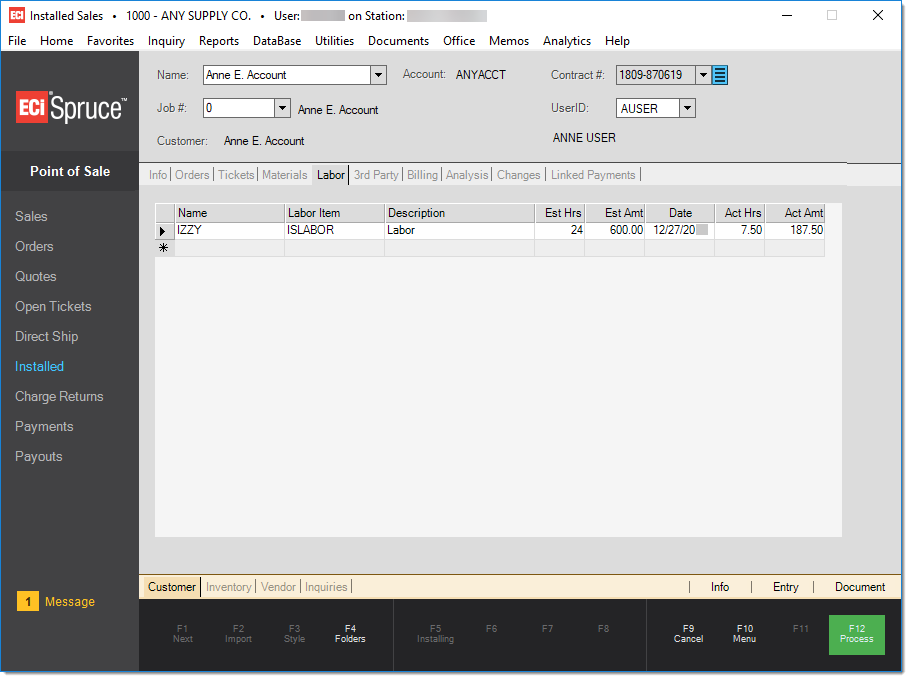

Installed Sales > Labor

The labor tab is used for recording the price of labor associated with an installed sale contract. This is specifically meant for labor employed by your company, not a 3rd party (independent contractor, etc.). If outside labor is being used, use the "3rd Party" tab so that Payables can be tied in with payments which are made to the labor provider. The 3rd party tab treats the labor provider as a vendor and is helpful for tax reporting. Labor is not required for processing an installed sale contract.

Labor can be associated with a contract in a number of ways. One way is to add a "labor" type item to a customer order that will be associated with the contract. These items are automatically converted to labor charges when the order is associated with the contract. Labor can also be specified directly in the contract; however, a labor item is still required. Another way to specify labor is to use adjustments on the orders and tickets associated with the contract. Adjustments for labor are not recorded under the "labor" tab. This is because adjustments may be used for many different purposes besides labor (freight, delivery charges, etc.). Instead, adjustments for labor (and other things) show up under the Analysis tab only.

The name field is used to designate the user (at your company) responsible for the installation (labor). Only users who have a user-type of "installer" are included in the listing. Associating labor with a particular user is entirely optional. It is possible to also associate a specific labor SKU with the installer user from User ID Maintenance. If done, the SKU (item) will automatically be selected when the user is added to the labor data grid. Individual rows for additional installer names can be entered if preferred.

Labor, Profit, and Analysis

In regard to installed sale contracts, labor is not listed as a separate line item on the contract. It is primarily used for your analysis, is optional, and not required for software processing. Labor may, in certain cases, have an effect on sales tax, but this depends upon your local tax rules and sometimes the type of installation work being done. The software does not automatically determine tax eligibility, this is your company's responsibility. Sales tax rules in some areas may require maintaining some record of labor expenses or time.

How do you determine what to charge for labor? The amount your company charges for labor is usually not a reflection of what the employees earn. For example, a garage may charge $90/hr for labor, but the mechanic who performs the work is actually being paid a lessor amount. Another concept regarding labor is that when installers are full-time employees of your company, they are likely being paid regardless of whether there is installation work available. Given this, the labor they provide is not directly tied to a particular installed sale. In addition, payroll expenses include things such as taxes and benefits not reflected in the employee's hourly pay rate or salary. These all link with the labor costs for your company, but not necessarily a particular installed sale.

Because labor is linked to an item, a "labor" item may be assigned both a price and cost and may be taxable or not. The cost can be zero or some other amount. The retail price of the labor item is what will be charged for the labor on the contract. Any cost you may assign to the labor item is not reflected anywhere on the contract but does affect the overall profit for the labor SKU, ledger, and various sales totals.

It's important to understand the concept that the customer is paying an amount representing the entire installation job. Materials and labor are lumped together and included in one price. How your company uses labor can be flexible. This decision should be based primarily on how you want labor to be reflected in the margin for the job as well as to meet specific tax requirements regarding labor if they apply to your situation.

Hours and Amounts

The "Est Hours" column will be calculated from the extended quantity of labor-type items from any customer orders linked with the contract. Otherwise, labor can be manually specified as a decimal figure (for example, 1.75 hours is equivalent to 1 hour 45 minutes). The estimated hours can be adjusted. The quantities for labor are reported as "hrs" only. Labor items could be based on other time measurements such as days or minutes, etc.; however, the installed sales area will always report the quantity as hours (hrs), so this is not suggested to avoid confusion. Estimated hours is used for calculating an estimated contract amount on the billing tab and will be used for comparing to the actual hours the installation required.

The "Est Amount" is the extended price of the labor based on the labor item selected (or imported from any customer orders). The item's price determines the labor rate.

The "Act Hrs" column is for recording the number of labor hours the installer(s) actually worked. This figure may be used for analysis purposes to determine whether or not the installation contract was profitable. Enter the actual hours as a decimal figure (for example, 1.25 hours is equivalent to 1 hour 15 minutes).

The column "Act Amt" is the extended amount of the actual labor hours multiplied times the labor (item's) rate (price).

Unexpected Labor

If an installation requires additional labor beyond what was originally estimated, enter a zero for the "Est Hours."

Date

The "Date" column is used to indicate a date when labor was provided. If you use a single "labor" line-item (row), only one date can be specified. If you know that multiple days are going to be involved or multiple people, you can use multiple "labor" items on this. Labor is not listed on the contract as a separate item, so this is purely for your analysis and record keeping.