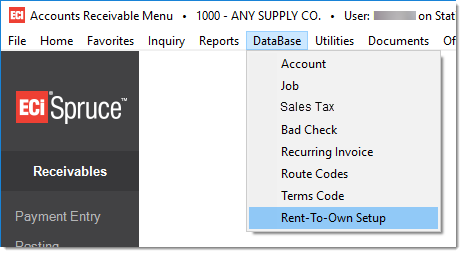

Rent to Own (Hire Purchase) Setup

"Rent to Own, also referred to as "Hire Purchase" in the UK (United Kingdom) and other areas, provides the ability to establish a payment plan for a customer's purchase for a specific period of time. The customer makes installment payments over the term of the agreement or contract. Some portion of their payment is applied toward principal unless no financing or interest is included. The amount applied to principal may be either a fixed amount each month or vary if a declining interest (amortized) method is used (at your company's discretion).

This form provides configuration for this feature at the Branch (location) level. The actual transaction is located on the Point of Sale menu. The default name of the transaction for customers in the United States and Canada is "Rent to Own." The term "Hire Purchase" is the default in other areas. Customers can rename both the "system" default (the name of the transaction on the menu) as well as the program name for each branch location. For example, a company could use the feature for Rent to Own at one location, but for lay-away plans at another.

For the purpose of these help files, the term Rent to Own will be used from this point on. Please contact your aftermarket sales representative to enable this feature.

|

As one example, a customer might purchase a living room set which they agree to make incremental payments for a period of three (3) years. During this period, the customer doesn't own the living room set and is considered to be renting. A portion of their regular payment (weekly, monthly, etc.) is applied to the purchase price and the remainder is applied to financing/interest at a determined rate. At the end of the term, the customer owns the living room set assuming that they have met the terms of the agreement. |

Before using this feature...

There are options affecting the recording of income that you may choose to use or not. The nature of the specific business, whether it be an actual "rent to own" operation, or something else, can change how transfer of ownership is viewed financially and/or legally. Specifically, this affects whether your company can defer (delay) the recording of income for a customer's purchase over the term of the agreement. In most cases, if ownership changes at time of purchase, income isn't typically deferred. If ownership is retained by your company, and not immediately transferred to the "renter," for example, you usually can defer the recording of income. In the case of deferred income, as the customer is billed, portions of the income and cost of sales (net profit) are recognized over the term of the agreement. Again, whether this is permissible may vary based on your location and the laws in your area. Prior to deferring income, you should consult an accountant to verify the correct method for your situation and location.

Income deferral must be determined at the branch level. If you have more than one business and need to use both methods (deferred and not deferred), you'll need separate software branch locations for those operations.

Receivables Representation (Account)

A special type of account is required for Rent to Own (Hire Purchase). We suggest that you only use this account for Rent to Own activity to avoid any confusion. The account is considered "cash-only." The only receivables activity allowed is the invoicing of orders associated with a Rent to Own contract. For receivables processing, the account is an "open item" and "job" billed account. The credit limit should match or exceed any purchase amount.

When a customer order linked to a Rent to Own (Hire Purchase) contract is invoiced, the due date of that invoice is set to match the end of the contract term. The original purchase is not aged until the due date passes and will be represented either as part of the customer's current balance. In some cases, we may show the amount due in the future separately; however, it is not maintained in the data separately from the current balance.

Customer statements will reflect the purchase and any current cycle adjustments as current. Unpaid adjustments (for billing) from prior cycles will be reflected as past due if unpaid.

The frequency (how often) a customer is billed can vary by contract (agreement). One contract might be billed monthly while another might be weekly. Aging doesn't reflect the age based on the number of billings or frequency of those bills. For example, a customer with a weekly plan who hasn't paid the past two (2) weeks might still show as "current" until the next billing cycle runs. Aging is only done once per month when the monthly billing process runs. In the same regard, the statement doesn't show past due amounts in weekly increments or any other period that doesn't match the monthly billing cycle.

The contract document can serve as a "status" of the current state of the agreement and we suggest using Email notifications for payment reminders.

