Returns Point of Sale Mapping

This topic is a continuation of the Point of Sale mapping topic. For the most part, returns of goods generate similar but opposite account entries to those created for sales. Companies may decide to use the same accounts as are found under the Sales category for much of the returns mapping; however, it is also possible to use different accounts whenever it is desirable to separate balances between returns and sales figures financially.

| # | Description | Type | Debit/Credit* | Details |

|---|---|---|---|---|

| 20 | Cash Returns | Income | Debit (-) | Product Group |

| 21 | Charge Returns | Income | Debit (-) | Product Group |

| 22 | Adjustment Returns | Income | Debit (-) | Detail Mapping |

| 23 | Cash Sales Tax | Liability | Debit (-) | Detail Mapping |

| 24 | Charge Sales Tax | Liability | Debit (-) | Detail Mapping |

| 25 | Cash Exempt Returns | Income | Debit (-) | Product Group |

| 26 | Charge Exempt Returns | Income | Debit (-) | Product Group |

| 27 | Cash | Asset | Credit (-) | |

| 28 | Refund Checks | Asset | Credit (-) | |

| 29 | Bank Cards | Asset | Credit (-) | Detail Mapping |

| 30 | A/R Credit Memos | Asset | Credit (-) | |

| 31 | Inventory | Asset | Credit (-) | |

| 32 | Cost of Sales | COGS | Credit (-) | |

| 33 | Adjustment Payable | Liability | Debit (-) | Detail Mapping |

| 34 | Adjustment Cost | Expense | Credit (-) | Detail Mapping |

| 57 | Capital One Trade Credit (formerly BlueTarp) (Return) | Asset | Credit (-) | |

| 62 | Gift Card | Liability | Credit (+) |

*Indicates the type of entry, either debit or credit. The + or - indicates whether the debit or credit represents and increase or decrease for the specific class of account (asset, liability, income, etc.).

20. Cash Sales Returns (Income)

If cash is returned to a customer due to a return of goods, this income account will be debited (decreased). In this case, the term "cash" means any payment method other than charge. Cash, checks, bank cards, and coupons are all considered "cash" for the purpose of recording income, in other words. Sales tax is not included in the income amount posted to this account and is recorded separately as a debit to a sales tax liability account.

21. Charge Sales Returns (Income)

When goods are returned by a customer and credited to their accounts receivable account, the income from the original sale must be reduced. This results in a debit to the account mapped here lowering the balance of the income account by the charge amount less sales tax.

22. Adjustment Returns (Income)

Both sales and returns can involve adjustments such as freight, delivery fees, etc. If a return is processed with adjustments, the adjustment portion of the return will debit (reduce) this income account.

Detailed mapping determines the G/L accounts which are available for adjustment codes (Sale Adders is the description used for detail mapping of income accounts for adjustments). Adjustment codes are maintained in their own database. Codes designated for Point of Sale use may be assigned to specific G/L accounts for income, cost, and payables. If specific accounts from the detailed mapping are assigned to an adjustment code, they will be used in place of this system mapping.

23. Cash Sales Tax (Liability)

When a cash return is processed with sales tax, the tax payable must be reduced. The account balance is lowered by a debit entry for the tax amount in these cases. Detailed mapping by tax location is also available and will be used instead if it has been set up. In this case, a "cash" sale is any non-charge transaction, so it includes payment methods such as check, bank card, coupons, etc.

24. Charge Sales Tax (Liability)

When a charge return is processed that includes sales tax, the tax payable must be reduced by a debit entry for the tax amount. Detailed mapping by tax location is available, so if has been set up, it will be used instead of the account mapped in the system journal.

25. Cash Exempt Returns (Income)

When cash returns are made to exempt tax locations or tax exempt customers, this income account is reduced by a debit entry. A "cash" sale or return is any non-charge transaction and includes other payment methods such as check, bank card, coupons, etc.

26. Charge Exempt Returns (Income)

Credit memos or returns to a charge account which are tax exempt will create a debit entry reducing the balance of this income account.

27. Cash (Asset)

If a return/refund involves a payment of cash to the customer, a credit entry that reduces the asset cash balance (this account) will be generated. Only a return payment method of "cash" creates an entry to this account. Other types of payment methods have separate mapping under assets (see below).

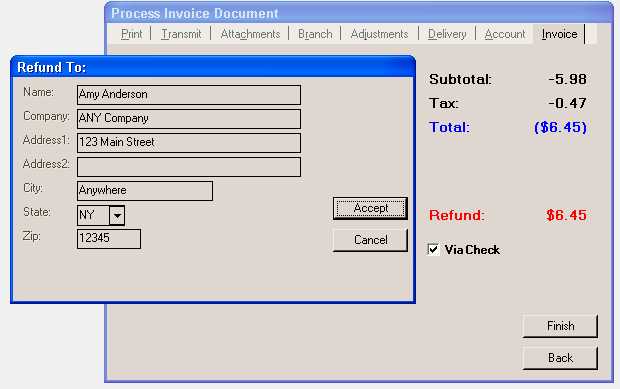

28. Refund Checks (Asset)

When a return is processed, users can designate "check" as a return method. The check return method is not intended for returning a physical check out of the drawer to the customer. This feature is designed for a refund using Accounts Payable to generate (print) a check to pay the customer.

