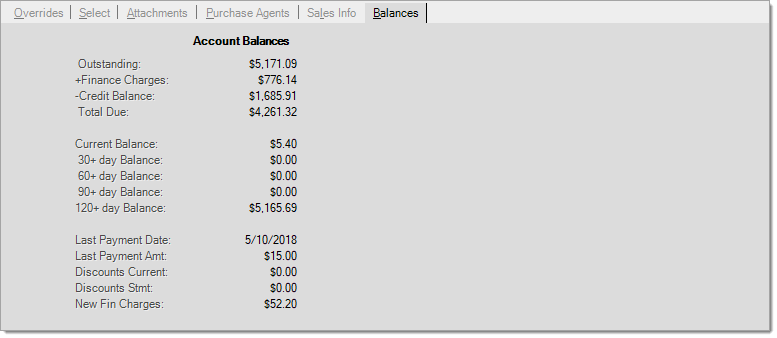

Balances (Job)

The "balance" tab (ALT-B) displays accounts receivable balances for either the job or account depending upon the account's billing level (either "account" or "job"). Billing level may not be changed after an account is added to the database. The balances tab will only display two (2) sets of totals if the account is set up with a billing level of "job." In this case, one column is reflects balances for the account as a whole, and another for the selected job. When the main account's billing level is set to "account," only account balances will be displayed even when jobs are associated with the customer's account.

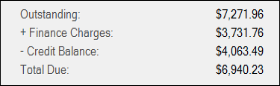

Balance Summary

A summary of balances, finance charges, and unapplied credits is listed along with the total owed (due) by the account (or job). Total due does not reflect any statement discounts.

Outstanding

This is the total of all aged balances including the current balance. It does not include finance charges, credit balances, or discounts. This total is maintained for the customer or job data and is not being directly calculated from the balances. Job balances are only maintained when the account linked with the job is assigned a billing level of job. This is always represented as a positive figure.

+ Finance Charges

The total of unpaid finance charges for the selected customer or job. Finance charges are only assessed by job when the account linked with the job is assigned a billing level of job. New finance charges are typically assessed with billing processing which is done on a monthly basis. Usually billing is done around the beginning or end of each month (last day of the month, or the 25th or first (1st), for example). Some companies have optionally elected to assess their finance charges mid-month (on a specific day of the month) instead. These finance charges are calculated on the designated date based on the customer's balances at that time; however, the finance charge won't appear in this total until the remainder of the billing process is completed. Finance charges are optional, and a number of settings and parameters affect if, how, and when finance charges are applied. This is always represented as a positive figure.

- Credit Balance

Credit balance is the total of unapplied (not posted) credits currently associated with the account. This total may be a combination of regular payments, credit memos (returns), and credit adjustments; however, it does not include discounts. This is always represented as a positive figure although it is deducted from the sum of the outstanding and finance charge totals.

Total Due

Total due is calculated from the outstanding, less any finance charges, and plus the credit balance. This is the total amount the customer currently owes not considering any discount or pending transactions (orders, tickets, etc. which have not yet been invoiced/processed). The total due may be a net credit amount (negative) if for some reason the unapplied credits exceed the sum of the outstanding balance and finance charges. In this case, the total due will be listed within parentheses. For example, "($14.92)" would indicate that the customer has an overall credit balance (negative total due).

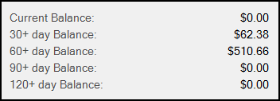

Aged Balances

Each month, an automated billing process ages balances. This is only done once a month on the day designated by your company... never on a daily basis. At this time, each balance is moved into the next older period's total. There are a total of five aging totals maintained for each account and, in some cases, for jobs. Job balances and aging are only maintained when the job's account has a billing level of "job." For accounts with a receivable's type of "open item," invoices aren't aged themselves; however, the age of items can be determined based on the billing cycle number that was assigned to each sale at the time it was processed. The billing cycle number is incremented by one each month (on the billing date).

Finance charges will be assessed on any "past due" (not current) balance remaining unpaid at the time finance charges are assessed. Payment of balances (as well as open items) is dependent upon the "posting" process which can be done either manually or automatically. Automated billing will process a "global" application of unapplied credits (posting) when it processes; however, this only applies payment and other credits to balance forward accounts except in cases where an "open item" account's total due plus finance charges and less any eligible discount equals the total credit balance exactly at time of billing. New finance charges are not assessed on "closed" accounts even if they maintain past due balances.

