Inventory Mapping

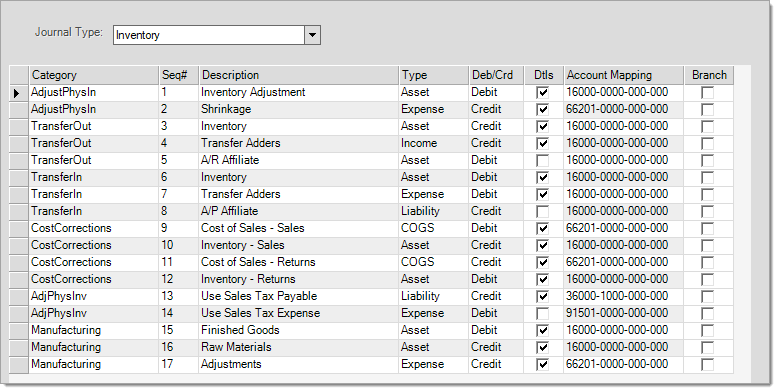

The Inventory system journal mapping contains six (6) categories: physical inventory adjustments (AdjustPhysInv), transfers out (TransferOut), transfers in (TransferIn), cost of sale corrections (CostCorrections), usage sales tax (for physical adjustments made done for "In Store Use"), and manufacturing. This mapping is used primarily with the various options for adjusting the value of inventory due to changes in quantities. It's important to point out that "inventory" mapping is not used for recording purchases of inventory, the receiving system journal mapping is used for that purpose.

System Journals: Inventory

Details

The "details" (dtls) check boxes are read-only and indicate whether detailed mapping is provided. Detail mapping varies in function somewhat based on the type of entry. In some cases, detail mapping allows a user to select an account from a list. In others, the account is selected automatically based on other criteria such as a product group as one example. The presence of a check mark only indicates that detail mapping it is available (not whether it is being utilized).

Branch

The "branch" check boxes can be modified. These indicate whether you want to use branch accounts if setup. If checked and individual branch accounts do exist (as designated by the department in the account number for the designated "base" account), they will be used in place of the account designated.

|

# |

Category |

Description |

Type |

Debit/Credit* |

Details |

|---|---|---|---|---|---|

|

1 |

Asset |

Debit (+) |

|||

|

2 |

Expense |

Credit (-) |

|||

|

3 |

Asset |

Debit (+) |

|||

|

4 |

Income |

Credit (+) |

|

||

|

5 |

Asset |

Debit (+) |

|

||

|

6 |

Asset |

Debit (+) |

|||

|

7 |

Expense |

Debit (+) |

|

||

|

8 |

Liability |

Credit (+) |

|

||

|

9 |

COGS |

Debit (-) |

|||

|

10 |

Asset |

Credit (-) |

|||

|

11 |

COGS |

Credit (+) |

|||

|

12 |

Asset |

Debit (+) |

|||

|

13 |

Liability |

Credit (+) |

|

||

|

14 |

Expense |

Debit (+) |

|

||

|

15 |

Asset |

Debit (+) |

|||

|

16 |

Asset |

Credit (-) |

|||

|

17 |

Expense |

Credit (-) |

*Indicates the type of entry, either debit or credit. The + or - indicates whether the debit or credit represents and increase or decrease for the specific class of account (asset, liability, income, etc.).

Adjustments to Physical Inventory

On-hand adjustments can be processed using the Adjustments activity under the Inventory application area. This mapping is also used when adjusting inventory when posting physical inventory counts.

1.Inventory Adjustment (Asset)

If the on-hand adjustment being made increases the value of your company's inventory, a positive debit entry increasing inventory is done. Should the adjustment result in a decrease of inventory, this same account is used but a "negative" debit will be generated reducing the value of inventory. The offset to inventory assets is an expense account that is credited either by a negative or positive number depending which way inventory value moved (up or down).

When inventory assets are increased or decreased by a quantity adjustment an expense account balance is also affected. Detailed mapping can be defined allowing users to pick a specific expense account for use as an offset to the adjustment to inventory assets for manual adjustments.

Transfers Out

This mapping is used for transfers from your location to another location. These are processed using the Transfers activity located under the Inventory application area.

When inventory is transferred out of one location, inventory assets are reduced for that branch. This account represents the default inventory asset that should be reduced (credited) when inventory is transferred out of this location. Detail mapping is available allowing a company to designate different inventory accounts to be affected by transfers based on the product groups of the items being moved.

If transfers include adders (freight, fuel surcharges, etc.), the account mapped here will be the default account used to record this income. Adders can be mapped to specific G/L accounts. If done, the mapping from the adder code will be used in place of the G/L account entered/shown in the inventory system journal.

An A/R (Accounts Receivable) affiliate is an asset account used to track the cost of transferred inventory owed by other locations to the transferring branch. It is suggested that this account not be the same as the general Accounts Receivable account since transfers are normally not treated the same as customer receivables. When inventory is decreased (by a credit), the A/R affiliate is increased (by a debit) for that amount plus any adders associated with the transfer.

