Release Details for Version 21

This section contains the detailed content for the version 21.0 release.

Key Updates:

Quick Tender Feature Improves Point of Sale Transactions

New: Cayan M400 Devices Available for Point of Sale Processing

Cayan: Changes to Manual Entry Options for Genius 2.0 Devices

Adding Delivery/Cartage Fees to Point of Sale Transactions

Using the Aggregator to Quantify Inventory

Application Resize Focuses on POS and Utility Forms

New Protections for General Ledger Chart of Accounts

GL Inventory Reconciliation Report: A Snapshot of Inventory Valuation

Account Payment Convenience Fees Made Easy

Creating Job-Level Price Groups to Manage Competitive Bids

Added Job Name to Posting Payments Form

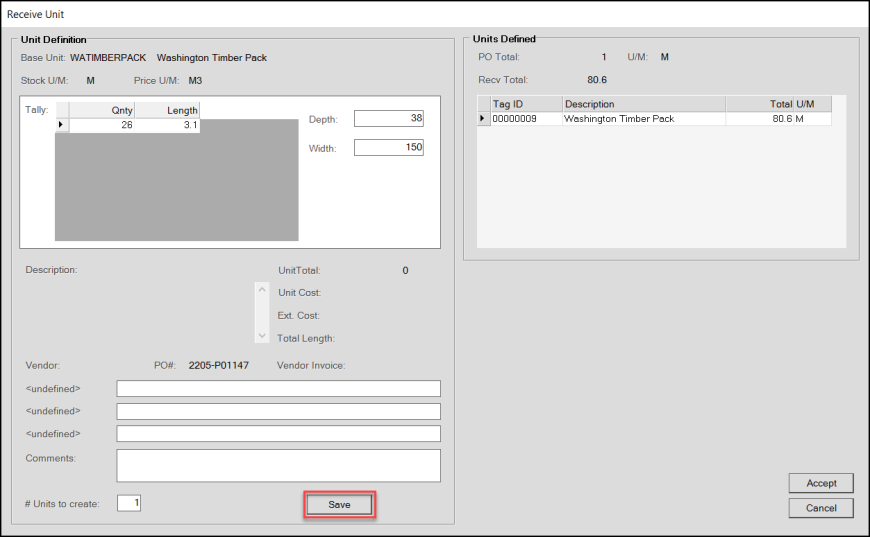

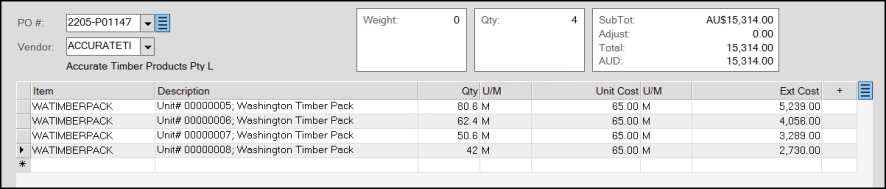

