Sales Tax Maintenance > United States

In the United States, sales tax is typically charged at time of sale by retail-facing companies. Sales tax is also generally required for store-use materials. Tax is generally remitted (paid) on a regular schedule to the state's tax department but usually includes any county or city portion of the tax charged. The Sales Tax Maintenance form is provided for defining sales tax locations which determine how much tax is charged and also for tracking the amount of sales tax charged and/or collected for reporting purposes.

Each tax code you define can be optionally split out using up to three levels (state, county, and city, for example). Despite the fact that levels are provided, tax totals are not maintained independently for the levels. The levels are provided for handling situations such as when a particular type of product isn't taxed the same by all levels. This is useful when the same tax considerations (such as sales tax on clothing) don't apply to both county and state, for example. If you do not need more than one level, just enter the sales tax rate (percentage) as a whole number in the "total percent" input and set the "level 1" percentage to match that amount (at least one level is required).

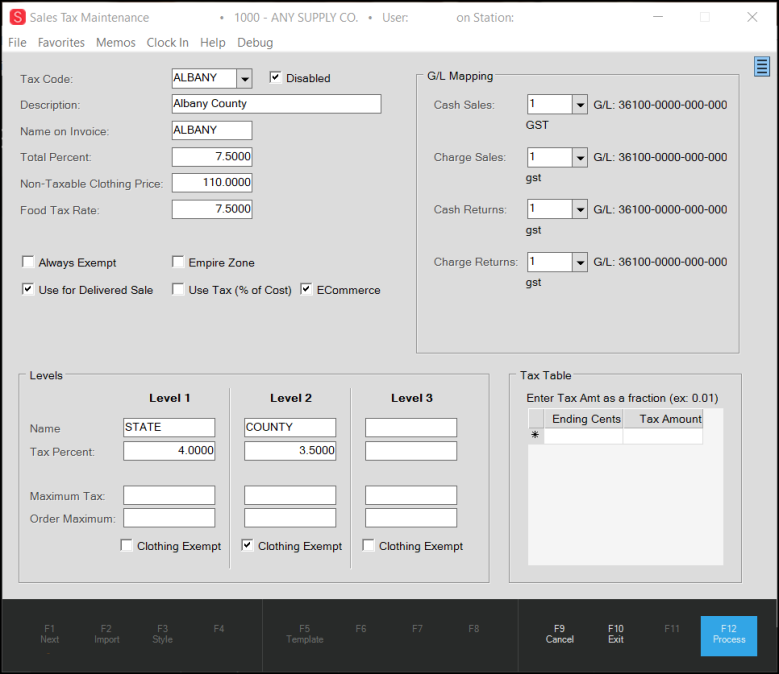

To create a new tax code, from the Main Menu, choose Point of Sale > Database > Sales Tax. The Sales Tax Maintenance form displays.

Complete the settings you need for each tax code as described in the fields below and choose Process (F12) to save them to the database.

Sales Tax Maintenance Form

Tax Code

The tax code is a 6-character code used for selection in transactions and utility forms requiring or allowing assignment of a tax location. Each tax location would have its own unique code. In the United States, each code can have up to three separate levels, such as state, county, and city. Levels have an impact on how tax is calculated; however, they aren't tracked individually in any detail.

Description

This text-area provides a more detailed description for the tax location up to 30-characters.

Name on Invoice

Use this field to enter the name of the tax. The application will print this name on documents that display a tax location. You can enter a name that is up to nine-characters long.

Total Percent

This is the combined percentage including any levels. The actual percentage can vary in certain special cases such as with partially exempt items (clothing and food, specifically). Additionally, if a maximum sales tax amount (cap) is designated for any levels, the tax charged is not necessarily or completely based on a percentage of the transaction total.