Some companies set a cash refund limit so that returns over a set dollar amount are issued only as checks (for example, a company might set a limit of $50 for cash refunds and for any returns above the limit they write the customer a check via Accounts Payable). This might also be used in cases where the customer has no receipt or their original purchase is in doubt (suspected theft, for example). Your company's policy should determine if and how this function is used.

Any returns processed using the "via check" (see below) function will generate a credit entry to decrease the balance of the asset account mapped here. This decrease of asset value is intended to be temporary. When Accounts Payable enters an invoice for the refund, the clerk should use this account (refund checks) as the debit offset to Accounts Payable. This will increase the balance of the asset and increase (credit) your company's payables. When the check is paid, assets will be reduced again (cash in bank is lowered via a credit) and accounts payable is reduced (debit) because your company no longer owes the money.

29. Bank Cards (Asset)

Return sales using a payment method of bank card reduce the balance of the asset account mapped here with a credit entry. Detailed bank card mapping is available. If detailed mapping exists, it will be used in place of the system journal mapping.

30. A/R Credit Memos (Asset)

A separate activity exists for processing credit (charge) returns in the Point of Sale application area. When a charge return (referred to as a "credit memo") is processed, the asset account mapped here is reduced by a credit entry. Normally, the account mapped here is located under the Accounts Receivable section/group of the asset mapping in the Chart of Accounts.

31. Inventory Issues (Asset)

When a return of goods (inventory) is processed, your company's assets increase. The cost value of the goods being returned is added back into inventory by a debit entry (the original sale would have decreased the asset balance for inventory your company maintains). If detailed mapping by product group for cost of sales exists, it will be used instead of the account mapped in the system journal.

32. Cost of Sales (COGS)

Cost of goods sold is increased (debited) when items are sold, so returns of inventory must decrease the balance of cost of goods sold (COGS) by a credit entry. The cost value of the items being returned will be credited to the account mapped here. If detailed mapping by product group for cost of sales exists, it will be used instead of the account mapped in the system journal.

33. Adjustments Payable (Liability)

When goods are returned and adjustments are applied (freight, fuel surcharge, etc.) during processing that would have been payable to another company, this liability account will be decreased by a debit entry. This liability balance would typically be reduced (debited) as the offset to accounts payable when entering an A/P invoice for payment to a vendor/payee. For example, a sale might involve freight charges payable to another company. In the case of a return of goods, the liability account balance is decreased by the adjustment amount because it is assumed that the money is no longer owed.

Detailed mapping determines the G/L accounts which are available for adjustment codes (Sale Adder Payable is the description used for detail mapping of liability accounts for adjustments). Adjustment codes are maintained in their own database. Codes designated for Point of Sale use may be assigned to specific G/L accounts for income, cost, and payables. If specific accounts from the detailed mapping are assigned to an adjustment code, they will be used in place of this system mapping.

34. Adjustment Cost (Expense)

A cost may be associated with adjustments used with Point of Sale transactions (adjustments may be designated on the Adjustment tab of the Process {F12} form). When goods are returned and adjustments are applied to the return, the cost expense is reduced (by a credit entry).

Detailed mapping determines the G/L accounts which are available for adjustment codes (Sale Adder Cost is the description used for detail mapping of expense accounts for adjustments). Adjustment codes are maintained in their own database. Codes designated for Point of Sale use may be assigned to specific G/L accounts for income, cost, and payables. If specific accounts from the detailed mapping are assigned to an adjustment code, they will be used in place of this system mapping.

Capital One Trade Credit (formerly BlueTarp) and Returns

If your company uses Capital One Trade Credit (formerly BlueTarp), customers who are Capital One Trade Credit (formerly BlueTarp) card holders can use their account to charge goods. This functions similar to a credit card, but is authorized directly with Capital One Trade Credit (formerly BlueTarp), not an independent card processor.

57. Capital One Trade Credit (formerly BlueTarp) {Return} (Asset - Credit)

This mapping records the amount refunded to a Capital One Trade Credit (formerly BlueTarp) card holder's account when a Capital One Trade Credit (formerly BlueTarp) account is used as a method of refund on a return Sale transaction. The credit decreases the balance of the asset account mapped here.

62. Gift Card Return (Liability)

This mapping is used when a return/refund is credited to a gift card. In this case, the gift card liability is increased by a credit (this essentially increases the dollar amount that your company "owes" to holders of outstanding, or unused, gift cards).