General Ledger Overview

The primary purpose of the General Ledger feature is to produce financial statements (reports) for your company. The application uses double-entry accounting standards commonly used by most businesses (or by their accountants). Personnel responsible for the maintenance of the General Ledger don't necessarily have to be an accountant, but an understanding of basic accounting principles is strongly suggested. Training and documentation is available from our company; however, it focuses more on using our application and assumes an understanding of basic accounting on the part of the user. Users who aren't familiar with accounting should seek third (3rd) party training or other resources to learn more. This topic provides some very basic information about General Ledger as implemented in the application as well as some basic accounting.

Maintaining the Ledger

The application creates ledger entries automatically for your company on a daily basis; however, there are other actions your company must take to manage this financial information.

Here are some procedures that your company is responsible for:

-

Initial entry and any later maintenance of the Chart of Accounts.

-

Initial mapping of accounts to System Journals and Detailed Mapping (and maintenance thereafter).

-

Reviewing journal entries for accuracy.

-

Additional manual or recurring journal entries as needed.

-

Posting journal entries to finalize them.

-

Closing Past Cycles (after any and all necessary adjustments)*

-

Running and Reviewing Financial Statements (reports).

Cycle CloseCycles are not closed automatically and can remain open for months and even years (this is not suggested). Leaving cycles open for short periods gives your company time to consult your accountant, make adjustments, and verify posted amounts before closing a cycle. Closing the last cycle of the fiscal year (the adjustment cycle) closes the year; however, this should only be done AFTER year-end adjustments have been posted. New entries cannot be posted to a closed cycle or fiscal year! Eventually, if you have not closed any cycles in a long enough time (2+ years), you will be blocked from posting new journals until some cycles are closed. Fiscal YearA fiscal (financial) year may be different from the calendar year. It is important to note that standard accounting principles (GAAP) indicates that any fiscal year ending or beginning within a given calendar year must be either the same as the calendar year or the next calendar year. For example, you cannot end the calendar year 2019 in 2020. The only fiscal years permitted during calendar year 2020 would be 2020 or 2021, but not any prior year. The software application follows this rule when determining the relative year and cycle for new journal entries. |

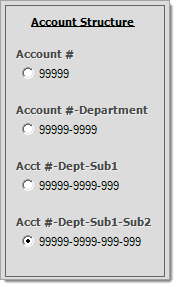

Account Structure

Your company's complete list of accounts is known as the "Chart of Accounts." Accounts are added from the Chart of Accounts maintenance form available from the Database menu in the General Ledger area. Ledger accounts only allow numeric values; however, a text description is provided for each account and is shown anywhere the account is displayed for selection. Four (4) different numbering schemes are available for account numbers. Account structure is determined by a parameter.

Account numbers must be either 5, 9, 12, or 15 digits in length. A company who selects a shorter structure may opt for a longer account number anytime later on if needed; however, once a company's chart of accounts has been set up, account numbers may not be reduced to any smaller size format.

Account (5)

This 5-digit section is the only required "part" of the account number. The first digit may optionally be used for indicating the type of account (asset, liability, etc.). This will only happen if the accounts your company uses establish these limits. Doing so can make account selection easier (type "2" for liabilities if the range for liability account were 20000-29999, for example). Accounts of the same type should be numerically grouped together. Account class (assets, income, etc.), ownership, and finally numbering are all used for determining the order that accounts are listed and how they will appear on financial statements. Numbering alone won't determine or prevent you from adding accounts to a particular class (header); however, it may cause confusion and make selection more difficult if your accounts aren't numerically grouped together by type.

Department (4)

The second 4-digit section is optional and can be used to indicate a branch (store location), group of branches, or some other type of separation. Branch ID codes are limited to 4-characters. If branch codes are numeric, department numbers can be created so that they match the branch code; however, this is optional. Departments don't have to correspond with a branch and you can also have a mix (some that do, some that don't).

Branch accounts can be generated automatically using the Setup Branch Accounts utility available from the Utilities menu in the General Ledger area. If you have multiple locations and are doing branch mapping, you would typically create a "posting" account with a "zero" department ("0000"). The "zero" account would be used for mapping system journals as well as any detailed mapping. These areas provide a "branch" check box to indicate which entries should use "branch" accounts as well as which should not.

