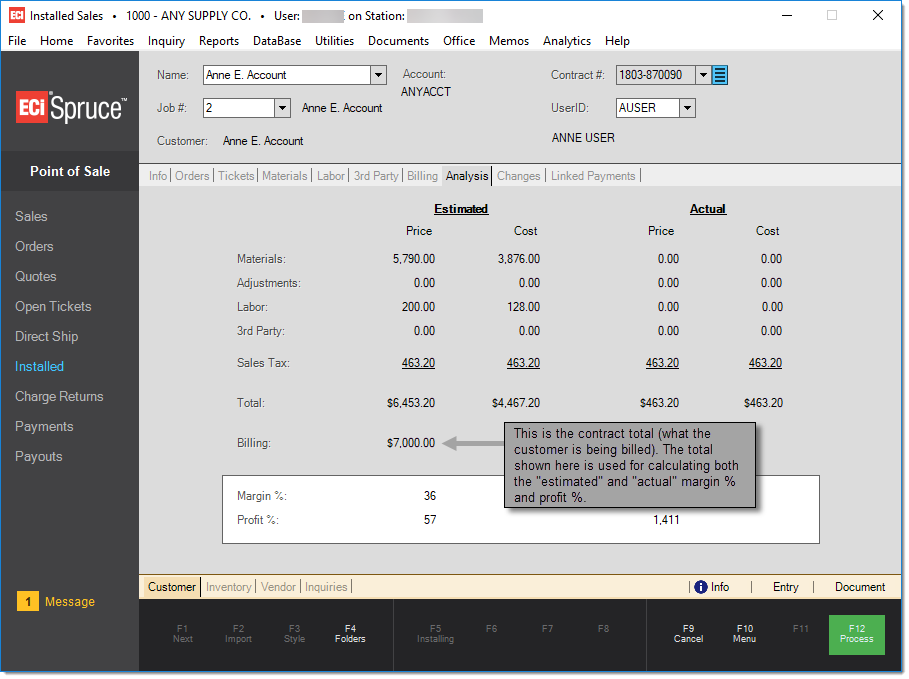

Installed Sales > Analysis

The Analysis tab is provided for comparing the estimated contract amounts with the actual amounts (when applicable). This includes material costs, labor, adjustments, sales tax, use tax, and 3rd party. Totals based upon price and cost are provided. The total billed is used along with the total cost to determine the margin % and profit % displayed for both actual and estimated figures. Until a contract's cost has been finalized, the profit and margin change and only reflect the current estimated or billed costs. For example, if only 1/2 of a contract's materials have been ticketed, the profit and margin listed for "actual" wouldn't include the cost of materials that haven't been ticketed yet, so the margin and profit would be higher at that time.

Change invoices are not reflected in any of the totals.

The customer receives no detailed breakdown of materials, labor, or 3rd party expenditures; this information is for your company's use so that you may analyze profitability. Analysis information is also available using the "Store Copy" format in the Document Viewer when viewing an Installed Sale Contract document.

Did we make money?

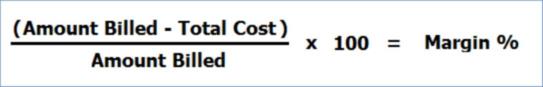

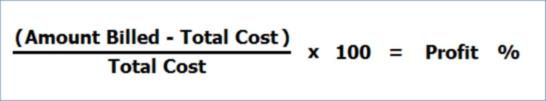

In the case of an installed sales, the margin is the percent difference between the billed amount and the cost totals (either estimated or actual). Profit is the percentage increase from the total cost that the contract total (Billing Amount) represents. Total cost from material, adjustments, and labor costs are used for margin and profit calculation, not pricing. Price totals are listed for reference and comparison to the amount billed.

Labor is also an inventory item. A "labor" item may have both a cost and retail which may, or may not, truly represent the cost of labor (labor charged is not necessarily the same as what your company pays for labor). Your company may or may not decide to assign labor items a cost. Labor, materials, 3rd party, and adjustments are split out for your company's analysis only, not for the customer.

The materials, adjustments, labor, and 3rd party figures are the only totals that may show different figures between estimated and actual. Sales tax figures are the same for both estimated and actual.

Another potential question is: did your company make more money from a fixed price installation contract than would have been made if all materials and labor were invoiced separately? This is why the "price" totals are shown. Compare the estimated and actual price totals to the total billed.

Estimated Totals

The source of each estimated total is explained below:

•Materials

This is the total price and cost value of non-labor items from customer orders that have been associated with this contract.

•Adjustments

This is the total dollar value of all adjustments from customer orders that have been associated with this contract. Adjustments cannot be added directly to an installed sale contract. Some adjustments may have an associated cost; however, this is optional. If the adjustment has a cost percentage assigned, the calculated cost amount will be shown.

•Labor

This is the total estimated price and cost of labor items that have been associated with this contract. The estimated amount defaults to the extended labor price and cost from customer orders that were associated with this contract. Estimated labor from customer orders may be modified. In addition, new labor items may be added that were not initially associated with an order.

