EasyAP Imports and GL Account Mapping

EasyAP, formerly known as InstantAP, is an integrated, third-party feature that automates the Accounts Payable process, allowing you to scan/email your payables documents (bills and credits from Spruce vendor documents for purchases and expenses) to a third-party cloud service, Backbone Solutions. They extract the data from the vendor documents and compare it to the Payables data in the application to generate PDF documents of bills and extract files that Spruce uses to create payables. Any data that does not match (over your specified threshold) is flagged (put on Hold) for review by someone in your organization to analyze and resolve. Backbone Solutions provides training for this process and helps you get your scanners and email addresses set up. Before you go-live on Spruce, work with Backbone to complete the setup processes they require.

After the EasyAP Import, How are the Payables Mapped to GL Accounts?

In most cases, EasyAP is processing payables for received inventory, which are paid to the Supplier, a Manufacturer, or a Group Buyer. For payables, we assign transaction types to the standard imported data to determine the type of ledger mapping to use.

| Transaction Type | Enumerator |

|---|---|

| Undefined (you don't have a standard enum for this type) | -1 |

| General Expense (Not Inventory related) | 0 |

| Received Inventory | 1 |

| Transferred Inventory | 2 |

| Direct Ship Purchase Order | 3 |

| Prebill Purchase Order | 4 |

With Payables, General Ledger entries are applied to offset account(s) to record the Accounts Payables liability. Accounts Payable holds the value for open payables and should match the net total for all open payables (payables that have not yet been fully paid). For positive payables (not vendor credits), the Accounts Payable entry is a credit which increases the liability balance. For vendor credits (negative payables), the Accounts Payable entry is a debit which decreases the liability balance.

Whenever you apply a general ledger entry, there are two parts, a debit and credit. Both sides, debits and credits, need to balance overall. The following specifications outline how you should determine which general ledger account(s) to use as the offset to the Accounts Payable liabilities. A “liability” account a category of ledger accounts, which typically represents money owed by the company to other parties. In this case, it’s the balance of what’s owed on recorded open Payables (bills). Below are a few examples of payables:

-

Inventory Purchases - Paid to the Supplier, Manufacturer, or Buying Group

-

Inventory Returns - Handled as Vendor Credits

-

General Expenses - Utility Bills, Rent, etc.

-

Contract Labor - Non-Employee Compensation

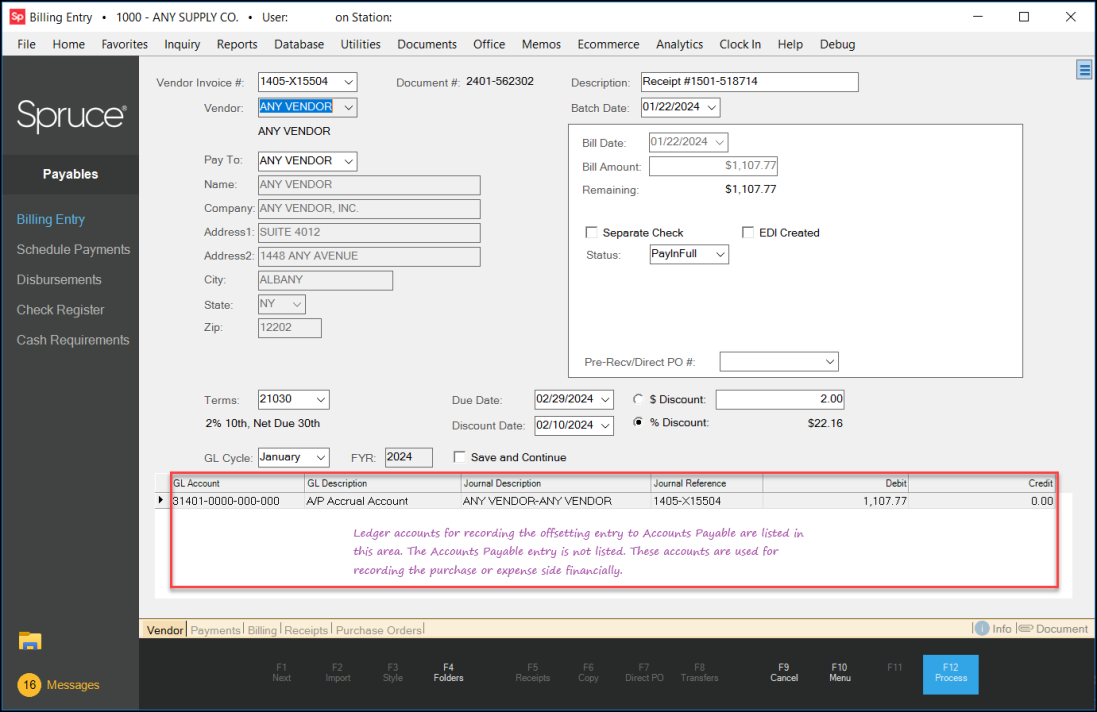

In the Billing Entry form, only the liability GL account displays showing the liability side of the ledger transaction. We assume the Accounts Payable account is the other side, so only the offsetting accounts are listed.

Some Payables aren’t inventory purchases, so they’d have no receipt or other transaction type to tie back with. There are also different types of transactions or payment circumstances that may be handled differently from purchase orders and receipts. In these cases, such as for miscellaneous expenses, the vendor may have a default GL account that they use as the default GL offset Accounts Payable GL account. In other specific cases, such as the situations below, the general ledger offset account(s) refer to the system journal mapping that is specific to the type of transaction or situation described below:

| Payables Situation | Journal | SysJournalType | Sequence | GL Mapping Description |

|---|---|---|---|---|

| Receipt Document | Accounts Payable | 1 | 1 | A/P Accrual Account |

| Discrepancy | Accounts Payable | 1 | 6 | EDI / Receipt Discrepancy |

| Partially Paid Receipt | Accounts Payable | 1 | 1 | A/P Accrual Account |

| Inventory Transfers | Receiving | 5 | 3 | A/P Accrual Account |

| Direct Ship PO | Point of Sale | 4 | 68 | Direct A/P Accruals |

We now ensure that we use the Sequence number associated with the AP item to determine the GL Mapping description to use to prevent errors.

But, what if the AP item is not one of these situations, how does Spruce determine what GL account to apply the liability to? We use this thinking to define the appropriate GL mapping account:

-

If we cannot find an appropriate GL Sequence number for non-transactional expenses, we use the vendor’s assigned ledger account (if specified).

-

For situations where no assigned ledger account exists (or when the transaction type is undefined or there are recording discrepancies between the data and the transactions they link with), we use the discrepancy account mapping (Payables Journal Sequence #6).

See Also:

Setting up the EasyAP Infrastructure