Sub1 (3)

This optional section provides an additional three (3) digits for account numbers. It may be useful for product group mapping as one example, or any other time you need an additional layer of account numbering keeping the first two (2) elements the same.

Sub2 (3)

This optional section provides an additional three (3) digits for account numbers. It may be useful for product group mapping as one example, or any other time you need an additional layer of account numbering keeping the first three (3) elements the same.

Posting vs. Summary Accounts

Accounts that can maintain a balance are referred to as "posting" accounts in the application. In addition to "posting," we offer three (3) other types which are provided for summary totals only: header, group, and title. Every account, except the "header" type, must have an "owner" account assigned to it. The owner determines which account summarizes that account's balance (or summary). For example, a header account might be used for all of your asset accounts and would provide a summary total for all posting and other summary types owned by the "header." One "header" might summarize two "groups" (current vs. long term assets, for example)... those groups summarize all of the "title" and "posting" accounts owned by the groups.

•Posting accounts can be summarized by either titles or groups directly, not headers. Header accounts cannot "own" a posting account.

•It is possible to have more than one header per class (assets, liabilities, etc.). For example, you could have one header for "current assets" and another header for "fixed assets" instead of using "groups" for these summaries. Posting accounts cannot be "owned" directly by a "header" type account and financial statements will report the additional headers as separate totals from the other headers. For example, a balance sheet might have more than one total for "assets" that aren't summed due to this.

•Your use of summary accounts will determine how much or little control you have over the output of your financial statements.

•The order of your chart of accounts will be reflected on financial statements unless you design custom reports that override this order.

The following is a simplified example of how header, group, title, and posting accounts might be used when creating a "chart of accounts." Financial statements (reports) provide the ability to include varying amounts of detail; however, this is really dependent on the organization of your "chart of accounts" and use of summary accounts. Summary accounts aren't required except at the top-most levels; however, financial statements won't provide much summary capability if they are not used. The organization of your chart of accounts should match the way you want your financial statements to appear using summary accounts whenever you want a "total" or "sub-total" shown. We do now offer a "custom report" option for the Balance Sheet and Income Statement (P&L) which does allow you to custom design your own statement and totals independent of the chart of accounts.

|

|

10000-0000-000-000 Assets ($1,000,000) (Header - Summary) |

|

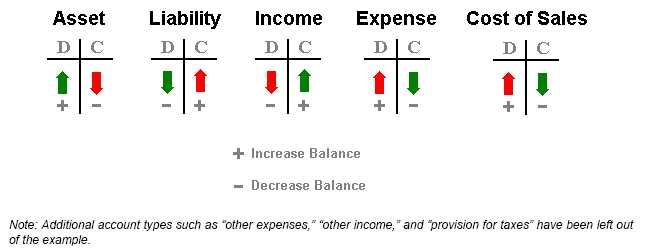

Double Entry Accounting Basics

In standard double entry accounting, accounts are categorized into "types" such as assets, liabilities, income, expenses, and so on. There are ten (10) types available for use in the application (see the listing below).

