Installed Sales > Billing

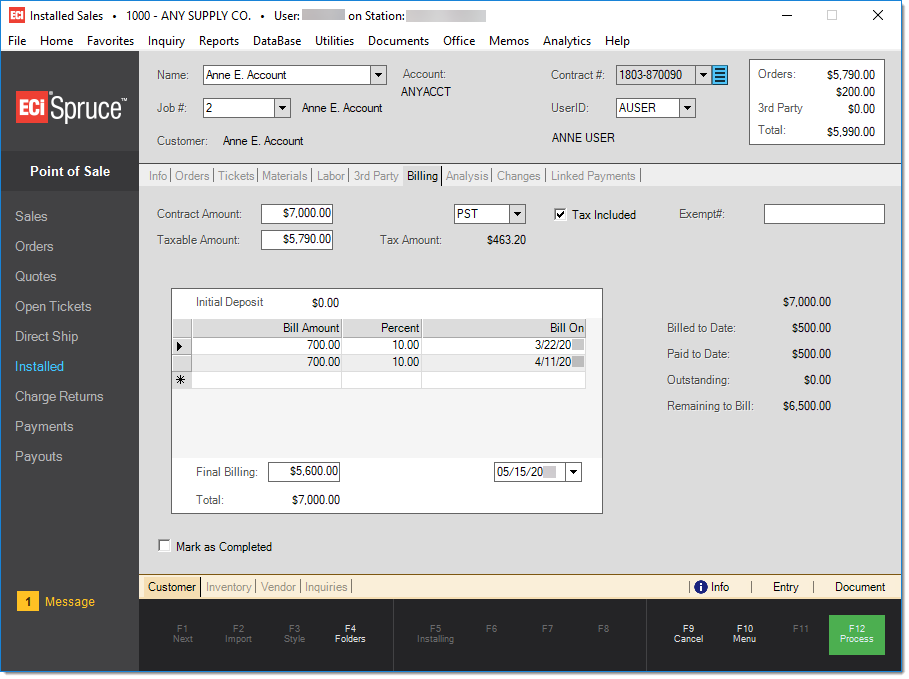

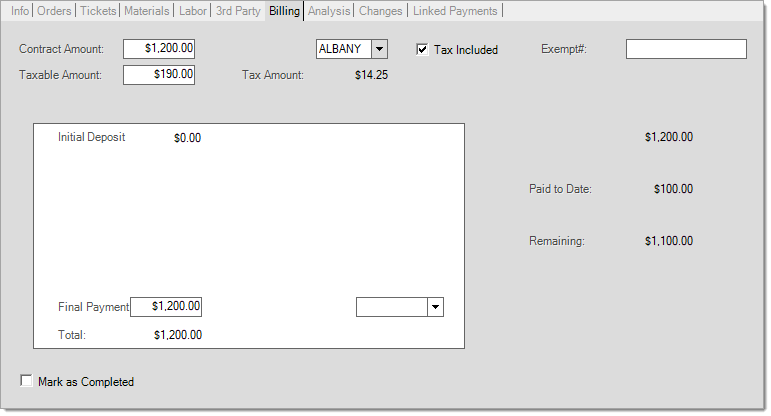

The Billing tab is used to set the contract's amount, sales tax, and establish billing terms for the contract. Installed sales customers with their own receivable's account can either be billed at one time or over an extended period of time. The multiple payment option is not provided for customers who either don't have a receivables account or are "cash-only."