Current Balance (New)

The current balance reflects "new" charges (sales and debit adjustments) since the last billing period closed. This could also be described as the "non-billed" balance since the customer would not have received a bill for this amount yet. When the monthly automated billing process completes, this balance is moved to the first of four past due periods (described below as "30+ day Balance"). Charges reflected by this balance may be anywhere between zero and 30 days old.

30+ day Balance (Past Due #1)

This is the first "past due" or billed balance. This amount should be considered "current" until the payment due date has passed. Whether or not a customer receives a discount if they paid this balance would be determined by the discount date in relation to when they pay their bill. The grace period and check clear days parameters can also have an effect on discount eligibility. When finance charges are assessed, if the account or job is assigned a finance charge percentage that is assessed on the "30+ Day balance" (see finance charge terms for the account or job) and this balance is greater than zero they would be assessed finance charges on this balance as well as any older balances. Charges reflected by this balance may actually be anywhere between one and 60 days old. It is referred to as "30+ Days" because any items making up the balance would typically not be billed until they are actually about 30 days old.

60+ day Balance (Past Due #2)

This is the second "past due" balance. This includes amounts that would have now appeared on two previous statements (bills) and typically would no longer be eligible for discounts if paid. When finance charges are assessed, if the customer is assigned a finance charge percentage that is assessed on the "30+ Day balance" or "60+ Day Balance" (see finance charge terms for the customer) and this balance is greater than zero they would be assessed finance charges on this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be anywhere between 29 and 91 days old. It is referred to as "60+ Days" because the items making up the balance typically would not be billed until it they are about 60 days old.

90+ day Balance (Past Due #3)

This is the third "past due" balance. This includes amounts that would have now appeared on three previous statements (bills) and typically would no longer be eligible for discounts if paid. When finance charges are assessed, if the customer is assigned a finance charge percentage that is assessed on the "30+ Day balance," "60+ Day Balance," or "90+ Day Balance" (see finance charge terms for the customer) and this balance is greater than zero they would be assessed finance charges on this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be anywhere between 60 and 122 days old. It is referred to as "90+ Days" because the items making up the balance typically would not be billed until they are about 90 days old.

120+ day Balance (Past Due #4)

This is the fourth and final "past due" balance. This includes amounts that would have now appeared on four or more previous statements (bills) and typically would no longer be eligible for discounts if paid. No further aging is done on this balance. When finance charges are assessed, if the customer is assigned any finance charge percentage and this balance is greater than zero they would be assessed finance charges on this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be 90 days or older. It is referred to as "120+ Days" because the balance typically would not be billed until they are about 120 days old.

This is the date of the most recent sale (for any payment method) made using the selected (current) account or job.

This is the date of the most recent "charge" sale made using the selected (current) account or job. Charge sales also cause an update for the last sale date.

This is the date of the most recent "charge" sale made using the selected (current) account or job. Charge sales also cause an update for the last sale date.

Discount Information

Depending upon whether the account or job is assigned

Current discounts are pending discount amounts calculated for "new" account activity (new activity since the last billing period close). These discount have not been included on a customer's statement. Current discount will become the new statement discount when the current (this) billing period ends. Any prior statement discount is cleared at the same time (discounts don't carry forward if they are not used). If a customer should choose to pay-off their account prior to billing, the current discount can be applied toward balances or open items. It is possible for current discount to display as a negative amount. This would only happen if the discount on returns exceeds the discount on regular charges. The discount on returns reduces any existing or future current discounts, but is never carried forward if negative at the end of the billing period.

This is the total discount from the customer's most recent (last) billing statement. This figure does not reflect any discount that may have already been applied during the current cycle, so it may represent be the discount available now to the customer. This amount is shown regardless of whether the customer is still eligible to receive the discount (discounts are typically tied to payment by a specified discount date, etc.). This will never be a negative amount. Discounts are optional. Statement discounts are calculated based on the customer's discount percentage at time of sale. Billing processing does not calculate discounts.

New Finance Charges (New Fin Charges)

This is the amount of finance charges most recently calculated for the account. This is not necessarily the same as the total finance charges pending payment on the account. In addition, for companies who assess finance charges mid-month (not on the same date as billing processes), this is not necessarily the same as the finance charges that appeared on the customer's most recent statement.