Product Group Mapping

The software allows you to designate specific mapping (accounts) by product group, and now group-section for certain inventory-related ledger entries. This is done from the Detail Mapping maintenance form available from the Database menu in the General Ledger area. Product groups (and sections) are assigned numeric values between 1 and 255, and used for inventory categorization. In releases 1.12.14.0 and later, the product section code may also be used for detail inventory mapping. Prior to this change only inventory product groups had mapping capability. Mapping can still be done done for an overall group without any section designation and any previously saved mapping is not affected. Section mapping will override any mapping at the group level if present.

There is detailed mapping that does not involve product groups. This topic only covers the detailed mapping that does.

If you have more than one branch (location) defined in the software, detailed mapping can be done for each branch location. This is usually designated when the mapping is done, but can be changed later. Branch accounts are determined by the department code of the account number (if any). Accounts matching the applicable branch department must exist to be used.

For reference, this document lists the expected account type or class (asset, liability, income, expense, etc.) as well as the corresponding system journal default mapping that any detailed mapping would replace. In certain cases, a different class of account may be needed than the default listed. The default balance (credit or debit) for the alternate class type would typically match the default selection.

If your company uses items for any other purposes than for actual inventory (labor, service charges, etc.), consult your company's accountant to find out where those items should be mapped.

Income (Sales) Mapping

In most cases, the following accounts are used to indicate the income type accounts that are affected when goods are sold or returned. There are exceptions, however. Some item types, such as gift cards, for example, should have their sales mapped elsewhere (a liability account in the case of gift cards specifically).

For the purposes of mapping, "cash" sales and returns include transactions involving any of the following payment methods: cash, checks, bank cards, and coupons. The term “charge” refers to sales involving receivables (store managed accounts) and not bank card transactions.

Inventory Cash Sales (Income)This detailed mapping allows specific income accounts to be mapped for use when cash sales involving inventory product groups are processed. If product group mapping is not defined, the default Point of Sale system journal mapping for “cash sales” is used (sequence #9). Inventory Cash Returns (Income)Specific income accounts can be mapped for use when returns involving a cash-type payment are processed for items within particular product groups. If product group mapping is not defined, the default Point of Sale system journal mapping for “cash returns” is used (sequence #20). Inventory Charge Sales (Income)When customer charge sales (receivables) are processed, income accounts can be mapped for use with sales involving specific inventory product groups. If product group mapping is not defined, the default Point of Sale system journal mapping for “charge sales” is used (sequence #10). Inventory Charge Returns (Income)Credit sales (receivables) to charge customers decrease (debit) the balance of an income account. Specific income accounts can be designated for charge returns involving specific product groups (lumber, etc.). If product group mapping is not defined, the default Point of Sale system journal mapping for “charge returns” is used (sequence #21). Inventory Exempt Cash Sales (Income)Cash-type sales that are tax exempt can be mapped to a specific income account based on the inventory product group(s) being sold. If product group mapping is not defined, the default Point of Sale system journal mapping for “cash exempt sales” is used (sequence #14). Inventory Exempt Cash Returns (Income)Cash-type returns that are tax exempt can be mapped to specific income accounts based on the inventory product groups being returned. If product group mapping is not defined, the default Point of Sale system journal mapping for “cash exempt returns” is used (sequence #25). Inventory Exempt Charge Sales (Income)Charge sales (receivables) made to exempt customer accounts can be mapped to specific income accounts determined by the product groups being sold. If product group mapping is not defined, the default Point of Sale system journal mapping for “charge exempt sales” is used (sequence #15). Inventory Exempt Charge Returns (Income)Charge returns (credit memos) made to exempt customers can be mapped to specific income accounts based upon the product groups being returned. If product group mapping is not defined, the default Point of Sale system journal mapping for “charge exempt returns” is used (sequence #26). |

Transfer Mapping

Transfers refer to the movement of inventory between branches (locations). The value of the inventory must be moved in cases where inventory assets are recorded separately by branch (usual).

