Understanding Installed Sales

The Installed Sale transaction helps your company manage installation services. It can be used for any type of installation such as flooring, kitchens, garage doors, etc. Due to the many factors of installations, such as third-party labor and unexpected expenses, it can be a challenge to really know if your company is making profit on installed sales. The installed sales transaction's primary purpose is for analysis and billing management.

An installed sale isn't usually a single transaction although it can be. In most cases, installed sales represent a number of different transactions.

Installed sales are different from other Point of Sale transactions because they don't involve item entry. Instead, one "installed" sale is linked with various documents (orders, tickets, payments, payables, and receivables).

There is one fixed amount for the entire installed sale contract. Once the amount is determined, this becomes the amount the customer will pay regardless of the details (materials, labor costs, etc.). Your profitability depends upon how accurate the contract amount is derived and whether or not unexpected costs arise during the installation.

Billing and Installed Sales

There are several ways installed sales are billed. This is primarily dependent upon the type of installation. For smaller jobs, there can be a single payment or a deposit and final payment only. For larger jobs, payment might occur on a schedule corresponding with the job's progress. For example, the first payment might be a deposit prior to any work, the second payment might correspond with the delivery of supplies, a third payment at a midway point, and the final billing occurring once the installation is completed.

For receivables customers (and the "system" installed sale account), the software allows up to 4 billings (plus 1 "deposit" level) per installed sale contract on receivables accounts and the default installed sale "cash" account. You are not required to use all the levels. In addition, a customer can make as many payments as they like and as frequently as they like. Levels are only used for billing purposes not for payment. For customers with their own cash-only accounts, only 2 billing levels are provided: initial deposit and final payment. We suggest creating a separate job on the customer's account for the installed sale (this can help keep selection simpler).

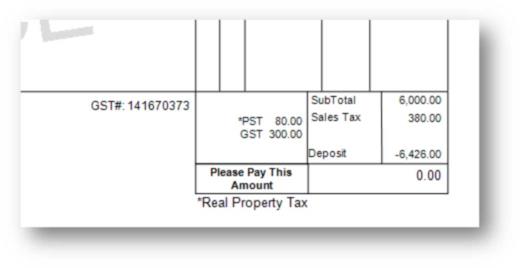

Billing for receivables (and the default installed "cash" account) is processed using the Invoice Recurring utility. This creates a debit adjustment on receivable accounts (or on the system installed cash account). All customer payments (Payments) are considered "deposits" on the installed sale contract until final processing.

After the final billing and payment, the contract may be marked as complete. Completing the contract produces invoices of the contract's tickets which bill for the materials. In addition, one final invoice is generated that includes any labor, 3rd party billing, and an "installed sale" item. The installed sale item records the net difference between the contract amount and the overall totals for materials, labor, and 3rd party services. This item doesn't necessarily represent whether or not you made a profit. It merely represents whether the total for materials (at retail, not cost), labor (at retail, not cost), and the amount billed by 3rd parties was greater than or less than the amount of the contract. The materials and labor may include profit amounts not reflected in this difference.

Once a contract is marked as complete, no further modifications are allowed.

Tax Considerations

We assume that most companies intend to include all labor and materials in the lump sum contract total amount. We also anticipate that any sales tax would be charged based upon the overall contract amount agreed to with the customer (either the sales tax is "included" or it is added to the total). The estimated taxable total and tax amount shown for a contract is solely based upon the tax rate chosen and the details of all orders originally associated with the contract (when the contract is added, not by later modifications). After this, the taxable amount is never adjusted or recalculated even if materials or labor estimates are changed. The sales tax amount is only recalculated IF the tax location is modified.

Depending upon your location, all or portions of installed sales may or may not be taxable (labor vs. materials, etc.). The type of installation service can also be a factor. Some areas treat capital improvements as non-taxable; however, this may only apply to those improvements considered "permanent" to meet this condition (installed hardwood flooring might be tax exempt where carpet installation is not, for example). In other cases, materials used during installation may require that your company pay "use" tax on certain materials used in the installation (this type of tax is not paid by the customer). It's also possible for labor and material costs to either exceed or be less than the contract total. The tax eligibility of any difference must be considered and manually adjusted into the taxable amount figure.