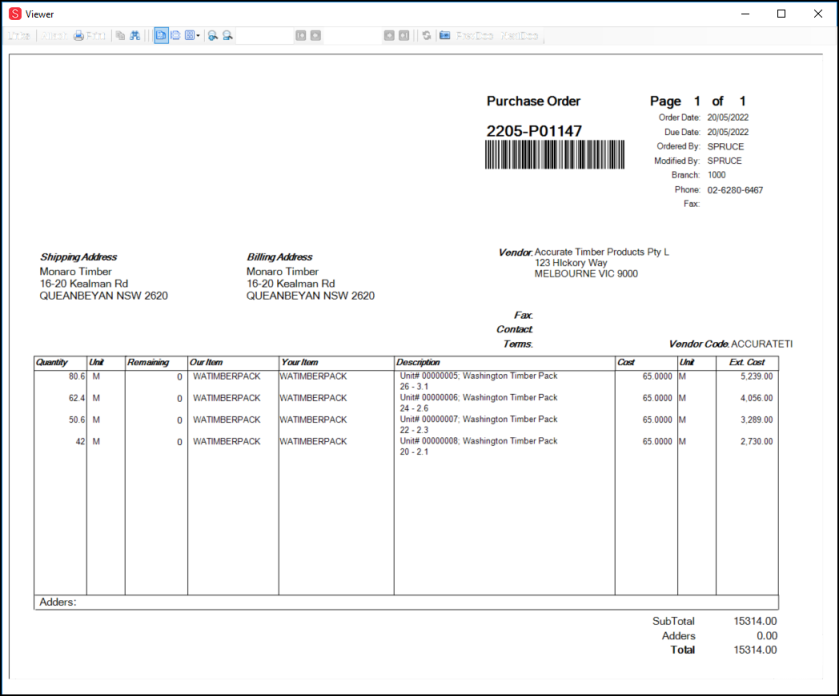

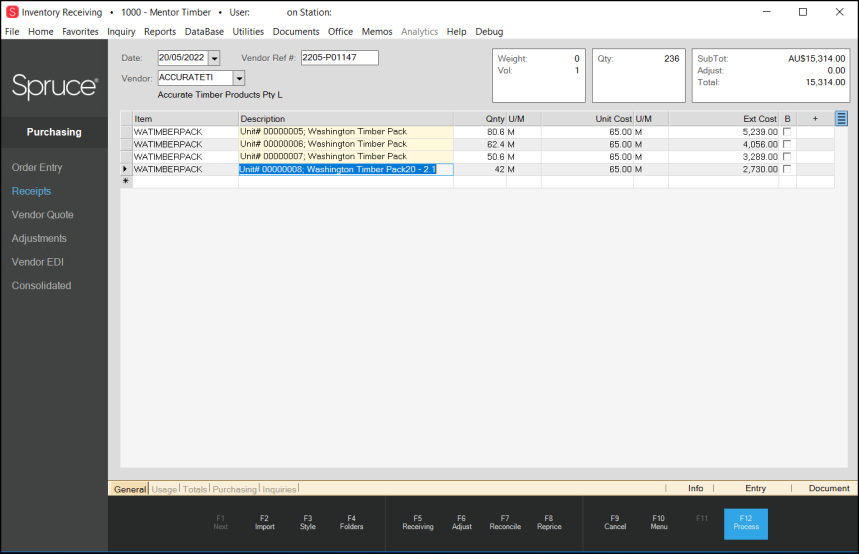

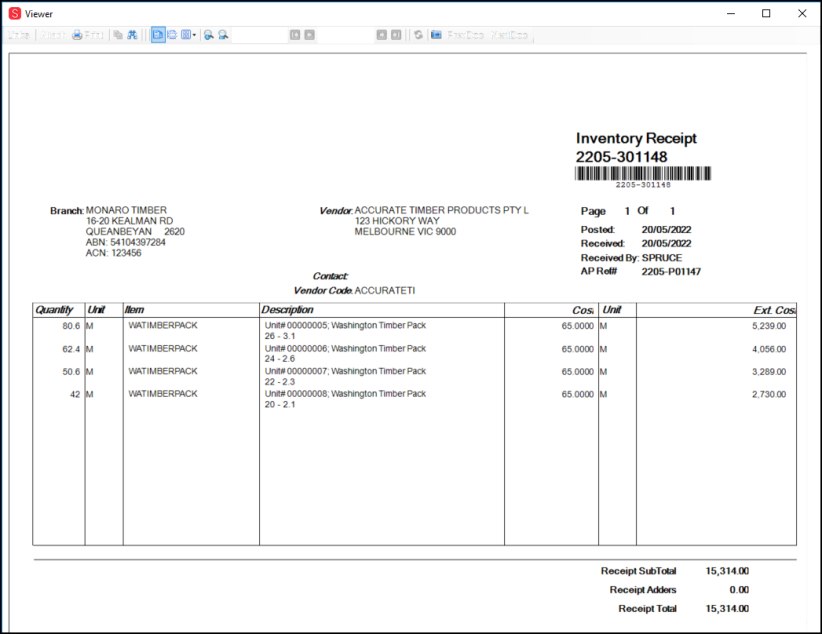

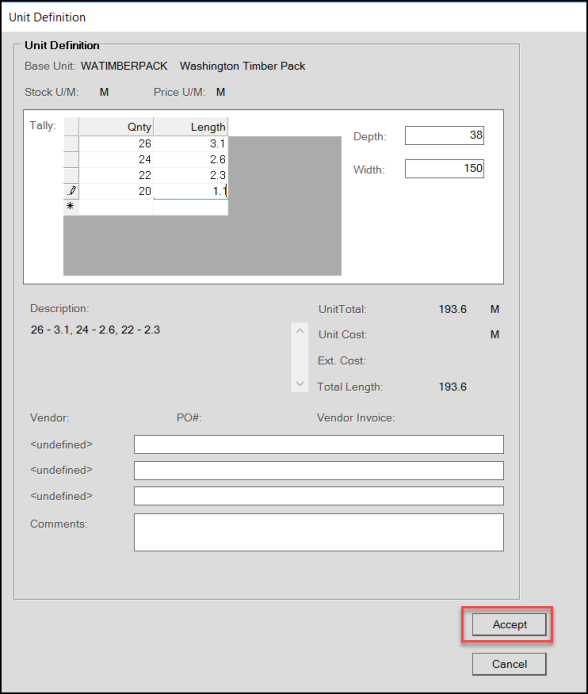

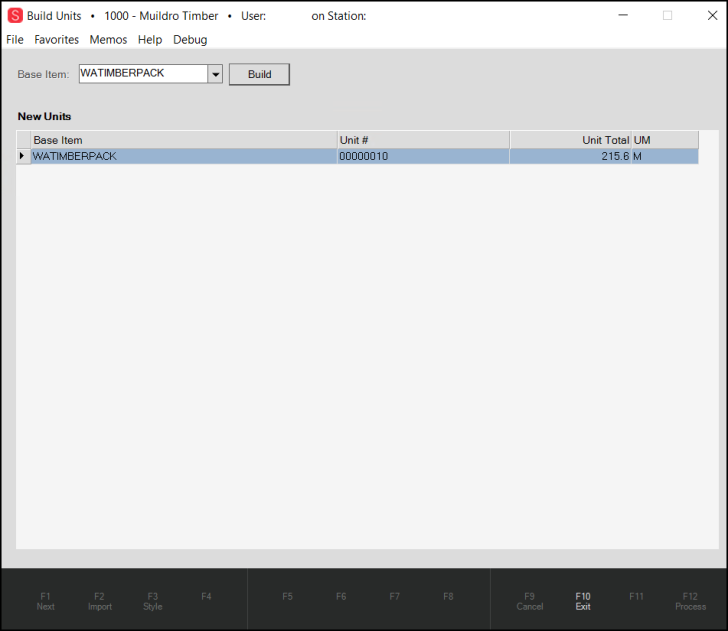

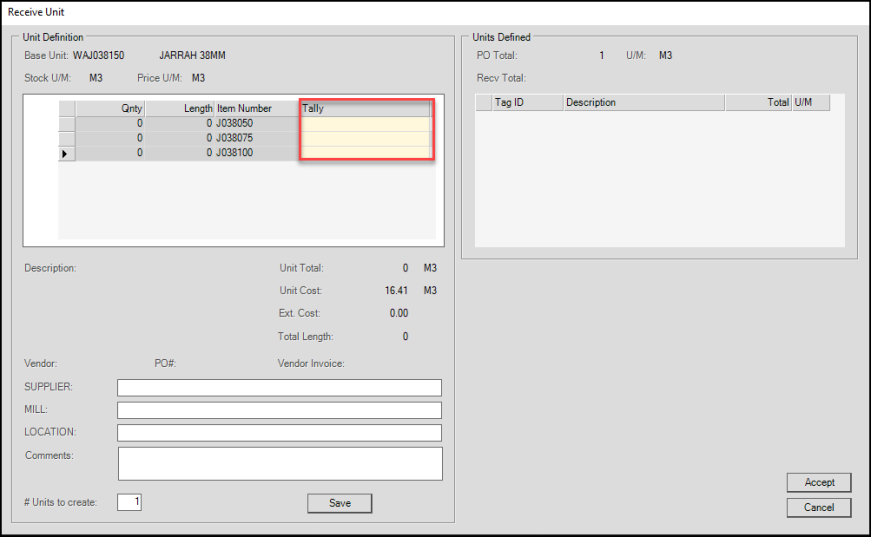

Timber/Lumber Unit/Pack Inventory Type Added

Receipts Focus on Vendor Rather than Date

Exporting Reports to XLSX Excel Format

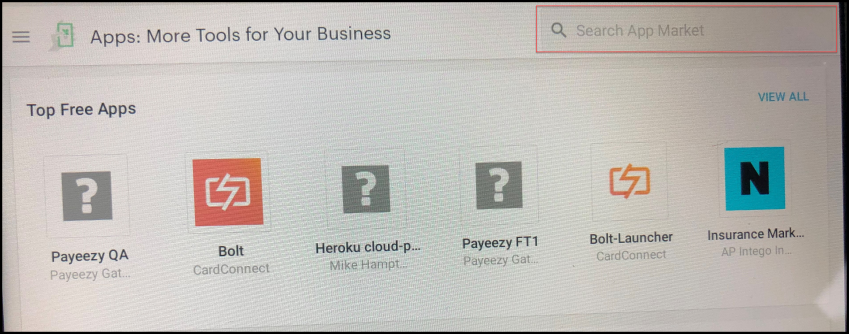

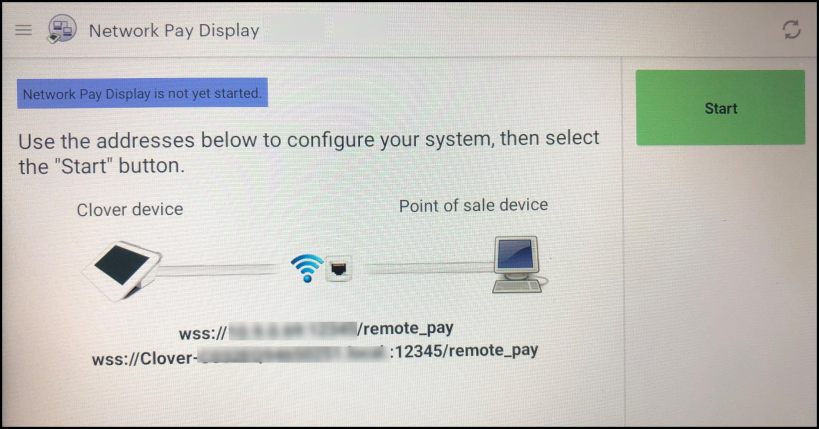

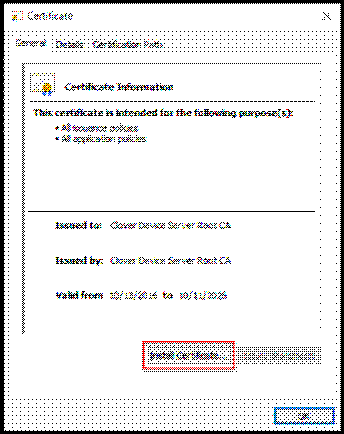

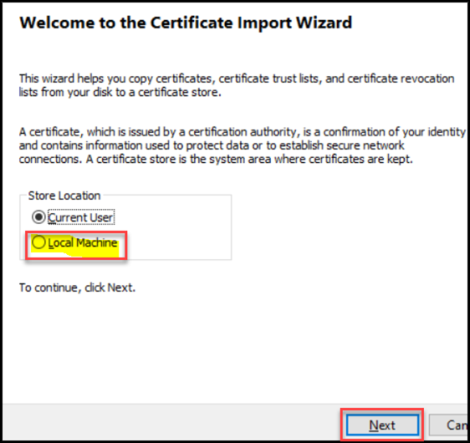

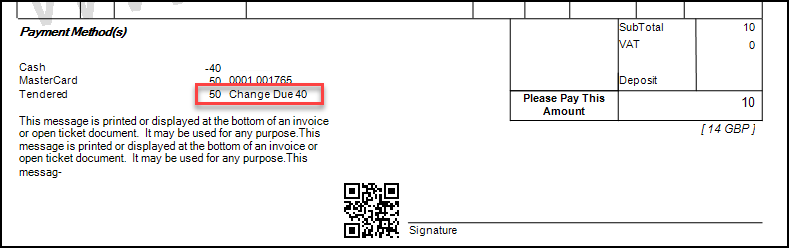

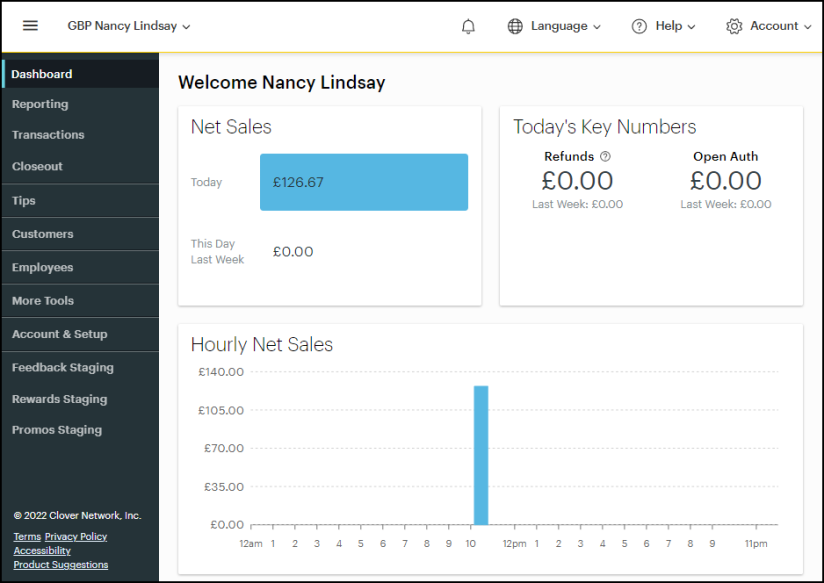

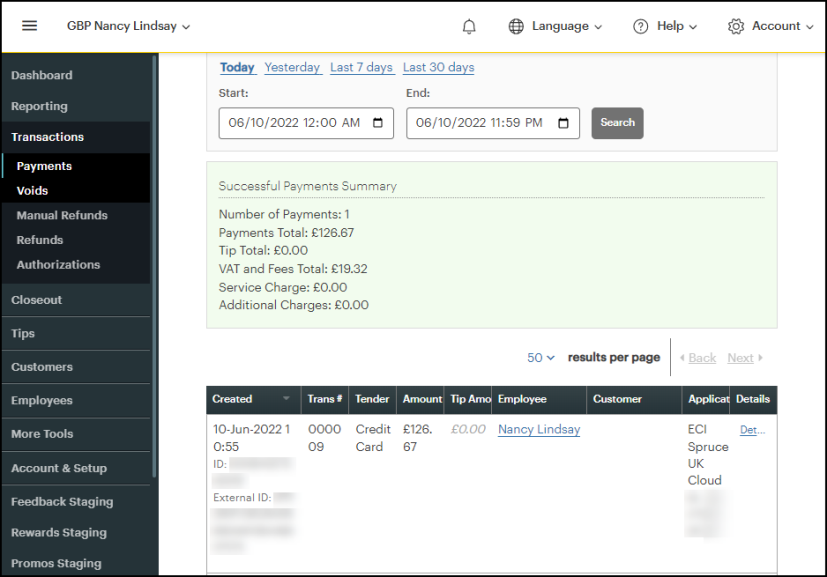

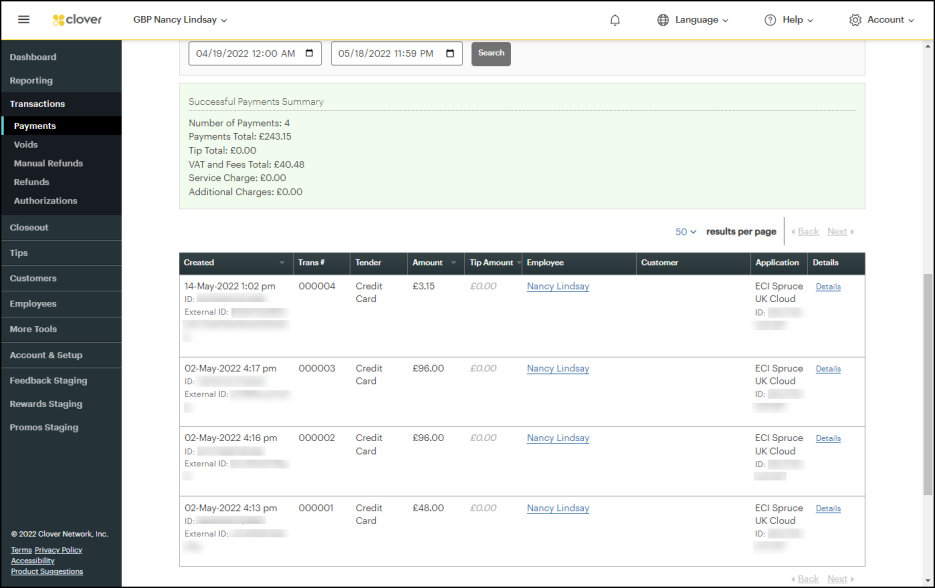

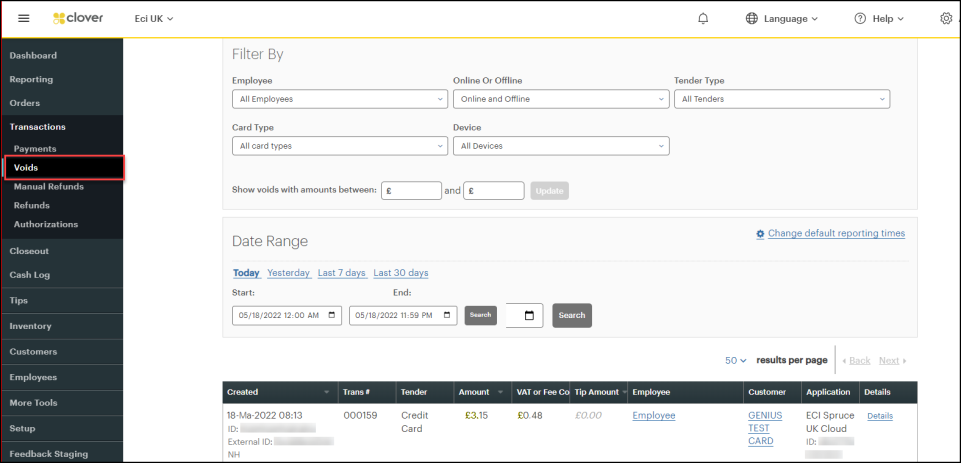

Payment Integration using Clover Devices (UK)

