Using at Point of Sale

|

Please note, this topic refers to card processing using the VeriFone PAYware Connect legacy solution that is being replaced by Verifone Point, Verifone System's new EMV-ready semi-integrated solution. Due to new EMV and PCI requirements, some capabilities discussed here are either not provided with Verifone Point or have changed. |

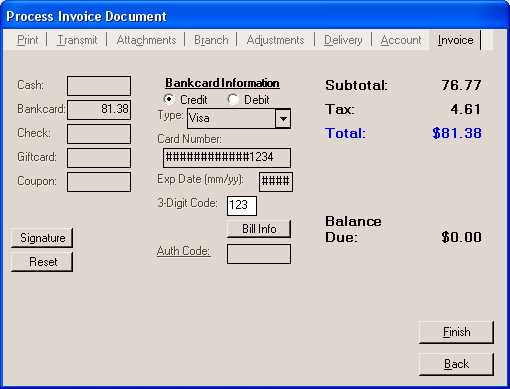

Most transactions in the Point of Sale area support bank card use as a method of payment on the Process (F12) form. Card processing may involve a signature pad device, USB card swipe, or manual entry of the customer's card information in the process form. If using manual card entry or a USB card swipe instead of a pad, the VeriFone pad may not be used for signature collection.

After swiping a card on a signature pad, the method of payment defaults to bank card. If a pad is not being used, payment information may be specified by the user and card information hand-entered on the process form. If a USB card swipe is used, the card must be swiped while the Card Number is the active input area on the process form. Debit card processing requires the use of a pad.

Depending upon the requirements of your selected processor or possibly your company's preferences, additional information may be requested or required for credit or debit processing. Once all required information is provided, the user chooses the Finish (Alt-F) button.

Pad processing varies a bit based upon the model of pad. Please see the topic Using VeriFone Pads at Point of Sale for more information.

A customer's card information is passed to either PAYware Connect, ICVerify, or PCCharge and, from there, to the processor. The software/service handling the authorization subsequently contacts the card processing company (clearing house) and receives either an authorization or denial. This communication is usually done using your company's high-speed internet connection.

Card Information on Process Forms

This section explains the purpose of the various fields available when processing a bank card as a method of payment.

Credit vs. Debit

The debit transaction can only be selected by the customer when using a pad supporting this option when debit processing has been enabled for the application. Additional requirements apply for debit processing. Most debit cards may be processed as a credit transaction if your company doesn't have the required hardware, software, and processor for debit card processing.

Type

Credit card types that list in the drop down are determined by Parameters located under the Maintenance area's database menu. A system administrator must specify the card types accepted by your company as well as those accepted by your processor. The 2 listings should match. Five preset selections may be enabled for use: Visa, MasterCard, American Express, Discover, and Diners Club. In addition, 2 additional user-defined card types can be specified and assigned a text description in Parameters. This field is automatically set when using a signature pad device to swipe a customer's card; however, it is must be set manually otherwise (including cases where USB card swipe devices are being used). If the card type doesn't match the card's number format, a task list error will be generated.

Card Number

Card numbers are typically a 16-digit number. The card number may be manually entered, swiped using a USB card reader device, or completed automatically when using a signature pad device.

Expiration Date (mm/yy)

This field is used for the bank card's expiration date, usually a numeric month and year. If entering this information manually, enter the numeric month followed by a slash (/) and the last 2 digits of the year that the card expires on. Expiration date is set automatically when users swipe a card using a USB card reader or a signature pad.

3-Digit Code

The 3-digit code (aka. CVV number), is located on the back-side of the customer's card, usually near the signature region (location will vary). This code is requested or required by some processors as an added security measure and to aid in prompt authorization of the card. If no code is specified, a task list warning may appear (unless the warning's severity level is lowered to a "hidden" type warning). Companies should consult their selected processor if they have questions regarding how much or what specific information should be collected for credit card transactions.

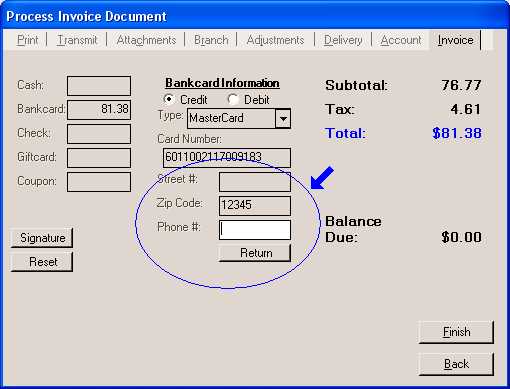

Bill Info

This button displays fields where a user may enter additional information about the customer using the card such as street address, zip code, and phone number. This information may be required or recommended by your processor and may aid in prompt authorization of the customer's card. Companies should consult their selected processor if they have questions regarding how much or what specific information should be collected for credit card transactions.

After the additional information is entered, users may select the Return button to re-display the usual bank card information fields. Any information entered in the street, zip code, and phone number fields will be retained for processing.

Authorization Code (Auth Code)

It is very important for users to understand the purpose of the authorization code field. Authorization codes should only be entered when an external authorization is received from the card processor. Manual authorization is intended for use in situations when either your company or your processor experiences network, internet, or other problems preventing the normal processing of cards.

Entry of any authorization code causes the software to bypass any and all immediate or future automated processing of the customer's card. This means that if an authorization code is entered but no authorization was actually received, the customer's card will never be billed and your company will receive no payment for the goods.

For security reasons, detailed credit card information is not retained in the database. This means that should a customer's card not be charged due to a user improperly entering an authorization, it will not be possible to obtain sufficient bank card information for later processing (unless it's possible to locate the customer and obtain their card information).

We strongly suggest that your software or IT administrator block access to manual authorizations at Point of Sale. A task list warning exists for any manual authorization. The warning appears every time a user enters an authorization manually. Warnings can be upgraded in severity to an error by either a system or application administrator. Errors prevent any processing until the error situation is corrected.

Canceled Transactions

When a Point of Sale user cancels a card transaction, there is a window of time where the card could have processed. In cases where there's some question, we send a notification to the first system administrator user as well as the receivables manager user (if any). These messages may be delivered by Email or the standard messaging feature.Enter topic text here.