Non-Taxable Clothing Price

If clothing is exempt or partially exempt for the sales tax location, this setting can be used to set the retail price at which an individual clothing item is no longer considered exempt. Items with a retail below the price will be treated as clothing exempt (where indicated by the clothing exempt check box on one or more levels). Items that equal or exceed the amount designated would not be considered clothing exempt. In New York State, the cap on exempt clothing is $110.00. So only clothing items that retail for less than $110 would be eligible for the exempt rate in that case. If clothing is exempt in your area but there is no "cap" amount, set the amount to be greater than the highest price clothing item you sell (or just enter a large number, such as $999, assuming you don't sell clothing above that amount).

Food Tax Rate

This is the overall percentage that is to be charged on food type items for this tax location. This is only really necessary if your business operates in an area where food is partially taxable or taxable at a different rate from other types of products. If food is not taxable at all, you can generally just set the food items up as non-taxable via item maintenance. When the sales tax you charge on food is not exempt but is different from the standard tax rate, you can use this field to set that percentage. The "food" tax rate is only applied when selling items that have been assigned an item type of "food."

Always Exempt

Check this box if the tax location is always exempt. This location might be defined for assignment to customers who have tax exempt status at all times. If a customer is assigned a default tax location that is marked as "always exempt," that tax location will be used in all cases regardless of the purchase location or delivery status of the transaction, and the tax amount calculated will always be zero. Otherwise, the tax location is treated as a "zero tax" delivery location, not an exempt tax code (this distinction is necessary because some areas simply don't charge sales tax, so even though they might have a zero tax rate, they are not exempt).

Empire Zone (Economic Development Zone)

"Empire Zones" refers to designated development areas that offer tax breaks to encourage investment, etc. Sales to businesses operating in these areas may be exempt or simply have a lower than normal sales tax rate. If an "empire zone" tax code is assigned to a customer as their default tax location, all sales default to use the assigned tax location (regardless of the delivery status).

Use for Delivered Sale

In some areas, the seller's tax location is used even in the case of delivered sales. In others, the tax location where the goods are exchanged (delivered) is used. This setting determines whether or not this sales tax location, when assigned to an account (or job), is used when processing a transaction that has been designated for delivery.

If this tax location should override the seller's (store's) default tax location in cases when goods are being delivered, check the box. Otherwise, if the branch location's default sales tax code should be used for deliveries instead of this code (when assigned to the customer's account), do not check the box. In cases when no delivery is designated, the store's (seller) location is always used by default and this setting has no effect.

Some other sales tax settings can override this. For example, if you assign tax locations to zip codes and the customer (or job) is assigned to a zip code with an associated tax location, the zip code's tax location will be used when a delivery is designated. The exempt status of the customer can also change how tax locations are used for delivery transactions.

Use Tax (% of Cost)

This setting is used primarily for Installed sales. If assigned to an Installed Sale contract this type of tax code indicates that the sales tax is to be calculated based upon the cost of the materials. Orders and Tickets can sometimes be assigned a "use" tax code, but only when the user processing the transaction has permission to access the installed sale area. When a "use" tax code is assigned to an installed sale contract, it is automatically assumed that any sales tax is already being included in the contract total (not added).*

*The "Tax Included" check box on the Installed Sale contract's Billing tab will be automatically checked and disabled (not allowing changes).

We no longer allow the Use tax setting to be enabled on tax locations that are currently assigned as the default tax location for accounts, jobs, or branches.

ECommerce

Select this check box to apply taxes specific to e-commerce transactions.

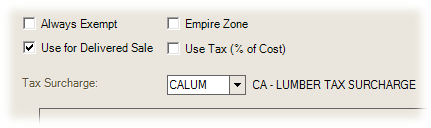

Tax Surcharge

The Tax Surcharge (additional tax) is an optional feature that must be enabled by Support. Unless enabled, this option does not display on the form. Use the drop down control to indicate the (other) sales tax location code that is to be used for items flagged for "additional tax." This feature is optional and is currently used only for companies operating in the State of California in the United States. California charges an additional tax amount on specific lumber and manufactured wood products. When the option is enabled, a check box for "tax surcharge" is provided in both Item Maintenance and the Sales Tax Maintenance form offers a drop down selection for choosing the additional tax location if it applies.

