Cash Requirements

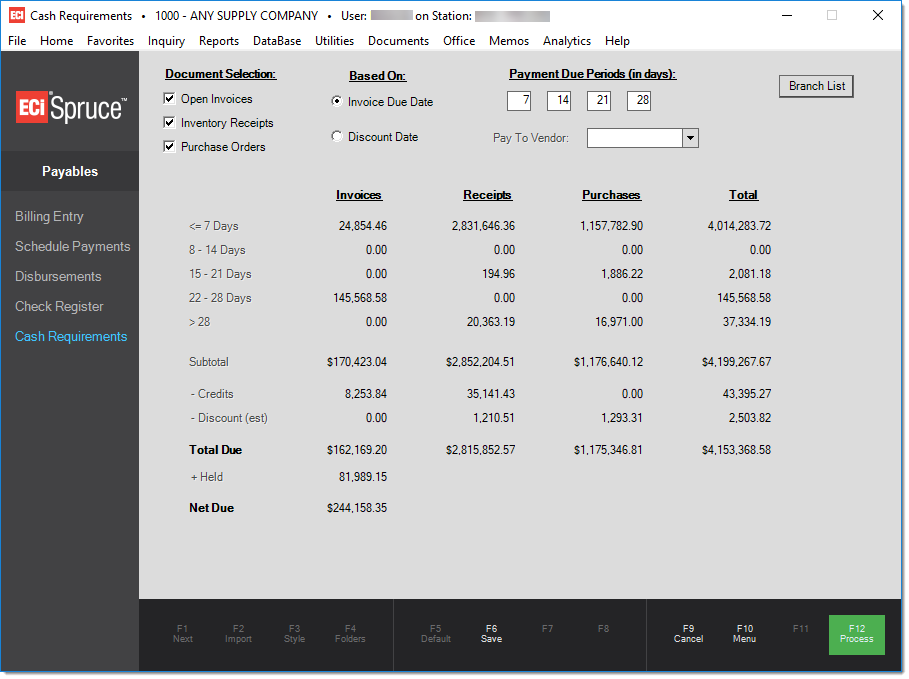

The Cash Requirements form provides a series of totals for payables related figures based upon user-defined due periods (in days). This is intended to provide an estimate of the cash required to meet your commitments (payables and anticipated payables) for the near future. Four (4) periods may be specified; however, totals are actually split into five (5) periods with the last period being any documents older than the last (right-most) period. You can change the payment due periods as needed, but must choose Process (F12) to repopulate the totals after any form change.

Periods should be entered in ascending order from the most recent (left-most) to the most distant future period (right-most). The lowest (earliest) period displays activity prior to the period's end day. The Save (F6) function can be used to save the payment due periods as defaults for future use (for all users).

The "based on" date applies to payables, but also receipts and purchase orders when the associated vendor is assigned a terms code. When no terms are associated with the vendor, the purchase order's due date or receipt's entry date is compared to the current day to determine the period. Receipts use the actual entry date (which cannot be changed by the user) and vendor's terms (if any) to determine the period receipts are listed in. Receipts with no terms are usually listed in the earliest period in this case.

The "branch list" button can be used to determine which branch locations are to be included when applicable, and the "Pay To Vendor" drop down control can be used to limit the totals to a specified vendor (pay-to).

Document Selection

There are 3 types of documents that an aging may be produced for: open (unpaid) payables, inventory receipts that haven't been billed as payables (totals also include any adjustments on transfers), and purchase orders that haven't been associated with payables. Once you've made your selections, totals are listed separately for each document type and a summary column for overall totals is also provided (on the right-hand side). Different selection criteria are used for each document type.

Open Invoices (Payables)

Payable invoices are selected based upon the selected branch (or branch list) and status of the invoice (invoices that have a status of either "paid" or "void" are not included). Invoices on "hold" are included in the totals however. Aging is not done for credit invoices or discounts. Discounts and credits are totals using a separate routine that including all invoices. Remaining amount is used for determining the totals.

Inventory Receipts

Receipts are selected based upon the selected branch(s), the entry date of the receipt document, and the payable status of the receipt. Only receipts that are not closed and have not yet been linked with a payable invoice are included in the totals. Receipt records linked to non-purchase activity are excluded (merged items, adjustments, etc.). Aging is based upon the entry date of the documents which is not necessarily the "post" (receipt) date entered by the user (users are allowed to modify the "post" date so this may or may not match the actual processing date).

In addition to receipts, receipt totals also include any adjustments ("adders") found on branch transfer documents. These are considered payable to the adder vendor and would typically exist if a 3rd party was used for shipping between locations, for example. The transfer's receiving branch is used when branch selection has been done, and the adjustment's vendor is used if a specific "pay-to" vendor has been specified.

