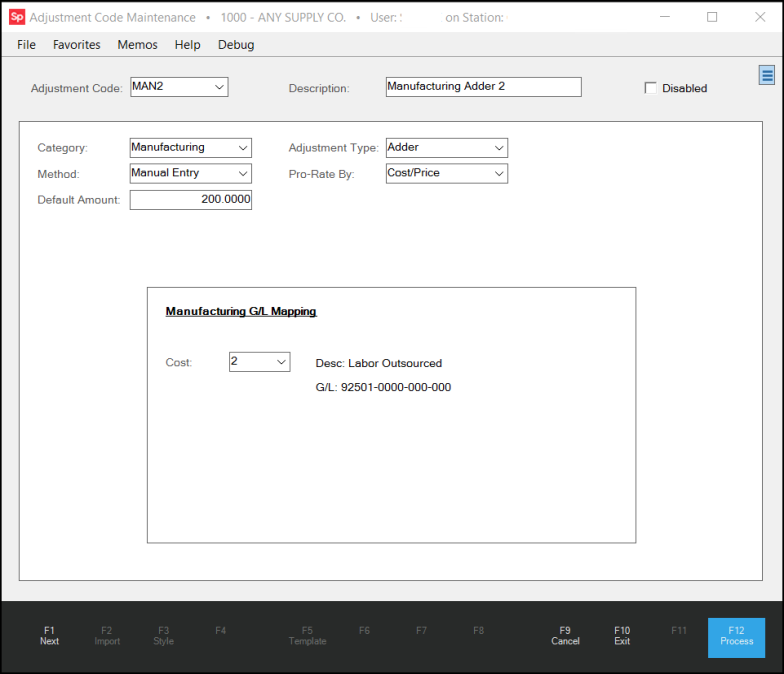

Manufacturing Adjustments

Adjustment Codes for Manufacturing only allow "adder" type adjustments. These are utilized from the Manufacturing transaction available from the Inventory area. Transactions typically save some information about the adjustment at the time the transaction was processed. Most future changes to adjustment codes, except for deletion, won't typically affect existing documents or transactions. Adjustments are not final until invoicing and may be modified prior to sale when associated with a open quote, order, or ticket (as long as the user has permission to do so). Later changes to an adjustment code do not alter the adjustment on pre-existing transactions. Basic adjustment information, such as the code, amounts, and type, are saved with each transaction and are what's used whenever that transaction is referenced by documents, other transactions, etc. in the future.

Adjustment Code: Manufacturing

Adjustment Code

This drop down control may be used to enter or select an existing adjustment code for modification or deletion, or to enter and define a new adjustment code. For selection in other areas (Point of Sale, Manufacturing, etc.), codes are filtered based on their assigned category so that only the applicable codes are listed. As an alternative to entering a code, you can type a full or partial description in the text area and then choose "Description" from the alternate menu.

Description

The description should indicate the purpose of the code. This will be listed along with the code in drop downs used for selection.

Disabled

This check box field may be used to disable an existing adjustment code. Disabling a code prevents the code from appearing in selection lists, but does not remove the code. This allows the code to still be referenced on documents and any transactions which may currently be assigned to the code. The menu marker ![]() allows the deletion of an adjustment code; however, it's best to only do this when a code hasn't been used. Deleting a code removes information about the code permanently and can cause code descriptions to disappear from any documents that referenced the code. For this reason, we strongly suggest using the disable option in place of deletion whenever an existing code may have activity.

allows the deletion of an adjustment code; however, it's best to only do this when a code hasn't been used. Deleting a code removes information about the code permanently and can cause code descriptions to disappear from any documents that referenced the code. For this reason, we strongly suggest using the disable option in place of deletion whenever an existing code may have activity.

Category

This determines where the code will be available as well as sets default values for certain fields on the form. Changes to the category on any existing code is strongly discouraged. If the category is modified, fields on the form are set to default settings for the category. Even if the category is then changed back, any prior entries on the form and for the selected adjustment code will be lost. If the category is accidentally modified for an existing code, it's best to first Cancel (F9) and reselect the code to reload the actual settings in this case. There are currently five (5) categories: Purchasing, Point of Sale, Manufacturing, Receiving, and Mfg Market.

Type

The only type available for manufacturing is the "adder" type. The field is read-only to prevent changes. Positive adder amounts represent an increase.

Method

Methods include the following: Manual Entry, Percent of Material Total, or per MBF/MSF (thousand board feet or thousand square feet).

•Manual Entry allows a user enter a specific dollar amount total. A default amount may be set, but this is optional.

•Percent of Material Total calculates the adjustment total based on a percentage you designated (default amount).

•The "per MBF/MSF" calculates a total dollar amount based on the total thousand board footage and/or square footage. In both cases, footage is calculated for the items being used for manufacturing. The items must be dimensional lumber or sheet goods items with specified dimensions (in Item Maintenance). If your company doesn't have dimensions specified, no MBF/MSF will be calculated (even if these are used as units of measure for the item). A default amount may be set or the user can type in an amount during processing. The amount determines how much per each MBF/MSF is to be applied.

•Setup Charge is an adjustment based on quantity. The adjustment amount will be multiplied times the quantity being ordered, quoted, or manufactured. This method is available in release 12 and later.

Pro-Rate By

The only "pro-rate" option is "Cost/Price." This applies the total adjustment amount calculated (based on the selected method) across the items being used for manufacturing based on the cost of each product. The description "Cost/Price" is shared among multiple code categories, so in some cases, it means "cost" and others "price." In the case of manufacturing, adjustments are applied based on cost.

Default Amount

The dollar amount or percentage to be used for calculating the adjustment.

Manufacturing G/L Mapping

Ledger mapping for manufacturing must be done before setting up an adjustment. This mapping is found the detail mapping database located under the General Ledger area (select "manufacturing costs").

Process (F12)

Choose Process (F12) to complete the changes or additions to the adjustment code database.