Point of Sale (Adjustment Codes)

The Point of Sale category is used with Adjustment Codes on a variety of Point of Sale transactions. Point of Sale type adjustments can be assigned to an account or manually added during Point of Sale transactions. User security can limit a user's ability to modify and add adjustments from the Process (F12) form in Point of Sale areas. Adjustments are not final until invoicing and may be modified prior to sale when associated with a open quote, order, or ticket (as long as the user has permission to do so). Later changes to an adjustment code do not alter the adjustment on pre-existing transactions. Basic adjustment information, such as the code, amounts, and type, are saved with each transaction and are what's used whenever that transaction is referenced by documents, other transactions, etc. in the future.

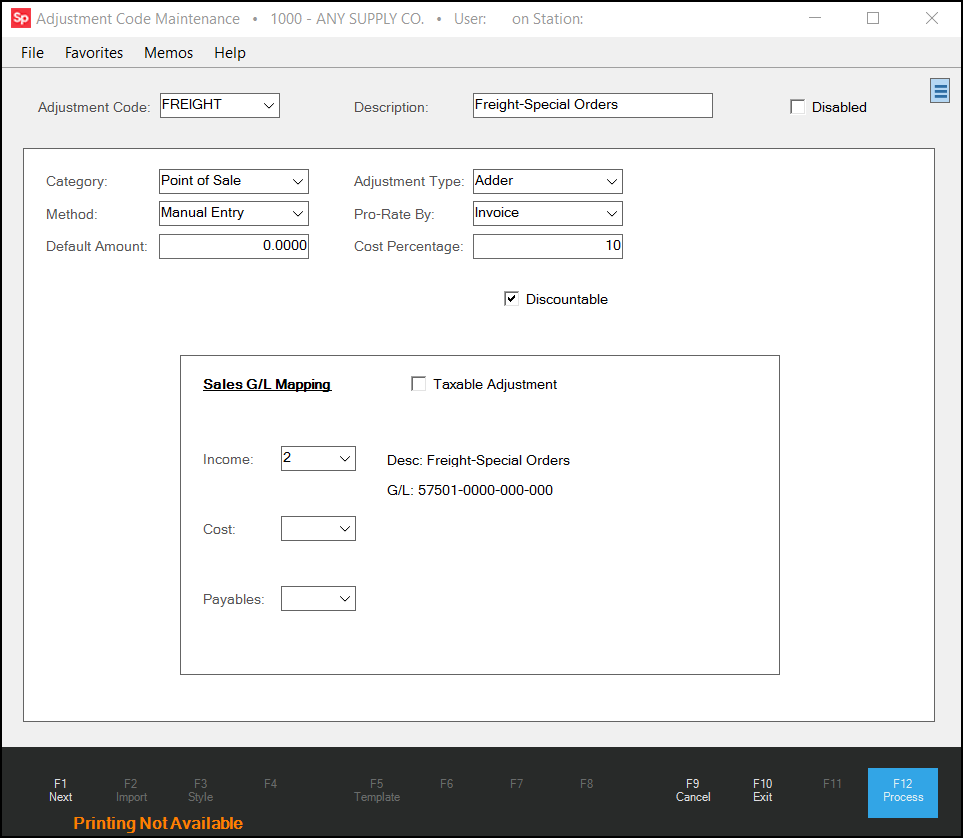

To access and complete a Point of Sale Category Adjustment Code:

1. From the Main Menu, choose Point of Sale > Database > Adjustment Code. The Adjustment Code Maintenance form displays.

2. Complete the following entries to define the adjustment code you need:

Adjustment Code

Adjustment codes can be up to 12-characters long. Codes, regardless of the category (Point of Sale, Purchasing, etc.), must be unique. The category limits the use of the adjustment, so you may have some duplication if similar codes are needed in more than one application area. Codes are typically retained with documents, even if the code is at some point deleted. For this reason, it is a good idea to make codes as descriptive as possible.

Description

The description allows for up to 30-characters to provide additional detail about the adjustment code. Descriptions are rarely (if ever) saved with transactions, so when printed on documents or reports, the description is always the current description for the code, and does not necessarily reflect the description at the time the code was actually used. When an adjustment code is removed (deleted) using the Menu Marker ![]() , the description will no longer be available to documents or reports. For this reason, we suggest disabling the code rather than deleting it, especially if the adjustment code has been used in the past.

, the description will no longer be available to documents or reports. For this reason, we suggest disabling the code rather than deleting it, especially if the adjustment code has been used in the past.

