example. Otherwise, for a "stored value" card number to be considered valid, the card must meet any of the following rules: •The card's "number" is 16-characters in length and the card number falls between "6034110000000000" and "6034119999999999." •The previous condition was not met, and the card's "number" is 19-characters in length, is numeric, and the number begins with the following digits: 60357101. •None of the previous conditions were met, and the card's "number" begins with "6034" or "6035," the length of the card's number is greater than 5-characters, and the fifth character is an "X" or the sixth character is an asterisk (*). Indicates a masked card number. •None of the previous conditions were met, and the "ALLGIFTCARDS" argument is present. This treats all card numbers as valid. This can be applied system-wide upon request. Please contact support if needed. Returning a Stored Value Card In cases where a stored value card has been sold and is being returned, you can do the following: 1.Use the "Check Balance" option found on the Process (F12) form to check the card's balance to make sure it hasn't been used. Write down the remaining amount. 2.From the Point of Sale, Sales transaction sell a non-taxable miscellaneous item. 3.Set the item's unit price to match the remaining amount on the card. No tax should be involved. 4.Process the Sale using the stored value card as the tender method (processed using the Bankcard method). 5.Return the same miscellaneous item for the same amount (negative quantity in the Sales data grid). 6.Process the return/refund sale using the same method of payment as the original stored value transaction (cash, bankcard, etc.). In some cases, you may need to return cash. For example, if the stored value card was paid using a debit card, you won't be able to credit that card. |

Comment

Comment items are used when an item code should prompt for a text description/message. When used in a transaction, comment items prompt the user with a text input box on a separate form. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Comment" type items have an ItemType value of fourteen (14).

Credit SKU

This item type was intended to be used for rewards coupons (Do it Best® Rewards to be specific) but is also used with the standard promotions feature. Coupons can be linked with specific items (which may have a barcode or alternate SKU assigned) and amounts. In the case of Do it Best Rewards, the coupon items may be added automatically by EDI processing and may require a rewards ID be associated with the customer or transaction. The taxable status of these items determines whether the coupon affects the taxable total of the transaction.

Taxable = Y

The coupon item won’t change the tax calculated for the transaction, similar to the “manufacturer” coupon option on the Process form. In this case, it is assumed that your company is being reimbursed for the coupon, so the tax is based on the original taxable amount before the coupon was applied.

Taxable = N

The coupon item will adjust the taxable total and therefore the sales tax calculated for the transaction. In this case, the coupon is treated similar to the a “store” coupon option on the Process (F12) form. It is assumed that the store is not being reimbursed for the coupon, so we handle it the same as a discount regarding sales tax.

*This type is not used with ACE Rewards™. When ACE Rewards is enabled, additional Item Types specific to ACE Hardware Corporation are used instead.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Credit SKU" type items have an ItemType value of fifteen (15).

ACE Reward

Item types used with ACE Rewards™ are only included if ACE Rewards has been enabled in the Parameter settings.

This is an item type that is provided for use with the ACE Rewards™ loyalty program offered by ACE Hardware Corporation. This item type only appears when ACE Rewards has been enabled for your company. EDI with ACE Hardware Corporation is a prerequisite for participation. Dealers must apply for and be accepted by ACE Hardware Corporation prior to participating in the ACE Rewards program. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "ACE Reward" type items have an ItemType value of sixteen (16).

ACE Instant Savings

This is an item type that is provided for use with the ACE Rewards™ loyalty program offered by ACE Hardware Corporation. This item type only appears when ACE Rewards has been enabled for your company. EDI with ACE Hardware Corporation is a prerequisite for participation. Dealers must apply for and be accepted by ACE Hardware Corporation prior to participating in the ACE Rewards program.

Instant Savings (IS) items are used to provide an immediate rebate to customers at Point of Sale. The item represents the dollar amount of the rebate and is triggered by the sale of a specific item. Your company is reimbursed for any Instant Savings.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "ACE Instant Savings" type items have an ItemType value of seventeen (17).

