Miscellaneous Mapping

Accounts Receivable Adjustment Mapping

When someone makes an adjustment to a receivable's (charge) account, you can choose a specific ledger account as the offset to the Receivables asset account. If detailed mapping is not done, the application uses the default accounts mapped in the Receivables system.

Credit Adjustment (Income)This detailed mapping records income (debit) and is used as an offset when credit adjustments are made to your company's Accounts Receivable (A/R) asset balance. One or more asset accounts are used for maintaining the balance of your company's receivables. The overall A/R asset balance is credited (reduced) whenever manual "credit" adjustments are done to an A/R customer's account. When processing a credit adjustment, the user may select the offsetting debit (from this mapping) to be the adjustment based upon the reason for the adjustment. For example, if an A/R customer was charged a finance charge and shouldn't have been, a credit adjustment can be used to remove that charge from their account. In this case, the user would typically select the account used for recording finance charge income as the "debit" offset to the credit adjustment. This mapping defines the list of accounts that a user may select from. This detailed mapping (if set up) replaces the default Credit Adjustment Income account (sequence #4) mapped in the Receivables system journal. Debit Adjustment (Income)This detailed mapping is used for recording the income (credit) offset when debit adjustments are made to an Accounts Receivable (A/R) customer's account. An asset account(s) is used for maintaining the balance of your company's receivables in General Ledger. The overall A/R balance is debited (increased) whenever debit adjustments are made to a customer's account. Users may select an account as the offsetting credit if this mapping is done. Selections should be based on typical reasons for debit adjustments. For example, if a customer has an outstanding unapplied credit on their account and no charge activity, they might request a refund. A debit adjustment could be used to remove the credit from their account. In this case, the offset might be either "cash on hand" or "refunds owed" depending upon the method chosen to reimburse the customer. This detailed mapping (if set up) replaces the default Debit Adjustment Income account (sequence #6) mapped in the Receivables system journal. |

Adjustment Code Mapping

Adjustment Codes are used to increase (adder) or decrease (discount) the overall amount of a transaction. Depending upon the type of transaction and the setup of the code, the adjustment may affect income, expenses, or both. For an example, an adjustment code might be used to provide a percentage discount based on the subtotal at Point of Sale or it might be used to add freight charges to a purchase order or receipt.

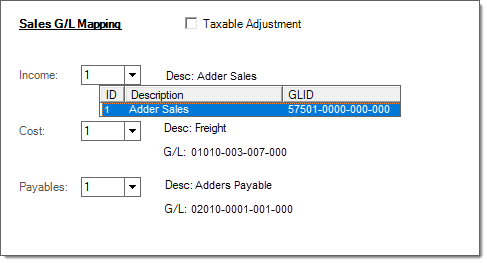

Purchasing Adders (Expense)This detailed mapping defines the list of G/L accounts that may be selected in the database for Adjustment Code maintenance for recording the cost of "purchasing" related adjustments (adjustment codes may also be used with Point of Sale; however, there are different mapping options available for those types of adjustments). The accounts defined here are made available for selection when adding or modifying a purchase adjustment code. Most adjustments increase the A/P liability balance when goods are purchased and are typically recorded as an expense. If this detailed mapping is not set up, the default mapping located in the Receiving system journal will be used instead (sequence #2). Sale Adders (Income)Adjustment codes used with Point of Sale transactions have more complex mapping than those used for purchases. There are three (3) account entries possible when an adjustment is associated with a sale: income, cost, and payables. This particular mapping is used for designating the income accounts available for selection in the Adjustment Codes database. Users who modify or add a Point of Sale type adjustment code have a drop down selection for IncomeAdder Sales. Adder income is typically a credit to the income account selected (increasing that account's balance) and a debit to an asset account based on the payment method used. The opposite would be true in cases of a return of goods with an associated adjustment code. If this detailed mapping is not used, the default mapping located in the Point of Sale system journal for sales and returns will be used instead (sequence #11 and #22).