Disabled

The "disabled" check box provides an alternative to deleting (removing) an adjustment code. When a code is disabled, the code won't appear in selection lists in the application areas so it can't be associated with any new transactions; however, the code's description and settings are retained for future reference and for printing/viewing on documents and reports. The Menu Marker ![]() allows you to delete an adjustment code; however, it's best to only do this when a code hasn't been used. Deleting a code removes information about the code permanently and can cause code descriptions to disappear from any documents that referenced the code. For this reason, we strongly suggest using the disable option in place of deletion whenever an existing code may have activity.

allows you to delete an adjustment code; however, it's best to only do this when a code hasn't been used. Deleting a code removes information about the code permanently and can cause code descriptions to disappear from any documents that referenced the code. For this reason, we strongly suggest using the disable option in place of deletion whenever an existing code may have activity.

Category

This determines where the code will be available as well as sets default values for certain fields on the form. Changing the category on any existing code is strongly discouraged. If the category is modified, fields on the form are set to default settings for the category. Even if the category is then changed back, any prior entries on the form and for the selected adjustment code will be lost. If the category is accidentally modified for an existing code, it's best to first Cancel (F9) and reselect the code to reload the actual settings in this case. There are currently five categories: Purchasing, Point of Sale, Manufacturing, Receiving, and Mfg Market.

Type

There are two types of adjustments: Adders and Discounts. Adders increase the amount due and usually represent some type of added charge or fee (freight, delivery, tarping, etc.). Discounts can either increase or decrease the amount due based on whether the discount amount or percentage is negative (-) or positive (+).

Adders are almost always positive amounts except in the following cases:

-

An Adder type adjustment code is associated with a Charge Return transaction. The Adder increases the amount refunded in this case (it is assumed that you are crediting the adder back to the customer/account in this case). (This is true if the adjustment code method is set to Manual Entry only. If the method is set to Percent of Sub-Total, the adder is negative for a manual return.)

-

An invoice with an Adder type adjustment is reversed. Reversals attempt to "undo" the original transaction exactly as it entered, so adjustments are also reversed.

Adders are never negative amounts when you process a credit manually in the Sales transaction in Point of Sale. Adder adjustments typically reduce the amount of credit because a positive amount is being applied to a negative balance due. The reason that Adder adjustments work differently in Sales vs. Charge Returns is that we know that a Charge Return is always a return (refund). The Sales transaction can be used for sales, returns, or a mix of both. For this reason, we never assume that an Adder type should be reversed when processing a Sale. To manually reverse an Adder type adjustment, you'd need a corresponding Discount type adjustment that duplicates the Adder but allows a negative amount.

Discount adjustment types work differently than Adder types with regard to credits or refund sales. A Discount always decreases the total, so if the total is negative, the credit amount would be lowered by the discount. Transactions with a positive total would also be reduced by a discount adjustment. The application assumes that when the total due is negative, a discount should reduce the refund, not increase it. For this reason, the fact that a sale's net total is negative or positive won't change how a discount is applied. A sale and corresponding return (refund) with the same items and discount-type adjustments would have the same ending total (except that the overall total would be the opposite sign).

The Discount Code parameter for Receivables determines how discount adjustments are calculated. The discount code can either calculate the discount on the pretax total or the total including sales tax. This parameter is located on the Receivables tab of the Parameters form (Main Menu > Maintenance > Database > Parameters).

Method

Method determines whether the adjustment's amount is a percentage or dollar amount. Choices include Manual Entry, Percent of Sub-Total, or Percent of Discountable. The Percent of Discountable method is only available with Discount type adjustments, so if you choose an Adder adjustment type, the only selections available will be Manual Entry and Percent of Sub-Total.

-

Manual Entry means that you can specify the dollar amount whenever this adjustment is used. Even if a default amount dollar amount is specified, you can modify the dollar amount on the Adjustments tab of the Process (F12) form.

-

Percent of Sub-Total calculates the adjustment amount as a percentage of the entire subtotal (including any "net" items).

-

Percent of Discountable calculates the adjustment discount as a percentage of the total for only those items that are not designated as "net."

Default Amount

The "Default Amount" field is used to specify either the dollar amount or percentage for the selected "method." A default amount is usually optional and can be modified by users with permission to add adjustments.

Pro-Rate By

Adjustment amounts intended for Point of Sale use can be pro-rated using four (4) methods: invoice, delivery, item, and discountable amount. This really doesn't change how adjustments are applied in most cases, but alters which items are included. A cost percentage may be used to set the cost of the adjustment as a percentage of the total adjustment amount.