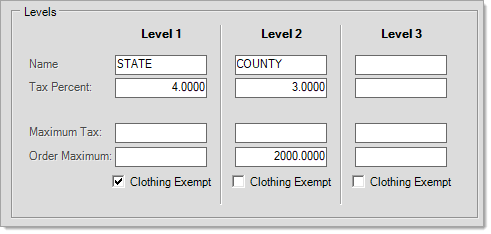

Defining Levels

For this tax code, you can define up to three levels. Even though sales tax is collected as one sum, you may need to pay a number of different government bodies (state vs. county in the United States, for example). Levels allow you to specify the portion (percentage) of the tax you collect to pay each government. There are five fields for each level. The software doesn't require that you define levels, so if there is no breakdown required by law or for sales tax reporting in your area, you can create a single level for the overall tax amount.

Name

Use this field to enter a description for the level. These could be general such as: State, County, and City, or you can be more specific at your company's discretion.

Tax Percent

Use this field to enter the tax rate for the level. Levels are set to the actual rate for the location/level... not a percent of the overall percentage. If the overall (combined) tax rate for this location is 8%, for example, and there are two levels, each might be 4%. Alternatively, one might be 5% and the other 3%. The percentages as a number should add up to the overall tax percent.

Maximum Tax

Use this field to specify the maximum tax charged when there is a cap on sales tax for the particular level. For example, any level may have a tax cap of a set dollar amount. The sales tax is calculated using the other parameters for the level (percentage, etc.), but if that tax amount exceeds the "maximum tax" or cap for the level, the maximum tax amount is used instead. The maximum cap is not applied if a tax table is used.

Order Maximum

Order Maximum is a cap on a sales tax for the particular level. For example, in Florida, some counties have a maximum tax for certain types of purchases; however, the state tax is still required. Tax locations for Florida may therefore require more than one defined level (i.e. State and County). We determine the tax at the customer order level because the tax maximum doesn’t necessarily apply to every order over the maximum. Only orders linked to a tax code with an order maximum will operate differently when they are invoiced.

In the scenario shown below, the local county tax is set at 3% and is only assessed on the first $2000 of the order. For this reason, the customer will be charged a maximum of $60 (3%) for the county portion of the tax even if the order amount is greater than the $2000. This $60 will then be added to the tax calculated for the Level 1 tax which has no maximum in our example.

The state portion of the sales tax is set at 4% of the entire sale total. The county tax is set at 3%, but can only be assessed on the first $2,000 of the sale (3% * 2,000). Therefore, if the sale total was $1500 the tax would be 7% of $1,500 or $105. However, if the sale total was $2,500 the tax would be 4% of $2,500 plus 3% of $2,000 (Order Maximum) or $100 + $60 = $160.

Tax is calculated when the order is created, and applied when the order is invoiced through a sales transaction (F12 Process). The invoice (sale) of the order will use the tax calculated from Point of Sale > Orders instead of the normal logic.

Because the tax is calculated for a specific order, the invoice may not be modified during the sale process. Changes can be made to the order before invoicing if needed. If an invoice does need to be modified after processing (remove or add items, modify price, etc.), the invoice will need to be reversed in full, at which point the order can be modified and re-invoiced if needed.

Clothing Exempt

Use the Clothing Exempt check boxes to indicate whether the sales tax level applies to clothes sales. Clothing Exempt applies to the sale of items with an item type of Clothing that retail for less than the Non-Taxable Clothing Price amount designated for this sales tax location.

The Non-Taxable Clothing Price is a cap amount (per item) for non-taxable clothing sales when clothing sales are exempt for any levels in the tax code (when the Clothing Exempt check box is enabled below a level). For item types of clothing that retail below this amount, no tax will be charged if the Clothing Exempt check box is selected. Any single items exceeding this price amount will be charged sales tax. This is not an overall tax amount cap, but an item-by-item price cap.