Inventory Transfers out (Asset)When inventory is transferred from a location, the asset value of that location's inventory must be reduced. This detailed mapping specifies asset accounts that will be credited (reduced) when a transfer of inventory belonging to a specific product group is transferred out. If detailed mapping is not set up for transfers out, the default mapping located in the Inventory system journal for “transfers-out” and “inventory” will be used instead (sequence #3). Inventory Transfers in (Asset)Inventory that is transferred in supplied by another location must increase the asset value of the receiving location. This detailed mapping specifies which asset accounts should be debited (increased) when transfers of inventory belonging to the product groups specified are processed. If detailed mapping is not set up for transfers in, the default mapping located in the Inventory system journal for “transfers in” and “inventory” will be used instead (sequence #6). |

Issues, Purchases, and Cost of Sales Mapping

Companies may choose to separate out different types of inventory activity that affects the asset value of their inventory. For example, your company might want to see the amount of inventory purchases for the year separated by the amount of inventory you sold during the same period. This can be done by product group as well.

Inventory Issues (Asset)Sales and returns involving inventory increase or decrease the value of your company's assets. An "issues" account is used to record changes to the value of a company's asset inventory due to this type of activity. The offset to an issues account is typically a "cost of goods sold" account (a special type of expense account). Sales reduce the asset value of issues decreasing the balance using a credit entry. Returns of inventory increase the asset value of issues using a debit entry. The opposite entry to either will be a debit or credit to cost of sales. Cost of sales increases when items are sold (debit) and decrease when items are returned (credit). This detailed mapping allows inventory product groups to be mapped to specific "issues" asset accounts to record Point of Sale related changes in inventory value. Otherwise, the default Point of Sale system journal mapping is used. Issues are mapped for both sales and returns (sequence #17 and #31 respectively). Cost corrections also affect inventory issues. Cost corrections occur when the cost of an item is modified after it has been sold or returned with another cost. In this case, the original entry made to increase or decrease asset inventory would need correction. If detailed mapping is not specified for a product group, the Inventory system journal mapping for the “cost corrections" category and either "inventory - sales" or "inventory - returns" is used instead (sequence #10 and #12 respectively). Inventory Purchases (Asset)When inventory is purchased, your company's assets increase. Purchase accounts are used to record the increase in asset inventory. Detailed mapping allows your company to map product groups to specific purchase asset accounts to allow a more detailed break-down of purchases based on the type of product. If this mapping is set up for a product group being received, it will create a debit entry increasing the balance of the asset account assigned to that group for purchases. If detailed mapping is not specified for a product group, the Receiving system journal mapping for “received inventory” is used instead (sequence #1). Inventory Cost (Cost of Goods Sold)As inventory is sold, a special type of expense account known as "cost of goods sold" is increased (by a debit entry). This account represents the cost of the inventory sold during the year. The balance of this account is cleared at the end of the fiscal year. If inventory is returned, cost of sales is credited (reduced). Inventory issues, representing the asset value of your company's inventory, is the offsetting entry to cost of sales. If detailed mapping is not specified for a product group, the Point of Sale system journal mapping for “cost of sales” is used instead for sales and returns (sequence #16 and #32 respectively). Cost corrections also affect cost of sales. Cost corrections occur when the cost of an item is modified after it has been sold or returned with another cost. If detailed mapping is not specified for a product group, the Inventory system journal mapping for “cost of sales” is used instead for cost corrections made to sales and returns (sequence #9 and #11 respectively). |

Direct Sales

Direct Sales occur when your company orders materials (inventory) from another party on behalf of a customer for direct delivery to the customer. Your company handles the billing of the customer and payment to the vendor (other party); however, your company does not actually handle any inventory nor does it provide delivery. The Direct Ship feature available from the Point of Sale are is used for this type of transaction. Product group mapping can be used to separate out the income and cost of sales for installed sales from regular sales involving items within a product group.