Invoice

The full amount of the adjustment is applied to all items being sold regardless of a given item's discountable status (any "net" items prices are affected also). When the adjustment is linked with a customer order, the first sale of the order will include the full adjustment amount even when partially selling the order. The Point of Sale user can clear the adjustment during the sale to prevent this. If done, the adjustment will remain on the order and will be used for the next invoice, etc.

Delivery

The adjustment total is pro-rated based upon the dollar amount being delivered, so the total adjustment is not necessarily applied (depending upon the items selected for sale).

Item

The adjustment total is pro-rated based upon the items being sold, so the total adjustment is not necessarily applied (depending upon the items selected for sale). This would only apply in certain cases, such as the partial sale of a customer order, for example.

Discountable Amount*

The adjustment is applied to only those items that are discountable (not "net" items). The total discount amount calculated may or may not be based on a total including "net" items.

This setting only affects how the determined discount affects item prices when applied, not how that discount amount was calculated. For example, you could calculate a discount based upon the total for all items (by subtotal) but only apply it to the non-net items. The customer would receive the same discount overall, but the individual prices of net items wouldn't reflect the discount.

*This pro-rate by option is the only one that can be selected when using the "percent of discountable" method.

Do Not Apply

This type of adjustment is applied normally during a sale to all items being sold, but isn't applied when the sale is a return that references an original invoice which includes a Do Not Apply type adjustment.

For example, if a $1.00 adjustment was applied to a $10.00 item, the result at time of sale would be a subtotal of $11.00. When that same item is returned and the return is linked to the original invoice, the return's subtotal won't include the adjustment. The return subtotal would be $10.00, not $11.00. Basically, this provides the ability to create a non-refundable adjustment.

Cost Percentage

If a Cost Percentage is entered for the adjustment, a cost is calculated from the adjustment amount based upon the percentage entered. Point of Sale adjustments can have an adjustment cost associated with them which is not necessarily the same as the adjustment amount. For example, you might have an "adder" charge for FREIGHT that includes your actual shipping charges plus an added on "handling" fee that your company keeps. The cost of the "freight" adjustment might be the cost your business actually pays for shipping charges in this example.

Specifying a cost percentage is optional.

POS Discountable

Usually, this option is used with "adder" type adjustments. The discount this refers to is a "statement discount," not a discount applied through repricing, for example. If enabled, the application calculates the discount for any adjustments after all other discount calculations have been made. If your adjustment code is calculated based upon the "discountable amount," the adjustment amount is first calculated based upon the eligible discount total* and the adjustment amount is added to the discountable total amount before discounts are calculated.

*Discountable total is not necessarily the same as the sub-total. Options exist that determine how discounts are calculated. Discount calculations may or may not include "net" items. Additionally, the discount calculated may either include sales tax or not.

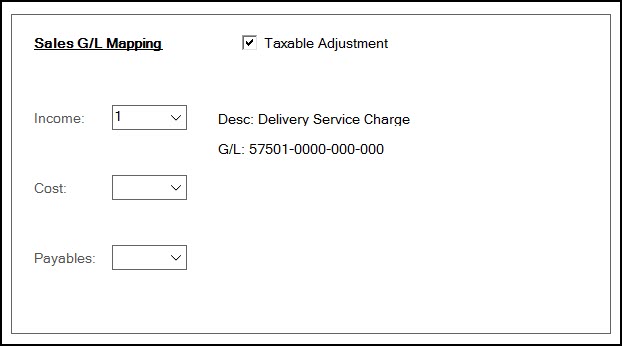

3. When you are ready to set up the General Ledger Mapping associated with this adjustment code, you first need to assess whether the adder or discount is taxable. Review this to determine whether to enable (check) this Taxable Adjustment check box or not.

-

Taxable Adjustment

It's possible that an adjustment may represent a service fee or other charge that is taxable or that the adjustment represents a discount which should decrease the tax due for the sale. If the adjustment's effect on the total due should be considered when calculating the sales tax amount, check this box. Otherwise, the adjustment will not be considered when doing sales tax calculations (if the box is not checked). The taxable status of an adjustment only determines whether the taxable total for the sale or return is either reduced or increased by the adjustment amount.

It's important to understand how the "taxable" flag on adjustments determines whether or not the adjustment alters the tax calculated for a transaction. If the "taxable adjustment" check box is not checked, the adjustment may either increase or decrease the amount the customer pays but wont incrementally increase or lower the sales tax. Adjustments that are not flagged as "taxable," have no effect on sales tax one way or another. Taxable adjustments do cause the sales tax to increase (adder) or decrease (discount) when the adjustment is applied.

