Post All Credits

The most efficient method for posting payments is globally applying credits (using the Post All Credits option). This can greatly minimize the amount of manual work that needs to be done to maintain your company's receivables.

You can access the Post All Credits function from the Menu Marker  in the Receivables > Posting activity. You may not have access to this Menu Marker, if your user settings do not have this feature enabled. Security decisions are the responsibility of your company's selected system-administrator.

in the Receivables > Posting activity. You may not have access to this Menu Marker, if your user settings do not have this feature enabled. Security decisions are the responsibility of your company's selected system-administrator.

|

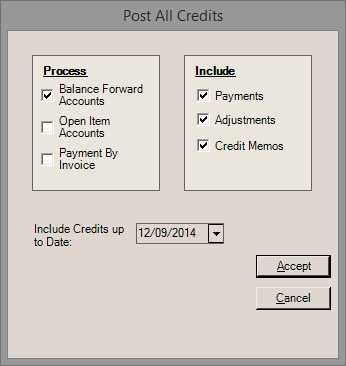

Process (Options)

Currently, three options are provided when processing a "global" post of all credits: Balance Forward, Open Item, and Payment By Invoice.

Balance Forward Accounts

The Post All Credits function applies all payments for Balance Forward accounts and to the oldest balances on the account or job (depending upon billing level).

Open Item Accounts

Posting "all credits" can also be done for Open Item accounts (optionally); however, there are some restrictions. In this latter case, posting only applies payments (or other credits) when the total of all the credits would exactly pay off the total amount due for either the account or job (invoice-by-invoice manual posting would then not be necessary). The reason for this restriction is that when the total credits for an open item customer (or job) result in a pay-off, the details regarding how those individual payments or credits are applied is no longer important. No posting is done for open item customers when the total credits would not result in a payoff.

Note: The balance pay-off for open items is calculated for either (1) the entire account or (2) individual jobs. This is determined by the billing level of the particular open item customer (either "master account" or "job").

Invoice Terms Note: The Post All Credits function does not apply to Invoice Terms accounts due to the different Discount calculation logic. Exclude Invoice Terms accounts from this process to ensure these accounts are posted properly.

Payment By Invoice

This applies payments with a check number of "Online" only (the check's reference would be "Check# Online"). These payments may come from some type of online submission, as would be the case with Spruce ProLink, or some other outside (third-party) source. For payments involving open item accounts, the payments must also have a document identifier associated with them. In this case, an account pay-off restriction is not enforced since each payment is associated with a specific invoice. This is not required for Balance Forward accounts. Payments can be loaded with the appropriate information from a spreadsheet or delimited file using the Import (F2) Wizard found in the Enter Payments transaction (also available on the Receivables menu).

When a global apply is processed, a listing of eligible accounts is generated. If open credits (payments, etc.) are located and applied (posted), the totals panel will update in the upper right-hand corner of the form. No details are listed; however, "posting" document with greater detail is created and can be viewed immediately.

The benefit to following this procedure is that it eliminates all manual posting except for those accounts or jobs for open item accounts who did not pay their account (or job, depending on billing level) in full. This can greatly reduce the amount of work required on a daily basis for managing your company's receivables. Posting can be done manually for both balance forward and open item accounts, it is just less efficient.

Include

There are three types of credits that can be posted using this feature: payments, adjustments, and credit memos. Payments may represent cash, checks, or bankcard receipts from the customer which are being applied to their receivable balance. Adjustments are usually some type of correction (finance charge write-off, discount, etc.). Credit Memos are generated by returns processed from the Point of Sale area. If you select all three "include" choices (Payments, Adjustments, and Credit Memos), the automated posting processes Credit Memos first followed by Payments and Adjustments lastly. This order can be overridden by selecting each "include" option one at a time and doing a series of postings.

Include Credits Up to Date

This sets the ending date for payments, credit memos, and adjustments to be included when processing. The date that is compared will vary by the type of credit (payments use the posting date, other types use the entry date). Posting date may be adjusted automatically if you use the check clear days or grace period parameters.

Keep in Mind: Timing Sensitivity and Discounts

It's important to point out that the order in which particular types of activity is posted can have an affect on the results and whether or not a customer receives their eligible discount. Credit Memos (returns) and adjustments are handled somewhat differently from Payments. There are parameters and manual date selections which can affect the date which payments are eligible for posting. These are not considered when applying credit memos (returns) or adjustments. Posting payments before credit memos and adjustments can potentially result in a customer not receiving their eligible discount.

Discounts are not applied when credit memos are posted.* For this reason, you'd want to apply any adjustments and memos first so that only the remaining amount due is considered when determining whether or not the account is eligible for discounts.

Payments should be entered promptly or assigned a "posting date" matching when the check was received. If you use either the parameter for grace period or check clear days, the posting date will be adjusted as indicated when applying payments. It does not make sense to use both parameters since they counteract each other, so please choose one or the other (or neither... they are optional).

Posting date has no effect on credit memos and adjustments, only payments. Credit Memos are always applied as of the "entry" (process) date of the credit regardless of when the posting is done. No grace period or check clear days parameters are applied when posting credit memos (returns). Waiting until the "discount" date has passed before applying credit memos (returns) does not change how they are posted; however, if payments have been remitted and posted prior to that date, it can cause the customer to not receive their discount.

*Credit memos affect the "current discount" immediately at time of return (invoicing). If the customer has other current activity that would result in a discount, this effectively reduces their "next" statement discount by the credit discount. Sometimes this will benefit your company, sometimes it benefits the customer.

Printing a Session Report

Before navigating to another area from the Posting form, users can print or save a session report using the Process (F12) function. This document is available from the Documents library form. It's strongly suggested that users review any global action such as posting after processing.