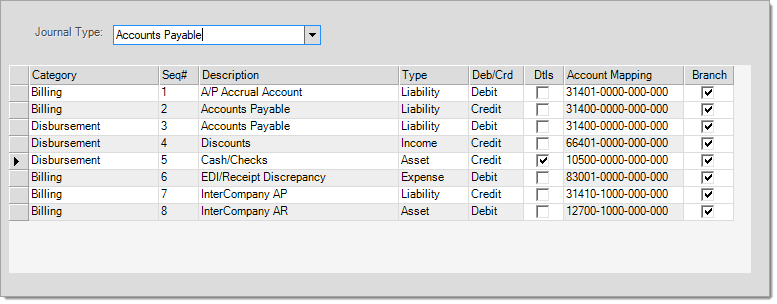

Accounts Payable Mapping

Eight (8) accounts (not including any detail mapping) are currently required for mapping the Accounts Payable (A/P) system journal. Accounts mapped for this journal are assigned to either of two (2) categories: Billing or Disbursement. If your company has more than one branch location, it's important to carefully consider whether or not you want to split payables between branch accounts. Some companies manage all of their payables from a single location and do not run financial statements by location but do so for their entire company. Other companies prefer some degree of separation between store locations financially. If you do choose to separate your payables across branches, it's important to do it in a way that is consistent. A consolidated (company-wide) payables is generally assumed unless your company indicates otherwise.

System Journals: Accounts Payable

Details

The "details" (dtls) check boxes are read-only and indicate whether detailed mapping is provided. Detail mapping varies in function somewhat based on the type of entry. In some cases, detail mapping allows a user to select an account from a list. In others, the account is selected automatically based on other criteria such as a product group as one example. The presence of a check mark only indicates that detail mapping it is available (not whether it is being utilized).

Branch

The "branch" check boxes can be modified. These indicate whether you want to use branch accounts if setup. If checked and individual branch accounts do exist (as designated by the department in the account number for the designated "base" account), they will be used in place of the account designated.

|

# |

Category |

Description |

Type |

Debit/Credit* |

Details |

|---|---|---|---|---|---|

|

1 |

Liability |

Debit (-) |

|

||

|

2 |

Liability |

Credit (+) |

|

||

|

3 |

Liability |

Debit (-) |

|

||

|

4 |

Income |

Credit (+) |

|

||

|

5 |

Asset |

Credit (-) |

|||

|

6 |

Expense |

Debit (+) |

|

||

|

7 |

Liability |

Credit (+) |

|

||

|

8 |

Asset |

Debit (+) |

|

Billing and Disbursement represent two (2) distinct functions:

Billing

Billing is the process of recording new purchases and expenses from the Billing Entry area of Payables. This process increases the balance of your Payables (money you owe to someone else). For purchases, the "accrual" account is automatically used as the offset to the Accounts Payable account. For expenses, the offset account would be either manually entered or associated as a default account with the vendor.

Disbursement

Disbursement describes the issuance of payment to parties that you owe money (Payables). This reduces both what your company owes to others and also your company's cash assets (bank account).

Both of these actions are handled by the mapping in this journal. A description for each one follows:

Billing Mapping

Billing mapping is used for recording a payable in the ledger either after, or in anticipation of, being billed. Some billing records purchases of inventory and therefore needs to affect the accrual account (which is used at time of inventory receipt). Non-purchase related billing typically affects some kind of expense account.

1.A/P Accrual Account (Liability)

This account is used as a holding account for inventory purchases that have not yet been invoiced in A/P. System mapping for receiving credits the A/P Accrual account (increases the balance, in this case) when inventory is received and debits an Inventory asset (purchases) account. This is how balances get into the "accrual" account to begin with. When payables billing (invoicing) for purchases is done and the resulting payables are transferred to General Ledger, the accrual account's balance is decreased by debiting the A/P Accrual account (lowering the balance) and crediting the Accounts Payable account (increasing the balance of what you owe). Accounts payable is reduced later on once the bill is paid. The accrual account is a consolidated account and does not use branch (department) accounts automatically.

