HMRC - Making Tax Digital

Making Tax Digital (MTD) is a key part of the UK government’s plans to make it easier for individuals and businesses to get their taxes right and keep on top of their affairs. To comply with HMRC’s Digital Tax policy, Spruce enables you to populate your VAT Return form with pertinent data you have already entered for tax submission.

From the VAT Return form you can create new returns, view saved returns, and edit tax forms that you have NOT submitted yet. After a VAT Return form has been submitted to HMRC, you cannot edit it again.

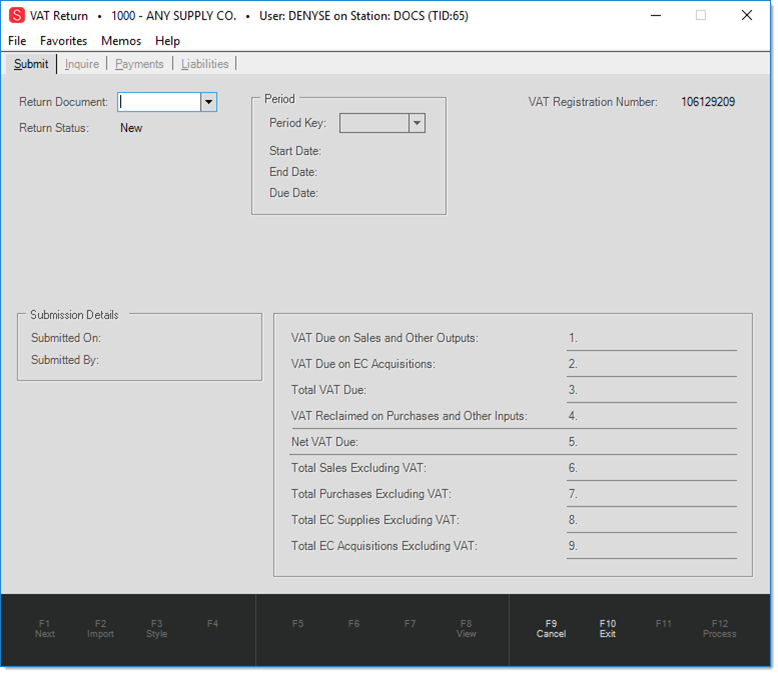

Submit Tab

You can use the Submit tab to create a new VAT Tax Return. The Start Date, End Date, and Due Date fields will be populated automatically as these are pre-determined by HMRC. The query that collects this information from your records runs for the specific date range to generate the values for each VAT tax.

Inquire/Payments/Liabilities Tabs

The Inquire, Payments and Liabilities tabs are interfaces into HMRC’s system that you can use to view your account’s data.

-

The Inquire tab shows your VAT obligations. A VAT obligation is a VAT return that is due or that has been submitted and is pending.

-

The Payments tab lists past payments that your business has made for VAT Due in past periods.

-

The Liabilities tab shows payments still due for VAT Returns that have been submitted but have not yet been paid.

Please note that none of the data on these tabs is stored in Spruce, it is provided for viewing purposes by HMRC.

Setting up the VAT Return Submission in the Software

These are the steps you need to take to submit your VAT Return using Spruce.

Consult your Implementation team to discuss the first step setting:

1. Set the accounting method (either standard or cash based on the needs of your business).

-

Standard is much more straightforward and simpler to understand and manage.

-

Cash has the benefit of matching cash-flow with tax payments, but ultimately, results in the same tax being paid over a longer period.

Note: These options are discussed in more depth in the section, VAT Return: Where do these figures come from?

2. Obtain your token from the HMRC MTD web services. See Getting/Renewing your VAT Authorisation Token for instruction.

3. After the reporting period has ended, you can prepare your VAT Return using the VAT Return form.

4. Submit your VAT Return by following the instructions in Submitting your VAT Return.

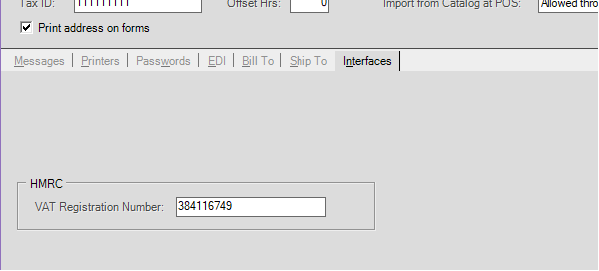

Setting up Multi-Branch (Location) Companies

When you have more than one branch location, and depending upon the nature of your business, you may have one VAT Registration code you share across multiple store locations, or you may have different registration IDs. Once enabled for use, all Branch {store location} records (Main Menu > Maintenance > Database > Branches – Interfaces {tab}) that have VAT transactions will need to be setup with the VAT registration ID they belong with.

When more than one branch has the same ID, those locations will be grouped together for MTD reporting purposes. The VAT Registration ID should only be the numeric value of the registration ID (numbers only).

Additionally, if recording VAT taxes paid to other tax entities separately (such as European Commerce) is necessary, you must define and use different tax locations to distinguish between those transactions and typical tax situations. The “EC Commerce” flag (on tax locations) can be used to indicate taxes and totals in boxes 2, 8 and 9. To make use of this, you would need to define additional tax locations for use with transactions. Tax locations can be assigned to import vendors meeting the requirements, for example. Once you have set up authorisation, you can view past return data (inquire), liabilities, and payments.

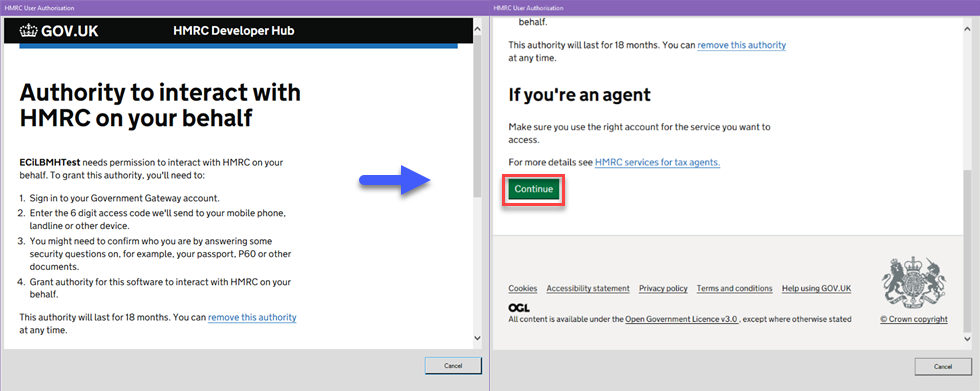

Getting/Renewing your VAT Authorisation Token

The first time you communicate with HMRC using the MTD (Making Tax Digital) service, you will have to log in and grant authority for the software to communicate on your company’s behalf. This authorization is stored as a token that remains in the application. When the token expires, as it will periodically, repeat this process to renew the token. The software will prompt you automatically when this is necessary; however, you should not expect this to happen every time you submit your VAT Return. If this re-authentication message appears too frequently, it could indicate some type of issue exists and you should contact Support for assistance.

To authorize the application, use the credentials you already have in place with the HMRC.

