Sales Tax Inquiry

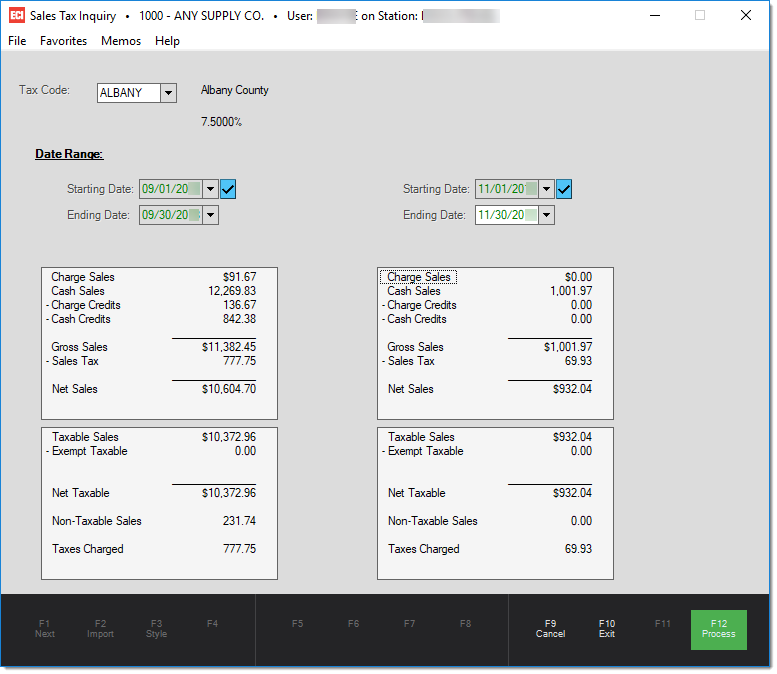

The sales tax inquiry displays sales and sales tax information regarding a tax location selected by the user. There are two identical sets of sales tax figures providing the ability to do a "side-by-side" comparison between different dates or ranges.

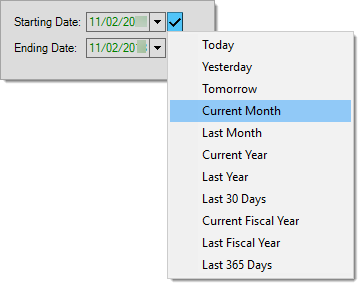

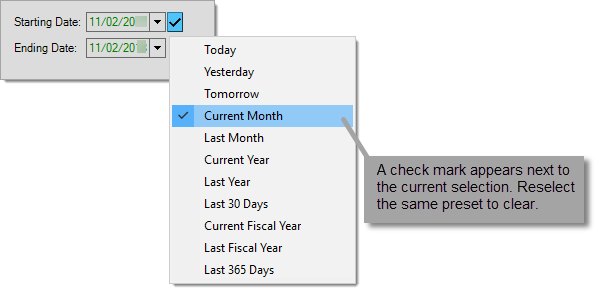

Some fields contain preset dates, particularly when the circumstances require a date range. When saving and scheduling reports, preset dates are the only date selections that automatically update when you save a report or process a scheduled report (manual date selections only run for the original date selected). The Check Mark icon ![]() indicates that preset values are available. Click the icon to review a menu of preset date selection options.

indicates that preset values are available. Click the icon to review a menu of preset date selection options.

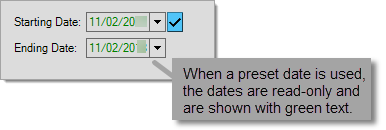

After you make a date selection, the date fields become read-only (disabled) and you cannot change them manually. The application displays the dates in green.

Preset values are based on the current date by default or use the current date to determine the "current" period (such as the current month or year). Fiscal year values may consider the current date as well but also use parameters for your financial (fiscal) year to determine the starting and ending months.

To clear a preset, reselect the same preset from the context menu. The date values may remain but the application will allow you to modify them after you clear the preset dates.

Sales Totals

The following definitions explain what each total represents.

