Sales Tax - Canada

In Canada, tax is remitted to the government based on your purchases and expenses. A company generally receives credit toward their taxes when goods are resold and sales tax is charged. In Canada, there is a federal tax known as the GST (Goods & Services Tax). Depending upon the province or territory, this tax is either reported separately or combined with any provincial or territorial sales tax. When combined, the tax is typically referred to as "harmonized" or HST. In areas where the GST is reported separately, the province portion is referred to as PST. The set up for taxes in Canada is covered in more depth in this topic.

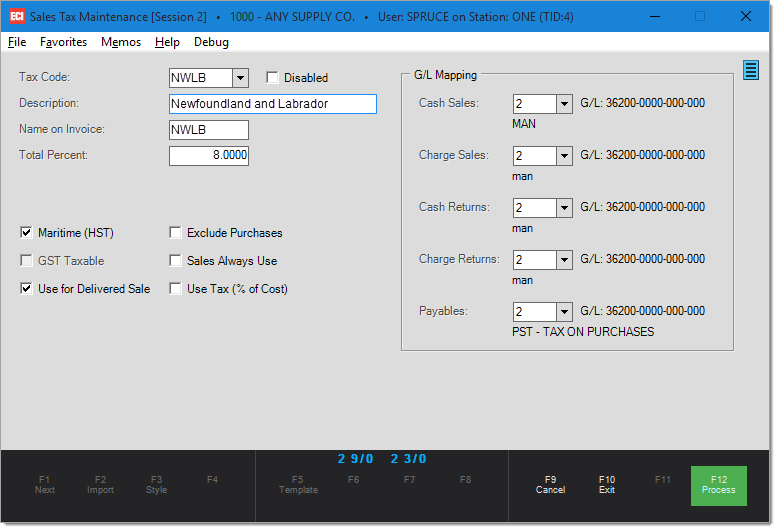

The form is a bit simpler for Canadian sales tax use. Enter the tax code, description, name or abbreviation to be used on documents, and the total percent of the tax rate (as a whole number, not the decimal equivalent of a percentage. For example, enter 5 for 5%, not .05 which would be treated as 5/100 of 1%). The total percent may or may not include the GST (goods & services tax) collected by the federal government. If your province has an HST (Harmonized Sales Tax), the percentage should include the GST rate. If not, meaning your province has separate PST from GST, the PST locations should not include the GST percentage. A separate GST tax code must also be set up (in either case) and designated in Parameters under the Point of Sale tab.

Sales Tax Maintenance (Canada)

Tax Code

The tax code is a 6-character code used for selection in transactions and utility forms requiring or allowing assignment of a tax location. Each tax location would have its own unique code.

Description

This text-area provides a more detailed description for the tax location up to 30-characters.

Name on Invoice

This field allows you to enter a longer or shorter name for printing on documents that display a tax location. The maximum size of the "name" is 12-characters.

Total Percent

This is the percentage to be charged. This may or may not include the GST rate.

Maritime or Harmonized Sales Tax (HST)

The check box labeled Maritime (HST), or Harmonized Sales Tax, is used to designate the tax location as being a combination of the standard GST (aka. Goods & Services tax) that is collected federal level as well as the provincial tax portion. The two (2) parts of the HST are combined together on documents and remitted together. Enter the TOTAL percentage of the rate and check this field so that the current GST rate is not added at time of sale.* This tax applies to certain provinces, particularly the maritime provinces (Nova Scotia, New Brunswick, and Newfoundland and Labrador). For example, an HST tax rate of 13% would include the 5% federal GST tax as well as the 8% province tax.

On other (non-HST) transactions, the GST and province tax codes are normally both printed as separate amounts. When a tax location is designated as a Maritime (HST) location, only one tax rate will be displayed or printed.

*Users must have previously created a tax location for GST use with the current federal tax rate and also have specified the GST tax code from the Parameters database (Point of Sale tab) located under the Maintenance area.

GST (Goods & Services) Taxable

The "GST Taxable" check box indicates whether the current tax location is calculated on an amount that includes the GST tax amount. This means that the GST is calculated and any other tax (represented by this code) is then calculated including that amount. At one point, Quebec did this (charge QST tax on the GST amount as well); however, they no longer do.

$100.00 + 5% GST = $105.00 + 8% (TAX) = $113.40 (Tax on Tax)

This check box is generally not selected (checked) for any situation including GST, PST, and HST.

Use for Delivered Sale

In some areas, the seller's tax location is used even in the case of delivered sales. In others, the tax location where the goods are exchanged (delivered) is used instead. If this tax location should override the seller's (store's) default tax location in cases when goods are being delivered, check the box. If the store's location should be used for any deliveries to this tax location, do not check the box. In cases when no delivery is designated, the store's (seller) location is used.

Exclude Purchases

In some cases, a particular province or territory may not charge PST for purchases, just GST, but must collect PST for Point of Sale (along with the GST portion). If this applies to the tax area, check the "Exclude Purchases" so that only the GST amount is set for purchases.

Sales Always Use

This setting can be used if you want the sales tax location to always be used when assigned to a customer or job as the default tax location. This would be used in cases, where regardless of the delivery status of the transaction, the customer's tax rate is used. This might be the case for economic development zones or special population zones, for example.

Use Tax (% of Cost)

This setting is used primarily for installed sales. If assigned to an Installed Sale contract this type of tax code indicates that the sales tax is to be calculated based upon the cost of the materials. Orders and Tickets can sometimes be assigned a "use" tax code, but only when the user processing the transaction has permission to access the installed sale area. When a "use" tax code is assigned to an installed sale contract, it is automatically assumed that any sales tax is already being included in the contract total (not added).*

*The "Tax Included" check box on the Installed Sale contract's Billing tab will be automatically checked and disabled (not allowing changes).