Note: You can access tax services through the agents services account and HMRC online services for agents. If your VAT return is being handled by a tax preparer and not a member of your staff, use the Trusted Helper service to get them registered so they can act on your behalf. When staff members or contractors manage your business tax affairs, they should use the business tax account for the business (not an agent services account). You may need to register for both depending on the tax service you want to use. If you act as a tax agent or advisor for another business, complete an anti-money laundering registration before you follow the steps below and become a tax agent with HMRC.

IMPORTANT: Before you get started, check to see if you have completed the required entries in the Branch Setup form (Maintenance > Database > Branches – Interfaces {TAB}) to add including any VAT Registration number(s) associated with your business.

Make sure you have access to any company-registered device needed for two-party authentication, such as a cell phone or an authenticator app.

To obtain the token for Spruce from the HMRC MTD web service:

1. Go to the Gov.UK website. When the dialog first opens, an informational page displays to explain what you need to do.

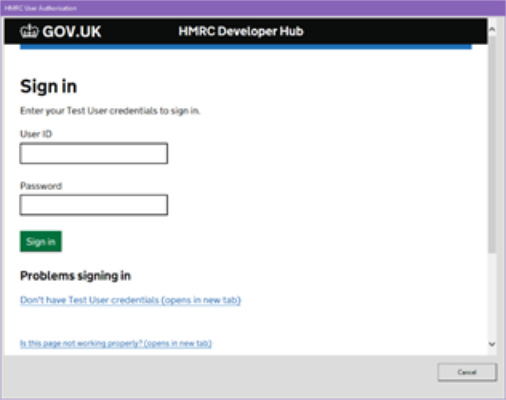

2. Scroll to the bottom of the page and click Continue. The Sign In page displays.

3. Enter your company's user ID and password in the fields provided and click Sign In.

Note: Typically, two-party authentication is required using either an authenticator app or a phone code. You may need access to a registered device (a cell phone, etc.) to approve the login.

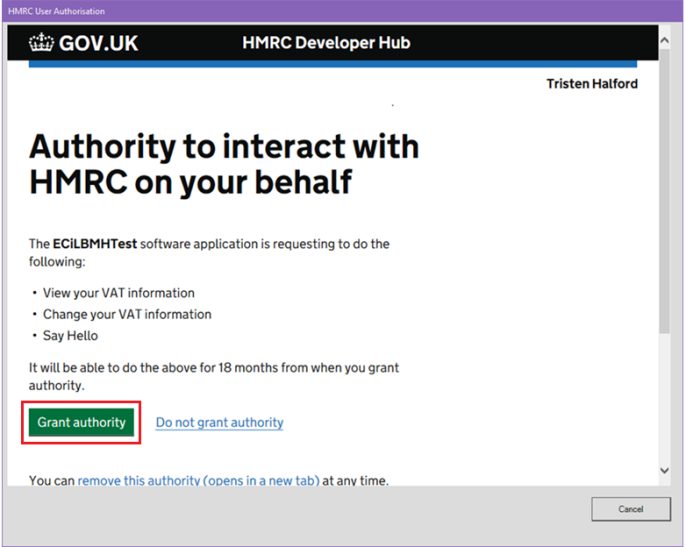

When you have completed the two-party authentication, the Authority to interact page displays.

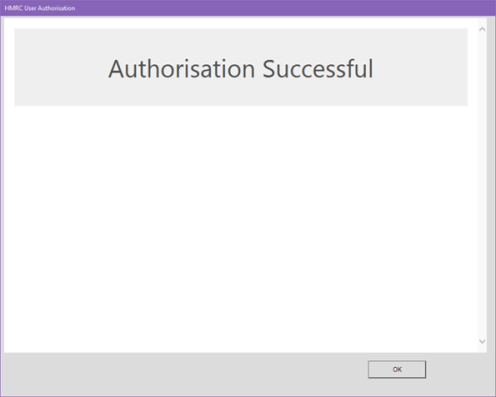

4. Click Grant Authority to authorise the software to submit VAT Returns. You should see a confirmation message, "Authorisation Successful".

5. Click OK to close the dialog and save the authorisation token locally for future use.

After successful authentication, the system grants your ECI software authority to submit VAT Returns.

IMPORTANT: Just to be clear, this is just an authorisation to communicate. This process does not submit your VAT Return.

Submitting your VAT Return

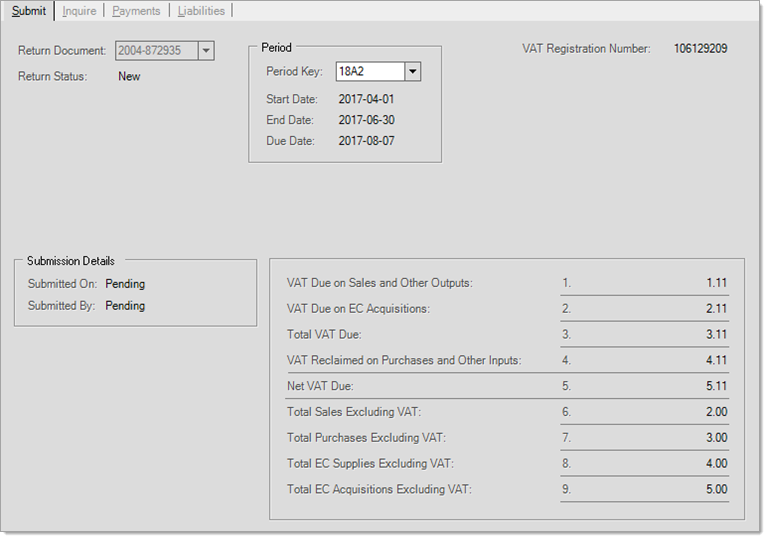

Before you submit your VAT Return using Spruce for the first time, make sure you have completed the steps in Getting/Renewing your VAT Authorisation Token. After authorisation has completed, the application populates the period key with any periods available to your company for VAT Return reporting. You’ll need to save the data before you can run reports to see the details behind any figures (a detailed “VAT Return Details” report is available in ActiveReports format.

To submit your VAT Return using Spruce:

1. Wait for the VAT reporting period to end (you can’t view all of the information or submit this information prior to that date).

2. During the grace period, enter all Payables, Adjustments, and other activity that you need to report for the period. When using the standard method, the billed date determines the VAT period for Payables. Hold payables are not included, so you may need to adjust those if you need to report VAT on them.

3. From the Main Menu, choose Point of Sale > Utilities > VAT Return – user security options would need to be enabled to allow access. The VAT Return form displays.

4. Open the drop down for VAT Return document and do one of the following:

-

If you are submitting your VAT Return for the first time, choose <<New>> in the Return Document list and continue to the next step.

-

If you have started a return you want to submit, choose the document you want to submit from the list, review the VAT return period key, and select View (F8) to populate the return figures with the most current data. Then, continue to the next step.

Note: Returns from prior finalised periods would also be visible in the Return Document list. You can view these documents for enquiry but you cannot modify them. If you choose to view a finalised document, the rest of these instructions do not apply.