For example, clothing items that retail for under $100 may be tax exempt and those over $100 taxable. In this case, the cap would be $100.

G/L Mapping

For the transaction types listed, select the account that sales tax charged to this location should be applied to when General Ledger journal entries are created. Different accounts can be mapped for cash sales, charge sales, cash returns, and charge returns. If specific accounts are not mapped, accounts mapped in the system journal named "Point of Sale" will be used instead.

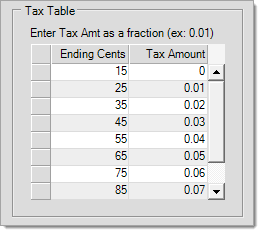

Tax Table

In some cases, sales tax is not calculated as a exact percentage based upon the transaction total. For example, some areas don't charge tax on amounts below a certain threshold and may also determine "break-points" specifying when tax is to be incremented. In these cases, a tax table is used to handle this situation. A tax table cannot be used along with the maximum cap provided with the levels. Tax tables are used first to set the sales tax amount. If no table is defined, we then check the levels for any maximum tax (cap) amounts.

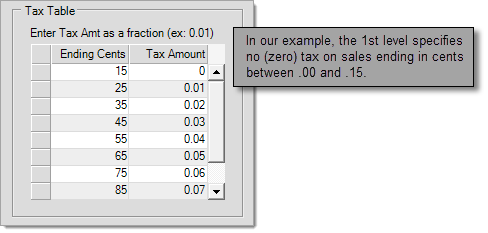

A tax table determines how tax is to be charged on sales amounts both (1) below one dollar/pound ($/£) and (2) between whole dollar/pound amounts. The left-hand column is used for specifying ending cents in ascending increments. Each ending cent/penny point determines when one tax amount (in cents/pence) ends and the next begins (with the following cent/penny or next higher level). The right hand column is used for entry of the tax amount (in cents) charged from the prior break point to the current. Be careful, enter tax amounts as decimals (0.01, for example) not whole numbers or sales tax will not be calculated correctly!

Tax tables can be confusing, so here's a specific example:

1. In most cases, there is a threshold amount for which no tax is charged; therefore, our 1st level is going to specify the maximum ending cents/pence that would not be charged any tax.

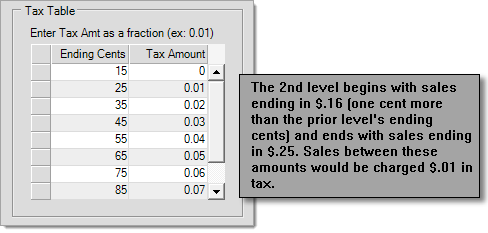

2. The very next level specifies the ending cents for the tax, in cents/pence, specified to the right. The beginning of the 2nd level's tax cents/pence range is one cent more than the prior level's ending cents/pence. Our 1st level's ending cent/penny amount was $0.15, so our 2nd level's range is applied to sales ending in any cent/penny amount between $0.16 and $0.25 (following our example).

3. Each level continues to increment in the same fashion until the maximum of 99 cents/pence ($.99/99p) is reached.

Do I have to use a tax table?

This really depends on the tax laws and rules for your area. Contact your area's tax department to find out. There is no requirement in the application that tax tables be used even if they are required by law in your area.

What if I do not use a tax table?

If no tax table is defined, sales tax is calculated based upon a direct percentage. The tax amounts are rounded to the nearest whole cent/penny.

Disabling a Tax Location

Tax locations may be disabled by checking the Disabled check box and choosing Process (F12). Disabling a tax code prevents the use of the tax location in Point of Sale and also suppresses the printing of the tax location on sales tax reports. If the tax location has activity, it may be best to disable the location after reporting (or manually add the activity when paying sales tax). Sales Tax inquiries and this File Maintenance form may still be used to view or modify a disabled tax location. A user with access to this form may also re-enable a previously disabled location at any time.