Sale Adder CostAdjustments linked with Point of Sale transactions (sales) may have a cost associated with them. For example, your company may charge a flat delivery rate of $15 per MBF (thousand board foot); however, the cost associated with that may be determined as a percentage of the total invoice or some other method. If the adder cost is linked to a sale, the resulting entry will debit (increase) the expense account mapped here. If this detailed mapping is not set up and assigned to an adjustment code, the default mapping for adjustment cost specified in the Point of Sale system journal (sequence #18 or #34, if a return) will be used instead. Sale Adder PayableWhen a cost is associated with an adder applied at Point of Sale, it is assumed that the cost of the adder represents a payable to another entity. A good example of this would be freight. Your company might pass on the cost of freight charges to the customer using and adjustment code. The customer pays the freight to your company, and your company must then pay the freight to the shipping company. The liability account mapped here (that has also been associated with the adjustment code) is credited (increased) when a Point of Sale adjustment involving a cost is processed on a sale. If a similar adjustment is associated with a return, the G/L entry is reversed (the liability account balance is debited or reduced). The offsetting entry to this payable is the Sale Adder Cost expense account set up in either the detail or system journal mapping. If this mapping is not set up, the default mapping located in the Point of Sale system journal for sales and returns will be used instead (sequence #19 and #33). Manufacturing CostsThis detailed mapping selection determines the ledger accounts available for assignment to "manufacturing" and "Mfg Market" type adjustment codes. These adjustment codes may optionally be used with the Manufacturing activity (located under the Inventory area). Manufacturing costs would typically represent expenses that aren't related to materials used for manufacturing (the cost of materials is already considered). Examples might be labor, electricity, etc. If no specific ledger account has been assigned to an adjustment code, the manufacturing adjustment account in the Inventory journal is used instead (sequence #17). The "Mfg Market" (Manufacturing Market Cost) adjustment allows for a cost reserve on manufactured goods representing the difference between manufactured items' market costs and the actual cost of manufacturing (raw materials plus other adjustments). |

Bank Card Details

Bank CardsThis mapping can be used to specify the G/L asset accounts to be used for transactions involving the various bank card types (Visa, MasterCard, etc.). If this mapping is not set up, a single account in the default mapping in the Point of Sale system journal will be used instead for all card types. For sales involving bank cards as a payment method, a debit entry will increase the balance of the appropriate asset account. Returns involving a bank card credit reduce the balance of the mapped account by a credit entry. If set up, this detailed mapping is used in place of the default accounts mapped for Sales, Returns, and Payments in the Point of Sale system journal (sequence numbers #3, #29, and #37). |

Inventory Adjustment

Adjust Inventory ReasonThe "Adjust Inventory Reason" detail mapping provides the ability to define credit offsets for selection when making quantity on-hand adjustments from the Adjustments transaction found in the Inventory area. If this mapping is not set up, the "shrinkage" account in the default system journal mapping for "Inventory" is used instead. Accounts you would add are typically expense accounts that become the offset the asset inventory being increased or reduced by the adjustment. If set up, this detailed mapping is used in place of the default accounts mapped for "Shrinkage" in the Inventory system journal (sequence number #2). |

Sales Tax Details

This mapping provides a selection list of ledger accounts which are used when adding or modifying a Sales Tax code. These allow a sales tax location to be mapped to specific liability accounts for cash or charge type sales and returns.

Sales Tax Cash Sales (Liability)Each sales tax location can be mapped to a specific G/L account. If set up for a particular tax location, this detailed mapping replaces the standard sales tax mapping located in the Point of Sale system journal Sales category for sales tax on cash sales (sequence #12). Sales Tax Charge Sales (Liability)Sales tax locations for charge sales can be mapped to specific G/L accounts. If detail mapping is done for a particular tax location, this replaces any standard Point of Sale system journal mapping found under the Sales category for sales tax on charge sales (sequence #13). Sales Tax Cash Returns (Liability)Each sales tax location can be mapped to a specific G/L account for taxable cash sales. If set up for a particular tax location, this detailed mapping replaces the Point of Sale system journal mapping found under the category Returns for sales tax on cash returns (sequence #23). Sales Tax Charge Returns (Liability)Sales tax locations for charge returns can be mapped to specific G/L accounts. If set up for a particular tax location, this detailed mapping replaces the Point of Sale system journal mapping found under the category Returns for sales tax on charge returns (sequence #24). |

Payments & Payouts Mapping

Certain Payments and Payouts types allow for ledger account selection. When detailed mapping is defined, a selection listing of the accounts mapped is provided; otherwise, the default system journal mapping is used.

POS Misc Payment Type (Income)This detailed mapping selection provides ledger offsets for use with certain payment types processed from the Point of Sale, Payments transaction. Currently, this applies to the selections Miscellaneous and Rebate Check (only provided when the Rebate Tracking feature has been enabled). If detailed mapping is not implemented, the Miscellaneous Pay-ins mapping from the Point of Sale system journal category Payments is used (sequence #43). Payout Reason (Expense)When money is paid out using the "petty cash" selection under the Payout activity located in Point of Sale, users can select from a list of G/L accounts (if this mapping is set up). The selected account is used as the debit offset to the credit entry reducing cash assets. The intention behind this detailed mapping option is to provide a way of recording the associated expense or reason for the petty cash withdrawal. A few reasons petty cash might be used include postage, tolls, office supplies, and donations to charity. Your company can use this detailed mapping to list the expense accounts that should be increased (debited) when petty cash is paid out. If detailed mapping is not set up, the default mapping from the Point of Sale system journal for Payouts will be used instead (sequence #45). |

System G/L Accounts

The following two (2) accounts are special accounts used to keep the balance sheet and income statement accounts in balance. They are affected only when there is some differences between either the total assets vs. liabilities or the total income vs. expenses in journal transactions. It is a requirement of journal entries that the sum of all the debits and credits balance (equal); however, this overall balance doesn't always mean that the sum total of assets vs. liabilities balance or that the sum total of income types vs. expense type accounts balance. In order to maintain the balance of assets and liabilities, the retained earnings account, also referred to as "owner's equity" is used. On the side of income and expense categories, "net income" is used to maintain the balance for all the other account types (non-balance sheet accounts).