4. When setting up Point of Sale adjustment codes, there are three GL Mapping settings: Income, Cost, and Payables. Choose the journals that will assist you in tracking these costs in your General Ledger.

Income

Income represents the total amount of the adjustment charged to the account (this is mapped to an "income" type and is a credit entry that increases the account's balance in the case of a sale). The offset to the income account entry will be based on the payment method of the sale or return (an asset typically).

Cost

Cost mapping reflects the cost of the adder as an expense (in the case of a sale, this is a debit that increases the balance of the expense account mapped). Adjustments only have a cost in some cases. Adjustments without a cost do not create a general ledger entry.

Payables

Payables is the credit offset to the cost expense (debit) and represents money owed to another entity for the cost of the adjustment (a freight charge, for example).

Adjustments without any cost create neither a cost nor a payables general ledger entry.

5. Choose Process (F12) to save the changes or additions to the adjustment code database.

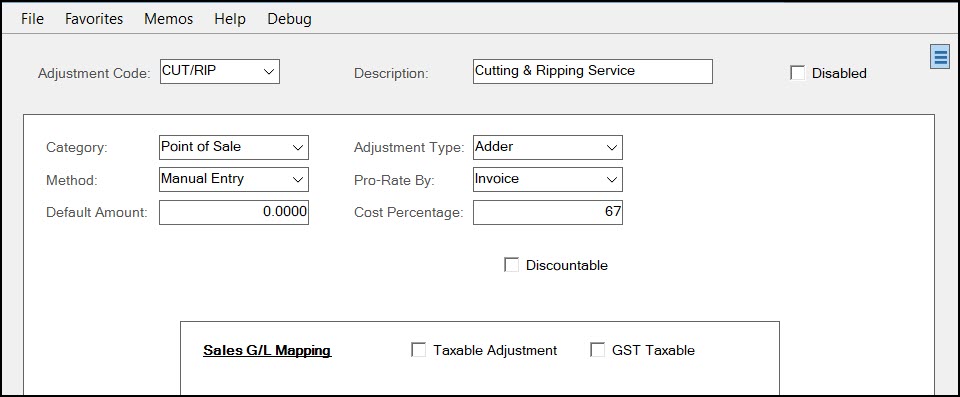

Managing PST, GST, and HST Taxable Adjustments

Managing PST, GST, and HST Taxable Adjustments

The Adjustments form is slightly different for businesses in the Canadian region. For this region, adjustments can potentially be taxable for PST (Provincial Sales Tax) and/or the federal GST (Goods and Services Tax). Some provinces have an HST (Harmonized Sales Tax), which combines the provincial tax rate with the federal.

-

For businesses that use the HST tax, select the GST Taxable check box to indicate the tax status of the adjustment. Checking or not checking the "PST Taxable" check box in an HST location won't affect the taxable status of the adjustment.*

-

For businesses that use the PST tax, select the PST Taxable check box only used in PST/GST tax provinces.

*If your company is located in an HST area but delivers goods to a PST/GST region and you are required to submit PST/GST taxes to that region, it's probably just best to check (or not check) both boxes accordingly. It may be necessary to have create separate adjustments for the same usage to accommodate transactions processed in or for different provinces or territories and if the taxable status of the adjustment isn't the same from region to region.

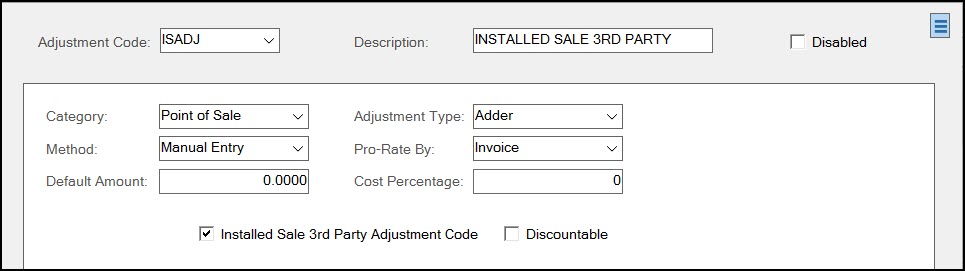

Adding a Installed Sale Third-Party Adjustment

If your company uses the Installed Sale feature in Point of Sale, you may create one adjustment code to be used for recording third-party charges associated with a contract (your company may or may not use 3rd party providers for installations). This adjustment is used for recording the portion of the installed sale total billed that was paid to a third party for installation services and/or materials. Only one code is needed for this function, so once an "Installed Sale Third Party Adjustment Code" has been designated, the check box won't appear when viewing other adjustments or adding new ones.