ACE Rewards Credit SKU

This is an item type that is provided for use with the ACE Rewards™ loyalty program offered by ACE Hardware Corporation. This item type only appears when ACE Rewards has been enabled for your company. EDI with ACE Hardware Corporation is a prerequisite for participation. Dealers must apply for and be accepted by ACE Hardware Corporation prior to participating in the ACE Rewards program.

This "Credit SKU" item is used to reduce the amount due on a Sales transaction.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "ACE Rewards Credit SKU" type items have an ItemType value of eighteen (18).

ACE Dynamic Promotions

This is an item type that is provided for use with the ACE Rewards™ loyalty program offered by ACE Hardware Corporation. This item type only appears when ACE Rewards has been enabled for your company. EDI with ACE Hardware Corporation is a prerequisite for participation. Dealers must apply for and be accepted by ACE Hardware Corporation prior to participating in the ACE Rewards program.

There are two (2) types of "dynamic" promotions: 6 and 7. This item type may be used when sales involve either type of promotion.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "ACE Dynamic Promotions" type items have an ItemType value of nineteen (19).

Food

The "food" type item is provided for use in areas where some or all "food" type products are partially taxable. In other words, "food" is taxable at a different rate from other types of products. Use of this item type is not necessary for areas where a food item is either exempt from taxes or is taxable at the same rate as any other product. In these two (2) cases, you can use the "standard" (0) item type with a taxable status of yes, no, or always depending upon the product (in some areas, candy might always be taxable; however, bottled juice is considered a food item and is not, for example).

Food-type items operate the same as the standard item unless a different tax rate for "food" has been assigned to the tax location being used for the Point of Sale transaction. Only in this case are food-type items handled any differently. The food rate must be assigned to each sales tax location that it applies to using the Sales Tax Maintenance form available from the Database menu in the Point of Sale area.

Existing sales tax inquiries and reports do not break-out sales for "food" type items separately. Sales Tax totals and invoice data do record the total food sales by tax location (and invoice). If needed, this information can be obtained by database inquiry or custom reporting. Existing application sales tax reports list sales involving partially taxable food type items under "taxable sales." Additionally, there is no line-item indication on invoice documents that a "food" item was sold at a reduced tax amount. The total tax on the document does reflect the proper tax (as a sum for all items), however.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Food" type items have an ItemType value of twenty (20).

ACE Gift Card

This item type is used exclusively for ACE branded gift cards issued by ACE® Hardware Corporation. For additional information, please see the topic "ACE Gift Cards."

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "ACE Gift Card" type items have an ItemType value of twenty-one (21).

Rewards Coupon

This item type is essentially a type of credit SKU that is used for True Value® coupons and True Value Rewards, but may also be used independently. Coupons can be linked with specific items (which may have a barcode or alternate SKU assigned) and sometimes amounts. There are two (2) types of True Value coupons: standard and limited use. Limited use coupons have to be authorized in order for your company to receive credit and are intended to be used once (per reward's membership). The taxable status of these items determines whether the coupon affects the taxable total of the transaction. For True Value, there is a parameter that overrides the item setting, and if enabled (checked), all rewards coupons will be considered "taxable."

Taxable = Y

The coupon item won’t change the tax calculated for the transaction, similar to the “manufacturer” coupon option on the Process form. In this case, it is assumed that your company is being reimbursed for the coupon, so the tax is based on the original taxable amount before the coupon was applied.

Taxable = N

The coupon item will adjust the taxable total and therefore the sales tax calculated for the transaction. In this case, the coupon is treated similar to the a “store” coupon option on the Process (F12) form. It is assumed that the store is not being reimbursed for the coupon, so we handle it the same as a discount regarding sales tax.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Rewards Coupon" type items have an ItemType value of twenty-two (22). This item type is available in release 12 and later.