TypeThe "type" describes the accounting classification of the account. There are a number of account types: asset, liability, expense, income, cost of goods, provision for taxes, owner equity, net income, other expenses, and other income. Each type has particular characteristics and uses from an accounting standpoint. The type determines the type of balance an account holds (debit or credit), for one example. An account's type also determines which financial statements the account appears on. Here are some general descriptions: AssetsAssets represent what your company owns such as cash, inventory, investments, and property. It is also used to record money that is owed to your company (receivables, rebates, etc.). Often, assets are represented as either "current" or "fixed/long-term" assets. Current assets are fluid and typically represent assets that frequently change during a fiscal year. Long-term or fixed assets refer to assets that usually don't change significantly through the fiscal year such as property and investments. Most asset accounts maintain debit balances (balances are increased by debits and reduced by credits). Asset accounts are included on the Balance Sheet, but not the Income Statement (aka. Profit & Loss or P&L). Asset accounts will carry a balance from one year to the next unless adjusted. LiabilitiesLiabilities represent what your company owes such as unpaid purchases (accrual), debt, and deposits collected but not yet applied to a sale. Liability accounts are also commonly grouped into two sub-types: "short-term" and "long-term." Short term liabilities would be those liabilities due within less than one year (utility bills, order deposits, inventory purchases, etc.). "Long term" would usually include those liabilities that would extend beyond the fiscal year such as mortgages and other long-term loans. Liability accounts usually maintain credit balances (balances are increased by credits and reduced by debits). Liability accounts are included on the Balance Sheet, but not the Income Statement (aka. Profit & Loss or P&L). Liability accounts will carry a balance from one year to the next unless adjusted. Owner's EquityOwner's Equity, also referred to as retained earnings, represents the net value of your company and, like net income, is used to balance your assets and liabilities. When journals are posted and the total asset and liabilities don't equal, owner's equity is affected. With release 11.1.0 (January 2016), we made changes so that retained earnings (and net income) can optionally allow branch account mapping; however, this only happens if a company does "manual" posting and does not automatically post journals. In this case, you would need to create department accounts (from the Chart of Accounts maintenance form). In cases where a journal has account entries with departments that are not mapped to a specific branch, the primary account ("0000") department would be used; otherwise, the department accounts would be used. There is usually no need to manually specify the owner's equity entry in journals, it is created automatically when needed. Owner's equity is sometimes manually adjusted when a company pays dividends (also referred to as an owner's draw). Owner's equity (retained earnings) does carry a balance from year-to-year; however, sometimes, companies prefer to move the balance from a "current" year retained earnings account to a "prior" year retained earnings account at the beginning of a new fiscal year. The owner's equity (retained earnings) account is designated via Detailed Mapping. At least one retained earnings (owner's equity) account must be defined and mapped prior to using the ledger actively. Income and Other IncomeIncome and "Other Income" accounts are used for recording revenue your company receives from sales or other reasons. For example, when "cash" is received due to a sale of merchandise, an income (sales) account would be increased as would an asset account for the cash collected. Income accounts typically maintain credit balances. Given our example, the asset account is increased by a debit, and the income account is also increased, but by a credit. Income accounts are not included on the Balance Sheet, but are included on the Income Statement which is also known as a statement of Profit & Loss (or P&L). "Other Income" may be optionally used to separate certain income accounts from others on financial statements. Income-type account balances always begin at zero for a new fiscal year (they do not carry a balance from one year to the next). Cost of GoodsCost of Goods represents the cost of inventory that has been sold, and is used as an offset when "asset" inventory is affected by sales (and returns). This account type is very similar to the "expense" type but only deals with inventory. Cost of Goods accounts usually maintain debit balances (balances are increased by debits and reduced by credits). For example, when a product is sold, your company's inventory is reduced. At this time, cost of sales is increased by the cost of the products you sold (the cost of sales expense is offsets the income received from the sale). Cost of Goods accounts are included on Income Statement (aka. Profit & Loss or P&L), but not the Balance Sheet. Cost of Goods account balances always begin at zero for a new fiscal year (they do not carry a balance from one year to the next). If you plan on comparing your sales and cost of sales from totals and sales reports to the ledger balances, it's best if you establish a separation between the cost of sales for actual inventory from the cost of sales for adjustments and any "items" that aren't recorded as sales (gift cards, for example). Gift cards aren't recorded as "sales" when they are sold; they are only recorded as sales when used as a method of payment. This is necessary so that the later use of the gift card as payment doesn't again reflect as a sale (essentially, the sale would be recorded twice). There are also items that are intended for use as coupons (credit SKUs), deposits, etc. which each should be considered individually and separated as needed. Expenses and Other ExpensesExpense and "Other Expense" type accounts are used for recording costs related to operating your business. This would typically include paying utility bills, rent, postage, office supplies, and payroll as some examples. Expense accounts maintain debit balances, so the account balance is increased by debits and reduced by credits. Expense accounts are included on Income Statement (aka. Profit & Loss or P&L), but not the Balance Sheet. "Other Expense" may be optionally used to separate certain expense accounts from others on financial statements. Expense-type account balances always begin at zero for a new fiscal year (they do not carry a balance from one year to the next). Provision for TaxesThe Provision for Taxes type is similar to the expense type account and is used for recording tax related expenses. Like an expense account, the "provision for taxes" type maintains a debit balance. Provision for Taxes accounts are included on Income Statement (aka. Profit & Loss or P&L), but not the Balance Sheet. Provision for taxes account balances always begin at zero for a new fiscal year (they do not carry a balance from one year to the next). Net IncomeThis is a special type of account. It is used for recording the net difference (if any) between non-balance sheet accounts (expenses, income, etc., but not assets, liabilities, and owner's equity). The net income amount is also referred to as "net profit or loss." With release 11.1.0 (January 2016), we made changes so that net income (and retained earnings) can optionally allow branch account mapping; however, this only happens if a company does "manual" posting and does not automatically post journals. In this case, you would need to create department accounts (from the Chart of Accounts maintenance form). In cases where a journal has account entries with departments that are not mapped to a specific branch, the primary account ("0000") department would be used; otherwise, the department accounts would be used. Net income entries are generated automatically when journals are created (when necessary). Net Income account(s) cannot be entered manually or added to any journal or detailed mapping (doing so can effect the ledger's overall balance). Net income account balances always begin at zero for a new fiscal year (they do not carry a balance from one year to the next). Net income account(s) are designated via Detailed Mapping. At least one retained earnings (owner's equity) account must be defined and mapped prior to using the ledger actively. Note: Search for "Chart of Accounts" and "Detailed Mapping" in the Search field of the Help System to learn more about these features. |

