Fixed Asset Depreciation - Examples

There are seven depreciation methods available to you to keep track of an asset's value. Straight Line depreciation is the simplest, dividing the fixed asset’s cost by the number of accounting periods it is expected to last. Other methods might yield greater depreciation in early accounting periods or take into account the residual (salvage) or scrap value of the fixed asset after it is fully depreciated.

Below are examples of all the methods available in Spruce, except for the Manual method.

Straight Line

Straight Line depreciation is a common and simple method of calculating the expense. In Straight Line depreciation, the expense amount is the same every year over the useful life of the asset.

Depreciation Formula for the Straight Line method:

Depreciation Expense = (Cost – Salvage value) / Useful life

Example

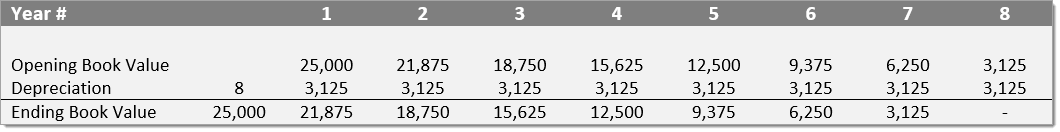

Consider a piece of equipment that costs $25,000 with an estimated useful life of 8 years and a $0 residual value.

Depreciation Expense = ($25,000 - $0) / 8 = $3,125 per year

The depreciation expense per year for this equipment would be as follows:

Declining Balance

The Declining Balance method takes the depreciation percentage and applies it to the remaining amount until the residual value is met. The most depreciation is taken earlier and slows as the periods progress.

Depreciation formula for the Declining Balance method:

Depreciation Expense = Opening Book Value x 25%

Example

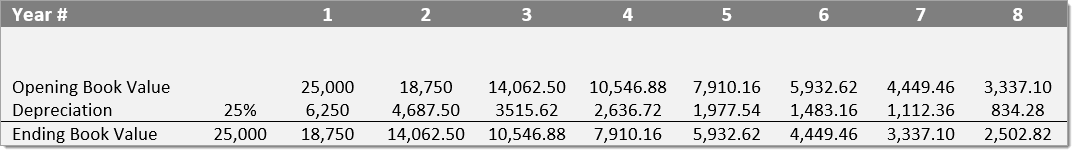

Consider a piece of equipment that cost $25,000 with an estimated useful life of 8 years and a $0 residual value.

First Year Depreciation Expense = $25,000 x 25% = $6,250

Second Year Depreciation Expense = $18,750 x 25% = $4,687.50

Double Declining Balance

The Double Declining Balance method results in larger expense in the earlier years as opposed to the later years of an asset’s useful life. The method reflects the fact that assets are more productive in its early years than in its later years. With the double-declining-balance method, the depreciation factor is 2x that of a straight line expense method.

Depreciation formula for the Double Declining Balance method:

Periodic Depreciation Expense = Beginning book value x Rate of depreciation

Example:

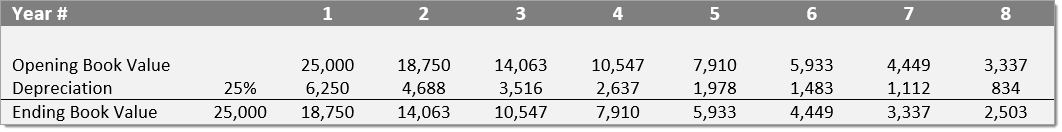

Consider a piece of equipment that costs $25,000 with an estimated useful life of 8 years and a $2,500 residual value.

Expense = (100% / Useful life of asset) x 2

Expense = (100% / 8) x 2 = 25%

Depreciation Expense for year 1 = $25,000 x 25% = $6,250

The depreciation values for this equipment using the double declining method would be as follows:

Percentage

The Percentage method takes a percentage of the total to determine the yearly depreciation amount. The amount is the same for each year until the asset is fully depreciated or the residual is met.

