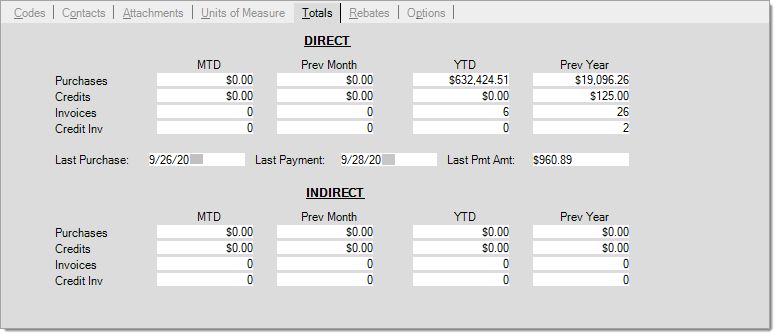

Totals

The Totals tab (Alt-T), provides an inquiry regarding the dollar amounts of direct and indirect purchases and credits as well as the quantity of invoices and credit invoices. Monthly, previous month, year-to-date, and previous year totals are included for both the direct and indirect figures. These totals are calculated dynamically from all the payables for the vendor for the period beginning with the start of the prior calendar year (January 1st). Payment status, including "hold," is not considered. Totals include ALL payables for the period. The "billed date" assigned to each payable is used for determining how payables are reflected in the totals.

|

Reporting Tip! There is also a "vendor totals" database table (dbo.VendorTotals) which maintains totals for the vendor; however, these totals are only updated after payables are paid. The vendor totals table is used for 1099 reporting. For this reason, the totals displayed in the folders (here) wouldn't usually match with the vendor totals in the table. |

What's the difference between direct and indirect?

The difference has to do with the pay-to associated with the purchase or credit. When a payable invoice's vendor and pay-to are the same vendor, the purchase or credit is direct. When the pay-to doesn't match the purchase vendor, the purchase or credit is considered indirect for the "purchase" vendor (an "indirect" vendor is the supplier of the goods, but is not the company being paid "directly").

For example, a purchase for vendor ABC is invoiced for $1,000. They belong to the XYZ co-op, and this vendor is listed as the pay-to vendor on the invoice. When the invoice is processed in Payables, vendor ABC's totals will reflect the $1,000 as an indirect purchase. Using this same example, vendor XYZ's direct purchases will reflect the same amount.

It's important to point out that neither the direct or indirect purchases figures reflect payments. Purchase figures are updated upon vendor invoicing in Payables and aren't updated by purchase orders or inventory receiving.

A vendor's payments can be viewed in the Billing Inquiry from Payables. The 1099 report option can also be used to display a vendor's payments for a selected year. 1099 reporting is based on "paid" payables only and won't usually match the figures shown here which are based on all payables activity.

Rows

For both "direct" and "indirect" vendor activity, we provide separate totals based on the type of payables activity for the vendor.

Purchases

Purchase totals include the sum dollar amount for all payables invoices with a positive (+) net total that were either direct or indirect and have a billed date matching any of the four (4) periods listed (see Columns below).

Credits

Credit totals include the sum dollar amount for all payables invoices with a negative (-) net total that were either direct or indirect and have a billed date matching any of the four (4) periods listed (see Columns below).

Invoices

These figures provide the total count or number of invoices with a positive (+) net total that were either direct or indirect and have a billed date matching any of the four (4) periods listed (see Columns below).

Credit Invoices

These figures provides the total count or number of invoices with a negative (-) net total that were either direct or indirect and have a billed date matching any of the four (4) periods listed (see Columns below).

Columns

The following definitions explain the totals columns (vertically) listed for both direct and indirect activity (purchases, credits, etc.):

MTD (Month-to-date)

Figures listed in the "MTD" column reflect the sum total of direct and indirect purchases, credits, number of invoices, and number of credit invoices for the current month and current year. This total would include any post-dated payables with a billed date meeting both the month and year criteria. It's important to consider that "MTD" usually does not represent a full month's activity.

Prev Month (Previous Month)

Figures listed in the previous month column reflect the sum totals of direct and indirect purchases, credits, number of invoices, and number of credit invoices with a billed date for the prior (last) month. Prior year is used when the current month is January since December of the prior year is the "previous" month. This total is notthe same (current) month from the prior year.

YTD (Year-to-date)

Figures listed in the previous month column reflect the sum totals of direct and indirect purchases, credits, number of invoices, and number of credit invoices with a billed date for the current calendar year. Payables post-dated into a future year would not be reflected in any of the totals shown here. Year-to-date is not the total for the past 12-months, so in January of each year, the MTD and YTD figures would be the same.

Prev Year (Previous Year)

Figures listed in the previous month column reflect the sum totals of direct and indirect purchases, credits, number of invoices, and number of credit invoices with a billed date for the previous (last) calendar year. Previous year totals typically reflect an entire year's activity whereas "YTD" often only reflects a partial year.

Dates

The following activity dates are listed for reference between the direct and indirect totals:

Last Purchase Date

This is the most recent date that a Payables invoice was processed involving this vendor (either as the materials or pay-to vendor). Payables invoices don't have to involve an "inventory purchase" to update this date. This date is not updated when creating or modifying purchase orders or by receiving inventory.

Last Payment Date

This is the most recent date that a payment was processed for this vendor. This date is updated by marking a Payables invoice as paid manually as well as any payments or partial payments processed through a check disbursement. Last payment date is only updated for the pay-to vendor.

Last Payment Amount

This is the amount of the most recent payment to this vendor. Last payment amount is only updated for the pay-to vendor.