All of these factors seriously complicate any potential tax calculation.

For materials, the tax location you assign to the order/ticket is used. If there is a mix of items with different tax considerations (such as some materials requiring "use tax" and other with normal sales tax), these materials must be ordered and ticketed separately! The "use tax" items would be placed on an order with a use tax location, and the other materials would be placed on an order with the appropriate standard sales tax, for example.

It's important to understand the tax rules in any areas where you will do installations before doing installed sales. The application does not automatically determine the appropriate tax based on the rules for your area. Users DO have the ability to designate the tax status on things such as labor, materials, orders, etc., and can manually adjust the taxable total to match the required taxes for the contract and situation. It is entirely your company's responsibility to ensure that this is done properly and according to the laws and rules required for your business.

Here are some questions you should ask and find answers to:

•Are ALL, NONE, or just SOME materials taxable when being installed?

•If materials are taxable, how is that sales tax calculated? Is it based on the retail price or my cost for the goods?

•For materials used during installation, is my company responsible for paying "use" tax?

•Is sales tax charged on labor that my company's employees provide?

•Do I collect sales tax on labor or materials from a 3rd party provider that I contract with to do installations?

•Will I do installations in any areas with tax rules that are different from my local area?

Who is the Installer?

An Installed Sale transaction supports two types of installers: company employed and a third party. Either or both may be linked with any installed sale contract. For example, you might use a 3rd party for certain types of installations and your own employees for others. In other cases, a combination of your employees and 3rd party contractors may be required (a plumber or electrician might be needed in combination with kitchen remodeling, for example). Third party installers are reimbursed (paid) via Payables transactions.

Do I need a separate Branch for Installed Sales?

A separate branch is not required. However, a separate branch would allow better separation of certain sales totals and ledger mapping. It may also make tax reporting easier. Having all installed sales processed from a distinct location may seem like a good idea, but it can have downsides (such as handling inventory from other locations).

Setting up Installed Sales

✓Installed Sale Vendors should be set up for any third parties who will be involved and paid via Payables. There is a new vendor type of "Installed Sales" that must be assigned to vendors in order for them to be associated with installed sales. The MISC vendor cannot be used with installed sales.

✓Your employees who do installation work can be assigned to the "installer" user type.

✓It may be necessary to add new sales tax codes specifically for delivery when tax is calculated as a percentage of "material cost" only ("use" tax). Sales tax locations designated this way can only be selected by users who have access to the Installed Sale transaction.

✓You will need to define one adjustment code for use with installed sales. This adjustment code is used to record any 3rd party installation costs when creating the final adjustment invoice (which also handles any differences in materials, labor, etc.). Only one installed sale adjustment code is required and only one may be added.

✓An inventory adjustment item must be created for use with installed sales. This item is used for recording the difference between the contract total and the total of all materials (after differences in 3rd party or labor expenses is accounted for). The amount applied to the adjustment item does not necessarily represent profit or loss. This is because materials usually have built-in measure of profit that isn't considered when accounting for the differences between the totals for materials and expenses and the contract amount. The adjustment item should be placed in its own product group for mapping purposes. The item should not maintain quantities, should not be taxable, and should not be used for any other purpose than installed sales. A parameter is provided for specifying the item you want to use for installed sales material adjustments.

✓One or more labor items must be added for recording labor on installed sales contracts. These items can be taxable or non-taxable depending upon the tax rules for your area. In addition, a labor item may have a price and a cost. The price is used on the labor tab and totals provided for determining the default contract amount on the Billing Tab. The cost is used for analysis. How your company chooses to view labor as well as any tax considerations should determine how your labor items pricing and costs are set. Here are a few ways to consider using the labor item's price and cost in relation to installed sales:

•Price > Cost

The price of the labor represents what you would charge the customer and the cost represents what that labor costs your company. In this case, you charge the customer a labor rate that is higher than what the labor costs your company. The labor includes some degree of profit in this case. The customer never sees a "labor" figure. Labor is separated for profit analysis and tax reasons only.

•Price = Cost

The price of the labor represents what you would charge the customer and that is treated the same as your expense for the labor. In this case, none of the labor is considered profit because the price matches the company's actual labor cost. Remember, the customer isn't supplied a "labor" amount, the contract is one lump sum amount from their perspective. The break down for labor is solely for your company's analysis and use. For this reason, you could charge for labor an amount representing what the labor actually costs your company.

