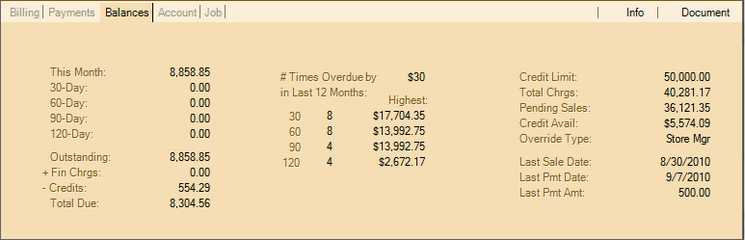

Receivables Folder: Balances Tab

The current or selected customer's balances, overdue history, and current credit available are listed on this tab.

Aging

Aged balances are listed on the left-hand side of this tab. Balances are aged monthly during billing processing only, not on a daily basis. Details that make up each balance will vary in actual age.

When reviewing a customer's balances, it's important to understand that the aging is a preview of the next billing. Aging does not reflect the actual age or status of the customer's account from their most recent statement. When a 30-day or older balance appears on a customer's account status or inquiry, it does not mean that their statement showed the same balances. The balances and aging reflect what the customer would owe/see on their next statement if they don't pay their balance before the end of the cycle.

This Month (New Charges)

The current balance reflects "new" charges (sales and debit adjustments) since the last billing period (statement). This could also be described as the "non-billed" balance since the customer would not have received a bill for this amount yet. When the monthly automated billing process completes, this balance is moved to the first (1st) of four (4) past due periods (described below as "30+ day Balance"). Charges reflected by this balance may be anywhere between zero (0) and 30 days old.

30-Day (Past Due #1)

This is the first (1st) of four (4) aging periods. The amount reflects charges that have been billed on a statement one time. The total reflects the balance that remains unpaid. Open, or unapplied, credits will not reduce aged balances, but do reduce the total due. The open items or balance reflected on the customer's prior statement may vary from this amount if payments, returns (memos), or adjustments have been applied since they were billed.

This amount should be considered "current" until the payment due date has passed. Whether or not a customer receives a discount if they paid this balance would be determined by the discount date in relation to when they pay their bill. The grace period and check clear days parameters can also have an effect on discount eligibility. When finance charges are assessed, if the customer is assigned a finance charge percentage that is assessed on the "30+ Day balance" (see finance charge terms for the customer) and this balance is greater than zero they would be assessed finance charges on this balance as well as any older balances. Charges reflected by this balance may actually be anywhere between one (1) and 60 days old. It is referred to as "30-Days" because any items making up the balance would typically not be billed until they are actually about 30 days old.

60-Day (Past Due #2)

This is the second "past due" balance. This includes amounts that would have now appeared on two (2) previous statements (bills) and typically would no longer be eligible for discounts if paid. When finance charges are assessed, if the customer is assigned a finance charge percentage that is assessed on the "30-Day" or "60-Day" (see finance charge terms for the customer) and this balance is greater than zero they would be assessed finance charges on this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be anywhere between 29 and 91 days old. It is referred to as "60-Days" because the items making up the balance typically would not be billed until it they are about 60 days old.

90-Day (Past Due #3)

This is the third "past due" balance. This includes amounts that would have now appeared on three (3) previous statements (bills) and typically would no longer be eligible for discounts if paid. When finance charges are assessed, if the customer is assigned a finance charge percentage that is assessed on the "30-Day," "60-Day," or "90-Day" (see finance charge terms for the customer) and this balance is greater than zero they would be assessed finance charges on this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be anywhere between 60 and 122 days old. It is referred to as "90-Days" because the items making up the balance typically would not be billed until they are about 90 days old.

