Detail Mapping

Detail Mapping is used in place of the standard system journal mapping in certain cases such as when an additional layer of detail is necessary. In certain transactions, the application may display a list of selections to choose from that affect ledger entries. Some of the detailed mapping options define those selections. We suggest using mapping IDs that begin with 0 and are sequential integer values.

Inventory Adjustments (Asset)

Adjustments to on-hand values are necessary for a number of reasons (damage, cutting, company use, etc.). When done, these adjustments either increase or decrease the asset value of your company's inventory. This detailed mapping option allows users to specify the asset inventory accounts that should be affected when adjustments are done based on specific product groups. When no detailed product mapping exists, adjustments use the default “inventory adjustment” account mapped in the Inventory system journal.

Credit Adjustment (Income)

This detailed mapping records income (debit) and is used as an offset when credit adjustments are made to your company's Accounts Receivable (A/R) asset balance. One or more asset accounts are used for maintaining the balance of your company's receivables. The overall A/R asset balance is credited (reduced) whenever manual "credit" adjustments are done to an A/R customer's account. When processing a credit adjustment, the user may select the offsetting debit (from this mapping) to be the adjustment based upon the reason for the adjustment. For example, if an A/R customer was charged a finance charge and shouldn't have been, a credit adjustment can be used to remove that charge from their account. In this case, the user would typically select the account used for recording finance charge income as the "debit" offset to the credit adjustment. This mapping defines the list of accounts that a user may select from. This detailed mapping (if set up) replaces the default Credit Adjustment Income account mapped in the Receivables system journal.

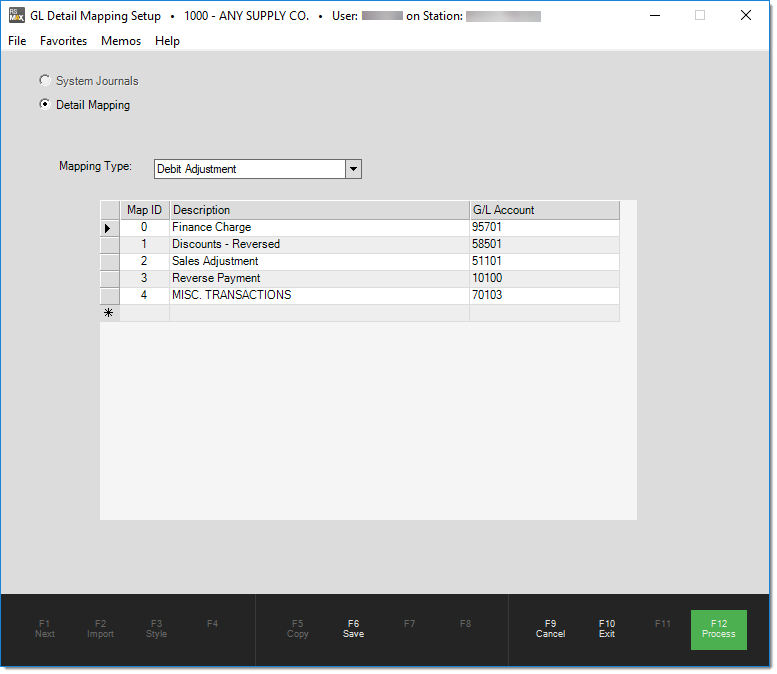

Debit Adjustment (Income)

This detailed mapping is used for recording the income (credit) offset when debit adjustments are made to an Accounts Receivable (A/R) customer's account. An asset account(s) is used for maintaining the balance of your company's receivables in General Ledger. The overall A/R balance is debited (increased) whenever debit adjustments are made to a customer's account. Users may select an account as the offsetting credit if this mapping is done. Selections should be based on typical reasons for debit adjustments. For example, if a customer has an outstanding unapplied credit on their account and no charge activity, they might request a refund. A debit adjustment could be used to remove the credit from their account. In this case, the offset might be either "cash on hand" or "refunds owed" depending upon the method chosen to reimburse the customer. This detailed mapping (if set up) replaces the default Debit Adjustment Income account mapped in the Receivables system journal.

Purchasing Adders (Expense)

This detailed mapping defines the list of G/L accounts that may be selected in the database for Adjustment Code maintenance for recording the cost of "purchasing" related adjustments (adjustment codes may also be used with Point of Sale; however, there are different mapping options available for those types of adjustments). The accounts defined here are made available for selection when adding or modifying a purchase adjustment code. Most adjustments would increase your ledger's A/P (Accounts Payable) liability balance when goods are purchased and are typically recorded as an expense. If this detailed mapping is not set up, the default mapping located in the Receiving system journal will be used instead.

Sale Adders (Income)

Adjustment codes used with Point of Sale transactions have more complex mapping than those used for purchases. There are three account entries possible when an adjustment is associated with a sale: income and cost. This particular mapping is used for designating the income accounts available for selection in the Adjustment Codes database. Users who modify or add a Point of Sale type adjustment code have a drop down selection for IncomeAdder Sales. Adder income is typically a credit to the income account selected (increasing that account's balance) and a debit to an asset account based on the payment method used. The opposite would be true in cases of a return of goods with an associated adjustment code. If this detailed mapping is not used, the default mapping located in the Point of Sale system journal for sales and returns will be used instead.

Sale Adder Cost (Expense)

Adjustments linked with Point of Sale transactions (sales) may have a cost associated with them. For example, your company may charge a flat delivery rate of $15 for appliance delivery; however, the cost associated with the delivery may optionally be determined as a percentage of the total invoice or some other method. If the adder cost is linked to a sale, the resulting entry will debit (increase) the expense account mapped here. If this detailed mapping is not set up and assigned to an adjustment code, the default mapping for adjustment cost specified in the Point of Sale system journal will be used instead.

POS Misc Payment Type (Income)

This detailed mapping selection provides ledger offsets for use with certain payment types processed from the Point of Sale, Payments transaction. Currently, this applies to the Miscellaneous selection. If detailed mapping is not implemented, the Miscellaneous Pay-ins mapping from the Point of Sale system journal category Payments is used.

Payout Reason (Expense)

When money is paid out using the Petty Cash selection under the Payout activity located in Point of Sale, users can select from a list of G/L accounts (if this mapping is set up). The selected account is used as the debit offset to the credit entry reducing cash assets. The intention behind this detailed mapping option is to provide a way of recording the associated expense or reason for the petty cash withdrawal. A few reasons petty cash might be used include postage, tolls, office supplies, and donations to charity. Your company can use this detailed mapping to list the expense accounts that should be increased (debited) when petty cash is paid out. If detailed mapping is not set up, the default mapping from the Point of Sale system journal for Payouts will be used instead.