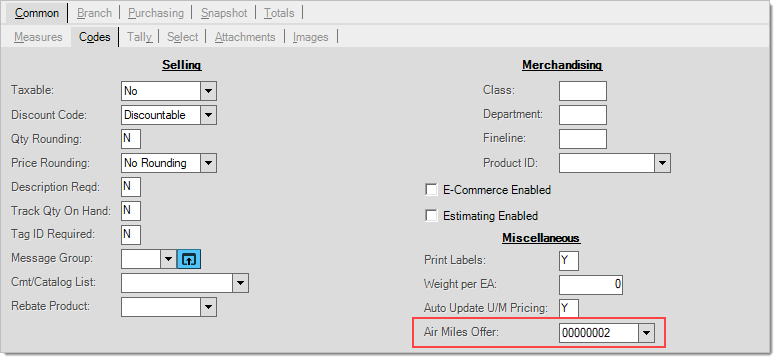

Air Miles Offer

AIR MILES is a points (miles) based loyalty reward program with wide adoption in Canada. Bonus offer codes must be linked to an "Air Miles Offer" type item in order to be applied at Point of Sale. When an item is assigned to the this type, the "Air Miles Offer" drop down control becomes accessible on the Common, Codes tab of the Item Maintenance form. "Air Miles Offer" type items have an ItemType value of twenty-three (23) in the InventoryCommon table. AIR MILES is available with release 1.12.12.x and later.

Variable Weight

Variable weight item types are used for random weight barcode scanning. Random weight barcode scanning is a custom feature where the content of the barcode itself determines the output of the scan into Point of Sale forms, and data grids in general. The application supports the use of UPC-A (12 digits) barcodes for weighted items. Click here to learn more about Random Weight Barcode scan criteria.

In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Variable Weight" type items have an ItemType value of twenty-four (24).

RepeatRewards Gift Card

The RepeatRewards Gift Card is a distinct item type that, when set up correctly, allows you to offer rewards to your loyal customers. You can learn more about this program here. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Repeat Rewards Gift Card" type items have an ItemType value of twenty-five (25).

RepeatRewards Promotion

The Repeat Rewards Promotion is a distinct item type that, when set up correctly, allows you to offer rewards to your loyal customers. You can learn more about this program here. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Repeat Rewards Promotion" type items have an ItemType value of twenty-six (26).

RepeatRewards Certificate

The Repeat Rewards Certificate is a distinct item type that, when set up correctly, allows you to offer rewards to your loyal customers. You can learn more about this program here. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Repeat Rewards Certificate" type items have an ItemType value of twenty-seven (27).

Aggregator

The Aggregator item type allows you to quantify inventory for different purposes. You can learn more about this program here. In the database, the InventoryCommon table contains a column named ItemType that maintains an integer (whole number) value. The integer represents an enumeration (number code) used to indicate the item type. "Aggregator" type items have an ItemType value of twenty-eight (28).

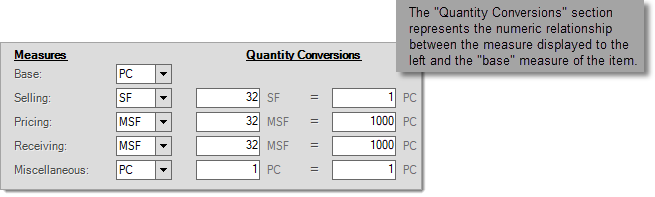

Defining Measures

Measures, or Units of Measure, describe a measurable quality of an item (in this case). Any given item might be measured any number of ways such as by length, volume, or weight. Items have between one and five assigned measures. The first measure, which we refer to as the "base" measure, is used for establishing a numeric relationship between different types of measures. The additional measures may be used to describe either the same measure as the BASE or some other measurable quantity. When an item has only one (1) measure (meaning all measures match the "base" measure), the relationship is 1:1 (one-to-one) for all measure conversions. When any additional measures (other than the "base") exist, you must define a numeric relationship between the other measure and the item's BASE measure.

