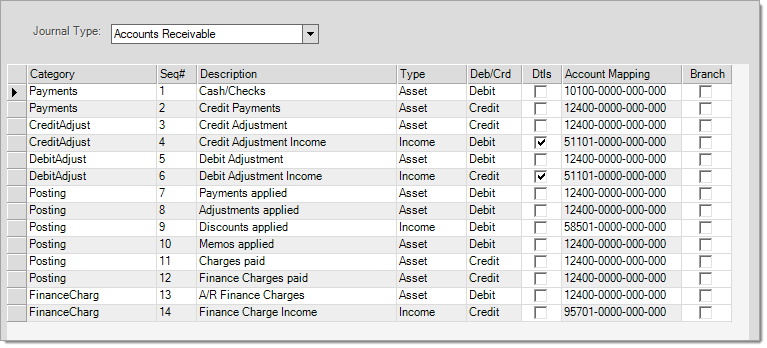

Accounts Receivable Mapping

Accounts Receivable (A/R) system journal mapping contains 5 categories of transactions: payments, credit adjustments, debit adjustments, posting, and finance charges. Each category represents an independent transaction(s) that can be processed in the application.

System Journal: Accounts Receivable

Details

The "details" (dtls) check boxes are read-only and indicate whether detailed mapping is provided. Detail mapping varies in function somewhat based on the type of entry. In some cases, detail mapping allows a user to select an account from a list. In others, the account is selected automatically based on other criteria such as a product group as one example. The presence of a check mark only indicates that detail mapping it is available (not whether it is being utilized).

Branch

The "branch" check boxes can be modified. These indicate whether you want to use branch accounts if setup. If checked and individual branch accounts do exist (as designated by the department in the account number for the designated "base" account), they will be used in place of the account designated.

|

# |

Category |

Description |

Type |

Debit/Credit* |

Details |

|---|---|---|---|---|---|

|

1 |

Asset |

Debit (+) |

|

||

|

2 |

Asset |

Credit (-) |

|

||

|

3 |

Asset |

Credit (-) |

|

||

|

4 |

Income |

Debit (-) |

|||

|

5 |

Asset |

Debit (+) |

|

||

|

6 |

Income |

Credit (+) |

|||

|

7 |

Asset |

Debit (+) |

|

||

|

8 |

Asset |

Debit (+) |

|

||

|

9 |

Income |

Debit (-) |

|

||

|

10 |

Asset |

Debit (+) |

|

||

|

11 |

Asset |

Credit (-) |

|

||

|

12 |

Asset |

Credit (+) |

|

||

|

13 |

Asset |

Debit (+) |

|

||

|

14 |

Income |

Credit (+) |

|

*Indicates the type of entry, either debit or credit. The + or - indicates whether the debit or credit represents and increase or decrease for the specific class of account (asset, liability, income, etc.).

Payments

Accounts mapped for the category "payments" are used when payments on account are processed within the software. Payments on account (aka. ROA or "Received on Account") can be entered in any of three (3) different areas: Payments (Point of Sale), Enter Payments (Receivables), and Posting (Receivables).

This account is an asset account debited (increased) when payments are received from Accounts Receivable customers. This would either correspond to the account mapping used for the bank account that the checks will be deposited in or a "cash-on-hand" type account used temporarily until a deposit is done.

This account represents the other side (credit) of the payment transaction. It will be the asset account that should be reduced when a payment is received. Typically, this account is located under the "accounts receivable" group in the asset section of your chart of accounts. It may be mapped either to a specific account just used for payments received or a general-use accounts receivable account.

Credit Adjustments

Credit adjustments increase the customer's (account's) available credit. These are commonly used to remove finance charges or make other similar corrections. Credit adjustments are usually done from the Receivables area's Credit Adjustment option, but can originate from other sources as well.

This is the asset account that should be credited (reduced) by "credit" adjustments to Accounts Receivable customer accounts. Credit adjustments decrease what the customer owes your company. A company may either (1) have a specific account for maintaining adjustments separately from other A/R activity or (2) a more general account that is shared by other types of A/R activity.

4.Credit Adjustment Income (Income)

This income account is debited (decreased) when a "credit" adjustment is applied to an Accounts Receivable customer account. Detailed mapping is available so that users can choose from a list of income offsets when applying a credit adjustment.

Debit Adjustments

This is the asset account that should be debited (increased) by "debit" adjustments to Accounts Receivable customer accounts. Debit adjustments increase what the customer owes your company. Companies may map either (1) a specific account for maintaining adjustments (separate from other A/R activity) or (2) a more general account that is shared by other types of A/R activity.

6.Debit Adjustment Income (Income)

This income account is credited (increased) when a "debit" adjustment is applied to an Accounts Receivable customer account. Detailed mapping is available so that users can choose from a list of income offsets used as offsets to the asset (debit) entry made to Accounts Receivable.

Posting

This asset account is debited (increased) when payments are applied to charges or finance charges. This account may be the same account mapped under the "payments" category for "credit payments." The credit offset for an applied payment would be either the "charges paid" or "finance charges paid" posting accounts listed below.

When credit adjustments are applied to charges or finance charges, this account is debited (increased). This account would typically be the same account mapped under "CreditAdjust" for the asset entry. The credit offset for an applied credit adjustment would be either the "charges paid" or "finance charges paid" posting accounts listed below.

If a discount is applied to charges, this income account will be debited (decreased) because your company's income is lowered when giving discounts to a customer for their purchases. The credit offset to this entry will be the account mapped under "Charges Paid" (described below).

If a credit memo (return of goods) is applied to charges or finance charges, this asset account will be debited (increased). Point of Sale system journal mapping determines the A/R asset account that is credited when a credit memo transaction is processed. This asset account would typically be the same as the account mapped here. The point of sale transaction would place a credit balance in the "memos" account (reducing the overall A/R balance), so posting would normally remove the balance from the same account (via a debit) and credit either "charges paid" or "finance charges paid" depending on how the memo was applied.

When marking charges as paid during posting using a payment, credit memo, credit adjustment, or discount, this account is reduced by a credit entry.

12.Finance Charges Paid (Asset)

When marking finance charges as paid during posting using a payment, credit memo, or credit adjustment, this account is reduced by a credit entry. Typically, this account would match the asset account that is debited (see the finance charge section below) when finance charges are assessed during billing.

Finance Charges

13.A/R Finance Charges (Asset)

This asset account balance is debited (increased) when finance charges are assessed during billing.

14.Finance Charge Income (Income)

This income account is credited (increased) when finance charges are assessed during billing. This records the income expected to be received from those finance charges paid by customers in the future.