Totals Inquiry

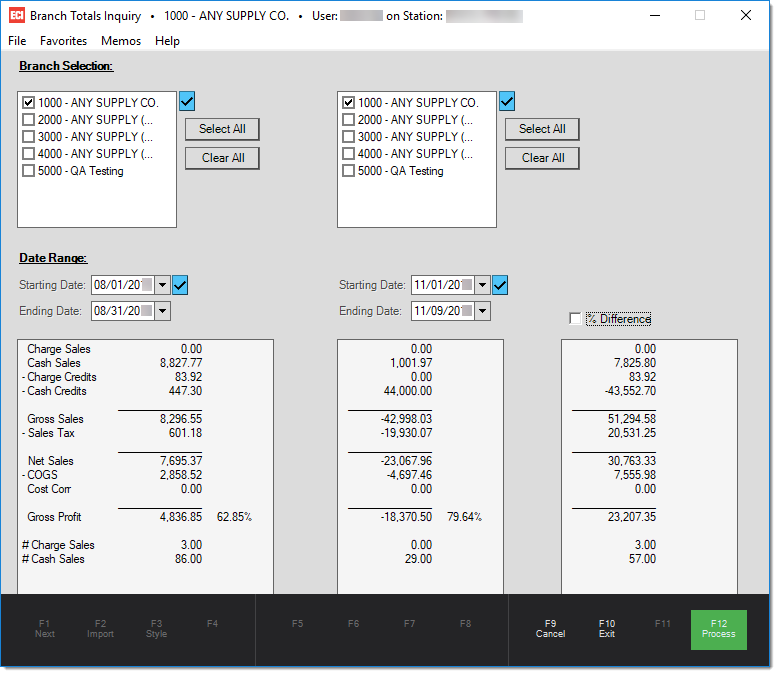

The Totals inquiry displays branch sales information based on location and date. Below the date selections are two (2) panels that display totals by date (or date range). To the right of these panels, a third section (far right) displays the dollar or percent difference between the two sets of totals. Use the context menus available from the date ![]() picker icon to select a preset date (today, last month, this year, etc.).

picker icon to select a preset date (today, last month, this year, etc.).

Use the Process (F12) function to refresh the screen after changes to selection fields have been made. The Cancel (F9) function clears any current entries, and the Exit (F10) function can be used to close the inquiry window.

How are the totals updated?

Sales totals are not updated immediately; however, they are updated on a regular frequency as determined by your Polling Interval parameter. This parameter determines the number of seconds between updates.

Sales Totals

The following definitions explain what each total represents.

Charge Sales

This figure includes the dollar total for any charge sales, not including returns*, for the period requested. Sales tax and adjustments are included in this figure. Charge sales is accumulated from both transactions that only involve "charge" and also those that involve "charge" mixed with other "cash-type" methods. For example, if a customer purchases $99 of goods and pays $50 in cash but charges the remainder to their account, the charge sales figure reflects that $49. Charge sales are not reduced by any statement (early payment) discounts. Sales tax and adjustments are included in this figure.

Cash Sales

This figure includes any sale, not including returns*, that involves a "cash-type" payment method. Besides actual cash, included as "cash-type" payments are methods such as checks, credit/debit cards, coupons, and gift cards. In addition, any COD (cash on delivery) designated sales are recorded in this figure. With COD transactions, the sales are recorded when the COD is created, not paid. Even if a payment for a COD involves a non-cash payment, the COD is still recorded under the "cash sales" category. Sales tax and adjustments are included in this figure.

Charge Credits (-)

This is the total of returns (credits) processed using a payment method of charge. These may be processed either in Sales or Charge Returns under Point of Sale. This figure includes sales tax and adjustments.

Cash Credits (-)

This is the total of returns processed using a cash-type payment method. Cash type payment methods include cash, check, credit/debit card, coupon, and gift card. Sales tax and adjustments are included in this figure.

Gross Sales

Gross Sales is the total of Cash and Charge sales less any charge and cash credits. This figure includes sales tax.

Sales Tax (-)

This figure is the net amount of sales tax charged to customers (not paid). This figure includes returns as well as sales. This sales tax figure does not include sales tax from "store-use" adjustments and may differ from the tax amount shown on the Sales Tax report (or inquiry) due to this reason.

Net Sales

Net Sales is the Gross Sales total (Cash and Charge sales less credit returns) minus the total sales tax charged.

COGS (-)

COGS is an acronym for "Cost of Goods Sold." This is the cost value (using weighted average) of the goods that were sold during the time period selected. Under normal circumstances, this figure should be lower than the Net Sales figure. If it ever appears higher, or wrong otherwise, examine the costs of the items sold during that time period (use date ranges to narrow down the problem to a particular day, if possible).

Gross Profit

Gross Profit is the dollar difference between the Net Sales figure and the COGS figure plus or minus any cost corrections. Profit is normally a positive amount.

# Charge Sales

This is the quantity of receivable charge sale and credit transactions (documents) for the selected date range. Transactions involving any charge amount, even if other payment methods are used, are recorded under charge sales only so that they are not counted twice.