Installed Sales, Billing (TAB) - Receivables Customer

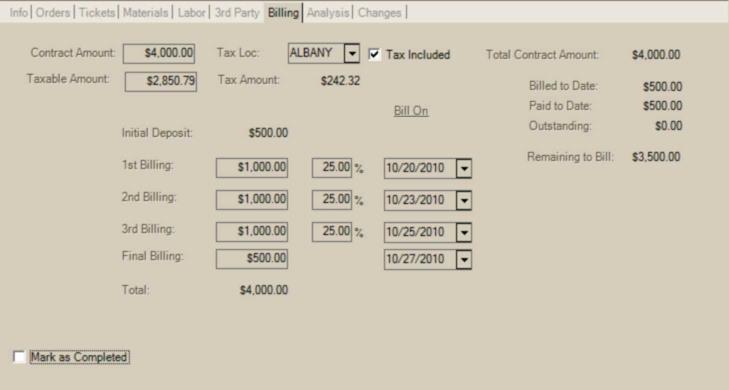

For a receivables customer, the actual number of independent payments a customer can make isn't limited. With releases prior to 12.10.x, the number of pre-determined billing periods was limited to a maximum of five (5) including the final billing; however, after release 12.10.x, a data grid has been implemented that allows an unlimited number of scheduled payments.

Percentages can be used to calculate billing amounts (or amounts can be manually specified). Specific billing dates would be entered for each level being used.

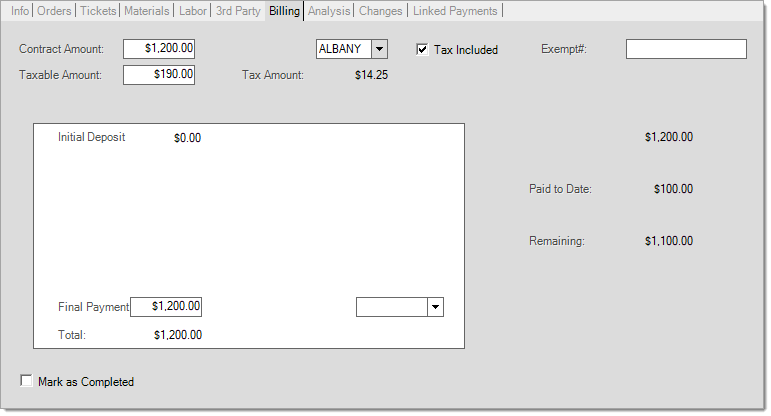

The information displayed for cash-only or system contracts doesn't display the data grid. Instead, only the initial deposit and final payment are available for payment. Note: if you did want to provide installment billing for a "cash" customer, you could temporarily set up a receivables account just for that purpose and then close the account once the contract was completed. Consider using the draw down job to limit charges to the contract total.

Installed Sales, Billing (TAB) - Cash Customer

The contract amount is intended to be a fixed amount which represents the exact figure that the customer will pay for the installation. For this reason, the contract amount is never updated by changes to the contract and is an amount that must be manually determined. The taxable amount listed below this total includes the original taxable material and labor from orders associated with the contract. The figures in the totals panel (upper right-hand corner) displays the current totals for materials, labor, and 3rd party (labor). These figures may be used in determining the contract amount or not.

This drop down selection allows the user to select the tax location used for calculating a sale tax amount on the taxable portion of the contract. This defaults to the tax location from the first customer order that is associated with the contract but may be modified afterwards. Orders and tickets associated with this contract may have different tax locations. Those locations would be used for the materials associated with those orders and tickets, not the tax location specified here. Any remaining tax is applied to the contract's tax location (specified on this tab) on the final reconciling invoice once the contract is marked as complete.

This check box determines whether or not the "tax amount" (explained below) is added to the billing amount due by the customer. The tax amount is calculated based upon the taxable amount, not the contract total. The taxable amount can and should be modified if needed. Warning! Changes to this check box re-calculate ALL billing amounts automatically regardless of whether or not billing has occurred. If you've previously billed the customer, you may need to manually adjust prior billing figures (this would require removal of any percentage amount).

This figure is used to determine the sales tax if sales tax is not included already in the contract total. Tax rules for installed sales vary based upon location and sometimes the type materials being installed. In some cases, labor may be taxable, in other cases not. For these reasons, one single "catch all" method for calculating the taxable amount is not possible. Instead, the taxable amount is an estimate based upon the taxable portion of the orders initially associated with the contract. This figure is not updated by later changes to the contract and must be manually adjusted if tax amounts need to change.

