Inventory > Utilities > Item Returns

This utility, located in the Inventory area, is provided for managing stocked or non-stocked returns processed using the enhanced returns feature. This feature may be optionally enabled for use with stocked and/or non-stocked type items (two separate Point of Sale parameters enable/disable these features). Updates to returns are only allowed for those that were not designated for immediate restocking during Point of Sale entry (and if the "enhanced" return parameters are enabled).

IMPORTANT: For invoices with terms, the discount on those invoices can be reduced if returns are processed referencing the invoice later. Check the document links for the terms invoice to see if any returns are linked to the sale if you notice or are questioned as to why a discount was reduced.

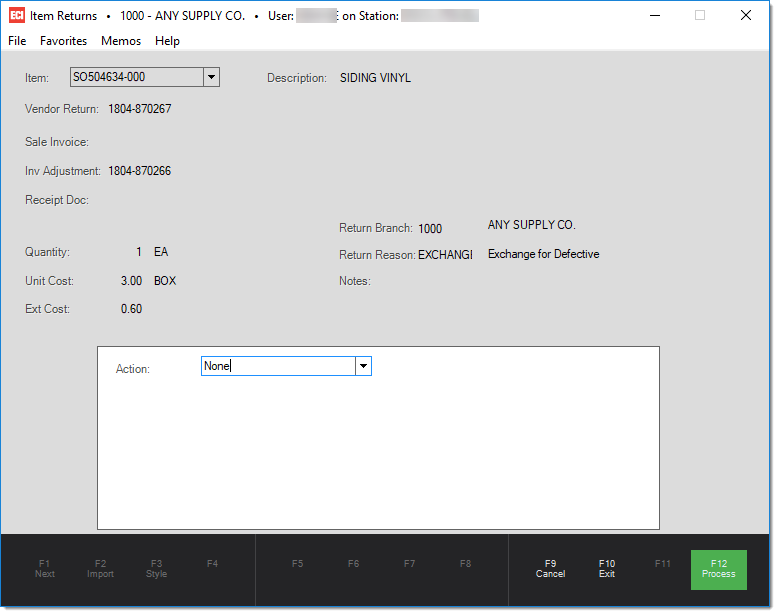

Begin by selecting a vendor return from the "item" drop down. After doing so, the form will populate with information regarding the return. This includes a listing of related documents, the item description, quantity, cost, branch, return reason, and extended cost.

For easy reference, you can double-click on any of the document labels to open them using the Document Viewer. Here is a brief description of the documents listed...

Vendor Return

The document created after the item was returned. Each return that is not immediately returned to stock during Point of Sale processing will have a document associated with it.

Sale Invoice

The original sale invoice that was indicated for the return when it was processed in Point of Sale. This invoice is selected by the user, not automatically.

Return Invoice

The invoice (or charge return) document created when the item was returned through Point of Sale.

Receipt Document

This only populates for returns of non-stocked products (using an auto-generated SKU). In these cases, it is often possible to locate the most recent inventory receipt associated with the item. If this field is blank, it does not indicate a problem.

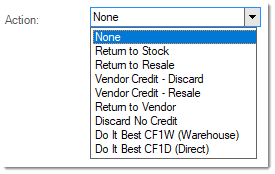

At this point, you choose an action.

Choose the action that describes how the return is being handled. Processing an action can have different results based upon the type of item (stocked vs. non-stocked). Cancel or choose "none" to not make any changes at this time. Descriptions for each of the other actions are listed below:

Return to Stock

This action is essentially the same as using the "restock" check box that is available during initial return processing at Point of Sale. This adjusts the on-hand for the item (making it available for resale) and closes the vendor return.

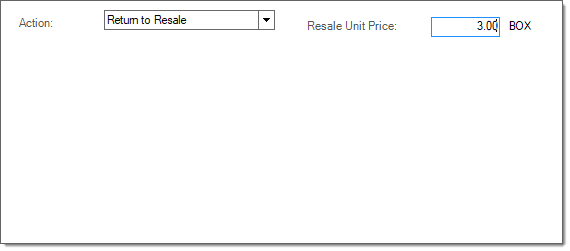

Return to Resale

This action varies somewhat based upon the stocked status of the item. In the case of a "stocked" item, this allows you to create a separate tracking SKU for the returned product that separates it from your regular inventory. This would be useful if you wanted to sell the product at a discounted price due to damage, missing packaging, etc. Non-stocked items that are returned should already be assigned to the item type "resale;" however, if the item is not, processing as a "return to resale" will force the type back to "resale."

If a new item is generated (in the case of stocked items only), the new item is assigned a SKU prefixed with the letters "RS" (resale) followed by the document sequence number of the original vendor return document.