5. Make any changes or adjustments you need to prepare your return for submission.

6. Click Refresh (F8) to save your changes. New values appear in the box figures.

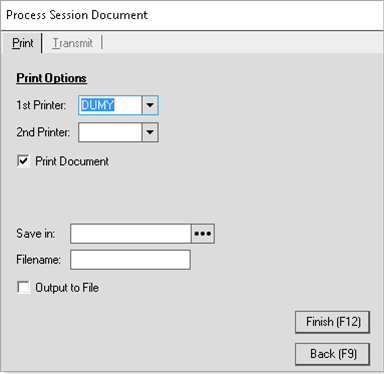

7. Click Process (F12). The Process Session Document form displays to allow you to select print and file saving options.

8. Choose your print or transmit options and click Finish (F12). A dialog displays to ask you if you are ready to submit your return.

9. Do one of the following:

-

To submit your VAT return, click Yes .

By clicking Yes, you submit your return using HMRC’s MTD (Making Tax Digital) web services. There is no “undo” for this action, so you should be very sure that the numbers in the form match what you intend to submit.

IMPORTANT: If you accidentally submit a VAT return and need to make changes, either adjust for the issue on your next return {next period} or contact HMRC for assistance. -

To save your entries but not submit your VAT return, click No.

This saves your data so you can keep working. This allows you to run detailed reports on the data you have saved. -

To close the VAT return without saving your entries, choose Cancel (F9). This closes the VAT Return form.

Note: We recommend that you save the data any time you make changes that affect the reporting period to ensure your reports are accurate. If you are just checking the totals visually, and not running reports, you don’t need to save.

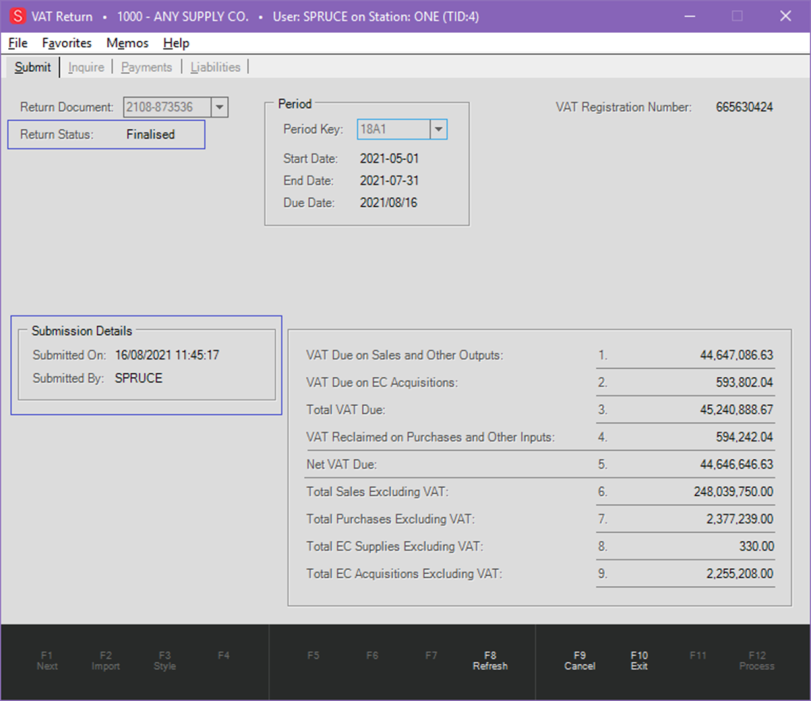

How do I know if my return has been accepted?

After you submit a return, a brief informational message displays at the bottom of the form (over the function key strip) confirming that the return has been submitted.

Additionally, when you reselect the return in the VAT Return form, it will display a Finalised status and show you other submission information, including who submitted the return and when. The “Due Date” reflects the finalised date after the VAT Return is submitted and accepted by HMRC. Prior to that, “Due Date” is pulled from HMRC and not stored locally.

VAT Return: Where do the Box figures come from?

Boxes 1 through 5 represent tax totals, which are shown as decimal values. These are affected by Sales, Returns, Payables, Store-use Inventory Quantity Adjustments, and VAT Adjustments. Boxes 6 through 9 represent basis amounts for transactions/activity involving tax and are shown as integer (whole number) values.

Accounting Methods

Figures are populated differently based on your company’s selected accounting method. The options provided are either (1) cash or (2) standard.

This method can be set by ECI Implementation personnel and should match the method you have chosen to use with HMRC.

-

“Standard” method does not consider whether payments were made {processed} for receivables or payables. This is the simpler method as it only considers the VAT recorded during the period.

-

“Cash” method considers the timing of payments when determining the tax due. For outputs (VAT on Sales/Returns), only “open item” accounts maintain data sufficient for output taxes, so VAT would still be considered immediately due regardless of payment for any balance forward receivables. Additionally, returns (credit sales) and store-use adjustments are considered “paid” immediately upon processing.

There are two different terms describing the source of the tax and whether it increases or decreases the overall tax due.

-

Outputs describe taxes your business collected {received} from others. Typically, this comes from activity such as Sales, which increase your output tax. Conversely, returns decrease your output tax.

-

Inputs describe taxes your business paid to others. Usually, this represents purchases of inventory. For example, a purchase of inventory would increase your inputs (usually, lowering the net VAT due). A vendor credit for returned materials or a rebate would decrease your inputs (increasing the net VAT due).

Outputs less Inputs represent the tax you owe the government. The tax you collected minus the tax you paid to others. It’s easier to remember if you think about which way the goods flow (goods are “out” to the consumer, rather than “in” when you purchase/replenish inventory, for example). In some special cases, the same transaction can be considered both an input and output. In this case, the transaction would have no effect on overall tax liability. An example of this would be certain cross border commerce, where the purchase is treated as both an input and output.

VAT Totals: Boxes 1 - 5

VAT amount boxes on the return are listed below:

1. VAT Due on Sales and Other Outputs

2. VAT Due on EC Acquisitions

3. Total VAT Due

4. VAT Reclaimed on Purchases and Other Inputs

5. Net VAT Due

Box 1: VAT Due on Sales and Other Outputs

With the standard method, the “output” figure is the net sum of the VAT tax amounts for Sales, Returns, Store-use adjustments, and output-type VAT Adjustments during the reporting period. Advice Notes are not included (only finalised sales). When using the cash method, the “output” figure is more complex. First, the sum of VAT for Sales involving cash-type and balance forward charge sales plus the payments made to open item invoices during the period is calculated. For open item receivable payments during the period, the prior VAT paid is calculated when determining how much VAT was paid (as a ratio). This is necessary since any given invoice could potentially be paid by more than one credit. Returns (negative sales) are considered immediately paid in all cases regardless of account type. In addition, we still consider store-use on-hand adjustments and VAT Adjustments in addition to the previously mentioned amounts. Regardless of method (standard or cash), “output” VAT Adjustments are included in this total if they are linked with a document from the period or were not previously included on a prior VAT Return at time of VAT Return submission. Additionally, the EC Commerce flag on the adjustment tax location {code} would have to be False.

Box 2: VAT Due on EC Acquisitions

This “output” figure is the net sum of the VAT tax amounts for Payables where the vendor’s assigned VAT code is or was set as “EC (European Commerce)” at time of Payables processing. This flag can be associated with a VAT tax location in the VAT {Tax} Maintenance form. This same amount will also be listed as VAT on Inputs in Box 4. Please consult HMRC tax guidance or your accountant for assistance with which Payables need to be recorded here. Credit payables (negative billed amount). Regardless of method (standard or cash), “output” VAT Adjustments are included in this total if they are linked with a document from the period or were not previously included on a prior VAT Return at time of VAT Return submission. Additionally, the EC Commerce flag on the adjustment tax location {code} would have to be True.