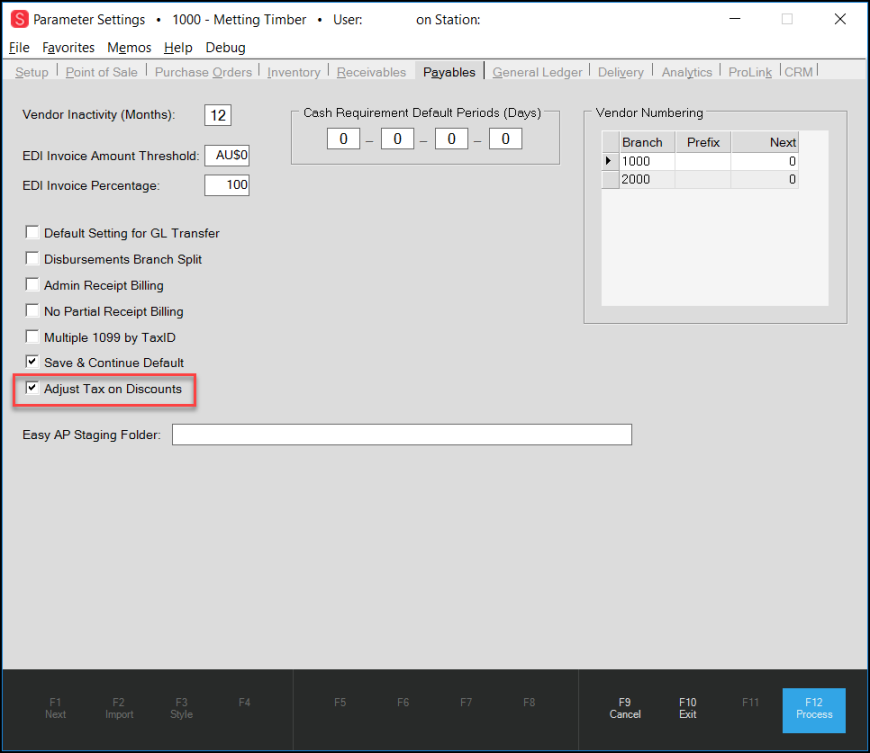

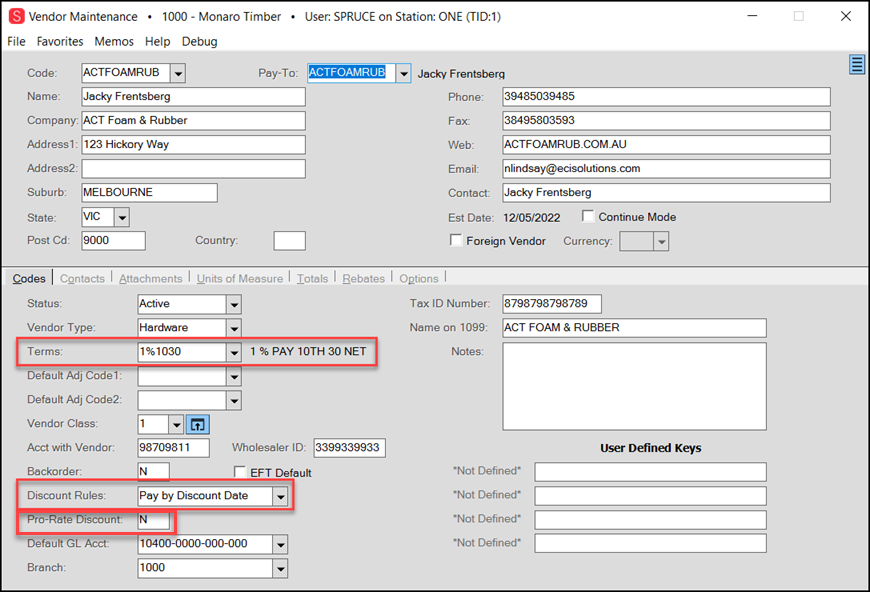

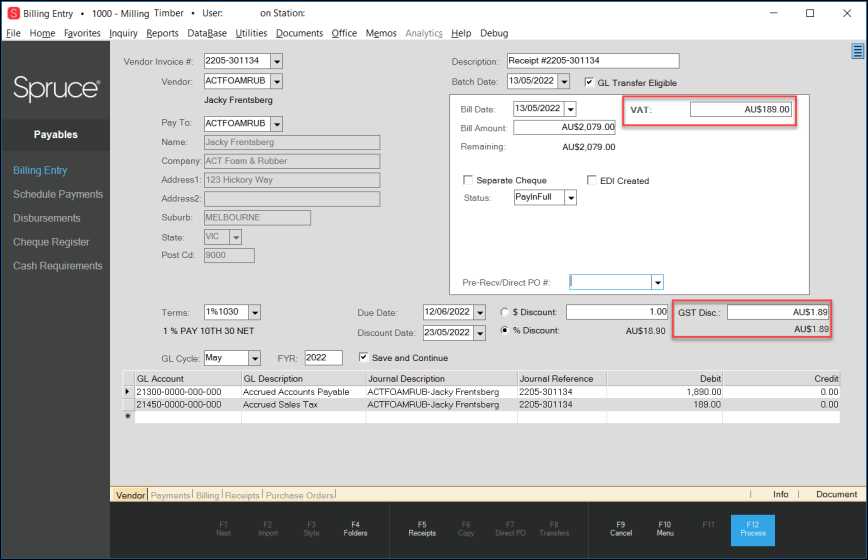

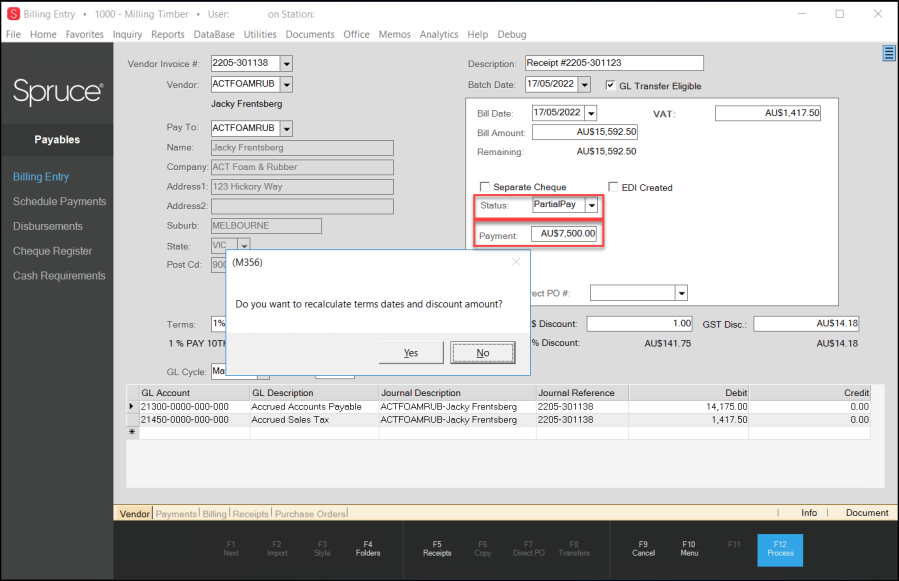

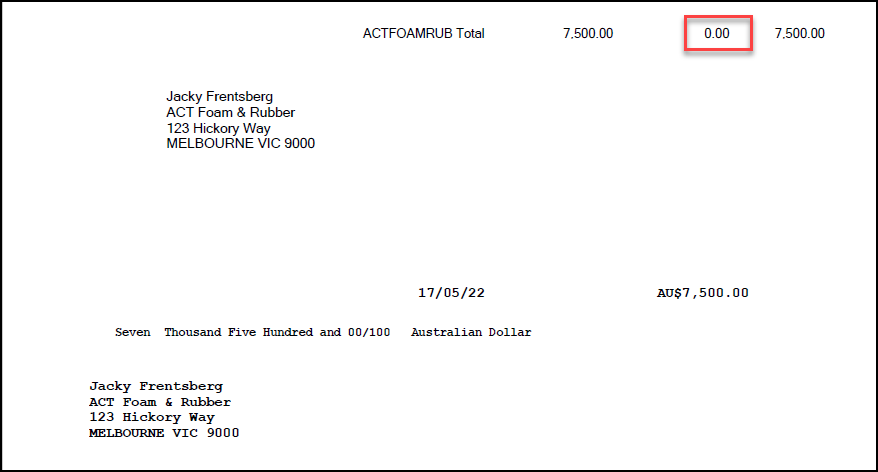

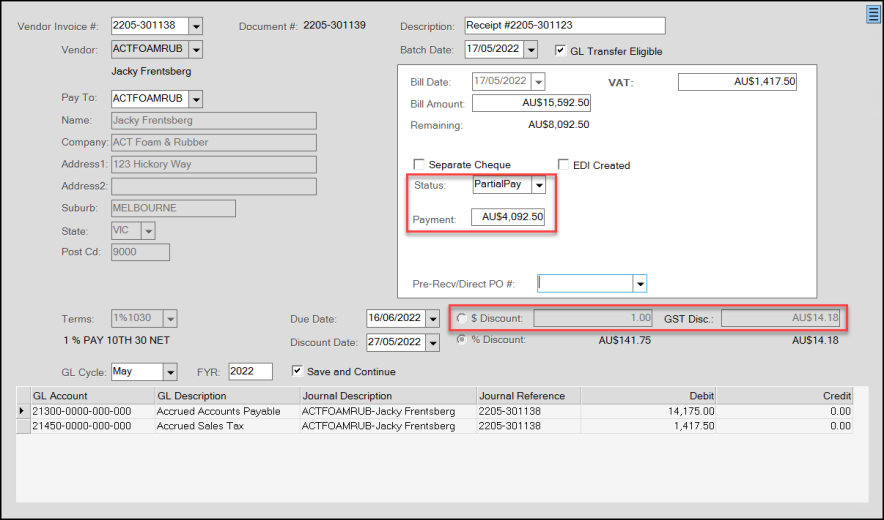

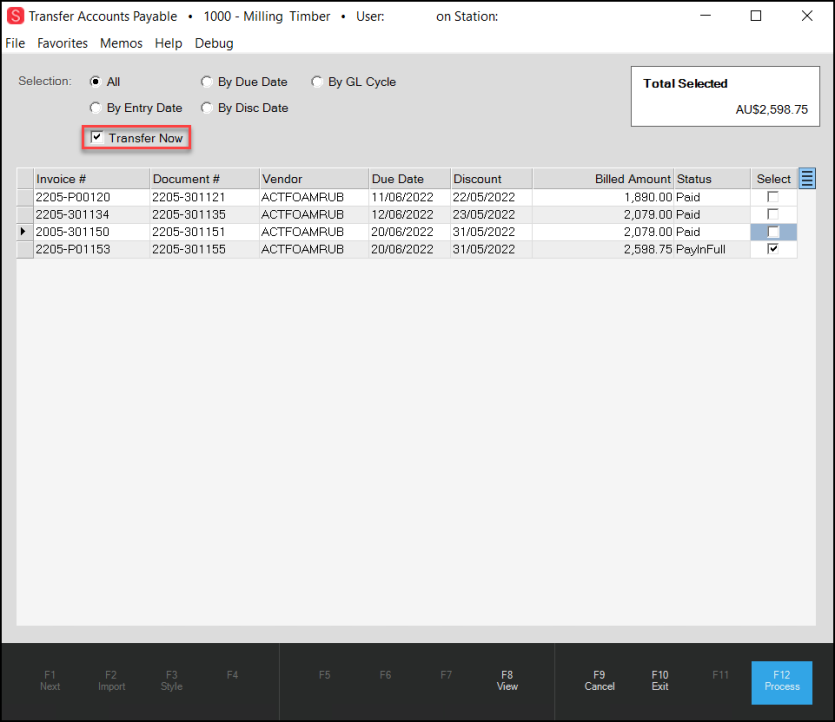

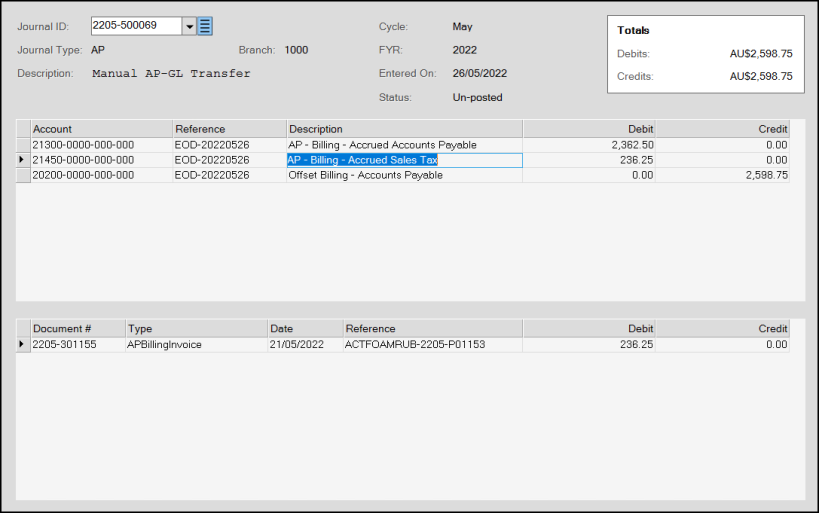

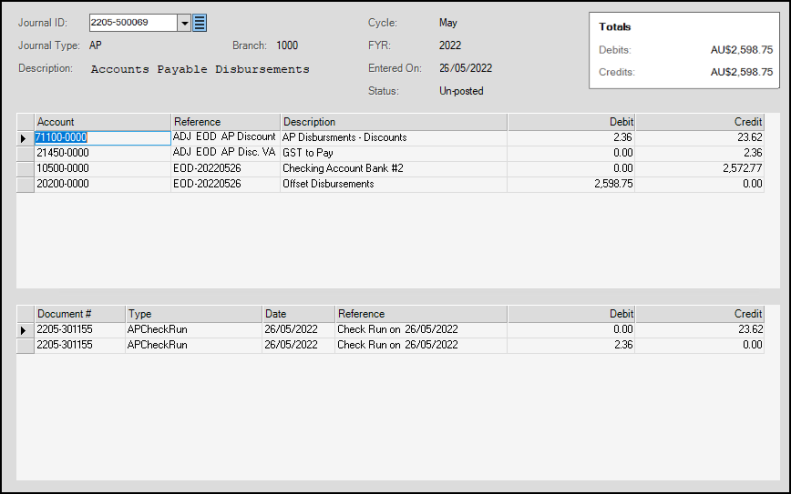

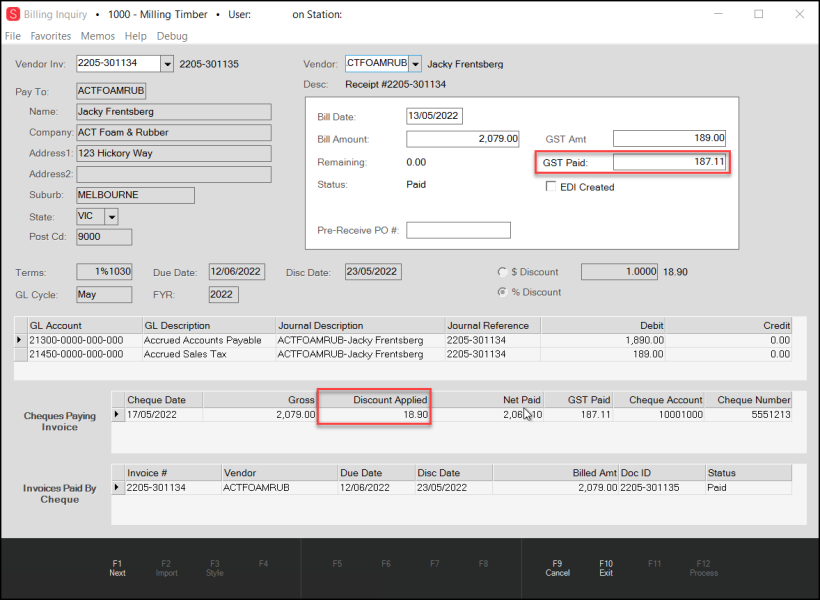

