Receiving Adjustments

Receiving Adjustments are really the same as purchasing adjustments except for the timing. Receiving adjustments, when assigned to a vendor, are automatically applied when goods are received only, not when the purchase order is created. Otherwise, receiving and purchasing adjustment codes are nearly identical. Later changes to an adjustment code do not alter the adjustment on pre-existing transactions. Basic adjustment information, such as the code, amounts, and type, are saved with each transaction and are what's used whenever that transaction is referenced by documents, other transactions, etc. in the future.

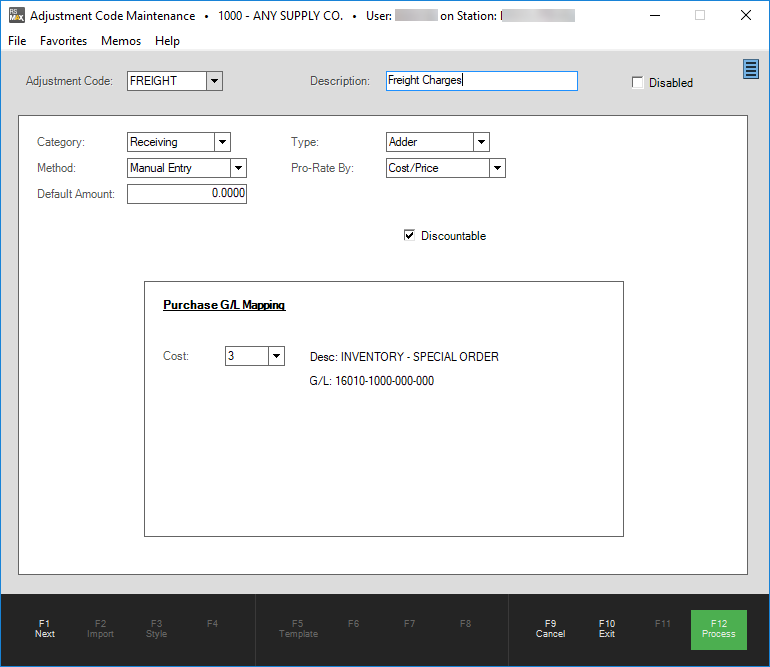

Adjustment Code: Receiving

Both Purchasing and Receiving type adjustments can be manually assigned during either Order Entry or Receiving and function exactly the same when this is done. One adjustment code of either type may be assigned to a vendor as that vendor's default adjustment code. If done, the code is automatically added either at time of order entry or receiving (based on whether it's a purchasing or receiving type adjustment). Differences between purchasing and receiving types are only noticeable in this specific case. If associated with a vendor, a "receipt" adjustment is added automatically during Receiving, but not order entry, so the purchase order would not reflect the adjustment.

Adjustment Code

You can add an Adjustment code of up to 12-characters long. Adjustment Codes, regardless of the category (Point of Sale, Purchasing, etc.), must be unique. The category limits the use of the adjustment, so you may have some duplication if similar codes are needed in more than one application area. Documents that these codes are applied to retain the code even if it is deleted at a later time. For this reason, it is a good idea to make the Adjustment Code itself as descriptive as possible. We do not recommend deleting Adjustment Codes, but rather disabling them.

Description

You can enter up to 30 characters to describe the Adjustment Code in the Description field. Descriptions are rarely (if ever) saved with transactions, so when they are printed on documents or reports, it is always the current description for the code, and may not be the original description added when the Adjustment Code was created. If the adjustment code is deleted, the description is also deleted and will no longer be available to display on documents or reports. For this reason, we suggest "disabling" an Adjustment Code rather than deleting it to preserve this information. Disabling an Adjustment Code prevents the code from being selecting it in the future.

Disabled

The "disabled" check box provides an alternative to deleting (removing) an adjustment code. When a code is disabled, the code won't appear in selection lists in the application areas so it can't be associated with any new transactions; however, the code's description and settings are retained for future reference and for printing/viewing on documents and reports.

Category

There are currently five Adjustment Code Categories: Purchasing, Point of Sale, Manufacturing, Receiving, and Mfg Market. The Category determines where the code will be available and sets the default values for some fields on the form. We do not recommend that you change an adjustment code's Category, because when the Category is modified, the fields on the form reset to new Category's default settings. Even if you change the Category back, any prior entries on the form (and for the selected Adjustment Code) would be lost.

Note: If you modify the Adjustment Code Category accidentally, it's best to first choose Cancel (F9) and reselect the code to reload the original settings.

Type

There are two types of adjustments: Adders and Discounts. Adders represent an increase when entered as a positive figure (negative amounts indicate a decrease). Discounts represent a decrease when entered as a positive figure (negative amounts indicate an increase). Some application areas and/or adder settings may prevent adders or discounts to be entered as a negative amount.

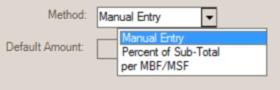

Method

Method determines the way the adjustment's dollar amount is set. Choices include manual entry, percent of sub-total, and "per MBF/MSF." Manual Entry means that the user may be required to either specify or modify the dollar amount when the adjustment is used. Percent of Sub-total calculates the adjustment based upon a percentage specified rather than a dollar amount. "Per MBF/MSF" is used when a set dollar amount is applied on the basis of thousand board feet or thousand square feet. The "Default Amount" field is used to specify either the dollar amount or percentage for the chosen "method."

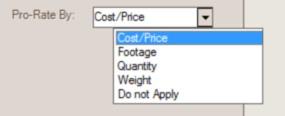

Pro-rate By

Adjustments may be pro-rated using a variety of apply options including: cost/price, footage, quantity, or weight. Relevant information must be present in the item database for certain pro-rate selections (weight factors, footage, etc.). An additional selection "do not apply" can be chosen for an adjustment used only for printing purposes (an "included" item already part of the pricing or costs of the goods). In this case, the adjustment acts more as a separate line-item and is not applied to the costs of the items being purchased. Unapplied adjustment amounts use the ledger account specified for the adjustment in place of the "inventory" asset account that would normally reflect a change in inventory value.

Purchasing and Receiving type adjustments can be assigned as the default adjustment code for a vendor. If done, the adjustment will automatically be associated with any purchase order (or receipt) created for the vendor.

Default Amount

The dollar amount or percentage to be used for calculating the adjustment.

Purchase G/L Mapping

Set a default amount (if any) and map the cost of the adjustment to a general ledger account to complete the adjustment code.

Important! The account mapping is only used IF the adjustment is NOT being prorated across the cost of the products (as referred to in the "Do Not Apply" selection). Otherwise, the adjustment amount is applied to the cost of the product and is not handled separately.