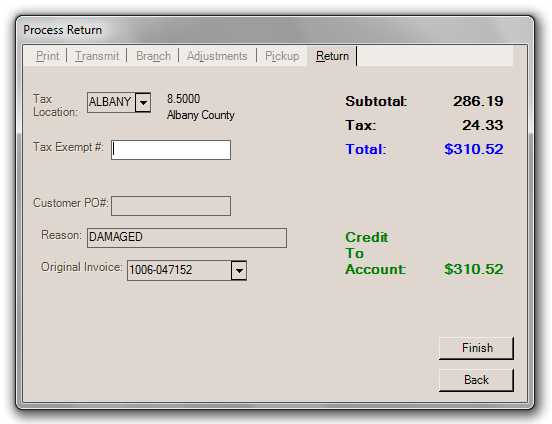

Return

The Return (ALT-R) tab of the process form displays the subtotal, tax, and total as well as the amount being credited to the account. Users may modify the sales tax location if necessary. In addition, an original sale invoice may be selected and a reason for the return designated. Additional fields are included for specifying a tax ID if applicable and customer's PO (purchase order). Canadian users will also see a GST Exempt field.

Charge Returns Processing: Return Tab

Tax Location

The default tax location is the tax location assigned to the current branch; however, if an original invoice is designated, the tax location may change if the original invoice was processed using a different tax location (this might be the case if the original sale was a delivery or originated from another branch in a different tax location).

The process form will use the job's or customer's assigned tax location in cases where the assigned location is flagged as "always exempt" or if the job or customer is also assigned a tax exempt number. The delivery (in this case "pickup") status of the transaction can also cause the tax location to change when a different delivery tax location is specified for the job, customer, or delivery address zip code.

Customer PO#

This field is used for specifying the customer's purchase order if any. Some customers may require that their transactions be linked with a purchase order. A default purchase order may be assigned to accounts and jobs or it may be required for entry at Point of Sale. The customer's purchase order is included on documents when applicable and can be located using search options in the Documents form.

Reason

This text area is provided for entry of a reason for the return. This may default to the return reason for the first returned item on an invoice when applicable (some item types prompt for return information during entry).

Original Invoice

The original invoice, if selected, is included on the document for reference. In the case of an open item account, the original invoice is used when credits are being applied to open items in the Receivables, Posting area. The software will default to apply the credit memo (return) to the designated invoice whenever possible (assuming the original invoice is still an "open" item, etc.). Balance forward accounts don't offer this function because invoice details are not maintained for the purpose of posting.