Applying VAT/GST Discounts in Payables

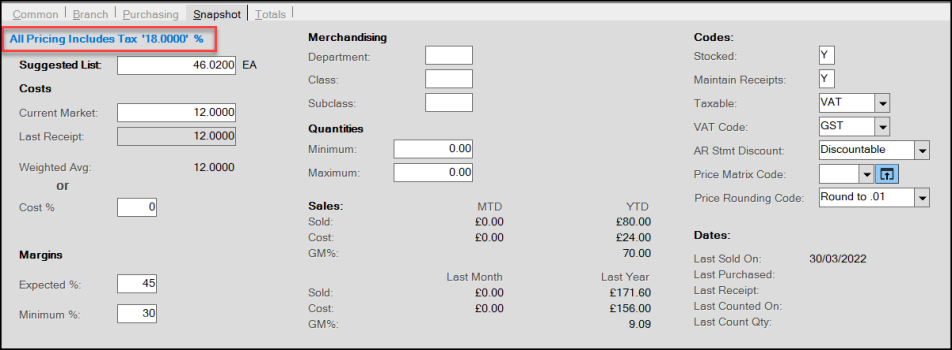

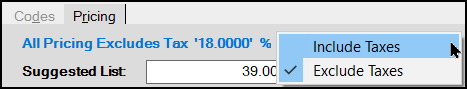

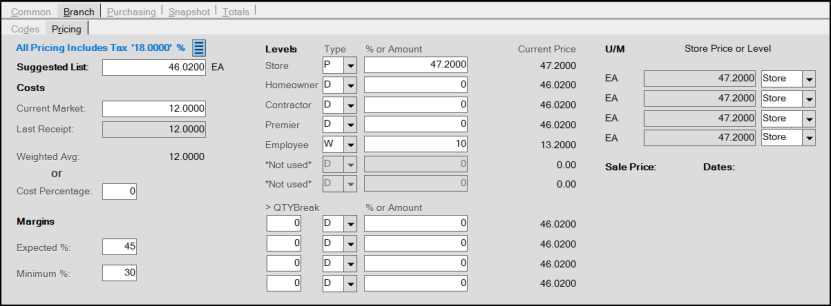

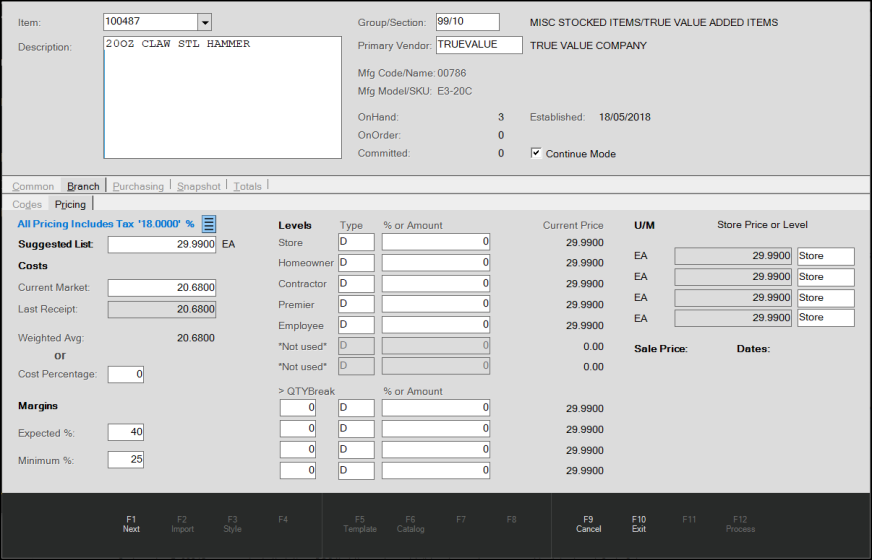

Including/Excluding Taxes on Items for GST Tax Regions (AU)

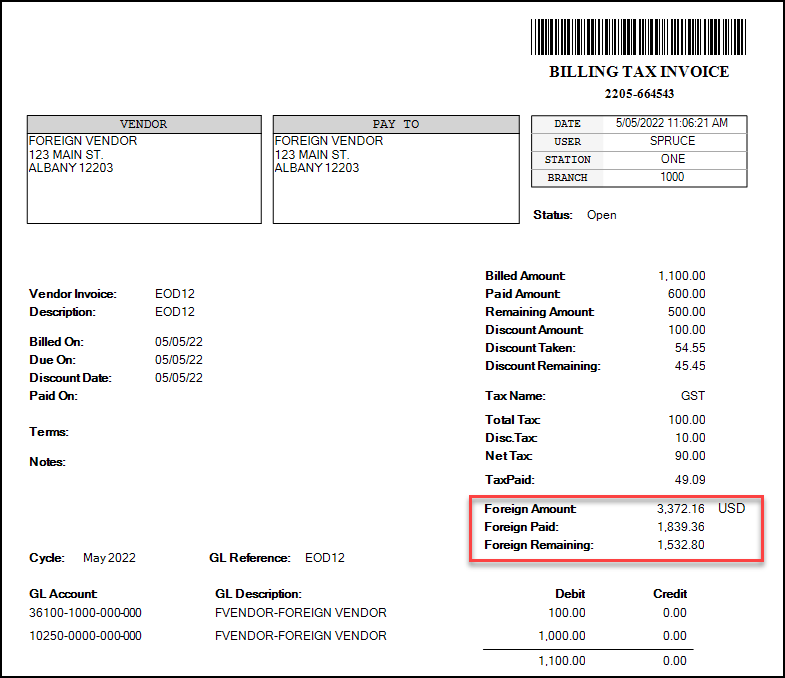

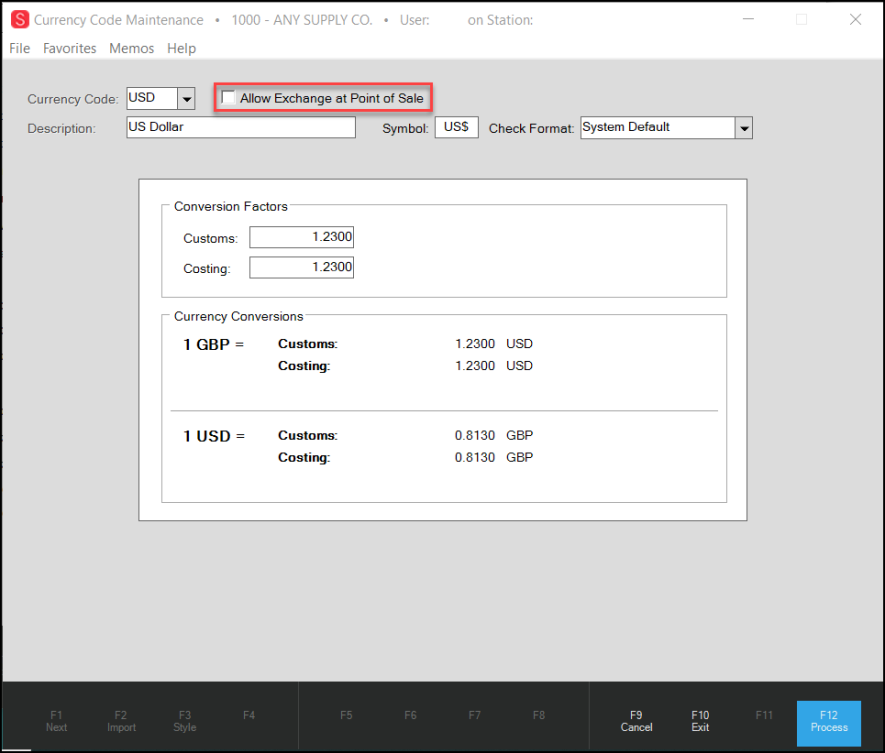

Support for Zero-Decimal Currencies Complete

Landscape Format Update for Tax Document Styles (VAT/GST)