Form Entry

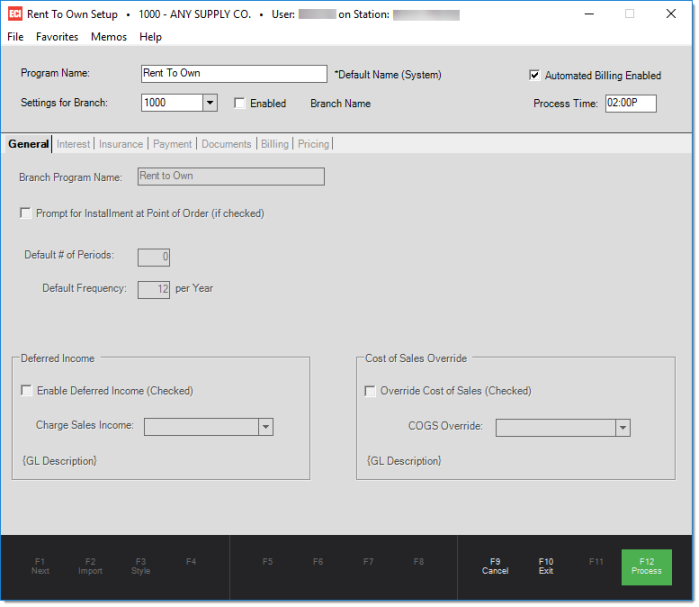

Program Name

The program name will initially default to either "Rent to Own" or "Hire Purchase" depending upon your region settings. Changes to the name will affect the name of the feature on the Point of Sale menu in all branch locations. There is a secondary Branch Program Name that can be used to customize the name if you choose to use it differently in other branches. Changes to this setting affect ALL branches and users.

Settings for Branch

The Rent to Own feature is enabled per branch location. Select the branch you want to enter settings for. The selection defaults to the current branch location.

Enabled (Check Box)

Check the "Enabled" check box once all set up is complete and you want to activate the feature for users in the selected branch location. The check box must be checked before any additional configuration.

Automated Billing Enabled (Check Box)

This check box determines whether the automated billing is enabled for the feature (regardless of branch). When enabled, a process is run at the designated time of day which generates bills and insurance invoices (if insurance is enabled) based on the billing schedule established for customers. Billing can optionally generate Email reminders to customers, so consider the timing in regard to the delivery of these messages if you plan on using them. Automated billing is either enabled for all branches or not (branches that aren't enabled won't process billing until they are enabled, however).

|

Automated billing should be enabled upon active use of the feature. Automated billing can be disabled in the event of an issue requiring our assistance, during setup/testing of the feature, or prior to your company's live date. |

Email notifications are only sent in the following situations.

•Valid SMTP Email configuration is present for your installation (system).

•Notifications are enabled on the Payments tab of this form.

•The Rent to Own (Hire Purchase) transaction is enabled for notifications and a valid Email is saved with the installment contract.

Process Time

The time of day that billing processing will occur. There are two (2) process that run: billing (ARInstallmentBilling) and past due (ARInstallmentPastDue). The first updates the billing schedule for active contracts creating adjustments for interest/financing, insurance invoices (if enabled), and notifications (again, if enabled). The second process assesses late fees (if any) and past due notifications if enabled. The second process runs 15 minutes after the first.

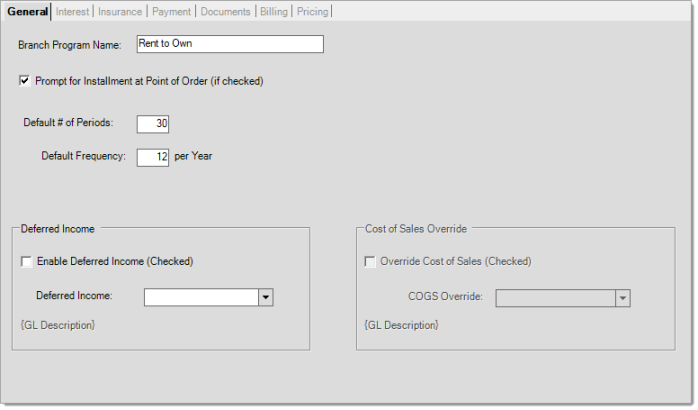

General Tab

The General tab includes settings related to the overall feature in the selected branch location.

