VAT Adjustment

You may need to adjust your VAT entries for a variety of reasons. For example, there may be business activity that is not typically recorded by application processing or is but has no automatic tax impact. For taxable activity that is not tied to application processing, your company will be responsible for any record keeping. All adjustments must be tied to some type of document, but these can be documents which would normally not have a tax such as manual journals in the ledger. VAT adjustments only apply to regions with value-added tax requirements.

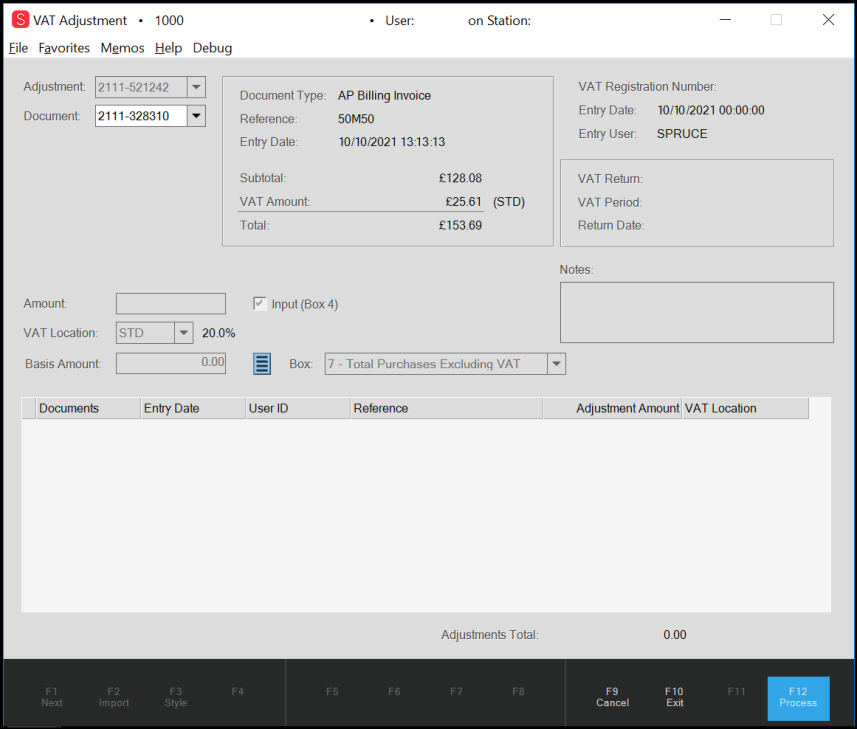

VAT Adjustment Form

VAT Adjustments affect the VAT returns they are associated with. To learn more about submitting a VAT return, see VAT Return.

Adding a VAT Adjustment to a Transaction Document

All adjustments must be tied to some type of document, but these can be documents which would normally not have a tax such as manual journals in the ledger.

About the Amount {VAT} field:

The amount text area is provided for the tax (VAT) amount to be adjusted. It permits both positive and negative values but cannot be zero. You can optionally calculate this as a percentage of the basis {using the context menu marker} if a basis amount has been entered. You can also calculate the basis from the tax. There are situations where the tax amount is not the same percentage of the basis due to special tax considerations (1/2 tax, etc.). In these cases, you can enter a tax amount that doesn’t match the exact percentage of the basis. You will receive a warning when processing if this is the case, but you can accept the warning if you are sure that the tax is correct.

About the Basis Amount field (New field):

In releases prior to 12.18.4, VAT Adjustments only affected the VAT amounts, not the sales and purchases totals reflected in boxes 6-9. With release 12.18.4, VAT Adjustments can optionally affect boxes 6 –9. If you want to affect boxes 6 –9, you must specify a “basis amount” and choose the appropriate box. For “outputs” (such as Sales/Returns), boxes 6 and 8 are provided as options. For “inputs” (such as purchases), boxes 7 and 9 are provided as options. Boxes 8 and 9 are reserved for EU commerce situations. If you need to affect an EU commerce amount, you should select a tax code that’s also flagged for European Commerce.

To be clear, you add a VAT adjustment to a document and then the document applies to a VAT Return (usually based on date of adjustment).

To add a VAT adjustment to a document:

1. From Point of Sale > Utilities > VAT Adjustment. The VAT Adjustment form displays.

2. In the Adjustment list, choose <<New>>. The system generates an unique adjustment code for tracking.

3. In the Document list, choose the transaction document to apply the VAT adjustment to.

Note: In some cases, the original document may have a basis and tax amount associated with it. Some do not.

4. In the VAT Location field, enter the location code appropriate for this transaction document.

Many companies only have one VAT location. If you do commerce outside the UK or sell products with different tax rates, you likely have or need more than one tax location. The tax location does the following:

-

For outputs, the tax location affects the consumer tax figures (tax totals).

-

For European Commerce tax codes, this affects how the tax amount is reported. Tax amounts lined with EU Commerce tax codes are represented in both boxes 2 and 4 (an input and an output).