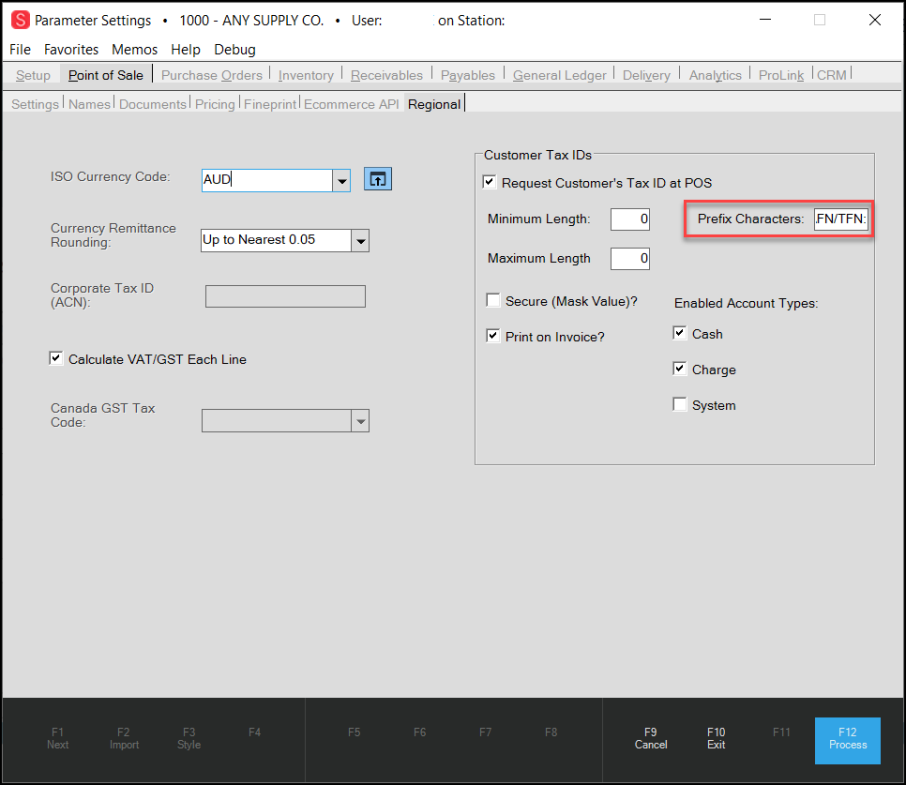

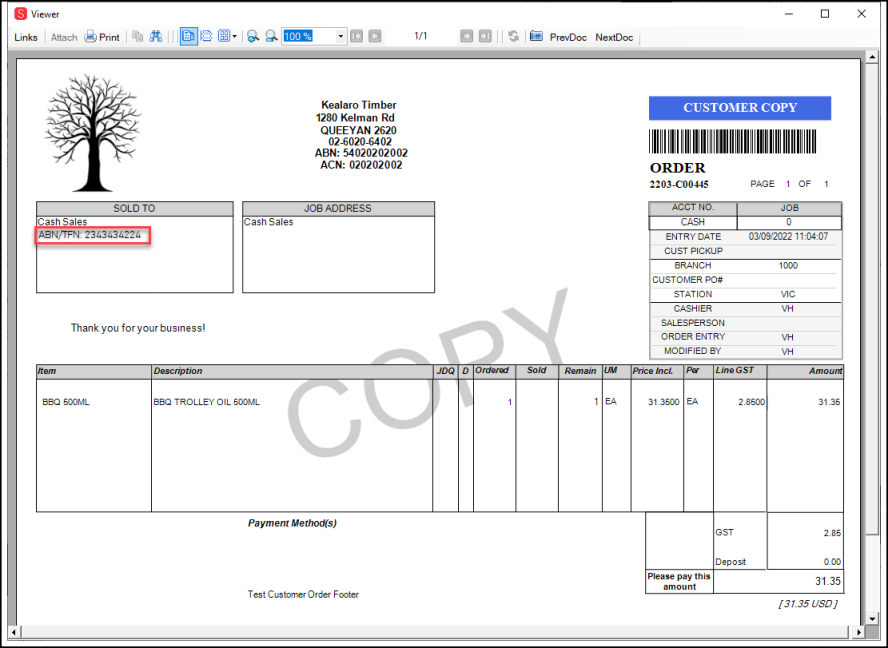

Updated Setting for Customer Tax ID Labels in Point of Sale Documents

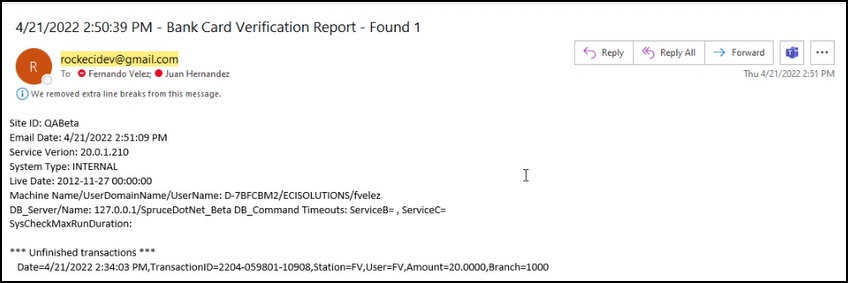

New: Cayan Genius 2.0 Alert Report

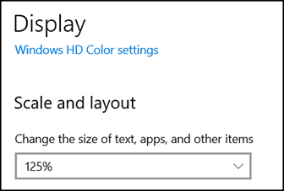

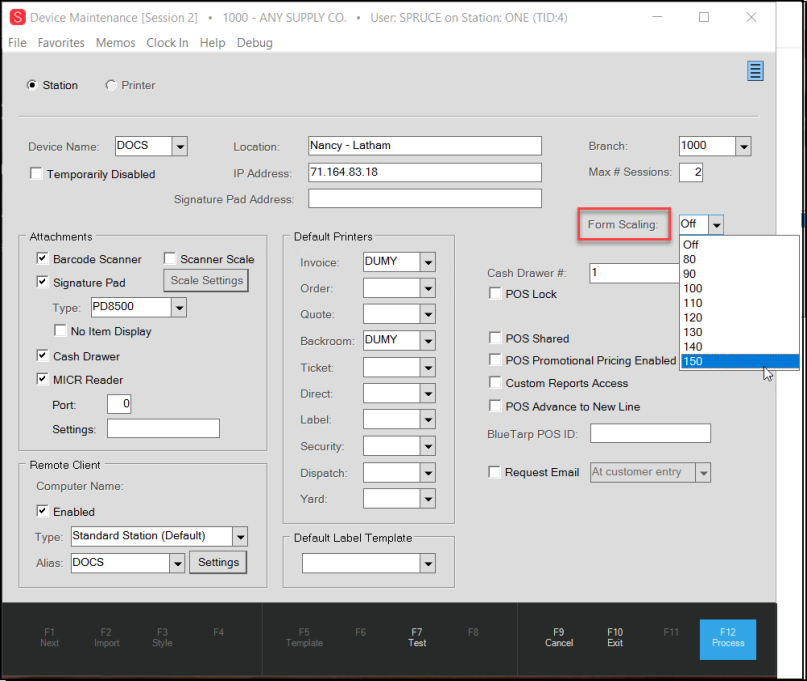

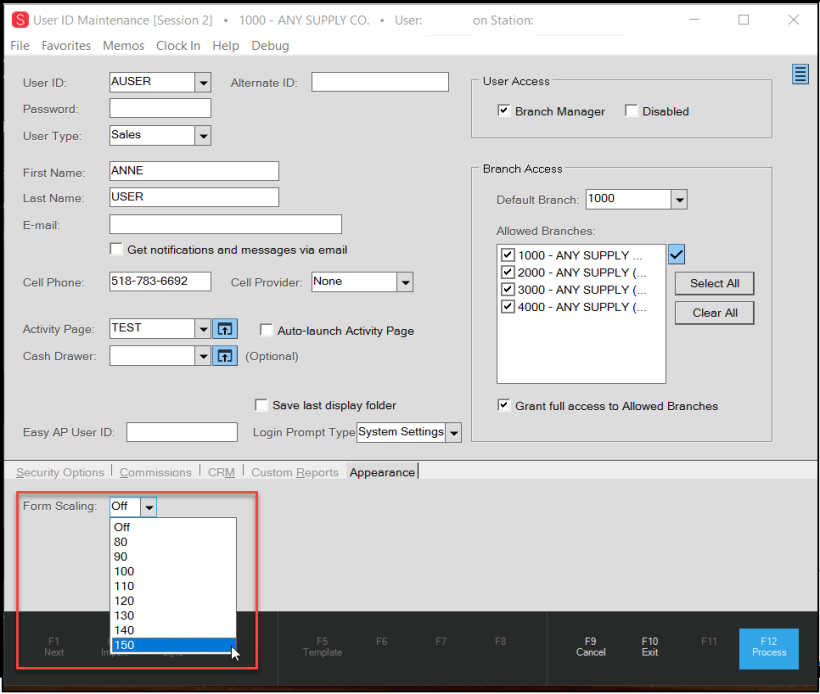

UPDATED: Using Windows Scaling to Manage Text Size in your Application

Point of Sale Updates

Quick Tender Feature Improves Point of Sale Transactions

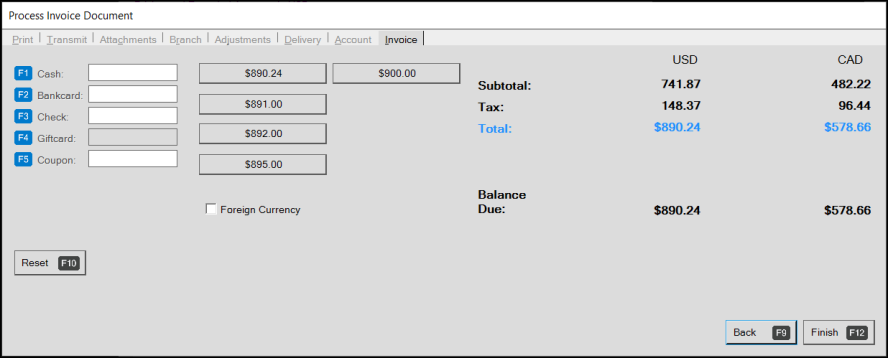

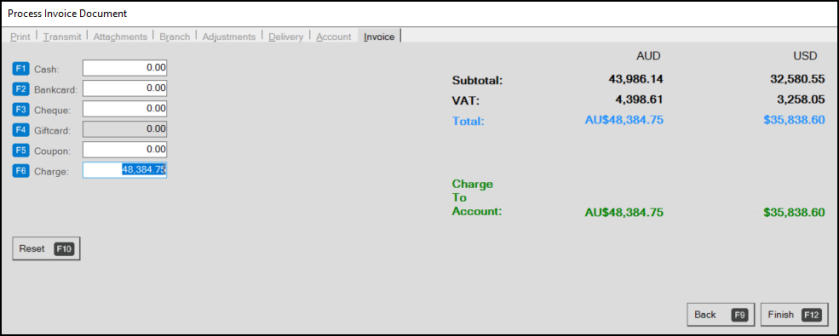

We have updated the Point of Sale Process Documents to make completing transactions faster. When you process the transaction, we have added function (FX) key options that populate the amount field with the balance amount. We use a Sale process in this example, but the Quick Tender buttons work the same way in Orders and Direct Shipments, and the F9 Back and F12 Finish buttons display this way in the other Point of Sale document boxes.

Select F10 Reset whenever you need to change direction after selecting a function key button.

Process Invoice Document with Quick Tender Options Displaying

You do not have to use the function keys to complete a transaction. You can still type the balance in the amount fields directly.

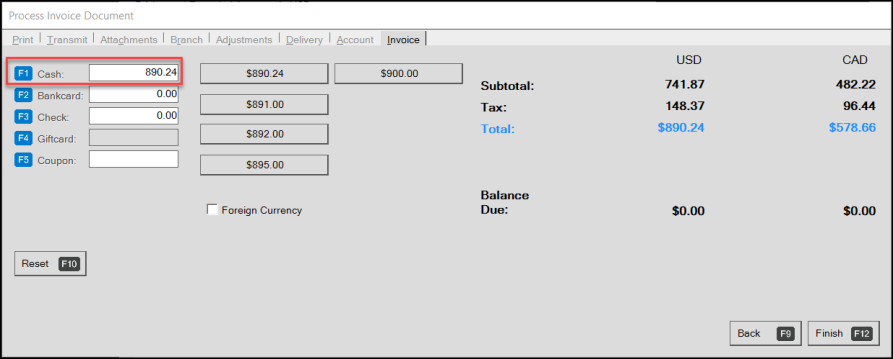

For example, to pay the entire balance in cash, select F1 Cash. The Cash field updates.