When taxes vary based upon parts of the contract, such as some materials being taxable and others not, it may be necessary to create separate orders for each tax situation. For example, some areas don't charge sales tax on materials representing for a "capital improvement," but do charge a "use tax" on those materials. A "use tax" is a tax paid by your company, not the customer, and is calculated based upon the "cost of the goods."

Some materials may fit the category of "capital improvement," others may not. For example, let's say you are installing flooring in a house. Some areas would consider hardwood flooring a "permanent" improvement whereas carpeting is not. If you are doing both on the same contract, you'd need to separate the hardwood flooring and carpeting into separate sales orders with different tax locations (a "use" tax location would be assigned to the hardwood flooring materials order, and a regular "taxable" location to the carpet order). Eventually, when the orders are ticketed and later invoiced, the sales tax totals would be updated appropriately. Any sales tax that was charged but not accounted for is applied to the "final" adjustment invoice and uses the tax location assigned to the contract.

Please seek the advice of a tax professional regarding what installation materials and labor costs are taxable in areas where your company does installation work.

Sales tax is calculated based upon the "taxable amount" entered and the tax location selected. The taxable amount figure is not updated automatically and is based only upon the customer orders initially associated with the contract. Taxable amount should be adjusted manually as needed.

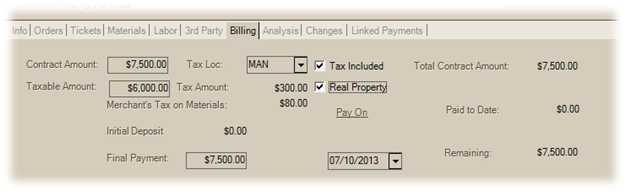

In Canada (only), an additional check box appears to the right of the tax amount labeled "Real Property." This is only enabled for non-HST tax locations (GST and/or PST locations only). When checked, the PST amount is based on the cost of ticketed materials only, not the taxable amount of the contract. The GST is always based on the taxable amount. If the check box is not checked, the "Tax Amount" includes both the GST and any PST amounts and both are based on the taxable amount of the contract. Adjustments to the taxable amounts on tickets are made when the contract is completed (which invoices the tickets and creates a final adjustment invoice to handle any additional amounts billed to the customer). Final invoices are for processing purposes only and are not intended to be provided to a customer.

Real Property (Canada)

For more information, please reference the overview section "Tax Considerations."

Billing Schedule

The billing schedule area varies based upon the type of customer account being used. Customers who have their own cash-only account only have two (2) billing levels: initial deposit and final payment.

Initial deposit is the sum total for deposits from all customer orders that have been associated with the contract. If a customer order is removed from the contract, any deposit amount associated with that order is removed from the total. The deposit total may not be modified from this area.

Customers who have a receivables account as well as contracts assigned to the "system" installed sale account, are provided multiple levels With release 12.10.x, an unlimited number of billing levels can be created. Previously, only five (5) payment levels were allowed. Use one or more of the available levels to determine the customer's billing schedule. Entering a percentage (optional) automatically calculates the billed amount as a percentage of the total for that level. The billing dates determine when the contract is eligible for billing using the Invoice Recurring utility for each billing level.