Branch Program Name

The branch program name is used on documents and forms except for the main Point of Sale transaction which uses the system-wide Program Name.

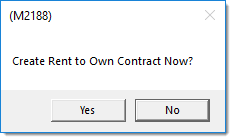

Prompt for Installment at Point of Order (Check Box)

If checked, at the end of processing a customer order in the branch, users will be shown a dialog asking if they want to create a Rent to Own (Hire Purchase) contract. If the option is not selected, you can still create a contract by navigating to POS > Rent to Own (Hire Purchase).

Default # of Periods

This is the default number of payments (bills) for new Rent to Own (Hire Purchase) contracts. If zero, the user will have to enter an amount when creating the contract before saving. The default is a convenience to make Point of Sale entry easier and can be changed by the end user.

Default Frequency

The frequency determines how often bills are due. One (1) year, or 365-days, is the base-line, so the frequency represents the number of billings in one year (365-days). This is true even if the contract spans more than one year. A frequency of 12 means monthly, for example. A frequency of 52 means weekly (52 weeks in a year) as another example. The frequency is just a default to make Point of Sale entry easier and can be changed by the user.

Deferred Income and Cost of Sales

Depending upon the nature of the transaction, you may be allowed to defer the initial recording of income (profit) for a transaction then incrementally realize (record) that income as the transaction is billed over time (in equal portions). Whether this is permitted or not usually depends on when ownership of the purchased goods is transferred. Typically, you are not allowed to defer income in cases where the ownership of goods transfers immediately at the time of the transaction. In a "rent to own," scenario, you may be able to defer income if your company retains ownership and this is permissible in your area. Consult your company's accountant if you aren't clear whether to use this feature or not.

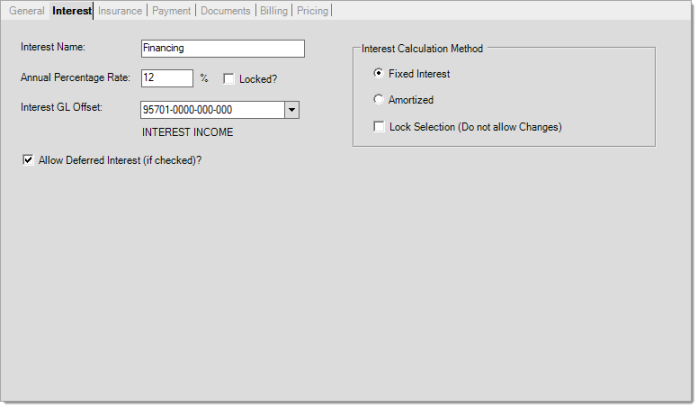

Interest Tab

The Interest tab includes settings related to the interest applied to the contract.

Interest Name

This is used on documents and forms.

Annual Percentage Rate

This is the default annual percentage rate for the Rent to Own contracts. You may also opt to lock in the annual percentage rate if you don't want the POS user to have the ability to change this value.

Interest GL Offset

Select which GL account the interest income is booked to. When interest is assessed or when billing happens, a debit adjustment is created on the Receivable account for the total bill amount, as well as a credit adjustment for the Principal, which is posted to the original purchase invoice. This will result with the next change in Receivables to be only the interest. The benefit to creating a debit adjustment for the full bill amount is that in the event that the contract holder does not pay the amount owed, that amount will age into a past due amount. You can then charge finance charges and show past due amounts owed by the contract owner.

Allow Deferred Interest

Select whether you allow deferred interest. Deferred interest allows your customer to carry a balance from month-to-month, without paying interest. Any balance held does accrue interest, but your customer will only owe that interest if they don't pay off the balance before a certain date (when the deferred interest period expires). In the event that your customer does not pay their balance before the deferred interest period is up, all of the interest they have accrued over the given time period will be added to their balance.