Balance

Accounts within each type (or range) maintain either a debit or credit balance by default (again, standard accounting). For example, asset accounts normally carry a debit balance and liability accounts usually carry a credit balance. When account entries are generated, they must "balance." Balancing means that the total of the debit entries equals the total of the credit entries. The total of all debit and credit entries for the entire Chart of Accounts must also balance (equal). In addition to the entire ledger balancing, balance sheet accounts and the remaining income statement (Profit and Loss) accounts also have a balance that is enforced by automatic entries to either the owner's equity (aka. "retained earnings") or net income accounts. For example, differences in a journal between the assets and liabilities would require automatic entries to the owner's equity account. These entries aren't made until journal entries are finalized by posting.

|

Net Worth As mentioned, both assets and liabilities (including "owners equity" also referred to as "retained earnings") have their own balance requirement. A common financial statement named a "Balance Sheet" is used to compare assets to liabilities. The purpose of this statement is to identify your company's net worth (what a company "owns" vs. what a company "owes"). The owner's equity (retained earnings) account is included on this statement and represents your company's "net worth." When necessary, owner's equity (retained earnings) entries are generated automatically when journals are posted (finalized). If required, the entry represents the difference between the sum of the net assets and sum of the net liabilities. Although all entries in a journal (collection of entries) must balance in total, the total asset vs. total liability entries do not necessarily have to balance. Owner's equity, or retained earnings, is represented on the balance sheet as part of the liabilities total (since it is money that technically is owed to the owner(s) of the company). Some company's do an "owner's draw" to reduce this equity payable to the owners or stock holders each year. The owner's equity account can be used in a manual journal when the only other account in the journal is a "liability." This allows your company to move money from "equity" to pay dividends or take an "owner's draw" from the value of the company. Net Profit or Loss Another common financial statement is a P&L (profit and loss), also called an "income statement" in our application. This statement compares the remaining accounts (those not found on the balance sheet) to determine your company's profitability. These remaining accounts also require their own "balance." When a journal has a difference between the sum of all "income" type accounts and sum of all "expense" type accounts ("cost of goods" is considered a type of expense account), a "net income" account is used to hold the difference and keep that part of your ledger in balance. "Net Income" basically reflects your company's net profit or loss. If income is higher than expenses, you operate at a profit. If expenses exceed income, you operate at a loss. |

Balance sheet accounts (assets, liabilities, and owner's equity) carry balances from year-to-year. All other types of accounts such as income and expenses have their balances cleared automatically at the end of a fiscal year. Your accountant will likely provide other entries that need to be done when ending the fiscal year. Generally, these are made in to the final "adjustment" cycle prior to closing the year and submitting your final financial statements to your accountant.