Box 3: Total VAT Due

This figure is the sum of Boxes 1 and 2.

Box 4: VAT Reclaimed on Purchases and Other Inputs

This is the total “input” VAT on business purchases.

When using the standard method, the billing activity determines the amount, not the payment, so regardless of payment, bills and credits entered during the reporting period would be part of the figure. In this case, the billed date of the payable determines the period. Only Payables with a billed date within the reporting period will be included.

When using the cash method, this considers payments and partial payments during the period rather than just the billing activity during the period. This amount would include the net VAT on Payables billed and paid during the period as well as the VAT on bills that were entered during previous periods but paid fully or partially during the reporting period. Unpaid (open) bills that have not been paid do not impact this figure. As with receivables, bills are not necessarily all paid at one time, so we prorate the VAT amount on partial payments that were made during the period (if some payments were made previously, for example). Regardless of method (standard or cash), “input” VAT Adjustments are included in this total if they are linked with a document from the period or were linked to any prior document, but not previously included on any existing VAT Return at time of VAT Return submission.

A Note about Hold Payables

Payables with a status of “hold” are excluded from the VAT amounts. Hold can be used for a variety of reasons, so it is not something we can automatically interpret. Additionally, the timing of when a payable is placed on hold and its status at that time can vary. If an invoice “on-hold” needs to be included on a VAT Return, changing the status temporarily may be necessary. Once saved with a VAT Return and that return is submitted, it will not appear on any future VAT Return, and you can modify the status back to “hold.” Another option is to create a VAT Adjustment linked with the Payable to record the VAT due.

Box 5: Net VAT Due

This figure is Box 3 less Box 4 (Outputs less Inputs).

Summary Totals: Boxes 6 - 9

Boxes 6 through 9 represent taxable totals (total sales, purchases, etc.) that the tax amounts are based on. Currently, VAT Adjustments with a basis amount are represented in the box selected for the adjustment. Prior to release 12.18.4, VAT Adjustments did not affect these figures. These figures, as mentioned in the descriptions, do not include the VAT amounts which are backed out of the figures when necessary.

6. Total Sales Excluding VAT

7. Total Purchases Excluding VAT

8. Total EC Supplies Excluding VAT

9. Total EC Acquisitions Excluding VAT

Box 6: Total Sales Excluding VAT

This “output” figure is the sum of the taxable basis from Sales less Returns during the period and the basis from any VAT Adjustments (basis can be set in version 12.18.4 and later). The VAT amount is not included in the totals (Ex VAT). The sum of the VAT totals for cash sales, cash returns, charge sales, and charge returns less the tax are used to calculate this figure. VAT Adjustments with a basis are added to that amount if assigned to box 6 or 8. If you are using the “cash” method, the totals are adjusted based on payments prior to the period being reported. This figure includes any EC (European Commerce) supplies reported in box 8.

Box 7: Total Purchases Excluding VAT

This figure is the sum of Payables for the reporting period based on the billed date of the Payable. The amount is the billed total less any VAT indicated. The billed date of the Payable determines the period. Payables that are “hold” status are not included. To include them, the status would need to be temporarily changed. Again, as with the other totals in this section, the VAT Amounts are not included. Credit payables involving VAT would reduce this figure. Payables are included even if they had no VAT liability unless the VAT Return Excluded flag is set. This flag is meant for use for Payables with zero VAT liability that meet requirements for not being included in the totals(certain types of payments, expenses, etc.). This figure includes any EC acquisitions reported in box 9.

Box 8: Total EC Supplies Excluding VAT

This figure represents the total for any “outputs” (Sales, Returns, etc.) involving European Commerce excluding the VAT Amounts on those transactions (ex VAT totals). Currently, VAT Adjustments can also affect the figures in this box (optionally) if a basis amount is entered and the adjustment box is 8. Please note that the tax amounts related to this activity are not listed separately as a figure in the VAT Return form but are included in the Box 1 figure. The box 8 total is also included in the box 6 amount.

Box 9: Total EC Acquisitions Excluding VAT

This figure represents the total for any “inputs” (Payables) involving European Commerce excluding the VAT Amounts on those transactions (ex VAT totals) during the reporting period. The box 9 total is also included in the box 7 figure.

VAT Adjustments (after release 12.18.4) can also affect the figures in this box (optionally), if a basis amount is entered and the adjustment box assigned is 9.

Box Figures and Manual Entry

You may have noticed that the figures displayed do not allow you to type in values or make direct changes to the totals. HMRC has an expectation that the data reported is stored in electronic form in whatever software you are using. For that reason, if you need to affect either the VAT Amounts or Totals, it must be done by some action in the ECI software. It may be necessary to maintain additional documentation to go along with whatever action you take; however, you minimally need to establish that electronic trail.

