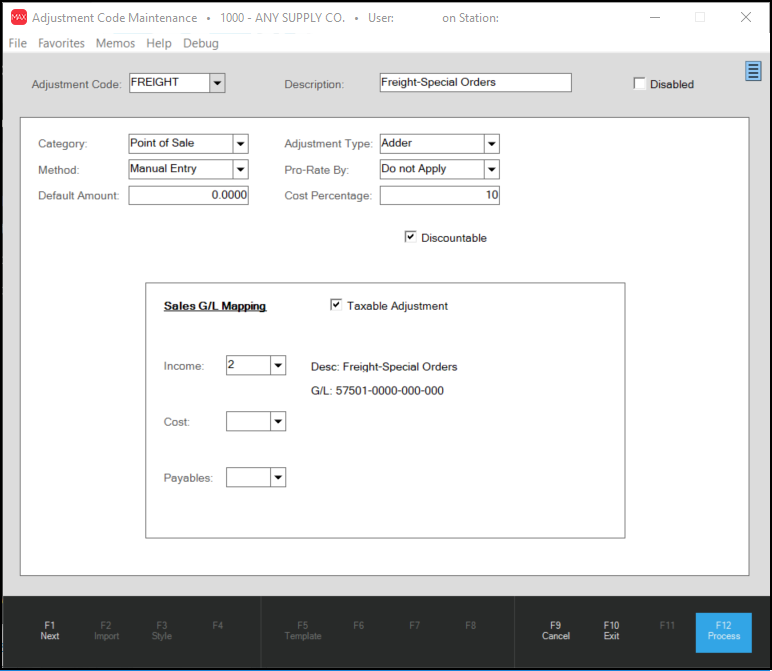

Purchasing > Adjustment Codes

The Purchasing category is used with Adjustment Codes on Purchase Orders. Purchasing type adjustments can be assigned to a vendor or manually added during purchase order creation or modification prior to receipt. Adjustments are not actually applied to the costs of products on the Purchase Order until time of receipt (if done). Later changes to an adjustment code do not alter the adjustment on pre-existing transactions. Basic adjustment information, such as the code, amounts, and type, are saved with each transaction and are what's used whenever that transaction is referenced by documents, other transactions, etc. in the future.

Adjustment Code

Adjustment codes can be up to 12-characters in length. Codes, regardless of the category (Point of Sale, Purchasing, etc.), must be unique. The category limits the use of the adjustment, so you may have some duplication if similar codes are needed in more than one application area. Codes are typically retained with documents, even if the code is at some point deleted. For this reason, it is a good idea to make codes as descriptive as possible.

Description

The description allows for up to 30-characters to provide additional detail about the adjustment code. Descriptions are rarely (if ever) saved with transactions, so when printed on documents or reports, the description is always the current description for the code, and does not necessarily reflect the description at the time the code was actually used. When an adjustment code is removed (deleted) using the menu marker, the description will no longer be available to documents or reports. For this reason, we suggest "disabling" the code in place of deleting especially if the adjustment code has been used in the past.

Disabled

The Disabled check box provides an alternative to deleting (removing) an adjustment code. When a code is disabled, the code won't appear in selection lists in the application areas so it can't be associated with any new transactions; however, the code's description and settings are retained for future reference and for printing/viewing on documents and reports.

Category

This determines where the code will be available as well as sets default values for certain fields on the form. Changing the category on any existing code is strongly discouraged. If the category is modified, fields on the form are set to default settings for the category. Even if the category is then changed back, any prior entries on the form and for the selected adjustment code will be lost. If the category is accidentally modified for an existing code, it's best to first Cancel (F9) and reselect the code to reload the actual settings in this case. There are currently five categories: Purchasing, Point of Sale, Manufacturing, Receiving, and Mfg Market.

Type

There are two types of adjustments: Adders and Discounts. Adders represent an increase when entered as a positive figure (negative amounts indicate a decrease). Discounts represent a decrease when entered as a positive figure (negative amounts indicate an increase). Some application areas and/or adder settings may prevent adders or discounts to be entered as a negative amount.

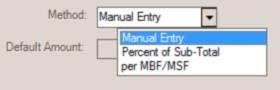

Method

Method determines the way the adjustment's dollar amount is set. Choices include manual entry, percent of sub-total, and "per MBF/MSF." Manual Entry means that the user may be required to either specify or modify the dollar amount when the adjustment is used. Percent of Sub-total calculates the adjustment based upon a percentage specified rather than a dollar amount. "Per MBF/MSF" is used when a set dollar amount is applied on the basis of thousand board feet or thousand square feet. The "Default Amount" field is used to specify either the dollar amount or percentage for the chosen "method."

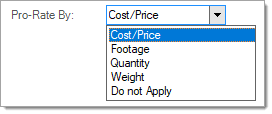

Pro-rate By

Adjustments may be pro-rated using a variety of apply options including: cost/price, footage, quantity, or weight. Relevant information must be present in the item database for certain pro-rate selections (weight factors, footage, etc.). An additional selection, "Do not Apply," can be chosen for an adjustment used only for printing purposes (an "included" item already part of the pricing or costs of the goods). In this case, the adjustment acts more as a separate line-item and is not applied to the costs of the items being purchased. Unapplied adjustment amounts use the ledger account specified for the adjustment in place of the "inventory" asset account that would normally reflect a change in inventory value.

Purchasing and Receiving type adjustments can be assigned as the default adjustment code for a vendor. If done, the adjustment will automatically be associated with any purchase order (or receipt) created for the vendor.

Default Amount

The dollar amount or percentage to be used for calculating the adjustment, if applicable.

Cost Percentage

If cost percentage is applicable, enter the adjustment cost as it should be calculated based on a percentage of the selling price. Commonly, cost percentage adjustments are used with bulk goods that maintain a similar margin overall, but may have different prices.

Discountable

The discountable check box determines whether a purchasing or receiving adjustment amount should be considered eligible for discounting in Payables.

Taxable Adjustment

Select this check box if the adjustment should be taxable. Leave this check box unchecked if not.

Purchase G/L Mapping

Set a default amount (if any) and map the cost of the adjustment to a ledger account to complete the adjustment code.

Important! The account mapping is only used IF the adjustment is not being prorated across the cost of the products (the "Do Not Apply" selection). Otherwise, the adjustment amount is applied to the cost of the product and is not handled separately.

Choose Process (F12) to finalize any changes or additions.