Transfers In

Transfers "in" (from another branch) are processed using the Transfers activity under the Inventory application area.

When inventory is transferred into a location, inventory assets increase for that branch. This account is the default inventory account that will be increased (by a debit) when inventory is transferred into this location. Detail mapping can exist for transfers based on the product group of the items being moved.

If adders are associated with a transfer being received from another location, that adder cost will debit the expense account mapped here (unless a specific G/L account is mapped for the adjustment code used).

Inventory transferred into a location is considered a liability for the receiving branch because the cost of that inventory is "owed" to another location. The A/P (Accounts Payable) affiliate account is used for maintaining the balance for the cost of goods received from another location by an internal transfer. The A/P Affiliate mapped here will be credited (increased) when transfers are processed.

Cost Corrections

Detail mapping by product group for Inventory Cost and Inventory Issues is available. If detailed mapping is set up, it will be used in place of the accounts mapped here for cost corrections. Cost of Sales corrections are processed under the Inventory application area using the Cost Corrections activity.

9.Cost of Sales - Sales (COGS)

This is the default cost of goods sold (COGS) account debited when the cost on a previous sale is changed. If the change is a reduction in the cost of goods, the debit will be negative (debits increase cost of goods sold, normally, so a negative debit reduces the account balance -- similar to a credit). If the change results in an increase in the cost of goods, the debit entry is positive (increasing cost of goods sold).

When an item is sold, the cost of the goods being sold also reduces the value of a company's inventory asset. If the cost of the sale was incorrect, the inventory asset will need to be corrected in addition to the standard "cost of sales" account. This is the credit offset to the debit entry done to the Cost of Goods Sold (COGS) account under sequence #9 (above). If the correction represents an increase in the cost of the item that was sold, the credit amount will positive. If the correction lowers the cost of the sale, the credit to this asset account will be negative (increasing the balance).

11.Cost of Sales - Returns (COGS)

When a cost of sales correction is done and it involves a credit sale (return), this account will be credited to affect the cost of goods sold (COGS) account in the ledger. The credit will be a positive figure if the cost of sales correction represents an increase in the cost of the goods returned. If the returned item's cost is being lowered by a cost correction, the credit amount will be negative so that cost of goods sold is increased.

This asset account is used as the offset to the Cost of Goods Sold (COGS) entry when a cost correction is made to a credit sale (return). When goods are returned, both COGS and inventory assets must be affected. This account represents the asset side of the entry as a debit. If the cost of the item being returned is adjusted up (increase in cost), the debit to this asset account will be positive. Should the cost correction lower the cost of the item that was returned, this entry will be a negative debit that decreases the inventory asset balance mapped here.

Adjustments to Physical Inventory (Use Tax)

13.Use Sales Tax Payable (Liability)

This liability account is credited (increased) when goods are adjusted out of inventory for store use and a sales tax location is specified by the user. "Use" taxes can apply to goods that a company removes from inventory for particular purposes. Consult a tax professional or the appropriate tax authority if you have questions regarding use tax rules. Detailed mapping for sales tax locations will be used if set up.

14.Use Sales Tax Expense (Expense)

This expense account is debited (increased) when use tax is associated with an "In Store Use" quantity adjustment.

Manufacturing Mapping

This account is used to record the addition of new manufactured goods back into inventory. When manufacturing is processed, the goods used for manufacturing are removed (via credit entries to the appropriate inventory asset accounts) and the goods created by manufacturing are added back in. Usually, the asset value of the finished goods will be greater than the sum of the raw materials used for manufacturing because this process typically involves some added expense (adjustments). Detailed Product Group mapping is available for finished goods. If detailed mapping exists for goods in the specific product group, it is used in place of the account listed here.

The "raw materials" account records the removal of existing inventory for the purpose of manufacturing some new item. When manufacturing is processed, a ledger entry is used to remove the items used from inventory and also add the new item (plus expenses) back into inventory. Detailed Product Group mapping is available for raw materials. If detailed mapping exists for goods in the specific product group, it is used in place of the account listed here.

The adjustments account mapped here is used for recording costs associated with manufacturing (such as labor, milling, etc.). This amount represents the change in inventory value between the raw materials and the newly finished product. Adjustment codes designated for manufacturing (Inventory, Database) may be mapped to specific ledger accounts. Detail Mapping may be optionally defined for use with adjustment codes. If done, those accounts would be used except in cases when an adjustment code had not been mapped.

Special Exceptions

There is a situation where this journal (Inventory) can show entries for the A/P accrual account which normally is not a part of this mapping. This can occur when inventory items are merged together. During a merge, if the item being removed (merged from) has an on-hand quantity, the application creates an "inventory receipt" to adjust the new item's quantity on-hand and affect the weighted average cost appropriately. In this case, the "A/P Accrual" account is affected for the same amount (the value of the merged item) in both the Inventory and Receiving system journals. An accrual entry is normally a part of the receiving journal when goods are received. This becomes a "wash" entry because both debit & credit entries for the same amount are created (although, they appear in different system journals).