Interest Calculation Method

Select whether you wish to calculate the interest using the Fixed Interest or Amortized method . If the "Lock Selection" option is selected, the end user will not be able to make changes to the Interest Calculation Method, if unchecked, either option could be selected when creating the contract.

Fixed Interest - A fixed interest rate is an unchanging rate, it remains the same throughout a set period. With this option, the contract owner will pay more interest at the beginning of the contract but less at the end. As the principal amount owed decreases over time, so will the calculated interest amount.

Amortized - This option has scheduled periodic payments that are applied to both principal and interest. An amortized load payment first pays off the interest expense, and the remainder of the payment reduces the principal.

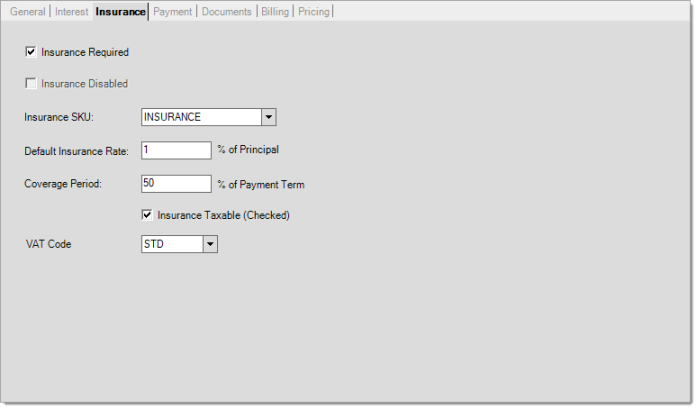

Insurance Tab

The Insurance tab enables you to enable or disable the option to apply insurance against a Rent to Own contract. The Insurance option is an add-on which works as a payment protection plan for the customer. In the event the customer cannot make payments to their contract, they will not be charged finance charges. An Insurance invoice is created on their account when billing occurs, based on the defined rate.

Insurance Required / Disabled

Select whether Insurance is required or if the option is disabled by selecting the designated checkbox.

Insurance SKU

If you choose to provide insurance against your Rent to Own contracts, you must create an inventory item (SKU) for the Insurance and select it in this field.

Default Insurance Rate

Enter the default insurance rate. This is a percentage of the Principal.

Coverage Period

You may set the coverage period as a percentage of the payment term. For example, on a 3 year contract, you may elect to cover for 75% of that period. Spruce will calculate where that coverage ends. Select the "Insurance Taxable" option if is taxable.

Insurance Taxable / Tax or VAT Code

Select the "Insurance Taxable" option if insurance is taxable and choose the associated Tax/VAT code.

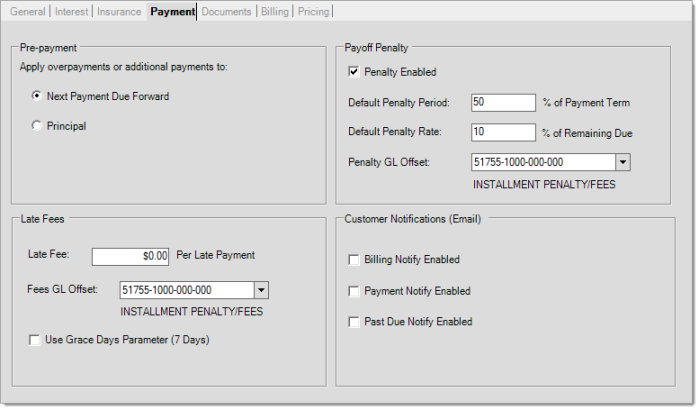

Payment Tab

The Payment tab is where you define how pre-payments and late fees are handled.

Pre-Payment

Define how overpayments are to be distributed. You may choose to apply the overpayment to the next payment due or against the Principal itself.

Next Payment Due Forward: Overpayment is applied towards the next billing cycle, thus reducing that billing cycle's amount due.

Principal: Overpayment is applied towards the remaining principal amount.