2.Accounts Payable (Liability)

This is the liability account used for accounts payable (the account that represents what your company has been billed for... or owes in payment to others, in other words). When the accrual account is reduced, the accounts payable account balance is increased (credited). Later, once payment is processed, this balance will be reduced because your company no longer owes the money. Accounts Payable is usually one shared account for the entire company.

6.EDI/Receipt Discrepancy (Expense)

This account is mapped for the purpose of accounting for any difference between electronic billing and the cost value of the goods that were actually received and processed by the software (essentially a difference between the billing and the accrual amount). This account is only used if your company utilizes EDI processing with a vendor, wholesaler, etc. For more information about EDI, see the following summary or review the detailed EDI document ion using the link (below).

EDI (Electronic Data Interchange) is a process by which data is received or transmitted by electronic means. Typically, the term EDI is used to describe electronic transactions between your company and vendors, wholesalers, and/or manufacturers. In the lumber and building supply industry, this typically involves an exchange of data related to purchasing, receiving, inventory, and payables. Options and functions do vary by vendor. It is not unusual for there to be differences between a vendor's data and what is physically received and added to inventory. In many cases, these discrepancies are small enough to be ignored; however, larger differences should be investigated.

Admin Billing Mapping

The following two (2) accounts only apply to companies with more than one branch who have enabled the "Admin Receipt Billing" parameter. This parameter is located in the Maintenance area (choose Database, Parameters, and the Payables tab). This option adds 2 additional account entries when invoicing a purchase from another branch location: Inter Company AP (Payables) and Inter Company AR (Receivables).

This account would usually link with branch accounts rather than one consolidated account. It represents the balance "owed" by each branch to the admin branch for payment toward the branch location's purchases.

This account would typically be a consolidated account holding the lump sum amount due to be collected by the branches for the admin branch location.

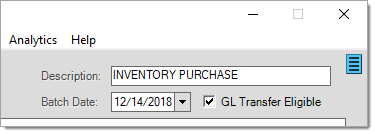

Important! The "billing" side of A/P transactions will be automatically recorded in General Ledger (G/L) at the time a Payables invoice is paid as long as that invoice had not previously been transferred.

Users may instead designate that the billing (expense/purchase) side of an A/P invoice be recorded prior to payment. This process is referred to as "transferring the payable to the ledger." A check box exists under the Billing Entry activity screen in Accounts Payable for designating that the invoice be transferred to General Ledger that business day. If this flag is not set, the A/P account in General Ledger will not reflect the amount owed for that invoice until either the invoice is paid or the flag is modified.

Disbursement (Payment) Mapping

3.Accounts Payable (Liability)

When payments are disbursed, this account is reduced by a debit (reducing what your company owes). The Accounts Payable account balance is increased when a new payable is transferred to the ledger. If the invoice being paid had not been previously transferred, the

If payments are reduced due to vendor discounts, a credit to this income account is made. This represents the difference between the accounts payable debit amount (what your company was billed) and the credit to the bank account (cash/checks) where the payment is being made from.

This amount is a credit that reduces your company's cash assets (bank account, etc.) when payments are made to vendors (payees). This amount will equal the A/P liability amount less any vendor discounts taken. Special mapping is available for the bank account that payments are disbursed from. Your company may maintain an unlimited number of bank accounts. When payments are disbursed, bank account selection is required if there are multiple registers.*

*The mapping for check registers is not located under the detailed mapping database. For Accounts Payable check registers, mapping is designated on the special process form used to add/modify/delete check registers. To access this, navigate to the Accounts Payable application area, select Check Register, and then click on the "form" icon

![]() next to the "Checking Account" selection drop-down.

next to the "Checking Account" selection drop-down.