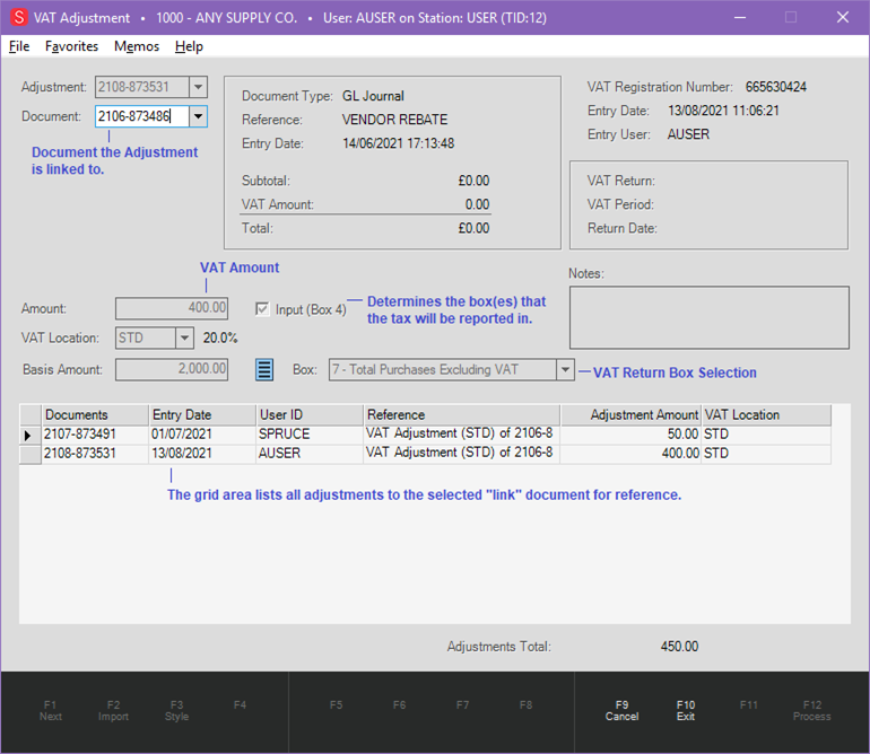

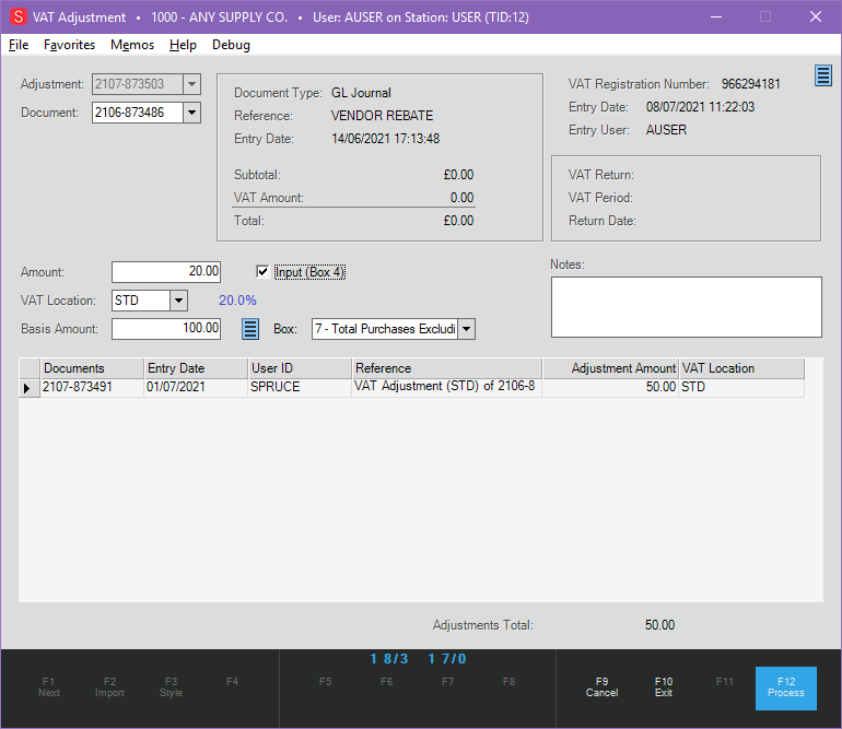

VAT Adjustments

You may need to adjust your VAT for a variety of reasons. For example, there may be business activity that is not typically recorded by application processing or is but has no automatic tax impact. For taxable activity that is not tied to application processing, your company will be responsible for any record keeping. All adjustments must be tied to some type of document, but these can be documents which would normally not have a tax such as manual journals in the ledger.

Choosing the Proper Adjustment Type

VAT Adjustments create a new document and are also linked with an existing document. They adjust the tax liability in VAT Return boxes 1-5 only. Only certain types of documents are permitted to be linked with VAT Adjustments. Some involve tax by nature (Payables, Sales, Returns, etc.), others do not (Receivables Adjustments, General Ledger Journals), etc.

Depending upon the return box you want to update, take the following actions in the VAT Adjustment form:

Scenario 1. VAT Due on Sales and other Outputs

a. Input check box is not checked.

b. VAT Location selected is not EC Commerce flagged.

c. Negative amounts decrease VAT liability (Total and Net VAT Due decrease).

d. Positive amounts increase VAT liability (Total and Net VAT Due increase).

e. Basis (optional) with Box 6 selected.

Scenario 2. VAT Due on EC Acquisitions

a. Input check box is not checked.

b. VAT Location selected is EC Commerce flagged.

c. Negative amounts decrease VAT liability (Total and Net VAT Due decrease).

d. Positive amounts increase VAT liability (Total and Net VAT Due increase).

e. Basis (optional) with Box 8 selected.

Scenario 3. Total VAT Due: Updated automatically based on the sum of 1 and 2.

Scenario 4. VAT Reclaimed on Purchases and Other Inputs

a. Input check box is checked.

b. Negative amounts increase VAT liability (Total and Net VAT Due increase).

c. Positive amounts decrease VAT liability (Total and Net VAT Due decrease).

d. Basis (optional) with Box 7 or 9 selected.

Scenario 5. Net VAT Due: Updated automatically based on the sum of Box 3 less Box 4.

Note: EC flagged "Inputs" affect both boxes 2 and 4.

See also How do VAT Adjustments affect Tax Liability?

Adding a VAT Adjustment to a Transaction Document

All adjustments must be tied to some type of document, but these can be documents which would normally not have a tax such as manual journals in the ledger.

About the Amount {VAT} field:

The amount text area is provided for the tax (VAT) amount to be adjusted. It permits both positive and negative values but cannot be zero. You can optionally calculate this as a percentage of the basis {using the context menu marker} if a basis amount has been entered. You can also calculate the basis from the tax. There are situations where the tax amount is not the same percentage of the basis due to special tax considerations (1/2 tax, etc.). In these cases, you can enter a tax amount that doesn’t match the exact percentage of the basis. You will receive a warning when processing if this is the case, but you can accept the warning if you are sure that the tax is correct.

About the Basis Amount field (New field):

In releases prior to 12.18.4, VAT Adjustments only affected the VAT amounts, not the sales and purchases totals reflected in boxes 6-9. With release 12.18.4, VAT Adjustments can optionally affect boxes 6 –9. If you want to affect boxes 6 –9, you must specify a “basis amount” and choose the appropriate box. For “outputs” (such as Sales/Returns), boxes 6 and 8 are provided as options. For “inputs” (such as purchases), boxes 7 and 9 are provided as options. Boxes 8 and 9 are reserved for EU commerce situations. If you need to affect an EU commerce amount, you should select a tax code that’s also flagged for European Commerce.

To add a VAT adjustment to a document:

1. From the Main Menu, choose Point of Sale > Utilities > VAT Adjustment. The VAT Adjustment form displays.

2. In the Adjustment list, choose <<New>>. The system generates an unique adjustment code for tracking.

3. From the Document list, choose the transaction document to apply the VAT adjustment to.

Note: In some cases, the original document may have a basis and tax amount associated with it. Some do not.

4. In the VAT Location field, enter the location code appropriate for this transaction document.

Many companies only have one VAT location. If you do commerce outside the UK or sell products with different tax rates, you likely have or need more than one tax location. The tax location does the following:

-

For outputs, the tax location affects the consumer tax figures (tax totals).

-

For European Commerce tax codes, this affects how the tax amount is reported. Tax amounts lined with EU Commerce tax codes are represented in both boxes 2 and 4 (an input and an output).

-

If you specify a basis, and the tax code is flagged for European Commerce, you should select the appropriate “EC” box (8 or 9). For outputs, the box is typically 8 and for inputs, box 9.

5. If the adjustment you are adding is an Input, select the Input (box 4) check box.

6. Continue based on the information you know:

-

If you know the VAT amount, enter that amount in the Amount field.

-

If you know the basis amount, enter that amount in the Basis Amount field.

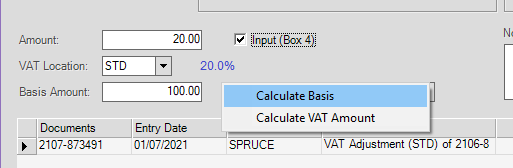

7. After you enter either the VAT Amount or the Basis Amount, you can calculate the other value using the Menu Marker  beside the Basis Amount box.

beside the Basis Amount box.

-

To calculate the VAT amount from the basis amount, enter the basis amount, choose the Menu Marker, and click Calculate VAT Amount.

-

To calculate the basis amount from the VAT amount, enter the VAT Amount, choose the Menu Marker, and click Calculate Basis.

8. From the Box {Selection} list, choose the VAT return box that the adjustment amount should be added to. This provides a choice of boxes 6 – 9.

