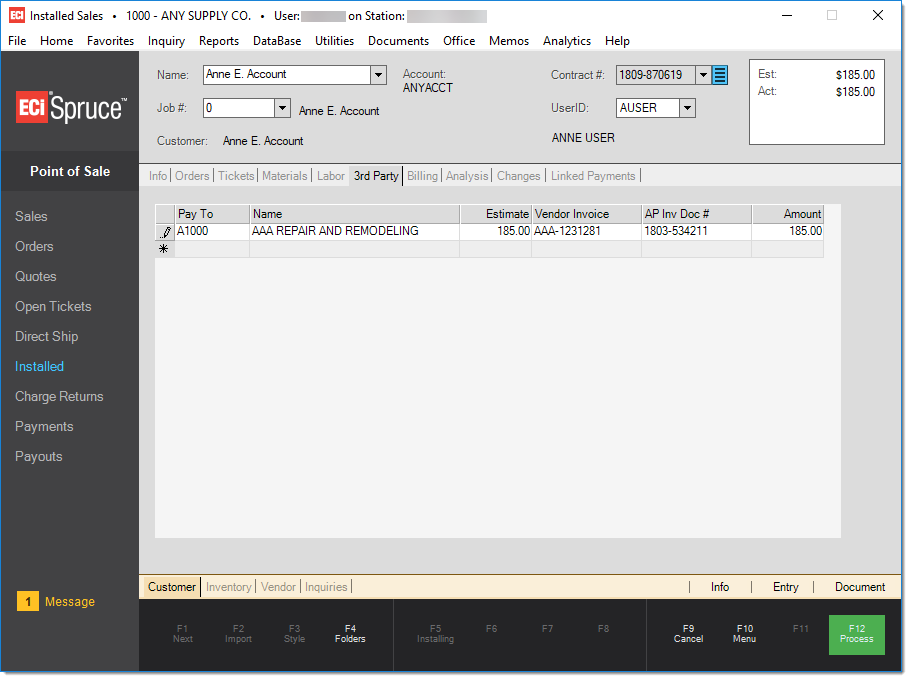

Installed Sales > 3rd Party

The 3rd Party tab is used for recording amounts paid (or expected to be paid) to an outside party who provides labor and/or materials for an installation. Third-party expenses are represented by a vendor and are paid using Payables. To include third-party amounts in the estimated contract amount, enter a dollar amount under the "estimate" column. If the labor wasn't included in the original contract amount, leave the estimated amount zero. After you receive a bill from the vendor, the vendor's invoice can be associated with the installed sale contract. Select the vendor's invoice and the Spruce document ID will automatically populate.

Important! Vendor selection is limited to those vendors assigned to the type "Installed." These vendors typically require 1099-MISC Federal Tax reporting in the United States. The MISC vendor is not allowed for installed sales for this reason (even if the type is set to "installed.")

Removing 3rd Party Labor

To remove a third-party labor charge from a contract, select the row header cell, press the Delete key, then re-save the contract by selecting Process (F12).