In both cases, you are able to specify a price for the "resale" item. A receipt entry will be generated and the item's on-hand incremented by the quantity returned. After processing, the vendor return's action taken is updated and is closed so that no further updating is allowed.

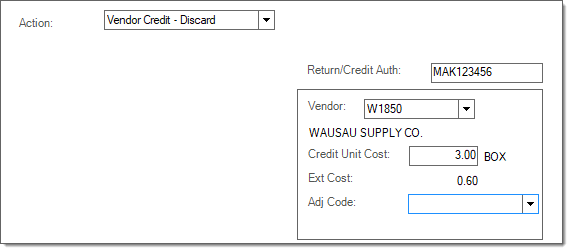

Vendor Credit - Discard

This action is used when you have received a credit from the vendor (or are eligible to do so) and you are discarding the item as opposed to returning it to the vendor or manufacturer or reselling it. A credit inventory receipt document is created using the selected vendor and credit cost specified. After processing, the vendor return's action taken is updated and is closed so that no further updating is allowed.

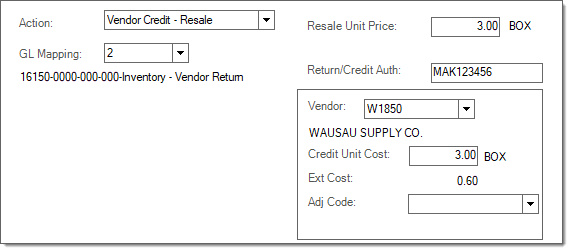

Vendor Credit - Resale

Use this action when the vendor is issuing you a credit and you are planning on trying to resell the product. In this case, a credit inventory receipt document is created using the selected vendor and credit cost specified, and the same actions as the "return to resale" option are applied (see above). The actions regarding resale vary based upon whether the item is stocked or non-stocked. After processing, the vendor return's action taken is updated and is closed so that no further updating is allowed.

If a new item is generated (in the case of stocked items only), the new item is assigned a SKU prefixed with the letters "RS" (resale) followed by the document sequence number of the original vendor return document.

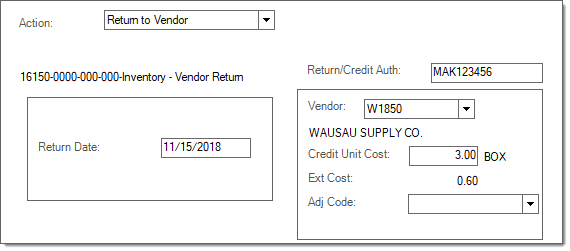

Return to Vendor

This action is used when you are receiving credit from the vendor and also returning the product. A credit inventory receipt document is created for the selected vendor and cost.

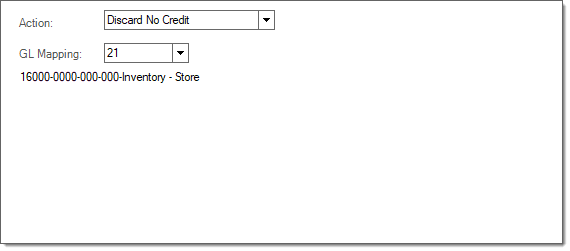

Discard No Credit

The "discard no credit" action is used in cases where no credit inventory receipt document is involved and the item is being discarded rather than being returned to inventory or shipped back to a manufacturer/vendor. In this case, the vendor return's action is updated and the return is marked as closed. No quantity on-hand adjustments are made since the original return did not increase on-hand.

|

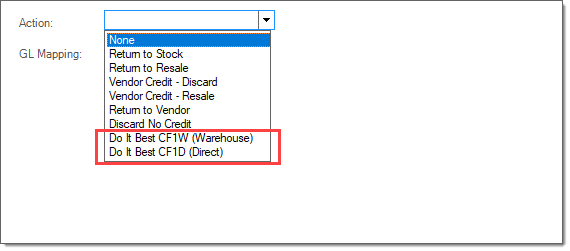

There are two (2) additional "actions" when your company is a Do it Best member: Do it Best CF1D (Direct) and Do it Best CF1W (Warehouse). These are not displayed to companies who don't have Do it Best Corp selected as an EDI option. For the purposes of the Spruce software, these are treated the same as a "Vendor Credit Discard." If selected, the "credit unit cost" is set based on the current catalog cost and the Return/Credit Auth text-area is populated with the vendor catalog's return code for the item. Note: Using this feature submits the claim to Do it Best via EDI (Electronic Data Interchange) automatically with the next purchase order your company submits. No further steps are necessary.

Do it Best CF1D (Direct)This action is used when the returned product originated directly from a supplier/manufacturer that was billed through Do it Best Corporation. Do it Best CF1W (Warehouse)This action is used when the returned product was purchased from a Do it Best warehouse. |