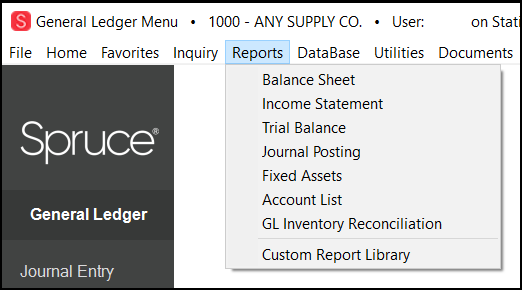

General Ledger Reports

Several General Ledger reporting choices are available. Three (3) reports are considered "financial statements." These reports are the balance sheet, income statement (or P&L), and trial balance. Financial statements report the financial health and value of your company.

Ledger information, including financial statements, are designed for cases where all locations are considered part of the same company. The software does not provide the ability to completely separate financials by branch location. To maintain entirely separate financials, your company would need a separate Spruce instance and database for each location. This has its own drawbacks and limitations as it prevents all other types of branch-to-branch operations (transfers, deliveries, consolidated purchasing, messaging, etc.). Financial statements and reports do offer the ability to limit reporting to specific departments (which may be assigned to branch locations); however, some important accounts are "shared" and reporting by department won't produce balanced or accurate financial statements (for a single location). Spruce financials are designed to be used with a "consolidated" or company-wide approach overall while still allowing for some degree of branch (location) break down.

It's a good idea to consider other sources, such as branch sales totals, to compare branch profitability, sales volume, etc. rather than relying on financial statements to do so.

Financial statements and reports use your company's chart of accounts. The organization of your "chart of accounts" determines how financials statements will appear (the order of accounts, which totals accounts appear under, etc.). Financial statements and reports do allow for varying level of detail; however, they will always be based on the chart of accounts structure you or your accountant decides upon.

Balance Sheet

A balance sheet is a financial statement that compares your company's assets (things or money your company owns) to its liabilities (money your company owes). A balance is maintained between assets and liabilities using an account named "owner's equity" (this is also referred to as "retained earnings"). When your assets are higher than your liabilities, your company has a positive net worth (overall value). If liabilities exceed assets, your company has a negative net worth (meaning you owe more than you own). The level of detail can be decided when running this financial statement. Account balances for assets and liabilities are carried over from fiscal year to fiscal year.

Income Statement (aka. P&L or Profit & Loss)

The income statement compares the remaining account types which are not represented on the balance sheet. These typically include various "income" and "expense" types (there are a few of each). Just as with the "balance sheet," a balance is maintained between these (income/expense) accounts as well. Any difference between overall expenses and income is your company's "net income." Just as with owner's equity (retained earnings), "net income" can be either a positive or negative value. If your income exceeds your expenses, you have a positive cash flow; otherwise, your "net income" is negative. Only "balance sheet" accounts (assets and liabilities) carry over a balance from year-to-year. Income Statement accounts are cleared (zeroed) at the end of each fiscal year. The level of detail can be decided when running this financial statement.

Trial Balance

All accounts in your ledger maintain either a debit or a credit balance (amount). These debit and credit amounts, when summed independently and for all accounts, are supposed to balance (total debits equal total credits). The trial balance lists the debit and credit balances for your ledger. The level of detail can be decided when running this financial statement.

Journal Posting

This is a report that lists information from journal entries that were posted to the ledger.

Account List

This report provides a "chart of accounts" (account listing) and can be used for reviewing the structure of your accounts which is used to determine the appearance of financial statements.

Fixed Assets

This report lists depreciation details for selected assets.

General Ledger Inventory Reconciliation Report

This report provides a snapshot of the valuation of your current inventory. It is broken down into three sections.

-

The first section compares the perpetual inventory value to the GL inventory value as of the close of business on the last day of the report (as selected).

-

The second section lists the transactions for the reporting period where there is a difference between the stock value and the GL inventory account balance change.

-

The third section lists any specific alerts the application has found based on the data associated with the inventory reconciliation itself. This section can show you specific reconciliation issues in the inventory calculation and reconciliation process.