•Price & No Cost

The price of the labor represents what you would charge the customer for labor, but you choose to not consider cost since you would be paying the employee regardless. This treats the entire labor as "profit" for analysis purposes.

✓An installed sale cash account is required. This is the default account for any Installed Sale when no other customer account is specified. Using this account is optional; however, it must be added and specified in Parameters. Contracts that use this account would only be offered 2 billing levels (an optional deposit and the final payment).

In addition, a special installed sale charge account may be optionally added. This account is a job billing "charge" account but could be used for any customers who you would like to bill on a schedule independent of the customer's own account (if any). Using this type of account would allow you to use the recurring billing feature for customer's without their own charge account. If you plan on using this account, it's strongly suggested that you create a separate job for each individual installed sale contract.

✓There are 2 new parameters for Installed Sales. In order to use Installed Sales, the "installed sale adjustment item" must be designated. In addition, a specific system account for use with non-charge Installed Sales contracts can be designated (optional). This account would actually be a charge account but is used for cash customers who do not have their own account. These parameters are located on the "Point of Sale" tab in the Parameters form (Maintenance area, Database menu).

Process Overview

The following is a summary of the typical process for installed sale from start to finish. There are some differences in this process depending upon whether the customer has a receivables account or not.

Creating the Contract

•Installed Sales begin with at least one customer order.

For customers who don't have their own account, an "installed" sale cash account can be used at this time. Even if an order is not originally designated for installation, it can still be associated with a contract at a later time. Doing so changes the account on the order automatically to the designated "installed sale cash account" (except in cases where a customer has their own cash-only or charge account).

•Create a new contract from the Installed transaction. Each contract is associated with a customer, contract document, and user (optional).

Unlike other Point of Sale transactions, you'll notice that the Installed transaction has no item grid. Instead, a tabbed consisting of 10 different tabs is provided: info, orders, tickets, materials, labor, 3rd party, billing, analysis, changes, and payment links.

•The next step is associating the customer's order(s) with an installed sale contract from the Installed form's Order tab.

If the order has a deposit, the deposit will be considered a "paid" amount on the contract.

•If required, the contract would be assigned estimated labor using the Labor and/or 3rd Party tabs. This would be based upon your own estimate of labor your company will provide, an estimate from a 3rd party (contractor, etc.), or possibly a combination of both.

•Using the totals for labor, materials, and sales tax (if applicable), determine and assign a total amount on the Billing tab. As much as possible, consider any additional materials or costs that might be associated with the installation later on when determining a total.

•Next, define the billing schedule (if applicable) if the customer has a receivables account and will be billed in increments.

Depending upon whether the customer has a receivables (charge) account or not, the customers may be billed at one time or on a payment schedule determined when the contract is created. Payment schedules are available for receivables accounts only and include an amount and due date (the amount may be based upon a percentage of the contract total). Installed sales for cash-only customers offer an initial payment and final payment only.

During Installation

•As materials are removed from inventory and used for installation, tickets are used.

Materials used that were associated with a customer order linked to the contract should be ticketed using the customer order (use the Ticketing (F5) function and choose "Installed Sale Contract" in the Open Tickets transaction). Any other materials used, other than what was ordered, can be directly associated with the installed sale contract either from the Tickets transaction in Point of Sale or later from the Installed Sale transaction (Tickets tab). Additional materials that are used for installation won't automatically adjust the contract total. It is best to consider the cost of such materials when initially determining the contract total if they will be included in the initial contract total.*

*It's possible to choose to bill and invoice any additional materials separately, but it's best to state this to the customer in writing, so that it's clear whether or not any additional charges will be included in the contract total.

|

Handling Returns There may be materials which are pulled from inventory and not needed or wind up being damaged and returned. For customer's with their own account, you can ticket the return using the Open Ticket's transaction by entering negative quantities for the products being returned. The ticket can either immediately be linked with the contract or this can be done later from the "Tickets" tab in the Installed transaction. |

•When a payment schedule is in place, bills are generated by the Invoice Recurring utility. Your company would use this utility for billing installed sales on a regular schedule (daily, weekly, or monthly, etc.). This processing creates debit adjustments for receivables customers in the amount of the bill. Cash-only customers have an initial payment and final payment only.