Examples

Here is a simplified illustration of how double-entry accounting would work for an inventory purchase:

When purchasing inventory your company is increasing what it owns, so a debit is made to your asset account for inventory increasing the balance. The purchase also increases what your company owes (assuming the vendor didn't provide the goods "free of charge"), so a credit entry is made to a liability for accounts payable (increasing the balance). Notice how the debit and credit both increased balances. This is because asset and liability accounts are affected differently by debits and credits.

|

Debits |

Credits |

|

Inventory (

This records the increase to your company's inventory by debiting one or more "inventory" asset account(s). |

Accrual (

Increase to what your company owes for the purchase of inventory by crediting the "accrual" liability account. |

When the vendor bills you company for the purchase, a "payable" is generated. This removes the purchase amount from the temporary "accrual" account and moves it to the "accounts payable" liability account. This results in no change to the overall liabilities total balance. Accrual represents purchases of inventory that have not yet been billed.

|

Debits |

Credits |

|

Accrual (

Decrease to the pending purchases or "accrual" account to record the billing of the purchase. |

Accounts Payable (

Increase to what your company has recorded as billed and due, but not yet paid. |

When paying the vendor for the purchase, your company essentially pays out cash, so an asset (cash in bank) is reduced by a credit. Since your company no longer owes the money, accounts payable (a liability) is reduced by a debit. In the end, your company's inventory has been increased and cash assets have been reduced by the amount paid for the inventory.

|

Debits |

Credits |

|

Accounts Payable (

Once the payable is marked as "paid," the accounts payable liability is debited (reduced) since the payment is no longer outstanding. |

Cash (Bank) (

The payment to the vendor, once cleared, will reduce the amount in your bank account, so the asset account representing this account is reduced by a credit. |

Below is a more complex illustration involving a sale:

A sale will typically have a mix of assets (inventory/cash or receivables, etc.), liabilities (sales tax/order deposits, etc.), income, and cost of goods sold (treated like an expense account). The overall transaction must balance between all debits and credits; however, there may be more or less assets compared to liabilities, or more or less income compared to expenses. When this is the case, retained earnings and net income are automatically affected. Differences between income and expenses increase or decrease net income, and differences between assets and liabilities affect owner's equity.

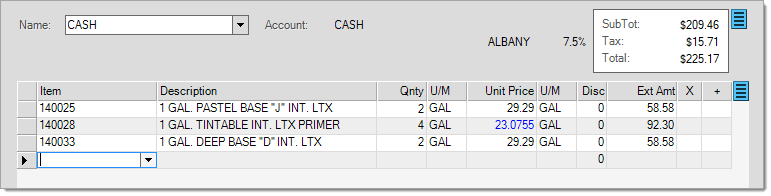

Above, is an example of a cash sale as processed from the Sales transaction in the Point of Sale area. This shows us the items, sub-total, sales tax, and total paid. The cost value of the inventory isn't listed. Below is a summary including the cost...

|

Subtotal: $209.46 (

|

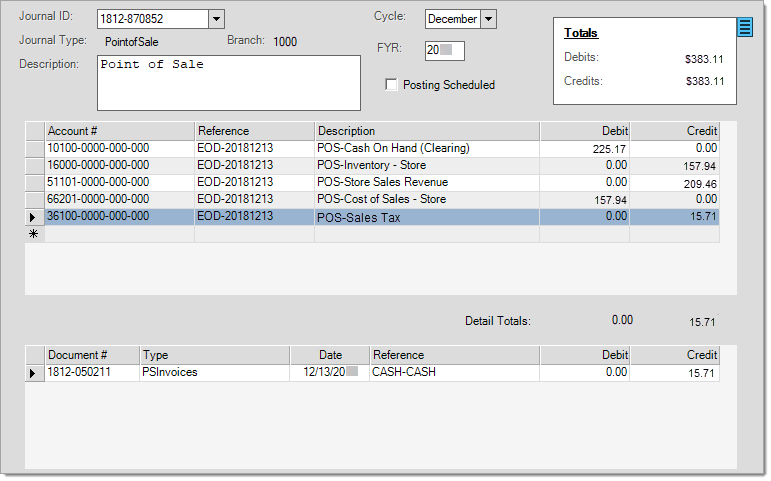

Below is the journal that would be created IF the only transaction for the day was the sale mentioned above (journals combine transactions, so this would normally not happen):

Notice that the total debits and credits match. You should also see that the net assets and liabilities ($49.18) do not balance, nor do the net income and expenses (also a difference of $49.18). When this journal is posted, automatic entries would be made to both the owner's equity (retained earnings) and net income account for $49.18 (in this case, the amount represents profit and an increase in net worth).