Charge Sales

This figure includes the dollar total for any charge sales, not including returns*, for the period requested. Sales tax and adjustments are included in this figure. Charge sales is accumulated from both transactions that only involve "charge" and also those that involve "charge" mixed with other "cash-type" methods. For example, if a customer purchases $99 of goods and pays $50 in cash but charges the remainder to their account, the charge sales figure reflects that $49. Charge sales are not reduced by any statement (early payment) discounts. Sales tax and adjustments are included in this figure.

Cash Sales

This figure includes any sale, not including returns*, that involves a "cash-type" payment method. Besides actual cash, included as "cash-type" payments are methods such as checks, credit/debit cards, coupons, and gift cards. In addition, any COD (cash on delivery) designated sales are recorded in this figure. With COD transactions, the sales are recorded when the COD is created, not paid. Even if a payment for a COD involves a non-cash payment, the COD is still recorded under the "cash sales" category. Sales tax and adjustments are included in this figure.

Charge Credits (-)

This is the total of returns (credits) processed using a payment method of charge. These may be processed either in Sales or Charge Returns under Point of Sale. This figure includes sales tax and adjustments.

Cash Credits (-)

This is the total of returns processed using a cash-type payment method. Cash type payment methods include cash, check, credit/debit card, coupon, and gift card. Sales tax and adjustments are included in this figure.

|

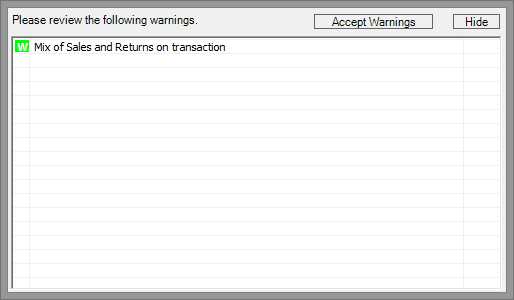

What is considered a "sale" vs. a "return?" By returns (aka. credits), we mean transactions where the overall total is negative, meaning there is a net refund amount. The individual quantity sold (or returned) for each item on a transaction is not considered. If the overall total is negative (-), even if some items are being sold, the transaction is recorded as either Charge Credits or Cash Credits (depending upon the selected refund method). On the other hand, if the overall total is positive (+), the entire transaction is recorded as either Charge Sales or Cash Sales type transaction. Cash vs. Charge is based on the payment method(s) selected, not the type of account. A single transaction can be both a charge and cash sale if multiple payment methods are combined. Mixing Items being Returned and Sold on the same Transaction We suggest blocking access to mixing returns and sales because (a) these types of mixed transactions can be difficult to locate and (b) you really aren't getting an accurate representation of both returns or sales. Here's an example that helps explain why mixing the two can be a problem: Imagine that an active customer claims they should see a credit on their account for an item they had returned. If searching for the returned item, while only considering credits, you would never find the return because it was mixed with a sale. Finding the sale would mean spending time reviewing all of the customer's sales, not just the returns. This involves much more work and may be confusing to the customer. A system or application administrator can either block or enable Point of Sale users ability to mix items that are being returned with those being sold. This is done by modifying the severity on a Task List item in Point of Sale, Sales.

"Mix of Sales and Returns on Transaction" Statement Discounts Another reason not to mix sales and returns is discounts, particularly statement discounts. When a transaction is mixed with items being returned and being sold, some items may be net, some not. If a net sale had all "net" goods except for one item being returned, the transaction could wind up with a statement discount that is negative resulting in more of a charge to the customer. If you've ever needed to explain why a statement discount calculated to a customer, attempting to do so when there's a mix of negative and positive quantity items can be extremely difficult. |

Gross Sales

Gross Sales is the total of Cash and Charge sales less any charge and cash credits. This figure includes sales tax.

Sales Tax (-)

This figure is the net amount of sales tax charged to customers (not paid). This figure includes returns as well as sales. This sales tax figure does not include sales tax from "store-use" adjustments and may differ from the tax amount shown on the Sales Tax report (or inquiry) due to this reason.