# Cash Sales

This is the quantity of cash-type sale and return transactions (documents) for the selected date range. Cash-type includes payment methods of cash, check, credit/debit card, coupon, gift card, and any COD transactions. Transactions involving an account charge of any amount are never recorded as a cash sale here.

Reconciling Sales to the LedgerThere are a number or reports and inquiries available with the software that report "sales" information for a period of time. These include reports and inquiry for Totals, Sale Tax, and Sales Analysis. Financially, the Income Statement (aka. P&L) would report your company's income from sales and might be compared to "sales" totals from the previously mentioned reports and inquiries. Below, you will find a listing of some nuances about each type of report/inquiry that you should be aware of before making comparisons: TotalsBranch sales totals include inventory sales except for gift cards and stored value cards. Totals include adjustments. "Net" sales would be compared to the Income Statement or other reports since it includes cash sales, cash returns, charge sales, and charge returns less any sales tax. Sales Analysis (Inventory)This report is based on the sales totals as recorded for inventory items (these can be individually viewed by item also). The report includes items as based on your selection criteria, so if that selection criteria includes gift card or stored value card type items, these "inventory" totals would not match the branch totals. Inventory sales totals do not include adjustments which would be another difference between inventory sales and the branch totals (and possibly your Income Statement). Inventory sales do not include sales tax. Sales Tax ReportThe sales tax report and inquiry include any activity affecting your company's tax liability. If your company does inventory adjustments for "store use" that are taxable, these would appear on the Sales Tax report and inquiry as "sales," but not appear as sales on the (branch) Totals report or inquiry. Store use adjustments do not affect usage nor do they affect item sales totals, so they would not be reflected on the (inventory) Sales Analysis report. Income Statement (aka. Profit & Loss or P&L) This financial statement (report) compares your company's income to its expenses in order to determine the net income or profitability of your company. When income exceeds expenses, your company is profitable; otherwise, your company is operating at a loss. System journal mapping and detailed mapping determine how software activity affects your company's financial statements. The structure of your ledger (Chart of Accounts) determines the appearance of the financial statement (the levels of totals and detail as well as the order in which accounts and summaries are listed). If your chart of accounts is designed in a way that separates the income from inventory sales from other types of income, it's easier to make comparisons between those totals and other areas. Income accounts may be used for other types of income and affected by non-sales activity. Manual journals as well as income that originates outside of Point of Sale can make comparisons more difficult. Reason for DifferencesThe following listing provides possible explanations for differences you may find when comparing reports and inquires to your financial statement or ledger account activity. •Adjustment Code Mapping When adjustment codes are mapped to a ledger account that is not in the Income category, sales affected by the adjustment won't appear on the income statement, but are included in sales totals from other areas. •Inventory Sales Mapping It is possible to map sales for specific product groups to any ledger account, including accounts that aren't income accounts (or an income account that's not normally used for inventory sales). This type of mapping is commonly done when "items" are used for non-inventory purposes such as gift cards, labor, delivery, and deposit reasons. Separate mapping exists for cash sales, cash returns, charge sales, charge returns, exempt cash sales, exempt cash returns, exempt charge sales, and exempt charge returns. When mapping a specific product group (such as for gift card sales) differently, it's important that all the appropriate sales categories be mapped. When detailed mapping doesn't exist, the default accounts from the system journal mapping are used (which may place certain types of sales in the wrong account or category). For example, if you mapped cash and charge sales for gift cards to a liability account, but forgot to map exempt sales or returns (if allowed), you might wind up with some gift card sale/return transactions affecting income accounts and others affecting liability accounts. •Gift Cards Gift card sales are linked with a special item-type of either "gift card" or "stored value card." Sales of gift cards are typically backed out of branch sales totals so that sales are not affected twice (once when the card is sold and again when the card is used as a method of payment). If the gift card, or stored value card, is mapped to a regular inventory "sales" income account in the ledger, it will appear as income on financial statements, but not appear in most sales totals. Inventory totals are updated for gift card and stored value card items, so the (inventory) Sales Analysis report would include these sales if the gift card items aren't excluded by using selection options (such as product group/section) when running the report. •Non-Taxable Coupons Non-taxable coupons reduce the sales tax liability of a transaction, so that the expected sales tax amount may not be reflected in the Sales Tax Report. This can cause a mismatch between your Sales Tax Report and your Point of Sale totals. You may want to keep this in mind when you are running a non-taxable coupon promotion. •Other Types of Non-Sales Income It's important to understand and consider the source of income that appears on your financial statement(s). Income may originate from Payables discounts and Receivable Finance Charges (paid), for example. Another possible source of differences would be Miscellaneous Payments processed from Point of Sale, Payments. Consider whether your company uses any income accounts for returned check fees, charitable donations, or other non-sales reasons. These would not be included in either branch, sales tax, or inventory totals. Check your system and detailed mapping for any "income" accounts. This may help you find non-sales activity which needs to backed out of your comparison. In general terms, when making comparisons, it is more accurate to compare overall totals (your entire inventory sales to sales income, for example) to the current date rather than trying to tie-out specific products or groups or past time periods. It is possible for changes to data, such as inventory items, to alter how sales are reflected by reports run for prior periods (item merges, product group changes, ledger mapping modifications, etc.). |