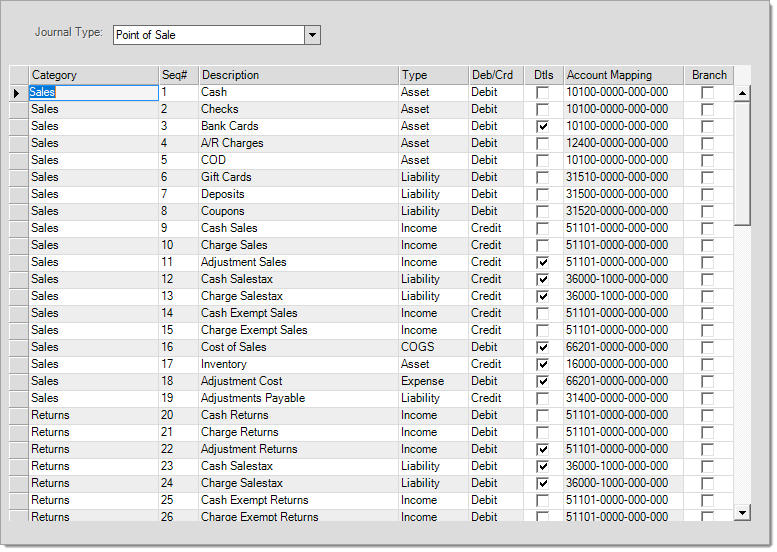

Journals

Account entries are generated daily between business days. These entries are organized into "journals." Each "journal" is a collection of ledger entries which must balance overall (debits vs. credits). Journals represent account entries that have something in common such as the entries created for Point of Sale activity, for example. There are three (3) types of journals: system, manual, and recurring. System journals have standard templates as required by the application. These need to be assigned to appropriate accounts from your company's Chart of Accounts. Manual journals are journals that are entered by hand. Recurring journals are templates that a user can use to make repetitive "manual" journals easier to process. Below is an image showing some of the system journal mapping for Point of Sale transactions.

System Journals designate the accounts used when specific types of transactions are processed. There are currently five (5) system journals: Accounts Payable, Accounts Receivable, Inventory, Point of Sale, and Receiving. These five (5) journals are considered the default mapping for all transactions processed in the software.

When looking at a system journal, a check box designates whether or not the types of entries that can be mapped in further detail (this designation may not be changed by the user, detailed mapping either exists or it doesn't). In these cases, more detailed mapping can be done beyond the default system journal mapping. For example, detailed mapping may be used for mapping inventory activity by product group as well as selection options for receivable adjustments, payments, payouts, and other areas.

The "branch" check boxes can be changed and indicate where your company would like to use branch accounts if they exist. This only applies to companies with more than one location. The accounts mapped to the journal should not be branch specific, however. The same mapping is shared by all branches. Branch accounts are designated by their department code (the second section of the account number). For multi-branch companies, you would need to choose an account format that includes the department section. In addition, department codes and offsets need to be defined for determining which department(s) map to which branch locations.

Setup

The following provides a step-by-step list of the process required to begin using the General Ledger feature with the application. Any setup should be done under the advisement of your trainer. These steps provide a guide as well as some suggestions; however, your process may vary.

|

Important! It is very important to not post (finalize) any journal entries until your balances have been initialized (set) from your prior software or accounting system and the ledger has been carefully reviewed and checked. In addition, you should not close any cycles or do any other operations beyond what's specifically indicated by your trainer until all set up has been completed! |

1.With the assistance of your trainer, complete and/or review the Parameters (settings) for General Ledger. These determine your fiscal year, fiscal year start, current cycle, cycle names, account structure, and department codes. We suggest defining at least one department code even if you don't plan on using departments.