Process Invoice Document with Cash Entry Displaying

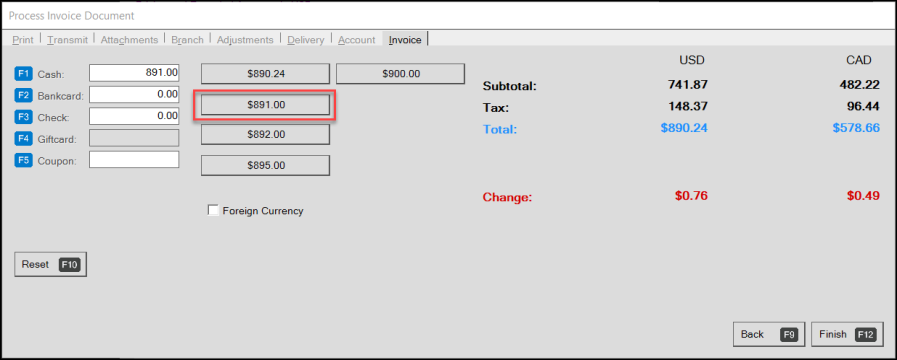

You can still use the Cash buttons if you prefer.

Process Invoice Document with Cash Buttons Highlighted

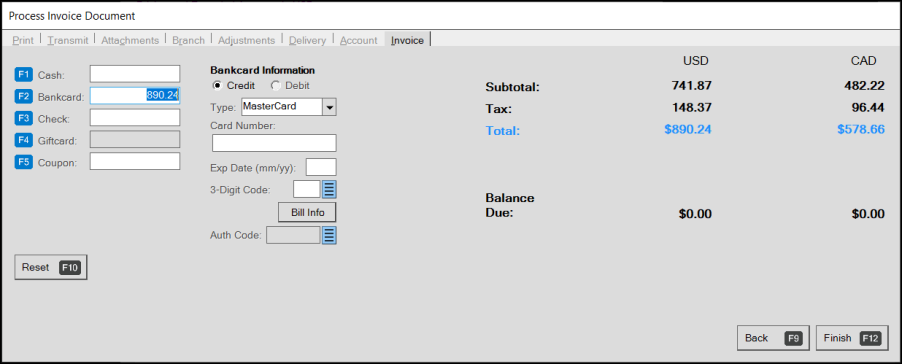

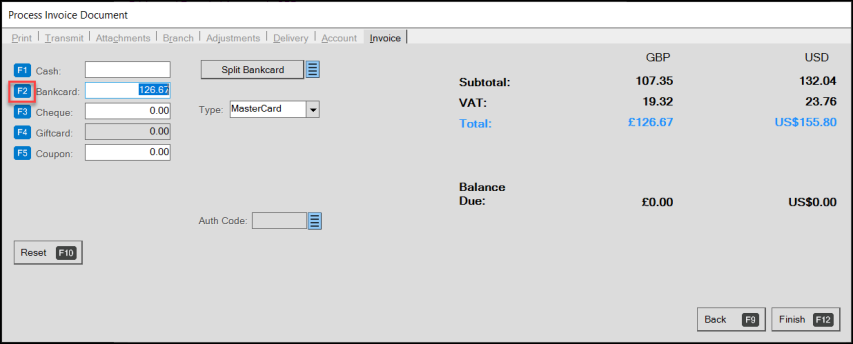

If the customer changes their mind and wants to pay by bankcard instead, select F10 Reset and then select F2 Bankcard. The Bankcard field updates with the total amount, as do the transaction fields.

Process Invoice Document with Bankcard Field Populated

Note: If the customer has a Blue Tarp account, you can still use the F6 Blue Tarp function key to update the transaction settings.

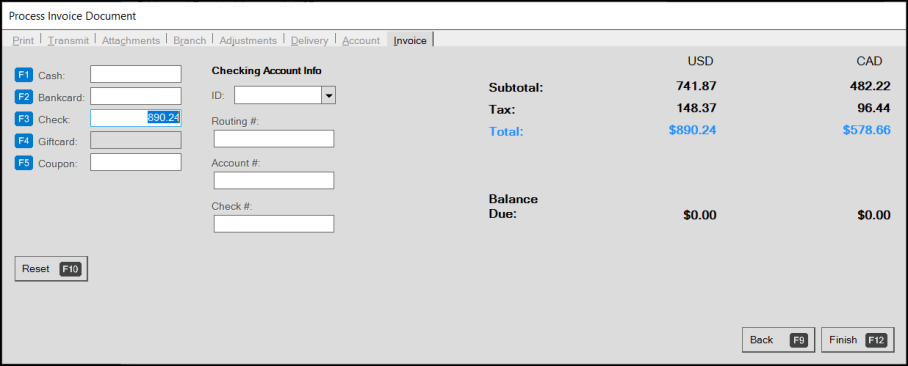

When the customer chooses to pay by check, select F3 Check to update the Check field with the balance.

Process Invoice Document with Check Field Populated

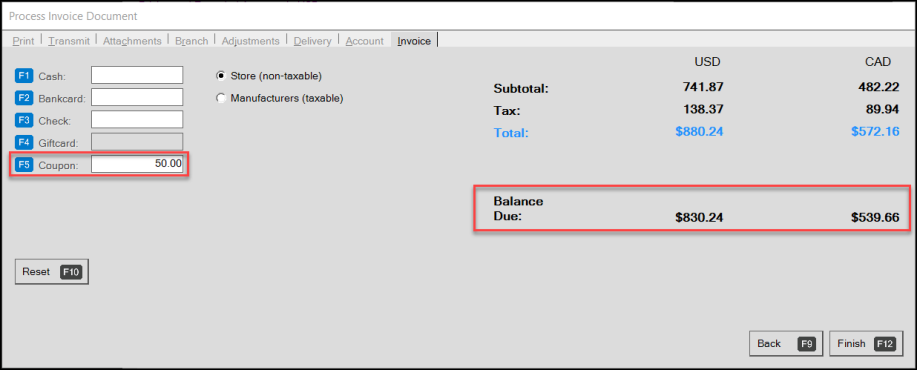

If the Customer remembers they have a gift card or coupon, select F10 Reset and select F4 Giftcard or F5 Coupon as appropriate.

Process Invoice Document with Coupon Field Populated

The application places the cursor in the field you selected. Enter the coupon/gift card value and select Enter. The application updates the transaction information to reduce the balance amount.

Note: If local taxes apply to the coupon or gift card, the application updates the tax amount, so the appropriate tax amount contributes to the balance due.

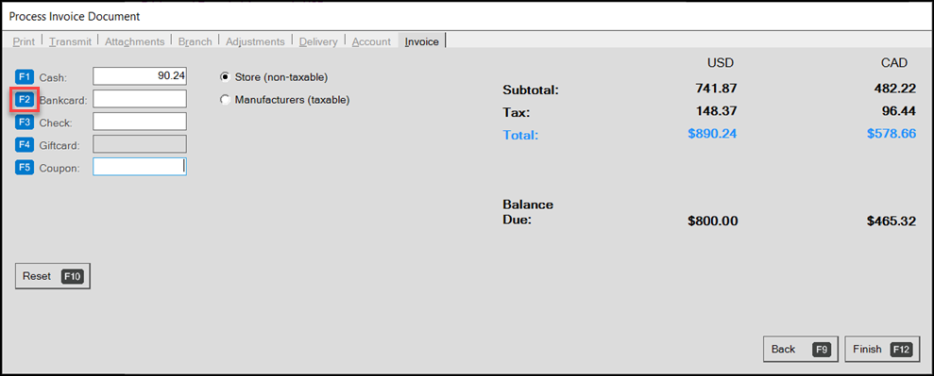

If the customer prefers to pay with multiple tenders, type the amount of the first tender in the appropriate amount field. The application updates the balance amount. Then, select the appropriate function key to update the other tender field with the remaining balance.

Process Invoice Document with Multiple Tenders In Progress

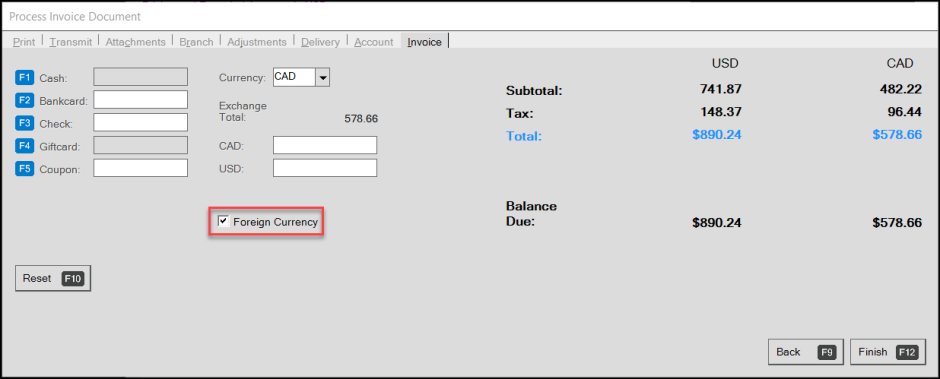

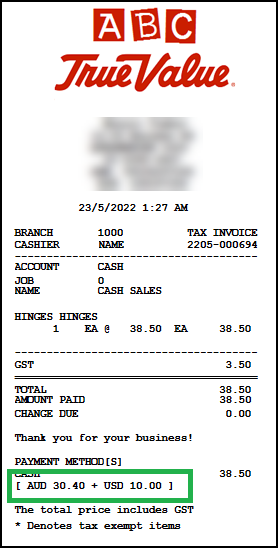

If the customer prefers to pay in a foreign currency, when you enter the document, select the Foreign Currency check box and use the same rules to process the transaction as you normally would. Cash rounding and the other regional settings still apply to these transactions.

Process Invoice Document with Foreign Currency Check Box Highlighted

To return to the transaction form, select F9 Back. Select F12 Finish to process the payment.

New: Cayan M400 Devices Available for Point of Sale Processing

B-103796 – You can process your transactions through the application using the new Cayan M400 devices. You can run these devices via ethernet, Bluetooth, or Wi-Fi and USB host and client connections are available. It has more memory than the MX915 and has the same payment acceptance capabilities. It has a faster processor and enhanced security. These devices will be available through ECI very soon.To set up the M400 device, you need admin rights.

Note: We are in the process of upgrading existing Cayan Point of Sale devices to support the Genius 2.0 standard. If you use these devices, you should have received a FAQ document earlier this year that explained this process. After you upgrade to the 21 release, you are eligible for this upgrade. To learn more about this program, email your questions to GeniusUpgradeRequest@ecisolutions.com.

To set up a station with an M400 device:

1. From the Main Menu, choose Maintenance > Database > Devices to display the Device Maintenance form.

2. From the Device Name list, select the station you are setting up.

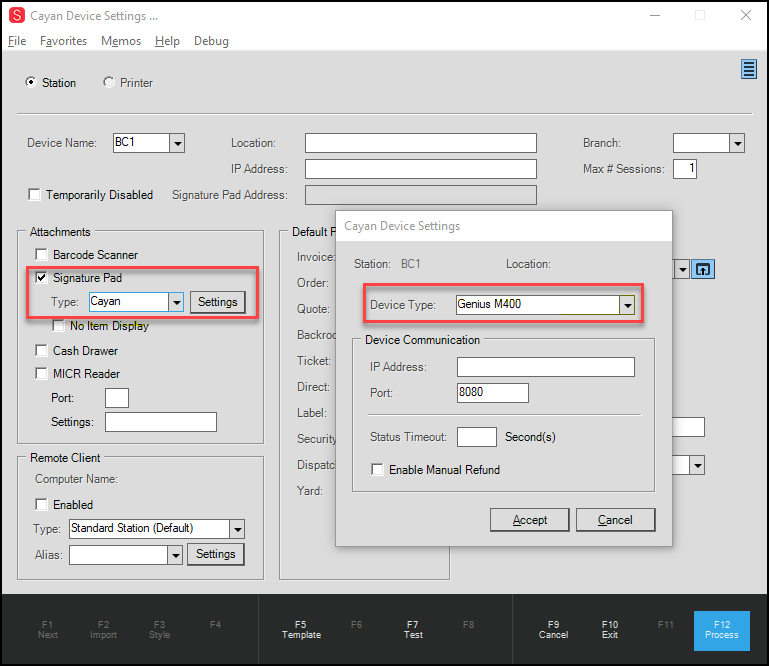

3. Choose the Signature Pad check box and from the Type List, choose Cayan.

The Cayan Device Settings box displays.