Purchase Orders

Purchase orders are selected based upon the selected branch (or branch list), the ordered date of the purchase order, and the payable status of the purchase order. Only purchase orders that have been marked as "ordered," but not yet been linked with a payable invoice are included. Period calculations consider the expected date of any given purchase order as its "billed date" for the purposes of calculating either due or discount dates for the projection which considers the payment terms code associated with the order (if any). For example, if purchase order ABC123 is due on 3/30/2020 and is assigned a terms code with a Net Due Date that is the 30th of the following month and a cut off billing date of the 25th, the calculated due date would be 5/30/2020 (because the PO's expected due or "billing" date is past the cut off, an additional month is added to determine the due date for payables).

Direct Ship purchase orders would be included in the Purchase Orders totals as long as they meet all the same criteria. Direct Ship, as well as other orders generated by Point of Sale activity, are not automatically marked as "ordered." Any Purchase Orders, including Direct Ships, won't be listed in the totals if their status wasn't at some point modified to "ordered" from the Order Entry area on the Purchasing menu. Once invoiced, the payables for Direct Ship transactions would be included regardless of the original ordered status. Direct Ship orders never become inventory receipts since the goods as shipped directly to the customer by the vendor.

Base Date Selection

Choose either "due" or "discount" date. The date chosen determines which date is used for comparison to the periods entered. Purchase Orders and Receipts calculate an expected discount or due date based on the terms assigned to the vendor (if any). If no terms are assigned to the vendor, the current date is compared to the purchase order's due date or receipts entry date instead.

Which date should be used? This depends on whether your company would typically remit payments within the discount period or after. For example, if it is your usual practice to pay by the discount date, you would probably choose discount date since it will more accurately reflect your company's payment practice.

Payment Due Periods

There are four (4) fields provided for the number of days determining each of the 5 periods. The intended use for these fields assumes that users enter each of the following periods as numbers that increase from left to right (7 days, 14, 21, 28, etc.).* Should these fields not be used in this way, the user may wind up with the same invoices, orders, etc. being included in more than one period.

The first period includes everything prior to the cut off date determined by that first period's number of days. For example, if today is September 2nd and the number of days in the 1st period is set to 7, the first period will include all invoices with due dates prior to September 9th. The second period spans the time period including invoices dated after the prior period's end date up to and including the end date of the period. If our second period is set to 14 days, using our previous example, the invoice totals for period 2 would include invoices dated between September 10th and September 16th (including those with a date of the 16th). The next 2 periods duplicate this logic. The last period, however, will include all invoices with a date (due or discount) greater than the final (4th) period's beginning date.

Example

Here is a break down using specific examples. We are assuming a base date of September 2nd and periods of 7, 14, 21, and 28 days for the following example:

Period 1 < = 7 All Invoices Prior to 9/9

Period 2 8 - 14 Invoices Between 9/10 up to and including 9/16

Period 3 15 - 21 Invoices Between 9/17 up to and including 9/23

Period 4 22 - 28 Invoices Between 9/24 up to and including 9/30

Period 5 29 = > Any Invoices Including and After 10/1

It's possible to set default values for the numbers of days so that they don't need to be entered each time. This is done from the Parameters database under the Maintenance area (choose the Payables tab) or by using the Save (F6) function (both options save the day periods for all users).

Pay-to Vendor

If a vendor is selected, the totals will only represent the figures where the selected vendor is the "pay-to" vendor for the payables, receipts, and purchase orders; otherwise, all vendors are included. If you change the vendor selection, totals are not automatically recalculated. You must choose Process (F12) to recalculate the totals after any form change.

Branch

By default, all branch locations are included in the totals. If you choose a different selection of branches, only documents for those branches will be included.

Totals

Depending upon your document type selections, up to 4 columns of totals are provided. The right-most column provides summary totals of the other columns. If you are including all document types (payables, receipts, and purchase orders), the totals column would provide a summation for each row of the three (3) document columns.

Functions

As with other transactions, this form offers several function key based actions:

This function provides an easy way to update the day period parameters directly from the Payables area rather than doing so from the Parameters form. The function only saves the days specified for the 4 periods, not the other form settings. This function will not save the vendor, date selection, or document types, for example.

Cancel (F9)

The Cancel (F9) function clears all form selections and totals back to their initial or default values.

Menu (F10)

The Menu (F10) function clears all form selections and totals, closes the transaction form and returns the user to the menu.

Process (F12)

The Process (F12) function must be used to initially populate totals as well as to recalculate (refresh) totals after any form changes.