2.Entry of the Chart of Accounts. Depending upon your prior method of accounting, you may need to use different account numbers and use summary accounts to duplicate your previous financial statements.

a.Use your most recent Balance Sheet and Income Statements from your prior system as a guide.

b.Enter summary accounts first in the same order as they appear on your financial statements beginning with the headers then groups and so on.

c.It's best to follow the flow used by the software for classes (assets, liabilities, equity, income, COGS, expenses, etc.).

d.Leave gaps between all account numbers, don't use sequential numbers. This helps provide for any new accounts you may want or need to "insert" in the future.

e.As a suggestion, consider numbering in increments of 10,000's for headers, 1,000's for groups, and 100's for title accounts. All other accounts should be numbered using increments of ten (10) or some other non-sequential increment to provide for future additions.

f.For asset inventory and cost of sales (COGS), you should keep in mind that some "inventory," such as gift cards, are not actual items and aren't recorded as sales. It's best to separate any non-inventory "items" from the rest of your inventory mapping. The same is true for items used for coupons, deposits, and adjustments.

g.For companies with more than one location, it's only necessary to create "0000" department accounts for now. Branch accounts can be added later using the Setup Branch Accounts utility.

h.Use the Account List report to print a copy of your Chart of Accounts. It's also suggested that you run (preview or print) the Balance Sheet and Income Statement with both summary and detail options to make sure your account structure is going to provide the report output you want.

3.Complete the System Journal mapping. This determines the default accounts used when entries are created based on application processing. Be prepared that you may need to add additional accounts to the ledger during this stage. Mapping may be required that would not have been necessary with your prior software or method.

a.It is notnecessary to have a unique account for each mapping selection. It is common that some accounts will be shared. For example, you might map the same account to Cash Sales and Cash Returns (at your discretion).

b.If you are multi-branch, consider what activity if any you want separated by branch. Map the "0000" department accounts rather than specific branch accounts. Use the "branch" check boxes on the System Journal Setup form to indicate which mapping should use branch departments.

4.Review the System Journal mapping and re-check your Chart of Accounts if any changes were made.

5.Complete any Detailed Mapping that is necessary. Minimally, you will need to map the owner's equity (retained earnings) and net income accounts. Canadian companies must also complete the VAT Payable-Purchases detail mapping.

a.If you plan on mapping activity based on (inventory) product groups, you will want to make sure your inventory groups are set the way you want them (if pre-live). If you plan on comparing sales and cost of sales totals and reports to the ledger balances, you should be careful to only include actual inventory in the detailed mapping. Map special item-types such as gift cards (not recorded as sales) to separate accounts that aren't in the same group as real inventory.

b.For multi-branch systems, map the "0000" department accounts rather than specific branch accounts. Use the "branch" check boxes on the Detail Mapping form to indicate which mapping should use branch departments.

c.Offsets for receivables adjustments, inventory adjustments, and miscellaneous payments can be done now or later as needs arise. Detail mapping determines the options users select from when doing this type of processing from the application.

6.Review the Detailed Mapping and re-check your Chart of Accounts if any changes were made.

7.If you are multi-location and want to automatically generate branch accounts, run the Setup Branch Accounts utility for each branch department you've defined. This will add branch (department) accounts for any system journal and detailed mapping options that have the "branch" check box set. Accounts are only added if they don't already exist.

8.Recheck your chart of accounts using the Account Listing report and run the Balance Sheet and Income Statement reports with each summary option and for departments to see the results.

a.When running financial statements for a selection of departments (and not all departments), please be aware that there is no requirement for any "balance" in these cases. The ledger isn't designed to provide "branch" financial statements as if each branch were an independent company, and not all information is separated by branch.

9.Now that all the accounts have been created and mapped to journals and other mapping, it's time to enter the balances from your prior method or system. This is done using the "Initialize Balances" utility available from the Utilities menu in the General Ledger area.

a.Before you begin, verify that the fiscal year (EOY) matches the prior (not the current) fiscal year for your company. Fiscal years may differ from the calendar year, so it's not necessarily the prior "calendar" year.

b.Secondly, verify that the cycle and fiscal year listed above the "Previous Month" column matches the month prior to your live date or whatever other date you decided to enter balances for. If the period is not the prior month, you may need to make additional journal entries to fill in whatever activity occurred in any interim between that period and when you went live.

10.Before doing any posting or closing of cycle, re-run the Balance Sheet and Income Statement financial statements and compare the prior year and prior month figures to the financial reports from your previous method or system. They should match. The Trial Balance report can also be used for checking the balances.