Net Sales

Net Sales is the Gross Sales total (Cash and Charge sales less credit returns) minus the total sales tax charged.

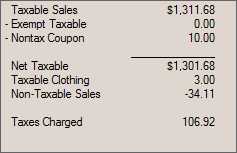

Tax Totals

A number of sales tax related totals may be displayed for the selected date(s) and tax location. Some are only made visible when a non-zero amount is involved.

Taxable Sales

Taxable Sales is the dollar amount of sales during the specified time period for taxable items and customers. This may include "store-use" inventory adjustments that would not be shown in the sales totals panel above. Each Point of Sale invoice or return has a "taxable" total associated with it.

Exempt Taxable (-)

Exempt Taxable is the dollar amount of sales to exempt customers that were taxable (some items may always be taxable regardless of the customer's tax status). This amount is usually a positive figure unless the total exempt taxable from credit (return) sales exceeds the total exempt taxable from regular sales. The amount is subtracted from the taxable sales to determine the net taxable amount (below).

Coupons that your company is not being reimbursed for, such as coupons your company issues themselves, are usually not taxable because they are considered a "discount" and not a method of payment. When using the "coupon" payment method at Point of Sale, the Process (F12) form offers two (2) options: store coupon and manufacturer's coupon. The manufacturer's coupon is taxable since coupons are usually reimbursed by the issuer.

This total is calculated as the sum of the Taxable Sales, Exempt Taxable (-), and Nontax Coupon (-) figures shown above. This is the sales amount that your sales tax liability would be based on.

This figure is the total sales for clothing type items that are partially taxable and is only shown if partially exempt (or partially taxable) clothing sales were done for the period and selected tax period. Clothing sales that are entirely exempt (no taxes are charged) are listed in the non-taxable sales total, not here. When any "clothing" type items are sold during the selected period and tax code, one or more tax code levels are "clothing exempt" and some tax was charged, the total sales for those items is listed here (this does not indicate how much tax was charged on those items, however).

In the United States, the Sales Tax Maintenance form offers the ability to flag each of the three (3) taxable levels associated with a tax code as "Clothing Exempt." If multiple levels are used, such as for state and county taxes, each level may or may not be "clothing" taxable. When any level is clothing exempt, the exempt tax rate is used for clothing items purchased below the "non-taxable clothing price." This lowers or eliminates the tax on the item when eligible.

Non-taxable Sales

Non-taxable Sales is the sales total for items with a non-taxable status (U.S. flags, clothing in some areas, food, etc.). This figure is only negative if the total of non-taxable returns exceeds the total for non-taxable sales (for the selected period and tax code).

Taxes Charged

Taxes Charged is the dollar amount of sales tax calculated for transactions during the selected period but not necessarily the amount that payment has been collected for.

Pay When Paid or Deferred Sales Tax

Some areas offer deferred sales tax payment plans. These plans base tax payments upon the sales tax amounts a company has received payment for rather than the tax amount they have charged to their customers. Really, this only affects businesses who maintain their own receivables (charge accounts). Program participation is limited in some areas to specific types of businesses and there may be an application process for such programs before participation is allowed. Rules and laws vary from area to area, so please check with your area's local tax department(s) to find out more specific information regarding any requirements.

It is the responsibility of your business to make sure any tax reporting and payments are done properly and that sufficient information is retained in the event of an audit. Using a pay when paid program does make sales tax payment a more complicated process and requires more diligent record keeping by your business.

Typically, pay when paid plans have a time limit on how long tax may be deferred (usually one year from the transaction date). After this time period, any unpaid sales tax is due regardless of the payment status. Because all sales tax that has been charged is eventually due to be paid (even if your company never receives payment), there is some limit to the benefit provided by deferred tax plans. The main benefit is that tax payments can be more closely tied to your company's cash flow. When more payments are received toward receivables items, your company has more money to pay the sales tax, in other words.

How does the Software Handle Pay When Paid?