Depreciation formula for the Percentage method:

Percentage Expense = Cost x 15%

Example:

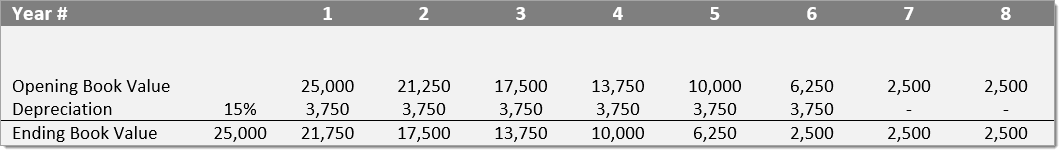

Consider a piece of equipment that costs $25,000 with an estimated useful life of 8 years and a $2,500 residual value.

Percentage Expense = $25,000 x 15% = $3,750

Sum of Year

The Sum of Years method is an accelerated depreciation method. A higher expense is incurred in the early years while lower expenses happen the later years. In this method, the remaining life of an asset is divided by the sum of the years and then multiplied by the depreciating base to determine the expense.

The depreciation formula for the sum-of-the-years-digits method:

Depreciation Expense = (Remaining life / Sum of the years digits) x (Cost – Residual Value)

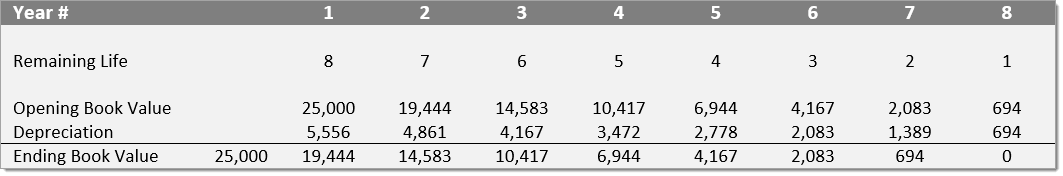

Example:

Consider a piece of equipment that costs $25,000 with an estimated useful life of 8 years and a $0 residual value. In this example, the asset has a life of 8 years, so the sum of years would be 1 + 2 + 3 + 4 + 5 + 6+ 7 + 8 = 36.

The information in the table is explained below:

1.The depreciation base is constant throughout the years and is calculated as follows:

Depreciation Base = Cost – residual value

Depreciation Base = $25,000 – $0 = $25,000

2.The remaining life (RL) row is the remaining life of the asset. For example, at the beginning of the year, the asset has a remaining life of 8 years. The following year, the asset has a remaining life of 7 years, etc.

3.RL / SYD is “remaining life divided by sum of the years.” In this example, the asset has a useful life of 8 years, so the sum of the years would be 1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 = 36 years. The remaining life in the beginning of year 1 is 8. Therefore, the RM / SYD = 8 / 36 = 0.2222.

4.The RL / SYD number is multiplied by the depreciating base to determine the expense for that year.

5.The same is done for the following years. In the beginning of year 2, RL / SYD would be 7 / 36 = 0.1944. 0.1944 x $25,000 = $4,861 expense for year 2.

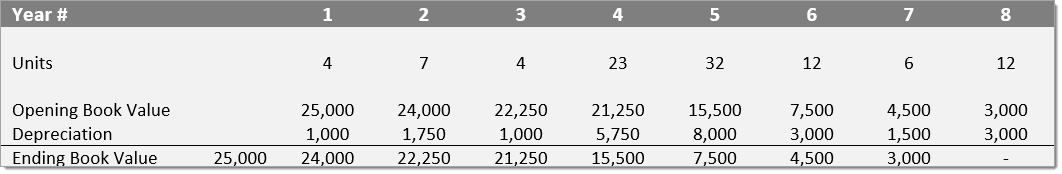

Units

The Units depreciation method depreciates assets based on the total number of hours used or the total number of units to be produced over its useful life.

The formula for the Units method:

Depreciation Expense = (Number of units produced / Life in number of units) x (Cost – residual value)

Example

Consider a machine that costs $25,000 with an estimated total unit production of 100 million and a $0 residual value. During the first quarter of activity, the machine produced 4 million units.

Depreciation Expense = (4 million / 100 million) x ($25,000 – $0) = $1,000

Return to Fixed Asset Depreciation