The additional measures are named: Selling, Pricing, Receiving, and Miscellaneous. For the most part, the way measures are used is fairly flexible; however, certain measures are used for specific purposes. Each additional measure made up of two (2) parts: a text description and a numeric value that relates back to the "BASE" measurement. Measures determine how an item's quantities and pricing will be represented to the user in different activities as well as the numeric relationship between each measurement and the item's base measure. Descriptions (names) for measures are defined under the Inventory area, Database menu, Code Definitions form, and Units of Measure tab. Only previously defined codes may be used when adding or modifying an item (this helps keep measures consistent).

Base Measure

An item's base measurement cannot be directly changed once saved (without merging the item into another SKU), so make sure to choose the best measurement for the BASE measure before saving any new item.

|

It's best to have the BASE be the smallest unit quantity that the item is available to be sold or purchased by. Why? For quantities and pricing, the software maintains decimal values out to 4 decimal places (0.0001), and the BASE unit is used as the basis for most measure conversions. Four decimal places can be less precise when converting a larger figure to a smaller one, so if you are starting with a smaller figure (no decimal places needed), it's easier to convert up and maintain greater accuracy. Unit of measure preferences (under Branch and Codes) allow changes to how units of measures are used in various areas and activities. For example, these settings would allow you to choose one Unit of Measure for quantities at Point of Sale and another measure for quantities used when receiving inventory. |

When adding an item in a branch and that item already exists in another location, the 'base' measures will be set to match each other. This avoids problems when items are transferred or when consolidated purchasing is used.

The BASE unit of measure is used for the following:

•On-hand and other stock related quantities in folders and inquiries.

•Minimum, Maximum, Package Breaks and most other quantities used for Purchasing.

•Usage (quantities sold or used in manufacturing).

•Conversions back and forth between other units of measure.

Since the same measure description may be used more than once for the same item, users should be careful not to enter conflicting numeric relationships. For example, one BOX cannot be equivalent to 50 PC under RECEIVING and at the same time be equal to 75 PC under SELLING (for the same item). As a rule, if the numeric relationship to the base measure is not the same as a prior measure, a new or different measure description should be used.

The default for the BASE unit of measure can be changed from the Code Definitions maintenance form's Unit of Measure tab (for example, if you prefer items to default to EACH instead of PC).

|

Changing the BASE Measure on an Existing Item Direct changes to an item's base unit of measure are prohibited in order to maintain stable numeric relationships between the base and other measurements that may be in place. It is possible to modify the base unit, but to do so involves some work. •First use the Merge/Rename Utility to rename the existing item number. One easy option is to add a digit or character to the end of the existing item number. After this, modify the new item and remove the alternate SKU from the Select tab (Item Maintenance). This is necessary to allow reuse of the original SKU. •Next, create a new item using the original item's SKU. To do this easily, use the Template (F5) function to set the fields based on the renamed item number's setup. Change the Base Unit of Measure to the desired unit of measurement and change Quantity Conversions as needed. •Finally, use the Merge/Rename Utility to merge the original (renamed) item number back into the new item (the one now assigned to the original number). Enter the conversion quantities when prompted. The original item number will now have the desired Base Unit of Measure. Merging combines some information about the items, so there can be a loss of some detail after a merge. Please see the documentation for the Merge/Rename Utility for additional information. |

Selling

The selling unit of measure is intended for use with item prices, but is not necessarily used as a default unless indicated.

Pricing

The pricing unit of measure is used for any pricing designated for the item in the Item Maintenance form. It is also determines how item pricing is reflected in Folders (F4) throughout the application.

Receiving

This unit of measure is the default for quantities on purchase orders and receipts when adding a new item.

Miscellaneous

The miscellaneous unit of measure provides an additional measure if one is needed.

The way measures are used can be adjusted somewhat by using the unit of measure settings found on the Branch > Codes tab. These allow you to change the default unit of measure that is used for specific functions on a branch-by-branch basis. Other settings can sometimes override the default unit of measure such as customer default measure and whether or not unit of measure item pricing is involved.