-

If you specify a basis, and the tax code is flagged for European Commerce, you should select the appropriate “EC” box (8 or 9). For outputs, the box is typically 8 and for inputs, box 9.

5. If the adjustment you are adding is an Input, select the Input (box 4) checkbox.

6. Continue based on the information you know:

-

If you know the VAT amount, enter that amount in the Amount field.

-

If you know the basis amount, enter that amount in the Basis Amount field.

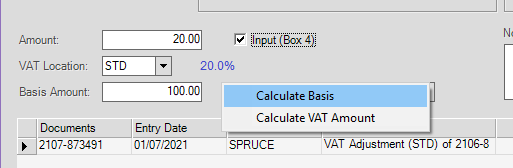

Note: After you enter either the VAT Amount or the Basis Amount, you can calculate the other value using the Menu Marker ![]() beside the Basis Amount box.

beside the Basis Amount box.

VAT Adjustment with Menu Marker List

-

To calculate the VAT amount from the basis amount, enter the basis amount, choose the Menu Marker, and click Calculate VAT Amount.

-

To calculate the basis amount from the VAT amount, enter the VAT Amount, choose the Menu Marker, and click Calculate Basis.

7. In the Box {Selection} field, choose the VAT return box that the adjustment amount should be added to. This provides a choice of boxes 6 – 9.

-

For Inputs, choose box 6 or 8.

-

For Outputs, choose box 7 or 9.

-

For EC supplies and acquisitions, choose box 8 or 9.

8. In the Notes {Text Area} box, enter information you want to preserve about this transaction, such as the reason for the adjustment.

This entry is optional (and a good idea).

Note: You can also attach documentation to the VAT Adjustment document using the Documents form.

9. When you have reviewed and confirmed your entries and selections, click Process (F12) to update the adjustment for this transaction.

Note: When the information needed for any of these calculations is not present, an error message displays.

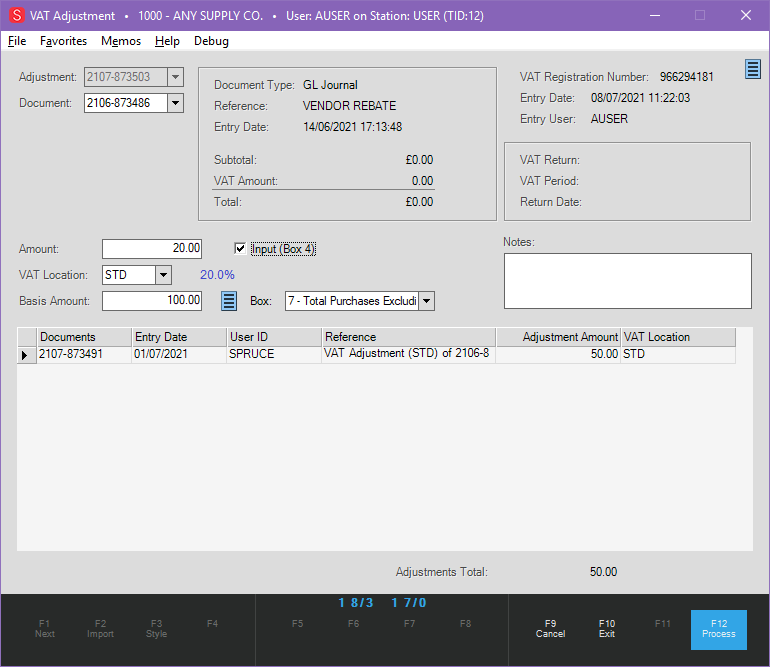

VAT Adjustment with Entry

Understanding the VAT Location Entry

The VAT Location code determines the VAT location linked to the adjustment. Many companies only have one VAT location. If you do business outside the UK or sell products with different tax rates, you likely have or need more than one tax location. The tax location does the following:

-

For Outputs, the tax location affects the consumer tax figures (tax totals).

-

For European Commerce tax codes, this affects how the tax amount is reported. Tax amounts linked with EU Commerce tax codes are represented both in boxes 2 and 4 (an input and output).

-

When you specify a basis, and the tax code is flagged for European Commerce, you should select the appropriate “EC” box (8 or 9). For outputs, the box is typically 8 and for inputs, box 9.

Which Return will show the Adjustment?

VAT Adjustments affect one (1) of two reporting periods (prior or new) depending upon the timing of the adjustment in relation to the finalisation of the VAT Return submission.

-

For VAT Adjustments processed during the current reporting period and linked with a prior period document after the prior period has been finalised, those adjustments will be included with the “current” {new} period.

For example, my most recent quarterly reporting period closed on June 30. On July 10, I submit my VAT Return and it is finalised by HMRC. On July 25, I enter an adjustment for £50 and link it to a manual journal created in June. Since my reporting period has been finalised, the adjustment will instead affect the current period (July - September) once that period has ended. The prior period’s figures will remain unchanged. -

For VAT Adjustments processed during the current reporting period and linked with a prior period document before the prior period has been finalised, those adjustments will be included with the “prior” period.