Inventory Direct Sales (Income)This income account is credited (increased) when Direct Orders are invoiced by linking the Direct Ship Purchase Order document to a Payables invoice. If detailed mapping is not specified for a product group, the Point of Sale system journal mapping for “direct sales income” is used instead (sequence #65). Inventory Direct Cost (Cost of Goods Sold)This cost of goods sold account is debited (increased) when Direct Orders are invoiced by linking the Direct Ship Purchase Order document to a Payables invoice. If detailed mapping is not specified for a product group, the Point of Sale system journal mapping for “direct cost of sales” is used instead (sequence #67). |

Installed Sales

Installed sales involve either someone from your company or another party installing materials (inventory) supplied by your company. Detailed mapping is provided for installed sales for recording income and cost of sales by product group. This might be used to separate income from installed vs. regular sales for one or more product groups.

Inventory Installed Sales (Income)This income account is credited (increased) when installed sales contracts are marked complete. If detailed mapping is not specified for a product group, the Point of Sale system journal mapping for “installed sales income” is used instead (sequence #74). Inventory Installed Cost (Cost of Goods Sold)This cost of goods sold account is debited (increased) when installed sales contracts are marked complete. If detailed mapping is not specified for a product group, the Point of Sale system journal mapping for “installed sales COGS” is used instead (sequence #75). |

Manufacturing Mapping

Manufacturing often involves removing inventory as materials to produce something new which is then added back into inventory. This mapping allows your company to map this movement of inventory by product group.

Inventory Manufacture Finished Goods (Asset)This asset account is debited (an increase in the asset balance) when manufacturing is completed and any manufactured items are added to inventory. The offsets to this account would be the raw materials account (also mapped here) as well as any expenses from the manufacturing process. When no detailed product mapping exists, manufacturing uses the default “finished goods” account mapped in the Inventory system journal (sequence #15). Inventory Manufacture Raw Materials (Asset)Manufacturing usually involves "use" items. The cost value of the items being removed from inventory for the purpose their use in manufacturing is recorded by a debit to this account. Once manufacturing is complete, this account is credited (reduced) and "finished goods" is increased by the cost of the materials plus any expenses. When no detailed product mapping exists, manufacturing uses the default “raw materials” account mapped in the Inventory system journal (sequence #16). |

Additional system journal and detailed mapping for "Manufacturing Costs" is also provided; however, it is used for Adjustment Codes and does not involve product group mapping.

Quantity Adjustment Mapping

Inventory occasionally needs to be adjusted due to loss, theft, and human error. Your company can separate various types of adjustments by product group. This can help you compare which types of products being adjusted from a dollar value standpoint.

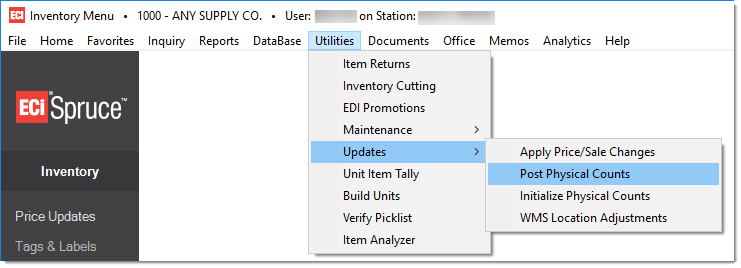

Inventory Physical Count Shrinkage (Expense)When a physical inventory is done, adjustments are made to correct on-hand quantities. This helps ensure that inventory valuation is kept reasonably close to actual stock quantities. This detailed mapping option can be used to map inventory product groups to specific shrinkage (adjustment) expense accounts. The accounts mapped here are used to record the loss (usually) in inventory value. Physical inventory adjustment entries originate from counts entered in the Physical Counts activity that are posted using the utility "Post Physical Counts."

Post Physical Counts The other side of an entry affecting shrinkage expense would be an asset change (see Inventory Adjustments below). When no detailed product mapping exists, adjustments use the default “shrinkage” account mapped in the Inventory system journal (sequence #2). Inventory Adjustments (Asset)Adjustments to on-hand values are necessary for a number of reasons (damage, cutting, company use, etc.). When done, these adjustments either increase or decrease the asset value of your company's inventory. This detailed mapping option allows users to specify the asset inventory accounts that should be affected when adjustments are done based on specific product groups. When no detailed product mapping exists, adjustments use the default “inventory adjustment” account mapped in the Inventory system journal (sequence #1). |