Cayan Device Settings Box with Genius M400 Device Type Entered

4. From the Device Type list, select Genius M400.

5. In the Device Communication box, enter the station's IP Address and Port information.

6. In the Status Timeout field, enter the status time out for this device.

The application sets a 60 second time out if none is selected.

7. Select the Enable Manual Refund check box if it applies. (Not Required)

8. When you have completed your entries, click Accept.

9. Choose Process (F12) to save your station changes.

Cayan: Changes to Manual Entry Options for Genius 2.0 Devices

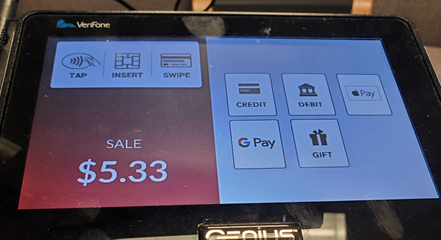

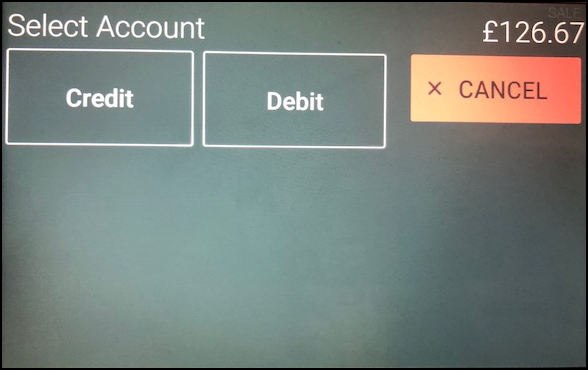

B-104186 – When processing card options on a Cayan Genius 2.0 device, you need to be able to distinguish among debit, credit, and gift cards for Point of Sale transactions. To allow your customer to enter the card information manually, we have added the following process. The cashier must have sufficient permissions to complete manual card processes and be connected to a Genius 2.0 device. This process is slightly different from the one for Genius 1.0, so we show the differences for clarity.

To pay by credit card using the manual entry process:

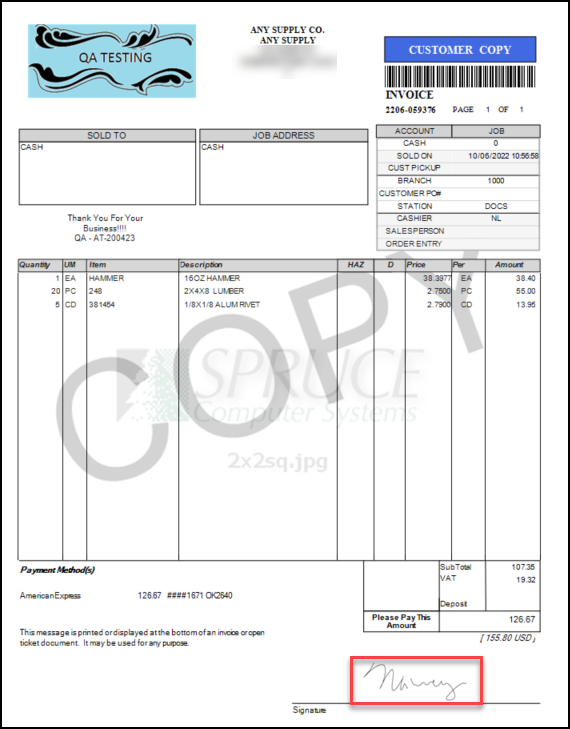

1. Complete the Point of Sale entry process as you normally would and choose Process (F12) to process the payment. The Process Invoice Document form displays.

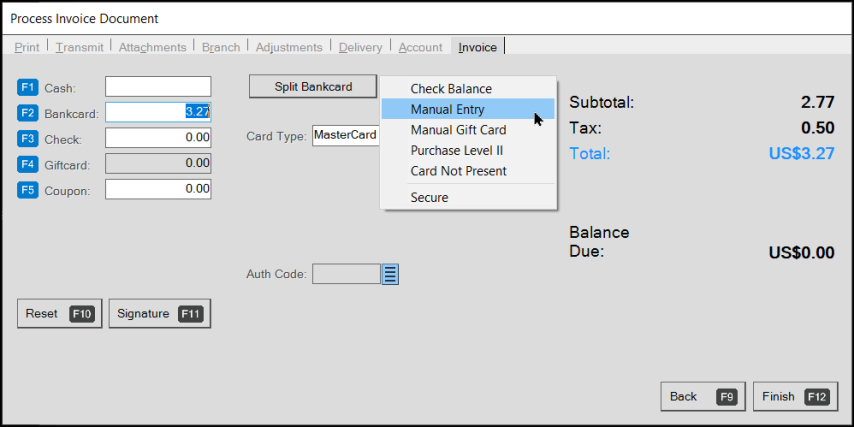

2. Choose Bankcard (F2) to add the total to the Bankcard field and display the Card Type options.

Process Invoice Document with Context Menu Option Manual Entry Selected

3. Beside the Split Bankcard button, choose the Menu Marker  and select Manual Entry from the list.

and select Manual Entry from the list.

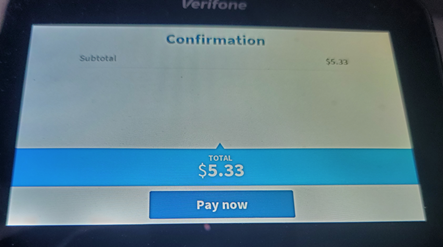

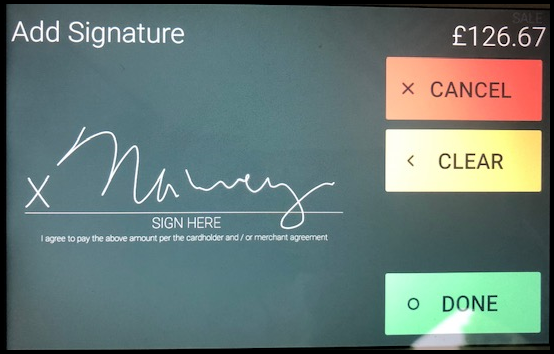

4. Choose Finish (F12). The Genius 2.0 device displays the total with a Pay Now option.

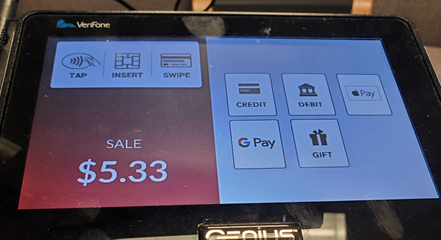

Genius 2.0 Device with Pay Now Button Displaying

Genius 1.0 Device with Payment Amount Version

The Genius 1.0 device would have displayed the total with all payment options.

5. For Genius 2.0 devices, ask the customer to tap the Pay Now option.

The Genius 2.0 device then prompts the customer to enter their card number, their expiration date, their CVV code, and their postal code. When they have completed these entries, the Cayan device validates the entries and completes the transaction.

To allow the customer to pay for the transaction using a manual entry gift card:

1. Complete the Point of Sale entry process as you normally would and choose Process (F12) to process the payment. The Process Document form displays.

2. Choose Bankcard (F2) to add the total to the Bankcard field and display the Card Type options.

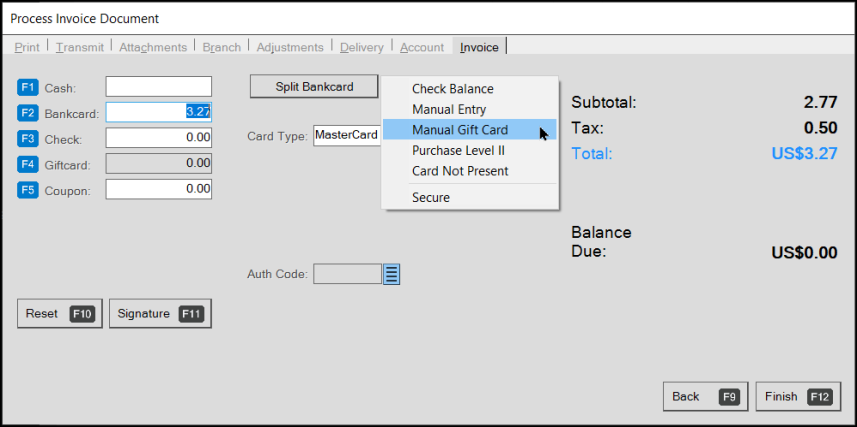

Process Invoice Document with Context Menu Option Manual Gift Card Selected

3. Beside the Split Bankcard button, choose the Menu Marker  and select Manual Gift Card from the list.

and select Manual Gift Card from the list.

4. Choose Finish (F12).

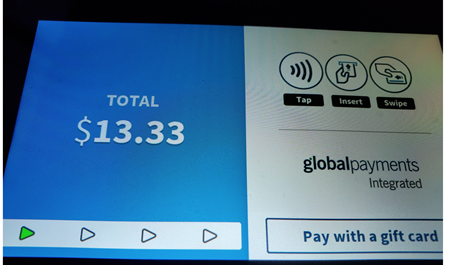

The Genius 2.0 device displays the total with a Pay with a gift card option.

Genius 2.0 Device with Gift Card Prompt Displaying

Genius 1.0 Device with Gift Card Version

The Genius 1.0 device would have displayed the total with all payment options, including the Gift Card option.

5. Prompt the customer to tap the Pay with Gift Card option.

The Genius 2.0 device then prompts the customer to enter their gift card number in the field provided.

When they complete this entry, the device validates the gift card entry and processes the transaction.

Adding Delivery/Cartage Fees to Point of Sale Transactions

B-98793 – We developed the Aggregator process to help you group-like-materials to calculate delivery costs, to quantifying assembly work, to calculate total coverage for paint/wallpaper/driveway sealer, and any other process where grouping materials is useful.

In this release, we focused of using the Aggregator process to calculate delivery charges for your inventory items at Point of Sale according to the items your customer has purchased. The Aggregator calculates an item’s multiplier based on some physical aspect of the item (such as number, weight, length, area, volume).In a transaction, the application links these multipliers to an aggregator SKU, which adds delivery (and potentially other) charges based on the measurement values of the sold product (s). You can use your current delivery charge calculation method to define these costs.

For example, to calculate the delivery charges for an order that has:

-

Lumber/Timber, you could use a lumber/timber aggregator based on the number of board feet/meters, number of pieces, weight, etc.

-

Sheet Goods, you could use a sheet goods aggregator based on square feet/meters,

-

Sand/gravel, you could use a volume-based aggregator based on weight or cubic feet/meters

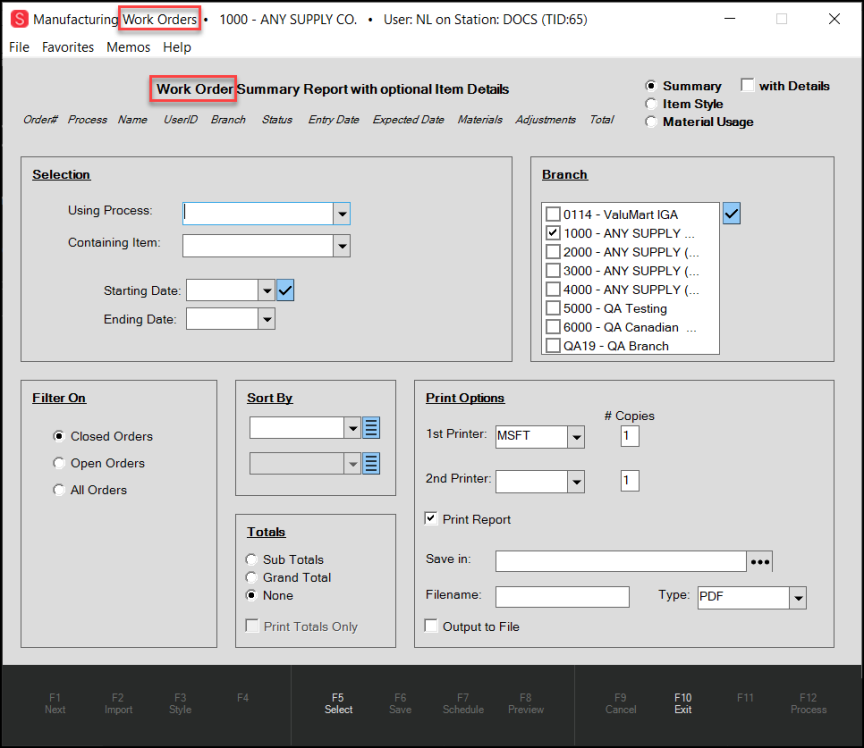

Each of these aggregators would appear separately in the data grid and show your customers the cost of transporting each type of item. You can use the Aggregator delivery calculation feature in Sales, Orders, Quotes, Direct Shipments, Open Tickets, and Charge Returns. You cannot use aggregator SKUs in Manufacturing Work Orders, Purchasing, or Inventory Transfers at this time.