•3rd Party

This is the total estimated dollar value for 3rd party charges specified for the contract as specified for the Installed Sale contract. An estimated figure might be provided by the 3rd party vendor prior to any work agreement, or based upon your company's own estimate. In either case, it must be manually entered if an estimated amount is desired.

•Sales Tax

This is the sales tax figure calculated from the taxable total on the billing tab. The dollar amount of sales tax is based upon this estimated taxable amount and is the amount of sales tax that will be charged to the customer if the sales tax is not included in the contract price.

Taxable amount is initially set to match the total extended taxable retail for materials and labor items (if associated with an order) from all orders associated with a new contract. No automatic changes to the taxable amount are made beyond this point. If changes are required, they must be manually made to the taxable amount. Orders assigned to "use tax" locations are excluded from the taxable amount because the company is responsible for the tax in that case (and the tax is based on cost of materials, not retail).

•Total

This is the total of the estimated price and cost figures listed above including any sales tax (materials + adjustments + labor + 3rd party + sales tax).

•Billing

This is the total dollar amount that the customer has agreed to pay and is the total that they will be billed (includes all billing amounts regardless of payment status or billing date). The same figure is used for calculating both the "estimated" and "actual" margin and profit percentages.

This is the percent difference between the estimated cost total and billing total. The estimated pricing of materials, adjustments, and labor is not considered since that is not necessarily the same as what the customer agreed to pay (contract total).

This is the percentage increase from the total cost that the billed amount represents. This is based solely on the total estimated costs (not pricing) and the amount being billed to the customer (the contract amount).

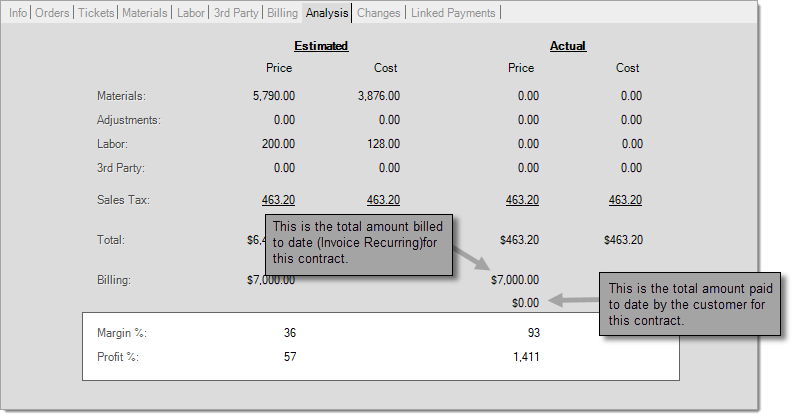

Actual Totals

The source of each actual total is explained below:

•Materials

This is the total price and cost value of non-labor items from tickets that have been associated with this contract.

•Adjustments

This is the total dollar price and cost of adjustments (codes) from tickets that have been associated with this contract. Adjustments cannot be added directly to an installed sale contract but may have been associated with either a customer order or ticket. Some adjustments may have an associated cost; however, this is optional. If the adjustment has a cost percentage assigned, the calculated cost amount will be shown.

•Labor

This is the total "actual" price and cost value of labor items that have been associated with this contract. It is up to your company to decide how to treat labor regarding the price and cost value assigned to the SKU. The "cost" of labor is what's used for calculating profit and margin, not the price of the labor. Remember, the customer is not receiving a detailed break-down of labor vs. materials, etc. Labor price and cost are solely for your company's use in this case.

•3rd Party

This is the total amount from all Payables invoices related to third party charges linked with this contract. This figure matches the vendor's invoice amount as entered in the Spruce Payables area.

•Sales Tax

This is the sales tax figure calculated from the taxable total on the billing tab. The dollar amount of sales tax is based upon the taxable amount assigned to the contract and is the amount of sales tax that will be charged to the customer if the sales tax is not included in the contract price.

Taxable amount is initially set to match the total extended taxable retail for materials and labor items (if associated with an order) from all orders associated with a new contract. No automatic changes to the taxable amount are made beyond this point. If changes are required, they must be manually made to the taxable amount. Orders assigned to "use tax" locations are excluded from the taxable amount because the company is responsible for the tax in that case (and the tax is based on cost of materials, not retail).

•Total

This is the total price and cost of the "actual" totals for materials, adjustments, labor, and 3rd party as well as sales tax listed above (materials + adjustments + labor + 3rd party + sales tax). The price totals are provided for comparing to your total billed amount (contract total). This can be used as an indicator as to whether your company made more or less money by doing the installation for a fixed contract total vs. individual sales of the products and labor. Cost totals are used for margin and profit calculations along with the total contract amount.

•Billing & Payments to Date

These two (2) totals are the total dollar amounts that the customer has been billed so far and the total amount they have paid (below).

•Margin %

This is the percent difference between the "actual" cost total and billing total (the Billing Total is listed under the "Estimated Price" column.

•Profit %

This is the percentage increase from the total cost that the billed amount represents. This is based solely on the total estimated costs (not pricing) and the amount being billed to the customer (the contract amount).