-

For Inputs, choose box 6 or 8.

-

For Outputs, choose box 7 or 9.

-

For EC supplies and acquisitions, choose box 8 or 9.

9. In the Notes {Text Area} box, enter information you want to preserve about this transaction, such as the reason for the adjustment. This entry is optional (and a good idea).

Note: You can also attach documentation to the VAT Adjustment document using the Documents form.

10. When you have reviewed and confirmed your entries and selections, click Process (F12) to update the adjustment for this transaction.

Note: When the information needed for any of these calculations is not present, an error message displays.

Understanding the VAT Location Entry

The VAT Location code determines the VAT location linked to the adjustment. Many companies only have one VAT location. If you do business outside the UK or sell products with different tax rates, you likely have or need more than one tax location. The tax location does the following:

-

For Outputs, the tax location affects the consumer tax figures (tax totals).

-

For European Commerce tax codes, this affects how the tax amount is reported. Tax amounts linked with EU Commerce tax codes are represented both in boxes 2 and 4 (an input and output).

-

When you specify a basis, and the tax code is flagged for European Commerce, you should select the appropriate “EC” box (8 or 9). For outputs, the box is typically 8 and for inputs, box 9.

Which Return will show the Adjustment?

VAT Adjustments affect one of two reporting periods (prior or new) depending upon the timing of the adjustment in relation to the finalisation of the VAT Return submission.

1. For VAT Adjustments processed during the current reporting period and linked with a prior period document after the prior period has been finalised, those adjustments will be included with the “current” {new} period.

For example, my most recent quarterly reporting period closed on June 30. On July 10, I submit my VAT Return and it is finalised by HMRC. On July 25, I enter an adjustment for £50 and link it to a manual journal created in June. Since my reporting period has been finalised, the adjustment will instead affect the current period (July - September) once that period has ended. The prior period’s figures will remain unchanged.

2. For VAT Adjustments processed during the current reporting period and linked with a prior period document before the prior period has been finalised, those adjustments will be included with the “prior” period.

For example, my quarterly reporting period closed on June 30, but has not been finalised with HMRC yet. On July 1, I enter an adjustment for £50 and link it to a manual journal created in June. Since my reporting period has not been finalised, the adjustment will still affect the prior period (April – June).

3. For VAT Adjustments processed during the current reporting period and linked with a current period document before the end of that period, those adjustments will be included with the “current” period once reporting for that period is available.

For example, my quarterly reporting began on July 1, and today is July 10. I enter an adjustment for £50 and link it to a manual journal created on July 2. Since my reporting period has not ended and the linked document is for the current period, the adjustment will affect the current period {that includes July}.

How do VAT Adjustments affect Tax Liability?

Adjustments that are output-types affect consumer tax totals for the period matching the original document. For example, a VAT Adjustment processed on July 15 for an invoice processed on June 30 would impact the tax totals for June, not July. Only “output” adjustments affect tax totals. Inputs, which credit the output amounts, are not recorded in the consumer {sales} tax totals.

In certain cases, the VAT Adjustment form will assume either “Input” or “Output” and not allow changes. For instance, if you link the adjustment to a PS Sale Invoice type document, that document is by nature an “output” not an “input.” The “Input” check box will be disabled (greyed out) preventing changes. Conversely, if you choose an AP Billing Invoice, the default type is “input,” so the opposite is true. In this second case, the VAT Adjustment form checks the “Input” check box and disables it to prevent changes.

In summary, the application prevents both “output” type adjustments linked to “input” documents and “input” type adjustments linked to “output” type documents when we can identify that situation.

When we can’t automatically determine whether the transaction is one or the other, you will have to choose.

Documents that are not clearly Input vs. Output

In certain cases, there is no clear way to know if the intention is input vs. output. For example, a General Ledger manual journal could represent either input or output. In this case, the user must select the option that matches their desired outcome (based on the box(es) on the return they wish to impact).

Generally, and assuming the tax accounts are set up as liability types, credits would increase your tax liability (what you owe) and debits would reduce the tax you owe. Payables invoiced and including VAT would typically be recorded as a debit to the VAT Purchases tax account decreasing your overall tax owed. Credit invoices entered via Payables would typically be recorded as a credit to the VAT Purchases tax account increasing the overall tax owed.

For output activity, a credit to a VAT account would increase your tax liability {owed} and debits would reduce that. Positive output adjustments decrease tax liability (like a purchase), so a negative VAT amount would increase it (like a vendor credit).

For input activity, the tax liability would be increased by sales (credit) and decreased by returns (debit). For VAT Adjustments that are input-types, positive amounts increase the tax liability and negative amounts decrease the tax liability. This is the opposite of how the positive/negative impacts output tax.

An opposing adjustment can be made for cases where the wrong input/output choice was made, or the amount was entered incorrectly as either a positive or negative. To reverse an error, use the same type (input/output) as the original, but reverse the sign of the amount (and select the same link document).

A single document can have multiple adjustments. Use the notes field for any explanation needed.

Application Handling for VAT Return Adjustments After Grace Period Updated

Based on customer feedback, we have improved how we apply adjustments to a VAT Return for tax reporting to the HMRC using the Making Tax Digital (MTD) service. In the past, the application either included or excluded VAT adjustments based on the document's entry date. The exception to this rule was in the case of Payables, including vendor invoices or credits.

In this release, we have adjusted the logic for VAT Adjustments involving Payables to consider the Payable's "billed date" rather than the document date. We will include VAT Adjustments if they reference a Payable (invoice or credit) billed either during or before the end of the VAT period, even if the payable is entered into the application after the reporting period has ended.

In addition, when you apply VAT adjustments to General Ledger journals, the application uses the cycle and fiscal year of the journal to determine the appropriate VAT period for the adjustment. General Ledger journals don't impact VAT independently, so applying a VAT adjustment to a journal should impact the VAT Return. Often, these adjustments may not occur until after the end of the reporting period. For example, for the reporting period May through July, if you enter a manual journal adjustment on August 10th for the prior cycle (July), the application would include a VAT adjustment in the May-July reporting period. This is true even though you created the journal adjustment after the end of the reporting period. This change allows you to make journal entries that affect the VAT Return for the prior period.

To summarize, the application uses the linked document's entry date to define the VAT period of a VAT Adjustment, with two exceptions.

-

For Payables, the application uses the Billed Date of the linked Payable and

-

For General Ledger journals, the application uses the cycle and fiscal year of the linked journal

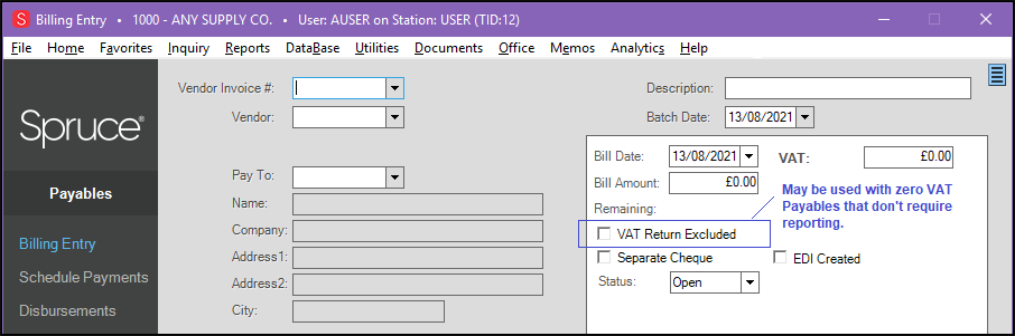

Payables - Billing Entry

For “standard” accounting, the billing date and status of the Payable determine whether it’s included on the VAT Return for the reporting period. For “cash” accounting, payments are considered (paid invoices to be precise). Partial payments during the period are included, not just payments in full.