Neither of these accounts appear in system mapping or transaction inquiry, but they are affected when transactions are posted (finalized as journal entries affecting account balances). Both accounts must be mapped before actively using General Ledger and are the only required detailed mapping.

Retained Earnings YTD (Liability)Retained earnings, or "owner's equity," is used to maintain the balance between assets and liabilities. Assets and liabilities are expected to balance (total assets = total liabilities). Retained earnings is treated as a special type of liability account. liabilities. A financial statement known as a balance sheet compares assets with liabilities and includes the Retained Earnings balance as part of the comparison. Retained earnings represents the "net worth" of your company. The only manual entries made to retained earnings usually involve owner's equity draws or dividend payments to stock holders -- or -- moving balances from "current" year to "prior" year retained earnings. At the beginning of a new fiscal year, some companies prefer to move retained earnings to a "prior year's retained earnings" account. Owner's draw or dividend payments are usually done in two (2) steps: (1) by moving a balance from retained earnings to a temporary liability account and (2) entering the temporary liability account as the offset to the Accounts Payable (A/P) liability account during A/P invoicing. Manual journal entries involving owner's equity (retained earnings) accounts can solely involve other liability accounts. With release 11.1.0, the application now allows "branch" mapping for retained earnings (owner's equity). This only happens if a company does "manual" posting and does not automatically post journals. In this case, you would need to create department accounts (from the Chart of Accounts maintenance form) and select the "branch" check box in the data grid from the Detail Mapping Setup form. In cases where a journal has account entries with departments that are not mapped to a specific branch, the primary account ("0000") department would be used; otherwise, the department accounts would be used when automated entries for "retained earnings" are created. If you have created branch accounts for retained earnings, check the "branch" check box when adding or modifying the base ("0000") account to enable the branch feature. Net Income YTD (Income)Net Income YTD represents the net profit or loss of your company. This account is used to maintain the "balance" for non-balance sheet accounts (all accounts that are not asset, liability, or owner's equity types) when necessary. Net income entries are created automatically when journals are Posted from the if necessary. At time of Posting, differences between the sum of all income-type and expense-type accounts in journal transactions cause entries to "Net Income." The balance of net income is cleared at the end of the fiscal year automatically. Net Income cannot be adjusted manually and may not be manually entered as a journal entry. A financial statement known either as an "income statement" or "profit & loss" (P&L) is used to report the difference between total income and expenses. With release 11.1.0, the application now allows "branch" mapping for net income. This only happens if a company does "manual" posting and does not automatically post journals. In this case, you would need to create department accounts (from the Chart of Accounts maintenance form) and select the "branch" check box in the data grid from the Detail Mapping Setup form. In cases where a journal has account entries with departments that are not mapped to a specific branch, the primary account ("0000") department would be used; otherwise, the department accounts would be used when automated entries for "net income" are created. If you have created branch accounts for retained earnings, check the "branch" check box when adding or modifying the base ("0000") account to enable the branch feature. |

VAT - Payables/Purchases

This detailed mapping type is specific to Spruce users in the United Kingdom (UK) and Canada but does not apply to users in the United States. VAT stands for "value added tax." This tax is applied to purchases of goods by the company and is not paid directly by the consumer. Although it is possible to specify more than one level for this mapping, only the lowest numeric level is used. When invoicing a payable in Billing Entry, the lowest level account mapped here will be used for recording the VAT amount for the purchase. There is no corresponding system journal mapping for this detail mapping and "branch" accounts are not currently supported.

Order Deposit Charge

This mapping is provided so that users who allow receivables (charge) deposits for customer orders can specify a different ledger account for "charge" deposits as opposed to cash-type deposits (cash, check, bank card, etc.). Although it is possible to specify more than one level for this mapping, only the lowest numeric level is used. It's possible to prohibit the use of a receivable "charge" payment method for order deposits (see the Point of Sale tab on the Parameters form).

The account mapped for "order deposit charge" is also used for temporarily holding the balance of payments on Installed Sale contracts for cash-only customers. When the contract is completed, this account is decreased by that contract's payments and recorded as income. Receivables accounts with installed sales contracts don't use this account. Those payments are treated the same as any other account payment financially.