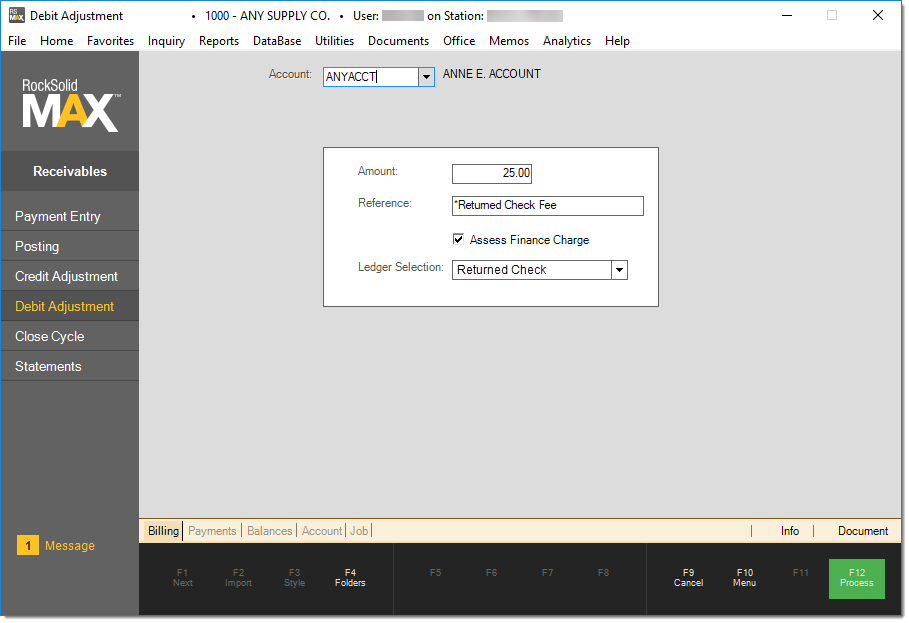

Debit Adjustment

Debit adjustments place a debit entry on the customer's account, increasing what they owe. Debit adjustments might be used for returned check fees, finance charges, or to remove a credit that was accidentally or incorrectly processed.

Begin by selecting the customer's account. If you don't know the account number, use the alternate menu selections to search by name, address, etc. Enter the amount of the adjustment. The "reference" is just a text description of the credit adjustment. It may print on the customer's statement, so it's a good idea to fill this in.

The box for "Assess Finance Charge" should be checked in cases where the debit amount should receive finance charges if not paid by the next cycle close (as would be done on an aged balance). Debit adjustments cannot be aged and there is no option for adding a manual finance charge to an account. Please refer to the section Assess Finance Charge below.

Ledger Selection

Once all the information is entered and is correct, use the Process (F12) function to save the debit adjustment on the customer's account. The debit adjustment will then appear either in the list of open items or the customer's balance (depending upon the account type: open item or balance forward).

Assess Finance Charge

If the check box "Assess Finance Charge" is checked, the amount of the debit is assessed a finance charge at the next billing period close (for the current cycle). Otherwise, the debit adjustment won't be assessed finance charges unless it remains unpaid when it's aged from current into 30-days (at the close of the second (2nd) future billing period). If debiting the account to replace a balance that was older than the current period, check this box if the customer should be assessed a finance charge on the balance with their next bill.

This check box does not provide the ability to manually add a finance charge to an account. Finance charges cannot be added to an account manually; however, there can be situations when finance charges are prematurely paid (posted) on a customer's account either accidentally or intentionally. One example, might be that a customer's check is applied, but refused by the bank due to insufficient funds (a "bounced" check). To avoid this situation, use the check clear days parameter to allow time for checks to clear a bank before being made eligible for posting. If a check does subsequently bounce, process a debit adjustment to the customer's account for the amount of the check and apply their "payment" to that debit instead of paying down finance charges or other existing charges to the account.