With release 12.18.4 and later, you have an additional option of excluding a Payable (with no VAT amount) from reporting on the VAT Return in the purchases (box 7) or EC acquisitions (box 9) figures.

Payables for vendors assigned to a European Commerce flagged VAT tax code (location) would be the only Payables recorded under box 9. VAT Adjustments can now optionally affect the basis reported in this box. Box 9 (EC Acquisitions) are also reflected in box 7 (Total Purchases Excluding VAT).

Certain types of payments do not require reporting in the “total purchases” figure. This is provided if a company using the application needs to do this; however, we cannot determine or verify whether your choice is correct or incorrect. You should be sure that you don’t have to report a Payable before checking the box. This doesn’t increase or decrease your VAT tax totals, just the purchases / acquisitions basis amounts.

Only Payables with no VAT amount allow use of the check box.

As mentioned previously, Payables on-hold status are not included in VAT reporting. We are unable to know the reason why a Payable is on “hold” nor the timing of when the Payable was placed on hold. If you need to include it, you have a couple of options:

-

Temporarily remove the hold while processing your VAT Return then change the status back to hold after completing your return.

-

Leave the payable on-hold but enter a VAT Adjustment linked to the Payable for reporting. If the Payable comes off hold in the future, after the period is finalised, it won’t appear on future returns (assuming the billing date is not modified to a future date). You would have recorded the VAT tax and linked the adjustment to the Payable as a documented trail.

How do I handle payables that are billed after the period is finalised?

If you receive bills for purchases, credits, or expenses that occurred during the prior period, but after you have finalised your return, enter them as bills for the current period (billed date) to ensure that they are reported on the next VAT Return. If a payable is dated to the prior period after the return is submitted, the application won’t recognize that activity on the next return.

As a suggestion, if you need to adjust dates, consider always using the same date, such as the first day of the new period, to make identifying any bills you adjusted easier in the future. You may need to adjust other dates such as discount and due period to make them correct in these cases.

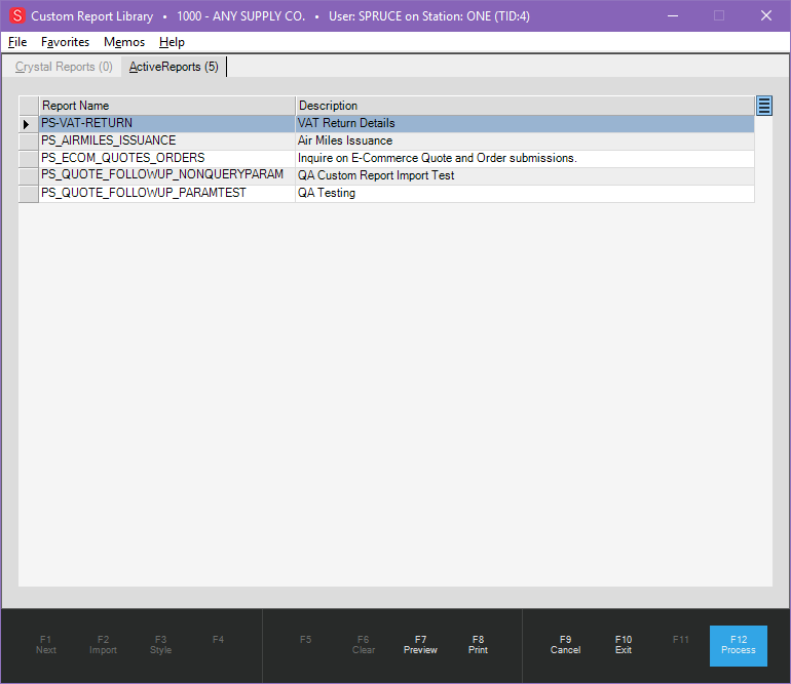

VAT Return Reporting

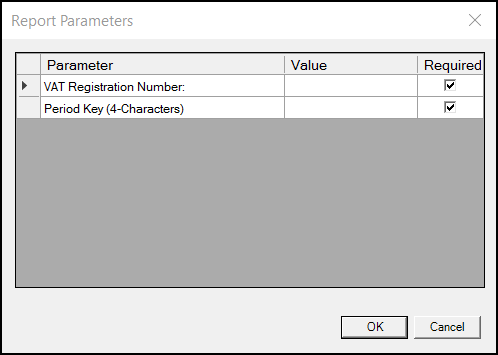

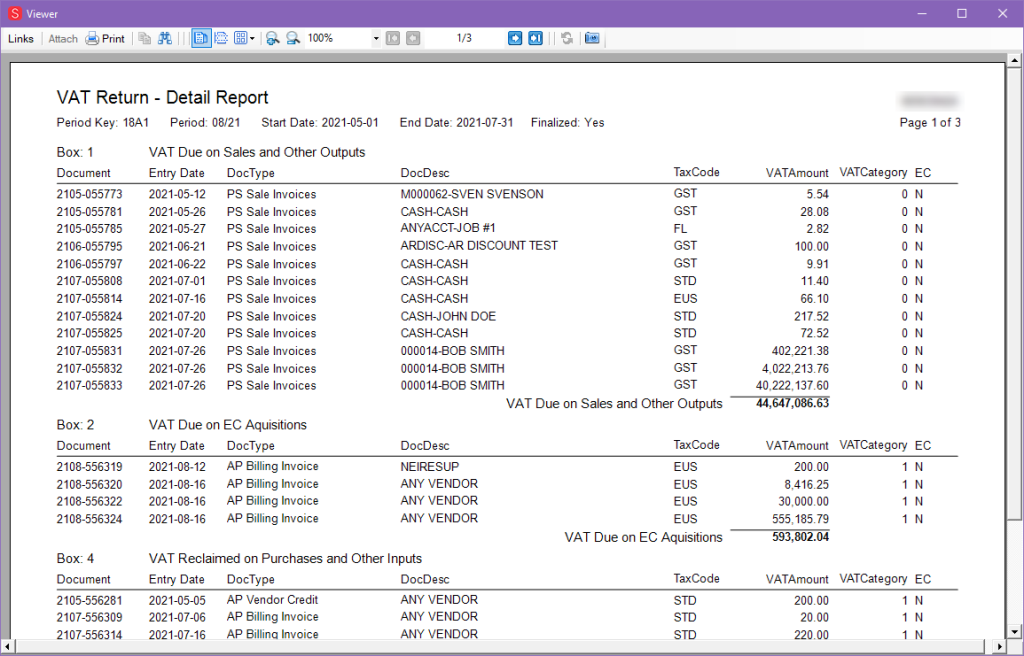

You can create a detailed report based on your VAT Return data using the PS-VAT-RETURN file in ActiveReports.

To run the VAT Return Details report, you need the registration number and VAT period key for the return you want to data about. You must have previously saved data for your return for this report to work (we are working on a preview version).