It's important to understand that in order to pay sales tax when your company receives payment, there has to be some way of knowing that this has happened and enough detail regarding each payment (tax amount, tax location, date of the transaction, etc.) to justify the taxes paid in the event of a sales tax audit. Effort and planning is required to do this properly and accurately. Balance-only accounts don't retain sufficient details for this kind of reporting.

The are limited functions built-in to the application and database to assist users with tracking sales tax payments for pay-when-paid tax reporting. Here is an important list of considerations and rules when choosing a pay-when-paid tax program:

1.All Receivables must be done as "Open Items" in order to retain the details required for accurate tax reporting. "Balance forward" charge invoices are never marked as paid!

2.The tax paid on non-charge sales is marked as paid immediately upon processing.

3.The Sales Tax by Invoice report may be used with selection criteria of "By Paid Date" to see the overall tax liability for a date range. To view a particular tax location, the selection "Tax Location" can be used in conjunction with the date selection. To view all tax locations for the period with sub-totals, choose "By Paid Date" selection along with the desired dates and also specify a "Sort By" choice of "Tax Location." Reporting can be done by branch if desired. If some locations are pay-when-paid eligible and some are not, any ineligible locations would have to be backed out of the totals manually.

4.For each tax period, businesses must also remember that they are required to pay sales tax on any transactions older than the pay-when-paid program's expiration period (usually 1 year). This means that if your program's expiration is one year, you'd be required to pay any sales tax that had not been paid on invoices older than a year. This can be tricky for the following reasons:

•Sales tax may still be paid on expired items in the future. If so, any expired invoice would still show up on the "Tax by Invoice" report at the time it's paid even if the tax had been previously paid (because it passed expiration). For this reason, once your company passes the expiration period, it's important to begin checking your "Tax by Invoice" report for any "old" invoices that may have been paid previously due to expiration. These amounts will have to be manually backed out of your payment calculation (keep a record of this).

•Once taxes have been paid on invoices older than the expiration, your company needs to keep track of this. There is no way to record which expired invoices have been paid previously and which one's have not. It's possible to use date ranges and reporting as long as someone at your company keeps manual and accurate records regarding which invoices and periods have been paid due to expiration.

5.For "open items" an invoice is only considered paid once that invoice (open item) is paid in full. Partial payments of sales tax are never considered or reported.

6.The standard Sales Tax report and Inquiry form don't reflect "paid" tax, only the tax charged. The "Tax by Invoice" report is the only built-in report provided relevant to pay-when-paid programs.

Keep paper copies of all Tax by Invoice reports (and electronic also if desired) and maintain records related to expired invoices which you have paid and the invoices for each period you pay taxes on. Reports are never saved as documents, so it's important to have paper records of tax payments in a secure location should there be a serious problem with your database, fire, etc.

In addition, it may be useful to create and use custom reports if the capability of the "Tax by Invoice" report is not sufficient to meet any requirements. Check our web site for available report templates, create your own report, or request a custom report written by support personnel (this is billable).

