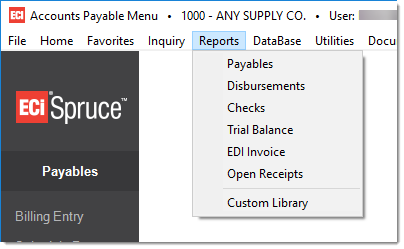

Payables Reports

The following reports are current available for Payables: Payables, Disbursements, Checks, (Vendor) Trial Balance, and EDI Invoice Analysis.

Note: Additional reports may display based on Region parameter settings.

Payables (Journal)

The Payables Journal reports on invoices that have been entered in Payables and can be run using a number of conditions (filters).

Disbursements

The Disbursements report lists invoices that have been selected for payment.

Checks

The Check Journal lists both checks and reference information (invoices and credits applied to the payment).

GST/PST Report (Canada Only)

The GST/PST Tax report shows the vendor purchases and tax totals by branch and date range.

Trial Balance

The Vendor Trial Balance uses aging periods specified by the user to create a projection of payments due in the future.

EDI Invoice Analysis

This report is used for reviewing Payables invoices generated as a result of EDI processing.

Open Receipts

This report can be useful for comparison to the accrual ledger balance based on the list of open receipts (receipts not yet invoiced).

Comparing Payables to the Ledger

Because the application uses an accrual account for inventory purchases, the ledger entry to increase your company's inventory assets does not rely on invoice processing in Payables. Instead, purchases create an "accrual" liability account entry on the date receiving is processed. Purchases don't affect the Accounts Payable (A/P) liability until the invoice is either transferred or paid. Other types of payables (non-purchases) usually represent expenses such as bill payments, for example. These don't use an accrual account and can also be optionally transferred (recorded as a payable liability) when invoiced or later when paid.

It is a common business practice for companies to compare their ledger liability account for payables to the actual listing of open invoices. Due to some procedural flexibility in the application, this can be either a simple or complicated process. Here are some points to consider:

-

Invoices only create an Accounts Payable liability entry in the ledger automatically when they are marked paid.

-

Invoices can be marked for transfer prior to payment optionally either during or after entry in the Payables area.

-

The accrual account will include purchases that have not yet been invoiced in Payables.

-

Invoices that are not transferred prior to payment, will both debit and credit the Account Payables liability account for the same amount (a wash entry).

If comparing the ledger balance for Payables to actual open (unpaid) invoices is important to you, consider the following procedures:

-

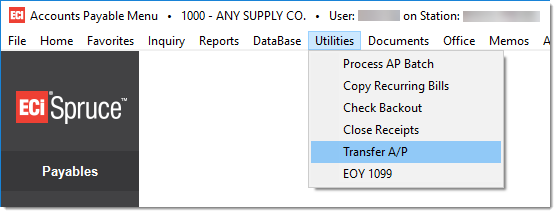

Always select the "GL Transfer Eligible" check box to transfer the invoice to the ledger that day or use the Payable's Utility named "Transfer A/P" to transfer all payables to the ledger. The Payables journal can be used to list invoices that have not been transferred to the ledger.

Payables Utilities Menu

-

Do not enter invoices for the future ledger cycles unless you also plan on running the Payables Journal for a future date that will include ALL invoices and financial statements that include all active future cycles. Use the Payables Journal to get a listing of open invoices that have been transferred,

-

Ledger account balances are only affected once entries are posted. This process must be done before a financial statement will reflect changes in balances (including the A/P account). If Payables are entered for future cycles, the subsequent ledger entries must be posted as well. Run a Trial Balance report in the General Ledger area for the Accounts Payable account to get the balance (make sure you run it so that it includes any future cycles A/P has been posted for).

-

When starting to use General Ledger, don't enter any balance for payables. Just enter the open invoices as of the "live date" and either select them as "transfer eligible" or use the Utility program to transfer them all at once.

If a balance is loaded for A/P and there are no matching invoices --or-- the invoices are entered as new but already are a part of the ledger balance and then transferred again (affecting the ledger balance twice), the Accounts Payable liability account will be wrong and will need to be corrected with a journal entry. If the Accounts Payable ledger account starts off with the wrong balance, the problem won't correct itself.