For example, my quarterly reporting period closed on June 30, but has not been finalised with HMRC yet. On July 1, I enter an adjustment for £50 and link it to a manual journal created in June. Since my reporting period has not been finalised, the adjustment will still affect the prior period (April – June). -

For VAT Adjustments processed during the current reporting period and linked with a current period document before the end of that period, those adjustments will be included with the “current” period once reporting for that period is available.

For example, my quarterly reporting began on July 1, and today is July 10. I enter an adjustment for £50 and link it to a manual journal created on July 2. Since my reporting period has not ended and the linked document is for the current period, the adjustment will affect the current period {that includes July}.

How do VAT Adjustments affect Tax Liability?

Adjustments that are output-types affect consumer tax totals for the period matching the original document. For example, a VAT Adjustment processed on July 15 for an invoice processed on June 30 would impact the tax totals for June, not July. Only “output” adjustments affect tax totals. Inputs, which credit the output amounts, are not recorded in the consumer {sales} tax totals.

In certain cases, the VAT Adjustment form will assume either “Input” or “Output” and not allow changes. For instance, if you link the adjustment to a PS Sale Invoice type document, that document is by nature an “output” not an “input.” The “Input” check box will be disabled (greyed out) preventing changes. Conversely, if you choose an AP Billing Invoice, the default type is “input,” so the opposite is true. In this second case, the VAT Adjustment form checks the “Input” check box and disables it to prevent changes.

In summary, the application prevents both “output” type adjustments linked to “input” documents and “input” type adjustments linked to “output” type documents when we can identify that situation.

When we can’t automatically determine whether the transaction is one or the other, you will have to choose.

Documents that are not clearly Input vs. Output

In certain cases, there is no clear way to know if the intention is input vs. output. For example, a General Ledger manual journal could represent either input or output. In this case, the user must select the option that matches their desired outcome (based on the box(es) on the return they wish to impact).

Generally, and assuming the tax accounts are set up as liability types, credits would increase your tax liability (what you owe) and debits would reduce the tax you owe. Payables invoiced and including VAT would typically be recorded as a debit to the VAT Purchases tax account decreasing your overall tax owed. Credit invoices entered via Payables would typically be recorded as a credit to the VAT Purchases tax account increasing the overall tax owed.

-

For output activity, a credit to a VAT account would increase your tax liability {owed} and debits would reduce that. Positive output adjustments decrease tax liability (like a purchase), so a negative VAT amount would increase it (like a vendor credit).

-

For input activity, the tax liability would be increased by sales (credit) and decreased by returns (debit). For VAT Adjustments that are input-types, positive amounts increase the tax liability and negative amounts decrease the tax liability. This is the opposite of how the positive/negative impacts output tax.

An opposing adjustment can be made for cases where the wrong input/output choice was made, or the amount was entered incorrectly as either a positive or negative. To reverse an error, use the same type (input/output) as the original, but reverse the sign of the amount (and select the same link document).

A single document can have multiple adjustments. Use the notes field for any explanation needed.

Choosing the Proper Adjustment Type

VAT Adjustments create a new document and are also linked with an existing document. They adjust the tax liability in VAT Return boxes 1-5 only. Only certain types of documents are permitted to be linked with VAT Adjustments. Some involve tax by nature (Payables, Sales, Returns, etc.), others do not (Receivables Adjustments, General Ledger Journals), etc.

Depending upon the return box you want to update, take the following actions in the VAT Adjustment form:

Scenario 1. VAT Due on Sales and other Outputs

- a. Input check box is not checked.

- b. VAT Location selected is not EC Commerce flagged.

- c. Negative amounts decrease VAT liability (Total and Net VAT Due decrease).

- d. Positive amounts increase VAT liability (Total and Net VAT Due increase).

- e. Basis (optional) with Box 6 selected.

Scenario 2. VAT Due on EC Acquisitions

- a. Input check box is not checked.

- b. VAT Location selected is EC Commerce flagged.

- c. Negative amounts decrease VAT liability (Total and Net VAT Due decrease).

- d. Positive amounts increase VAT liability (Total and Net VAT Due increase).

- e. Basis (optional) with Box 8 selected.

Scenario 3. Total VAT Due: Updated automatically based on the sum of 1 and 2.

Scenario 4. VAT Reclaimed on Purchases and Other Inputs

- a. Input check box is checked.

- b. Negative amounts increase VAT liability (Total and Net VAT Due increase).

- c. Positive amounts decrease VAT liability (Total and Net VAT Due decrease).

- d. Basis (optional) with Box 7 or 9 selected.

Scenario 5. Net VAT Due: Updated automatically based on the sum of Box 3 less Box 4.

Note: EC flagged "Inputs" affect both boxes 2 and 4.