120-Day (Past Due #4)

This is the fourth and final "past due" balance. This includes amounts that would have now appeared on four (4) or more previous statements (bills) and typically would no longer be eligible for discounts if paid. No further aging is done on this balance. When finance charges are assessed, if the customer is assigned any finance charge percentage and this balance is greater than zero they would be assessed finance charges on this balance as well as any other balances with in the finance charge terms. Charges reflected by this balance may actually be 90 days or older. It is referred to as "120-Days" because the balance typically would not be billed until they are about 120 days old.

Outstanding

This is the sum of the four (4) aged balanced plus the "this month" (current or new) balance. If the "this month" figure is not zero, the outstanding includes activity that has not yet been billed on a statement.

+ Finance Charges

This is the total of all unpaid finance charges currently due for the account. This amount is added to the outstanding when calculating the "total due."

- Credits

This is the total of unapplied credits available for posting for this account. This amount, if greater than zero, reduces the "total due." Aged balances and "this month" figures are not reduced by "open" (unapplied) credits.

Total Due

This figure is the sum of the outstanding (new activity and aged balances) and finance charges less any unapplied (open) credits.

|

Aging Example For example, if an invoice is charged to a customer's account on the 23rd of the month, it is considered a "current" balance at that time and would appear under the "this month" total. If we then do our billing on the 25th (2 days later), the "this month" balance will now be moved into the "30-Day" total and the "this month" (current) balance is set to zero for the new billing period. Our customer's invoice is now only 2 days old, but appears under 30-Days. Why? The customer's statement from the 25th would reflect the 2-day old invoice as a "current" charge (aging is done after statement documents are created). The statement includes the 2-day old amount and the expectation is that the customer will pay their entire balance prior to the next billing or earlier. If they do pay, the 30-day balance is reduced and the customer won't ever see that any aging occurred. However, if they fail to pay, their next statement will reflect the amount as a 30-day balance appropriately. |

Overdue Periods

The middle area of the Balances tab lists the overdue minimum amount (determined by a parameter) and the number of times during the prior 12-month period that this customer was billed and had a 30, 60, 90, or 120 days balance. The highest amount billed for each overdue balance is also listed. This information is useful for reviewing the payment history of an account as well as for any credit reporting your company may participate in.

For example, if the overdue table lists the customer as having four (4) past due balances for the 30-day aging, it means that the customer carried over a 30-day balance for four (4) out of the last twelve (12) billing periods.

The dollar amount appearing next to "# of times overdue by" text is determined by a system parameter. This figure is the minimum balance that an overdue balance would be recorded for. This would be used if your company decided it didn't want to consider amounts less than $100 as an overdue balance, for example. Setting the minimum is optional and applies to all customers if used.

The number of times a customer has been overdue is used for your analysis and optional credit reporting only. A certain number of times overdue would not directly prevent a customer from accessing their account (having overdue balances and/or exceeding a credit limit may affect a customer's ability to access their receivables account, however).

Credit Availability

The right-hand area lists the customer's credit limit, how much of that limit has been used, and other information.

These figures should be viewed independently, not as group.

Credit Limit

The customer's credit limit as assigned to their account by your company. Credit used can exceed this amount if overrides are either not enforced or have been approved by a store or credit manager.

Total Charges

Total Charges figure represents all charges to the account over time, not just current activity (some of those charges may have been paid). This figure is used to indicate how much potential volume or sales impact the customer has had over time. For example, your company might make some credit decisions differently for an account with very high sales volume vs. a customer who has used their account minimally. Total Charges is not used by any of the other figures in calculations.

Pending Sales

Pending Sales is the balance of outstanding customer orders (includes direct ship orders). The customer's order balance is one of the figures used for determining the customer's available credit.

Credit Available

This amount of credit available to the customer. It is calculated by taking the credit limit less the total due (new charges + past due remaining + finance charges - open unapplied credits) and less pending sales.

Last Sale Date

Last Sale Date is the last time the account was used for any type of sale. This is not necessarily the last receivable's charge sale.

Last Payment Date and Amount

Last payment amount and date are updated by receivables payment activity specifically, not other types of payments (order deposits, etc.).