Stored Value Cards

Stored Value Cards are a type of gift card that are managed by an outside source (such as an affiliated co-op or supplier). For example, Do it Best Corp. has a stored value (gift card) program that may be used with what we refer to as "stored value cards." What we refer to as "gift cards" in the Help and application are cards that your company manages internally, not via a third party, hence the distinction.1 This same item type is used for True Value® gift cards.

Stored value cards operate similar to a credit card in a number of ways:

-

Their balances are maintained by a third-party provider company, not our software.

-

They must be authorized during sale by some third party to be activated and hold a balance.

-

They are used like a credit card and must be authorized electronically during sale; however, there are differences.

It is common that a specific processor be required by the company issuing the card (RBS must be used for Do it Best® gift cards, for example). This is important since your company must select one card processor if you integrate card processing with the software.

-

They do not usually have a preset dollar amount.

-

True Value Gift Cards have a minimum activation of $5.00. If you are testing gift card functionality, only amounts equal to or greater than $5.00 will result in a successful activation. Other providers may also have minimum and maximum limits.

1This topic does not refer to Do it Best Private Label Credit Cards. These are credit cards that are processed via a specific and different processor and not considered a "stored value" gift card. There is currently no specific function to handle these types of card other than standard credit card processing IF your selected processor accepts these cards.

Requirements & Setup

There are some conditions to using a Stored value type card with the application.

Credit Card Processing Software

First, because this type of gift card must be processed by a third party, it's treated similarly to a credit card in regard to processing.

If your company is not already processing stored-value cards from the application, your company must implement integrated card processing.

-

For Do it Best gift cards, VeriFone PAYware Connect™ transaction bundle and TSYS Cayan are supported.

-

For True Value gift card processing, TSYS Cayan is required.

The card device (if any), PC, and PAYware Connect web server handles the transaction transmission and authorization between your company 's selected card processor and the authorizing company.

Important! Verify that your selected card processor accepts your stored value cards, not all processors do (RBS can be used for Do it Best gift cards, for example).

Item Setup

Just as with gift cards managed locally, stored value cards use a special item type. In this case, the type is named "stored value card," not "gift card." This item can be given any item SKU. There's no need to specify pricing; however, gift cards are usually non-taxable. You may also want to consider them non-discountable (net) so that gift card sales aren't eligible for statement discounts, etc.

Stored value cards are not considered inventory, so they are typically mapped to different accounts than your inventory would be. Doing this requires that the item be placed in a unique product group so that detailed mapping with the proper accounts can be specified for the item. If this is not done, gift cards will be treated as "inventory." Gift card sales are typically backed out of sales totals so that they aren't reflected more than once. Gift cards and stored value cards are considered tender amounts and sales are recorded once the card as payment.

Activation

Activation requires integrated card processing with Verifone (PAYware or Verifone Point) or TSYS Cayan, and the Point of Sale station must have a supported card device. TSYS Cayan is required for True Value gift card processing. For Do it Best gift cards, you must be using either Verifone PAYware Connect or TSYS Cayan.

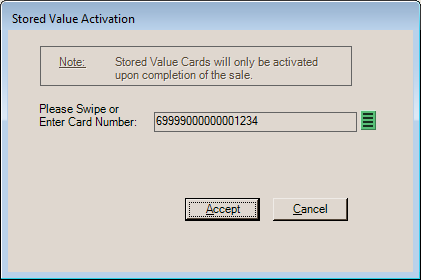

There are two (2) dialogs that might appear when attempting to sell a stored value card depending upon whether or not your company has integrated card processing. For companies that do not have integrated card processing, the following dialog appears:

Stored Value Activation (Card Entry)

Validation on the card number entered is performed only in this first case (above).

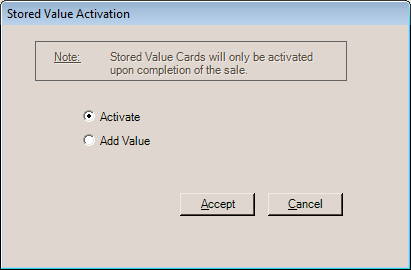

With integrated card processing, and a stored-value type item is entered into a Point of Sale, Sales transaction, a different dialog appears asking whether the card is being activated or re-charged (add value). Choose the proper action and then select Accept to continue. Cards are not activated until after any tender amounts are processed. If the stored value card is paid for using another card, the card transaction paying for the gift card will be processed first (before the stored value card is activated) to confirm payment. Even if a cashier chooses "activate" and the card already holds a value, the card's existing value will be added to during processing.

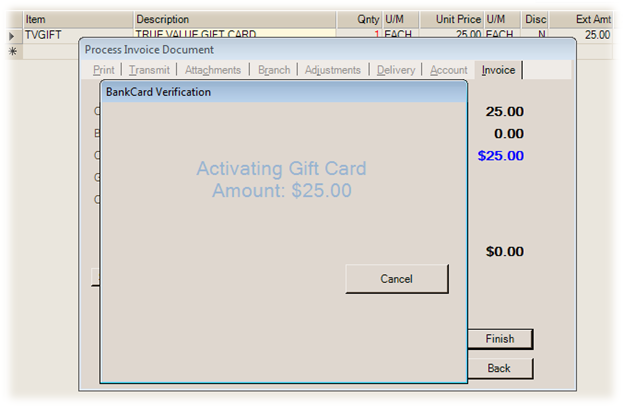

Once tender is processed, the message "Activating Gift Card Amount" will be presented to the cashier. The card device will prompt for the card to be swiped.

Once the card is swiped, it will be activated. The card device may display the amount of the card at this time.

Card Numbering

In some cases, rules apply to stored value card numbers that do not apply to self-managed gift cards. Certain types of cards may be activated without integrated card processing. For companies using integrated card processing to activate cards, this logic is not applied. These rules do not apply to True Value gift cards being processed with TSYS Cayan, for example. Otherwise, for a "stored value" card number to be considered valid, the card must meet any of the following rules:

•The card's "number" is 16-characters in length and the card number falls between "6034110000000000" and "6034119999999999."

•The previous condition was not met, and the card's "number" is 19-characters in length, is numeric, and the number begins with the following digits: 60357101.

•None of the previous conditions were met, and the card's "number" begins with "6034" or "6035," the length of the card's number is greater than 5-characters, and the fifth character is an "X" or the sixth character is an asterisk (*). Indicates a masked card number.

•None of the previous conditions were met, and the "ALLGIFTCARDS" argument is present. This treats all card numbers as valid. This can be applied system-wide upon request. Please contact support if needed.

Returning a Stored Value Card

In cases where a stored value card has been sold and is being returned, you can do the following:

1.Use the "Check Balance" option found on the Process (F12) form to check the card's balance to make sure it hasn't been used. Write down the remaining amount.

2.From the Point of Sale, Sales transaction sell a non-taxable miscellaneous item.

3.Set the item's unit price to match the remaining amount on the card. No tax should be involved.

4.Process the Sale using the stored value card as the tender method (processed using the Bankcard method).

5.Return the same miscellaneous item for the same amount (negative quantity in the Sales data grid).

6.Process the return/refund sale using the same method of payment as the original stored value transaction (cash, bankcard, etc.). In some cases, you may need to return cash. For example, if the stored value card was paid using a debit card, you won't be able to credit that card.