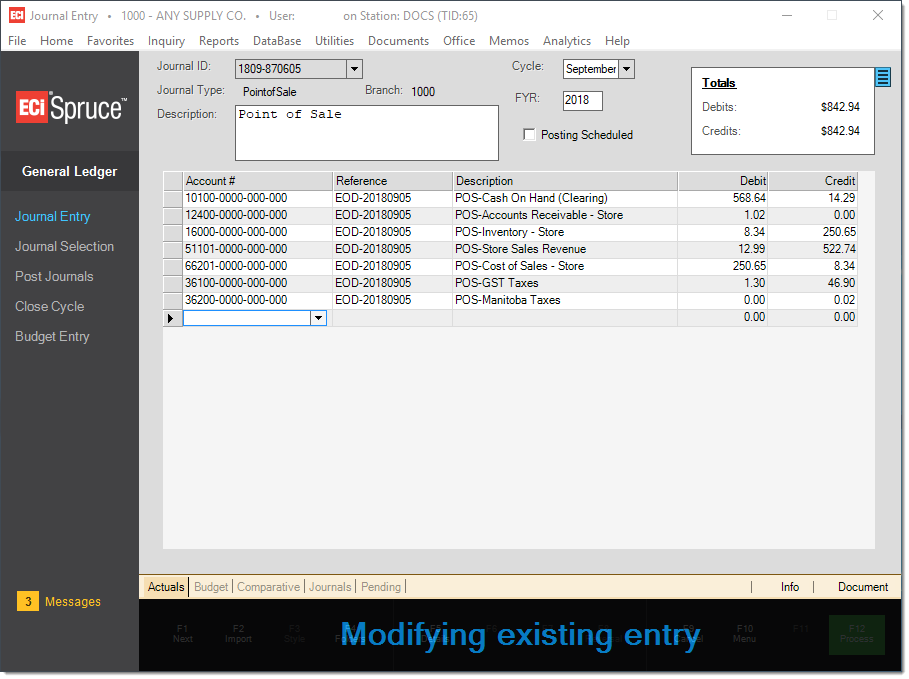

Journal Entry

The Journal Entry transaction is used for (1) modifying or reviewing system journals and (2) new entry or modification of manual journals. "System" journals are created automatically each business day (when necessary). There are five (5) types of system journals: Accounts Payable, Accounts Receivable, Inventory, Point of Sale, and Receiving. Accounts are mapped to these journals from the System Journals option found on the Database menu in the General Ledger application area. System journal mapping is used for determining which accounts are selected based on the transactional activity occurring during the date. Detail Mapping can sometimes replace the "system" mapping (this type of mapping can be triggered by product group or manual selection in some cases). Journals are always assigned to an accounting period or "cycle" and fiscal year.

Fiscal Year

A fiscal (financial) year may be different from the calendar year. It is important to note that standard accounting principles (GAAP) indicates that any fiscal year ending or beginning within a given calendar year must be either the same as the calendar year or the next calendar year. For example, you cannot end the calendar year 2019 in 2020. The only fiscal years permitted during calendar year 2020 would be 2020 or 2021, but not any prior year. The software application follows this rule when determining the relative year and cycle for new journal entries.

Posting Scheduled

This check box indicates whether the currently selected journal has been selected for posting the next time the "post journals" transaction is processed. Posting finalizes the journal entries affecting account balances. Until posting, journals can be deleted, modified, and appended. Account balances won't reflect the journal entries until this time. Once posted, a journal will no longer be available for selection in this form, but can be inquired upon (from the Inquiry menu's Journal option).

Viewing Journal Details

When viewing a system-generated journal, a user can select the Details (F5) function to display a breakdown associated with any of the journal's account entries. For example, when reviewing a Point of Sale system journal, use this function to list all of the documents that make up the "Cash Sales" figure for that day's business. The additional detail can save a lot of time when trying to figure out "why" an entry appears or has a particular amount.

"Manual Journals" are journals that are user inputted and not automatically generated. They, as well as recurring journals, can be used to for making ledger entries not automatically generated by the software. Neither "manual" nor "recurring" journals will have details associated with them.

How to enter a new Manual Journal

To make a manual journal entry, choose <<<NEW>>> from the "Journal ID" drop down. Enter a description then select a cycle and fiscal year for the new journal. In the grid area, enter the accounts and amounts that will make up the manual journal. To save the journal, choose Process (F12). To schedule the manual journal for posting, check the "Posting Scheduled" check box before processing. If selected, the next time posting is processed this journal will be finalized affecting account balances and financial statements.

A menu marker ![]() is available that allows deletion of journals. Access to this marker should be limited by user security. The Journal Inquiry form now offers an "un-post journal" option that can be used to undo the posting of a journal from an open (not closed) cycle.

is available that allows deletion of journals. Access to this marker should be limited by user security. The Journal Inquiry form now offers an "un-post journal" option that can be used to undo the posting of a journal from an open (not closed) cycle.

Rules and Restrictions

The application places certain restrictions on journal entries. Here are a few rules that are required for processing:

•Debits and credits must equal.

•The cycle and fiscal year must be open (not closed).

•The Net Income account cannot be added as a journal entry. Net Income entries are created automatically when necessary and don't need to be specified.

•The Retained Earnings (aka. "Owners Equity") account cannot be included in a journal entry unless the only other account in the manual journal is a liability account. After the close (end) of a fiscal year, some companies move the balance of retained earnings to a "prior" year retained earnings account. Retained earnings is also adjusted in cases of an owner's draw or dividend issuance. In this latter case, the balance being withdrawn would be moved to a liability account requiring an additional ledger entry.

Folders

General Ledger folders offer five (5) options (in addition to the standard "Info" and "Document" choices), these are labeled: actuals, budget, comparative, journals, and pending. Click here, for more information.

Processing

Use the F12 (Process) function to save any changes or additions. Processing creates a "GL Journal" document which can be printed or viewed from from the Viewer (via Documents). No option to print the document is presented when processing.