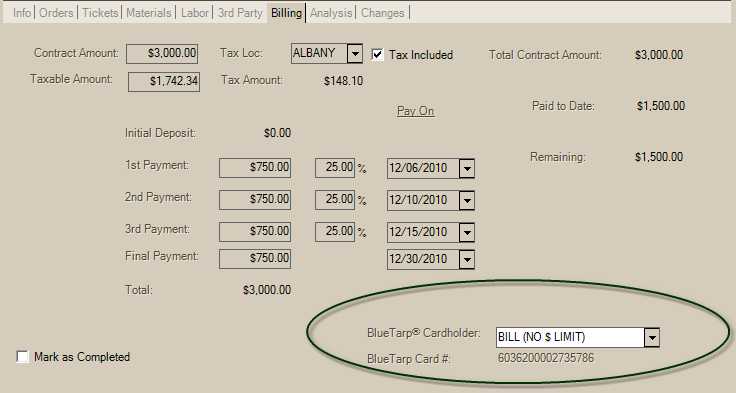

Capital One Trade Credit (formerly BlueTarp® Financial) & Installed Sales

If your company uses Capital One Trade Credit (formerly BlueTarp) for receivables management, Installed Sales can be billed to a Capital One Trade Credit (formerly BlueTarp) cardholder's account. Although, Capital One Trade Credit (formerly BlueTarp) accounts are considered "cash-only" (because no Spruce receivables are maintained), they are eligible for recurring billing just as a receivables customer would be. All billing levels are available for the Blue Tarp customer, while only the “Deposit” and “Final Payment” buckets would be available to a cash-only account. The Blue Tarp card number must be specified so we know what card number to use in the “Invoice Recurring” transaction.

Payment(s) can be processed either by using the Payments transaction in Point of Sale (the "Installed Sale Payment" option) or from the “Invoice Recurring” utility. If an Installed Sale Contract for a Capital One Trade Credit (formerly BlueTarp) account is processed in “Invoice Recurring," a Payment document is created (as opposed to the Debit Adjustment normally created for receivables accounts).

Totals

This section describes the totals on the Billing tab located to the right of the billing levels.

Total Contract Amount

This is the contract amount plus any sales tax. Sales tax is added to the contract amount field only if the "tax included" check box is not checked.

Billed to Date

This is the amount of the contract that billing has been processed for up to and including the current date. Any deposits from customer orders that have been associated with the contract are also included in the billed amount. The Invoice Recurring utility is used for billing customers for installed sales.

Paid to Date

This is the sum of any payments linked with the contract amount up to and including the current date. This amount includes any deposits from customer orders that have been associated with the current contract. It is possible for the paid amount to be greater than the amount billed and even the contract total. If this happens on a cash contract, you can refund additional amounts using Payables. For receivables customers, the additional payments will remain as credits on the customer's account and may be applied to other items or balances.

Outstanding

This is the remaining amount the customer owe's for the contract. It is the total contract amount less any paid amount.

Remaining to be Billed

This is the amount that the customer has not yet been billed for. The Invoice Recurring utility is used for billing customers for installed sales.

Mark as Completed

This check box is used to close the contract after all activity has ceased. It can only be used after all billing has been done (if applicable) and the contract has been paid in full. Marking the contract as complete does the following: invoices all associated tickets, closes associated orders, produces a final billing invoice, and closes the contract preventing any further changes.

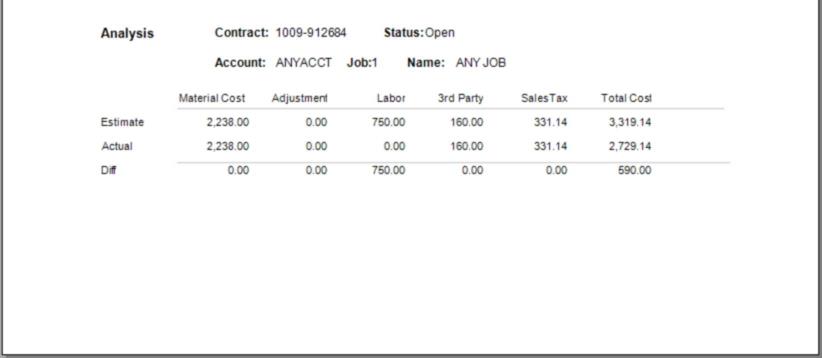

After a contract has been marked as completed, it is no longer available for selection in the Installed area. The contract document has an alternate format that allows your company to view the contract analysis on the document. The "Store Copy" format may be used to view analysis information at any time in the Document Viewer before or after the contract is completed.