Payoff Penalty

If a customer wants to payoff their contract early, you can charge a payoff penalty. Prepayment penalties can be set as a percentage of the remaining balance, or/and as a percentage of the payment term. If you choose to charge a payoff penalty, you must map this offset to a GL account.

Late Fees

Enter the late fee amount to be applied per late payment. If you elect to charge a late fee, you must map the General Ledger to indicate where this account must be applied to. You may also choose to use a grace day period before the late fee is applied. The Grace Day period is defined is Parameters>Database>Receivables.

Customer Notifications

Set default email customer notification preferences. An email will be sent to notify the customer of the selected upcoming event.

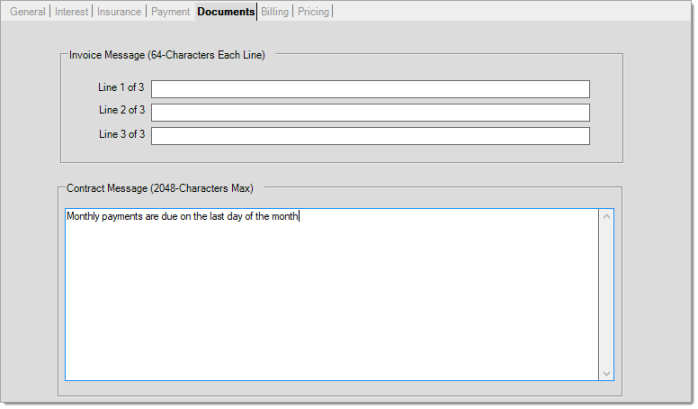

Documents Tab

The Documents tab is where you can customize messaging to print on documents.

Invoice Message

Enter the messaging you want to print on the invoices. You are limited to 3 separate lines of 64 characters each.

Contract Message

Enter the messaging you want to print on the contract. There is a maximum of 2048 characters.

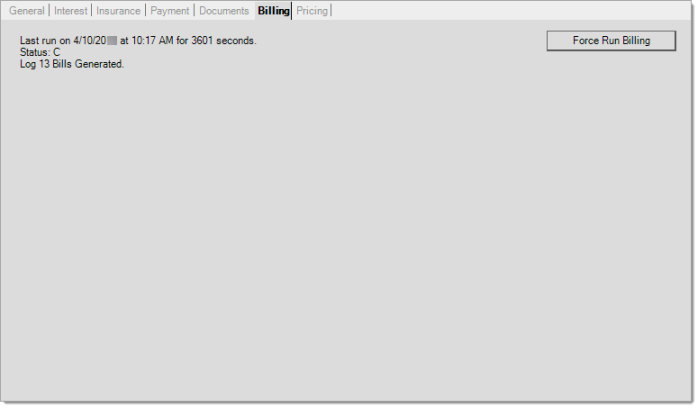

Billing Tab

The Billing tab is where you will go to Force Run billing if you don't have "Automated Billing Enabled" selected. You can force run billing at any time even if automated billing is selected.

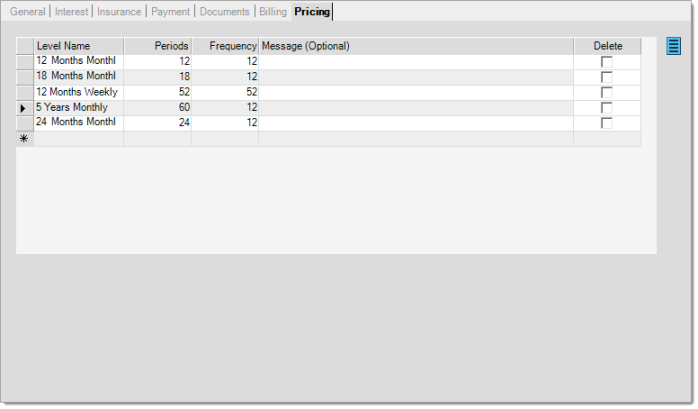

Pricing Tab

The Pricing tab allows you to predefine various pricing schemes. These pricing schemes can be used to calculate various payment plans when creating a contract in Point of Sale.