You can load this report into the Point of Sale Custom Report Library or, if you prefer, General Ledger or Maintenance. You should consider the permissions of the users who need this report when making this decision.

If this report is not already in your Custom Report Library, you can get it by logging into the Customer Portal and searching for VAT Report. The VAT Report is located at the bottom of the Spruce Reports Library (Point of Sale ) list.

To run the VAT Return Details report:

1. From the Main Menu, choose Point of Sale (or the application area you selected) > Reports. The reports context list displays.

2. Scroll down to the bottom of the list and choose Custom Report Library.

3. In the ActiveReports tab, double-click the PS-VAT-RETURN entry in the list to display the Report Parameters box.

4. Enter the VAT registration and period key information and click OK.

The report will populate with details that contain the figures compiled in the VAT Return form.

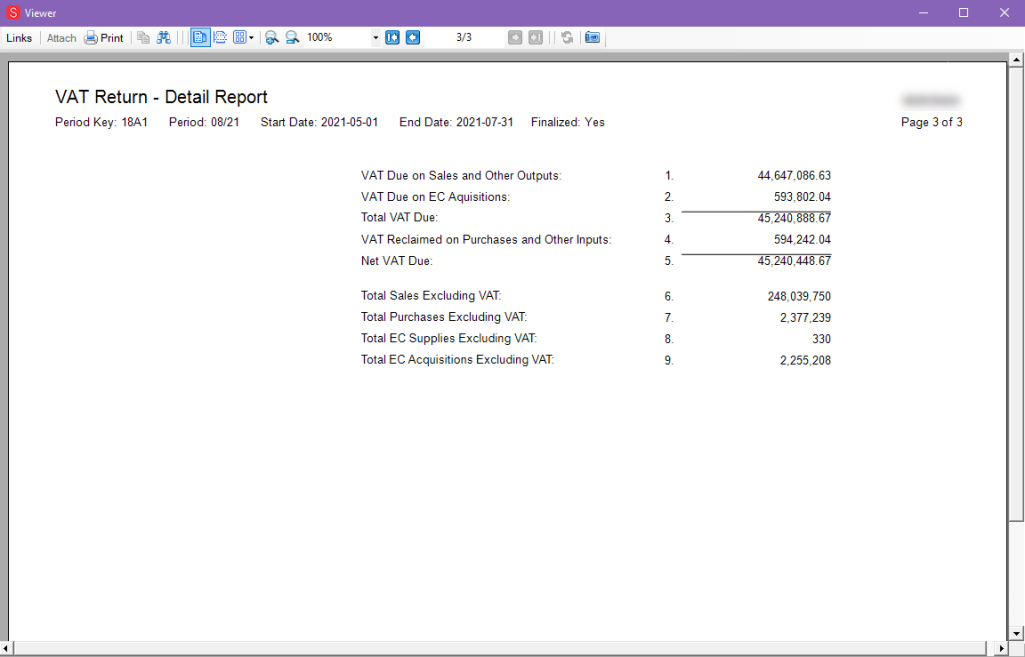

The final page of the report includes a summary by box number and description (like the VAT Return form).

5. To print this report, in the Viewer header click Print to display the options. Choose the printer settings for this report and click OK.

To ensure the numbers generated are accurate, you can run the following reports and compare the amounts prior to submitting:

-

Point of Sale > Reports > Management > Sales VAT Report – Select the date range and Grand Total.

-

Payables > Reports > VAT Paid – Select the date range and Grand Total.

Once you are confident the data presented is accurate, submit the tax to produce a VAT Return document.

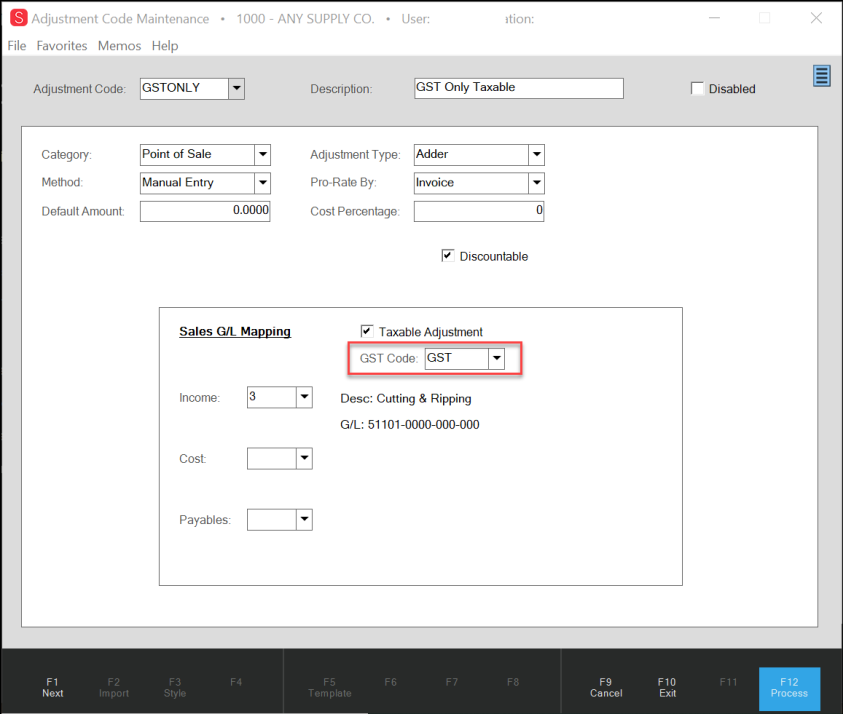

VAT Adjustments in Point of Sale for Value-Added Tax Transactions

A GST/VAT selection control allows you to choose the appropriate VAT/GST location code for the adjustment. Both the “Taxable Adjustment” and {GST/VAT} “Code” are required if the adjustment should impact tax when included on a Point of Sale transaction. Tax calculations will be impacted if the Adjustment is set to be taxable and assigned a valid VAT/GST Tax Location. Prior to this change, adjustments at Point of Sale had no tax impact.

To make an adjustment taxable:

1. From the Main Menu, go to Point of Sale > Database > Adjustment Codes to display the Adjustment Code Maintenance form.

Adjustment Code Maintenance with VAT (GST) Code Highlighted

2. Complete the fields as you would for any new Point of Sale tax adjustment code and choose the VAT/GST tax location code appropriate for the adjustment.

3. When you have completed your entries and selections, click Process (F12) to save your new adjustment.

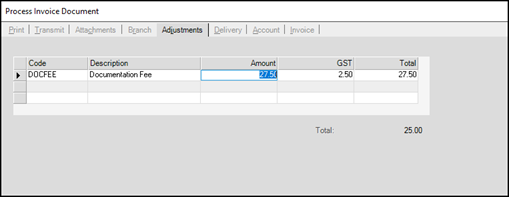

During processing, the tax is calculated for each line item in the data grid. When the cashier processes the payment, the tax impact caused by the adjustment(s) display on the Adjustments tab of the Process Invoice Document (F12) form. The name you have given the adjustment displays in the Code column. The tax information also displays on the receipt/ticket as well. This is applicable to Sales, Quotes, Orders, Direct Ship, and Charge Returns.

Process Invoice Document - Adjustments Tab with New Adjustment