Reconciling Sales to the LedgerThere are a number or reports and inquiries available with the software that report "sales" information for a period of time. These include reports and inquiry for Totals, Sale Tax, and Sales Analysis. Financially, the Income Statement (aka. P&L) would report your company's income from sales and might be compared to "sales" totals from the previously mentioned reports and inquiries. Below, you will find a listing of some nuances about each type of report/inquiry that you should be aware of before making comparisons: TotalsBranch sales totals include inventory sales except for gift cards and stored value cards. Totals include adjustments. "Net" sales would be compared to the Income Statement or other reports since it includes cash sales, cash returns, charge sales, and charge returns less any sales tax. Sales Analysis (Inventory)This report is based on the sales totals as recorded for inventory items (these can be individually viewed by item also). The report includes items as based on your selection criteria, so if that selection criteria includes gift card or stored value card type items, these "inventory" totals would not match the branch totals. Inventory sales totals do not include adjustments which would be another difference between inventory sales and the branch totals (and possibly your Income Statement). Inventory sales do not include sales tax. Sales Tax ReportThe sales tax report and inquiry include any activity affecting your company's tax liability. If your company does inventory adjustments for "store use" that are taxable, these would appear on the Sales Tax report and inquiry as "sales," but not appear as sales on the (branch) Totals report or inquiry. Store use adjustments do not affect usage nor do they affect item sales totals, so they would not be reflected on the (inventory) Sales Analysis report. Income Statement (aka. Profit & Loss or P&L) This financial statement (report) compares your company's income to its expenses in order to determine the net income or profitability of your company. When income exceeds expenses, your company is profitable; otherwise, your company is operating at a loss. System journal mapping and detailed mapping determine how software activity affects your company's financial statements. The structure of your ledger (Chart of Accounts) determines the appearance of the financial statement (the levels of totals and detail as well as the order in which accounts and summaries are listed). If your chart of accounts is designed in a way that separates the income from inventory sales from other types of income, it's easier to make comparisons between those totals and other areas. Income accounts may be used for other types of income and affected by non-sales activity. Manual journals as well as income that originates outside of Point of Sale can make comparisons more difficult. Reason for DifferencesThe following listing provides possible explanations for differences you may find when comparing reports and inquires to your financial statement or ledger account activity. •Adjustment Code Mapping When adjustment codes are mapped to a ledger account that is not in the Income category, sales affected by the adjustment won't appear on the income statement, but are included in sales totals from other areas. •Inventory Sales Mapping It is possible to map sales for specific product groups to any ledger account, including accounts that aren't income accounts (or an income account that's not normally used for inventory sales). This type of mapping is commonly done when "items" are used for non-inventory purposes such as gift cards, labor, delivery, and deposit reasons. Separate mapping exists for cash sales, cash returns, charge sales, charge returns, exempt cash sales, exempt cash returns, exempt charge sales, and exempt charge returns. When mapping a specific product group (such as for gift card sales) differently, it's important that all the appropriate sales categories be mapped. When detailed mapping doesn't exist, the default accounts from the system journal mapping are used (which may place certain types of sales in the wrong account or category). For example, if you mapped cash and charge sales for gift cards to a liability account, but forgot to map exempt sales or returns (if allowed), you might wind up with some gift card sale/return transactions affecting income accounts and others affecting liability accounts. •Gift Cards Gift card sales are linked with a special item-type of either "gift card" or "stored value card." Sales of gift cards are typically backed out of branch sales totals so that sales are not affected twice (once when the card is sold and again when the card is used as a method of payment). If the gift card, or stored value card, is mapped to a regular inventory "sales" income account in the ledger, it will appear as income on financial statements, but not appear in most sales totals. Inventory totals are updated for gift card and stored value card items, so the (inventory) Sales Analysis report would include these sales if the gift card items aren't excluded by using selection options (such as product group/section) when running the report. •Non-Taxable Coupons Non-taxable coupons reduce the sales tax liability of a transaction, so that the expected sales tax amount may not be reflected in the Sales Tax Report. This can cause a mismatch between your Sales Tax Report and your Point of Sale totals. You may want to keep this in mind when you are running a non-taxable coupon promotion. •Other Types of Non-Sales Income It's important to understand and consider the source of income that appears on your financial statement(s). Income may originate from Payables discounts and Receivable Finance Charges (paid), for example. Another possible source of differences would be Miscellaneous Payments processed from Point of Sale, Payments. Consider whether your company uses any income accounts for returned check fees, charitable donations, or other non-sales reasons. These would not be included in either branch, sales tax, or inventory totals. Check your system and detailed mapping for any "income" accounts. This may help you find non-sales activity which needs to backed out of your comparison. In general terms, when making comparisons, it is more accurate to compare overall totals (your entire inventory sales to sales income, for example) to the current date rather than trying to tie-out specific products or groups or past time periods. It is possible for changes to data, such as inventory items, to alter how sales are reflected by reports run for prior periods (item merges, product group changes, ledger mapping modifications, etc.). |