•When payments are received, they may be processed from the Payments form in Point of Sale or from the Receivables area when the customer has their own receivables account. If a customer has one or more installed sale contracts associated with their account, the payment areas will ask for the contract. It is best to select the appropriate contract at this time, so that the payment is associated with the contract. Payments for cash-only customers must be processed using the Installed Sale Payment option in Point of Sale, Payments.

For customers without a receivables account, payments are treated as deposits until contract completion. There is special ledger mapping for the "order deposit charge" account that is used to specify the account used for maintaining the deposits until the contract is marked complete.

After Installation

Once a contract is paid in full, and no further changes are necessary, it can and should be marked as completed. If the possibility of later adjustment is likely or common, and you would prefer that any additional activity be linked with the contract, your company should wait until a "safe" period of time has elapsed before completing the contract. Closing a contract cannot be easily undone and new activity cannot be linked with a previously completed contract.

Completing a contract generates invoices for the tickets for the purpose of recording the sales of the materials and a final invoice reflecting labor costs, 3rd party billing, and an adjustment item. The adjustment item records any difference between the contract amount and the totals for materials. Labor and any 3rd party costs are also reflected on the adjustment invoice. It's important to point out that the invoices generated by the tickets are not intended for the customer and will not appear on statements. These invoices are considered "paid in full" by the deposit amounts applied to the contract. They are not charged to the customer's account as normally would be the case with a ticket. The invoices of tickets from installed sales are generated for updating totals and for tax purposes. These documents usually do not match the contract amount you billed the customer for materials and labor, etc. For this reason, these invoices should not be provided to customers.

If a contract is closed and there is additional work that needs to be done or mistakes that need to be corrected, it's important to understand and consider that a "contract" is a collection of other transactions which are processed usually over a time period. There is no single "contract" transaction which can easily be reversed. The individual parts of a transaction can be reversed either manually or automatically; however, this won't necessarily affect or be linked to the original contract.

Work Flow Example

The following lists the steps/stages for processing an installed sale from start to finish:

✓A customer places an order for materials that will be installed.

✓A customer order is created for the goods and a labor item is added with an estimate of the hours the job will take (labor is optional).

✓The customer order is associated with a new Installed Sale contract. At this time, the total for the installation is determined as well as the billing schedule. Any deposit on the order is automatically transferred to the contract. Labor items (if any) are removed and moved to the labor tab of the contract.

✓The contract is printed and the customer signs agreeing to the amount (your company may want to include additional contract language and/or legal information that the customer signs as well. This could possibly be printed on the other side of the contract paper or be done as a separate document outside the software).

✓As goods are removed for the installation, they are ticketed. This removes the materials from inventory and updates the contract's "actual" total for material used. Tickets don't involve payment.

✓During the installation process, the customer may optionally be billed (payment can also be processed without bill processing). Billing may be timed to be done in relation to the beginning of work and end of work, for example. The utility named Invoice Recurring is used to generate bills for any contracts due to be billed (each billing is linked to a date). Debit adjustments are used on receivables accounts. Customers with their own cash-only accounts don't generate debit adjustments. In the case of a cash-only customer, only an optional deposit and one final payment are involved.

✓If additional materials or labor are needed during the installation, these would be processed as a ticket without a customer order. The ticket can be associated with the installed sale contract immediately in Tickets or later in Installed (Sales).

✓When a customer pays their bill (or makes any payment), they are processed from Payments in Point of Sale (or either Enter Payments or Posting in Receivables). These payments are recorded as deposits on the installed sale contract. For receivables customers, the payments must be applied (posted) just as any other receivables payment.

✓Once the installation is complete, all billing has been done, the contract fully paid, and no further adjustments necessary, the contract should be marked as "complete." This invoices any associated tickets, closes the contract, and creates a final invoice representing labor, 3rd party services, and the installed adjustment item. The adjustment item is used for recording the sales difference between the actual and estimated materials. The final invoice also includes labor charges (recorded as "sales" for the labor item). In addition, any 3rd party amounts are invoiced using a special adjustment code (this code must be added in advance of completing any contracts).