You can also use Aggregators for non-delivery processes. We focus this section on calculating delivery costs.

IMPORTANT: You are responsible for defining the relationship between the linked items and the aggregator SKU because you know your inventory best. You can use your current method to charge for delivery of materials. The delivery charges for the inventory items you link to the aggregator SKU will be a sum based on multipliers assigned to those items. The application calculates the total based on the quantity and units of measure at the Point of Sale. To set up your inventory items in the Aggregator, see Setting up the Aggregator to Quantify Inventory. The setup must be complete before you can create the aggregator SKUs.

Understanding the Aggregator Type and Method

Aggregator SKUs use a Type to quantify the delivery size and a Method to specify how to handle the charges for the load back and forth. There can be several similar Aggregator SKUs that represent the same items but for different delivery conditions.

Aggregator SKUs allow your business to group items you need to deliver/pick up by Type based on their physical characteristics using:

-

Total Quantity for any items whose delivery charges would be determined as a piece/box/each.

-

Total Lineal (Length) for any items whose delivery charges would be determined by their length.

-

Total Area for any items whose delivery charges would be determined by their area.

-

Total Volume for any items whose delivery charges would be determined by their volume.

-

Total Weight for any items whose delivery charges would be determined by their weight.

Aggregator SKUs use the Method to specify whether/how to account for the delivery/pickup of the transported items by:

-

Positive Quantity > Use this method when you are delivering items only or you do not intend to charge for pick up (negative quantities).

-

Negative Quantity > Use this method when you are picking up items only or you do not intend to charge for delivery (positive quantities).

-

Absolute Quantity > Use this method when you are charging for item delivery and pick up.

-

Net Quantity > Use this method when you are charging for item delivery and crediting the account for pick ups.

Your inventory is assigned to aggregator SKUs so their quantities are included in the deliver charge calculation. So, after you add the items to the data grid, and add the aggregator SKU(s) for those items, the application can calculate a default delivery charge. You can adjust this amount in the Point of Sale when necessary.

Important Aggregator Notes

-

The application applies all multipliers to the BASE measure quantity of the items in inventory, which may not match the measure listed for the quantity in the transaction.

-

Even though aggregator records are stored in the Inventory area, the application handles them like adjustment codes, so they don’t appear on inventory reports.

-

You cannot use Aggregator assignments for e-Commerce sales at this time.

-

After you create an aggregator SKU and use it in Point of Sale, you cannot delete it or merge it.

The supported use for this feature is for calculating cartage fees and other charges associated with delivery and shipping. You may use this feature for other purposes in the future, but we cannot anticipate every need in this regard.

WARNING: In addition to the Inventory and Point of Sale setup, you need to define detailed general ledger mapping for the inventory to record aggregator SKU use financially. The application does not perform this work automatically.

Using the Aggregator SKU to Calculate Delivery (Cartage) Charges

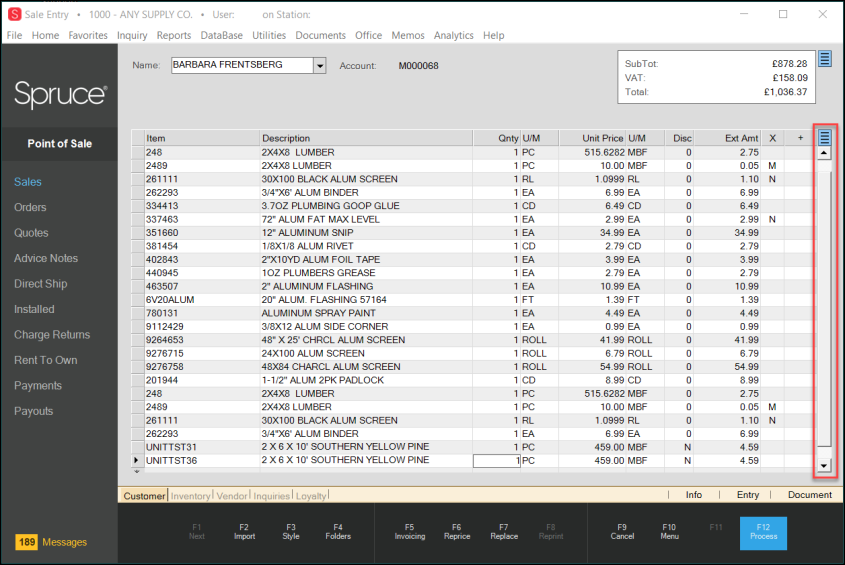

B-98801, B-98802, B-98803, B-98804, B-98805, B-98808, B-98809 – After you add the customer’s items to the data grid, you can add the corresponding aggregator SKUs. Your customer can see the charges by item type, and the Point of Sale documents also display the delivery/cartage charge information. You can apply aggregator SKUs to sales, orders, quotes, direct shipments, open tickets, and charge return transactions.

You cannot enter the same aggregator SKU to the data grid more than once in a single transaction. If you enter items into the data grid for delivery without adding their defined aggregator SKU(s), a message displays pointing out which items are missing their SKUs.

To add Aggregator charges to a transaction:

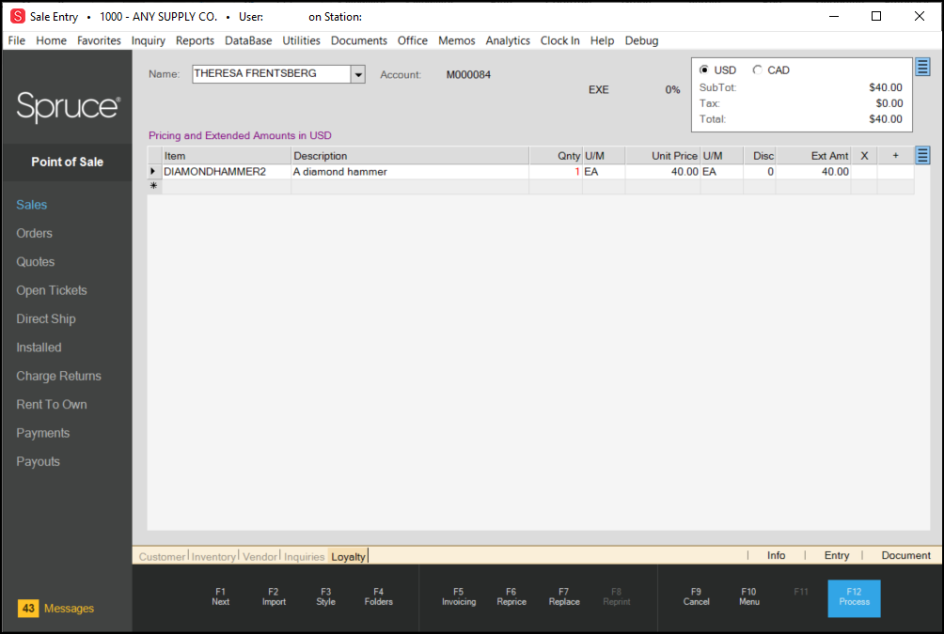

1. From the Main Menu, go to Point of Sale, choose the transaction type, and add the customer’s items to the Point of Sale data grid as you usually would.

2. To choose the appropriate aggregator SKU(s), consider the aggregator SKU(s) make sense:

-

What materials determine the aggregator SKU(s) I need?

For example, for SKUs based on the type of material (Hardwood, Lumber, Sheet Materials, etc.), look for those types of SKUs.

-

What type of delivery charges determine the aggregator SKU(s) I need?

For example, is this a delivery only, a pickup only, are we charging for delivery and pickup, or are we charging for delivery and crediting for pickup?

3. In the data grid, enter the appropriate aggregator SKU(s) based on your assessment. The Qnty column updates to show the aggregator total based on the item quantities associated with that SKU. You can update this quantity manually if you need to.

Note: If you manually change the aggregator SKU quantity and then later update the item quantity values in the data grid, the application recalculates the aggregator SKU value and replaces your manual entry. For this reason, it is best to add the aggregator SKUs at the end of the data grid list.

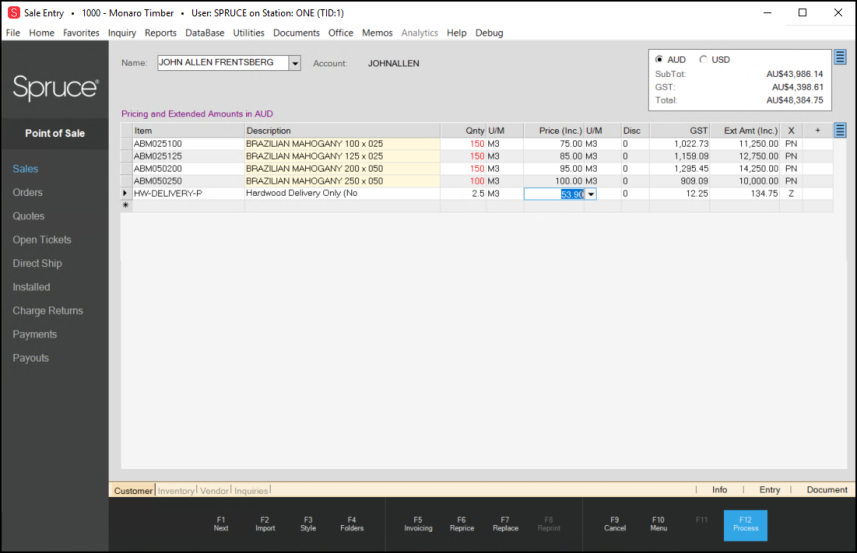

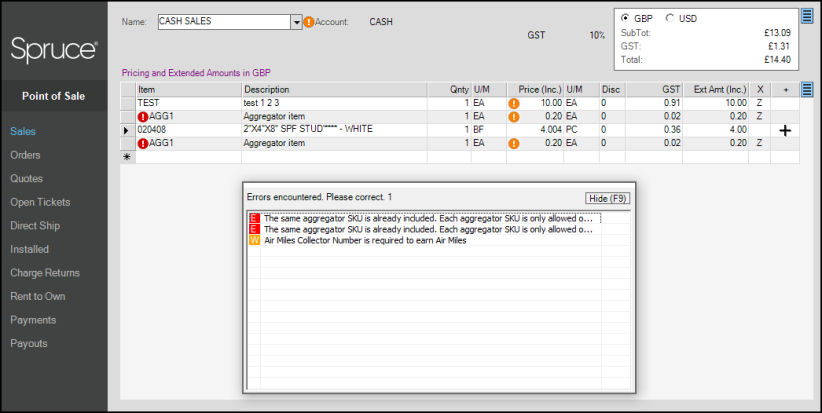

Sale Entry Form with Aggregator SKU Entered

When you make changes to the items in the data grid, such as adding new items, changing the quantities of existing items, or removing items from the data grid, the application updates the aggregator SKU(s) to reflect any changes that affect the multiplier value.

Note: Repricing items in the data grid does not affect the pricing in the aggregator SKU. Only changing the item quantities or adding new items change the aggregator SKU values.

4. In the Price field for each aggregator SKU, review the default price. Continue based on what you decide:

-

If you want to keep this price, for example, to a round number, continue to the next step.

-

If you want to change this price, enter the unit price you want to apply to the aggregator SKU and press Enter.

The Extended Amount field updates with the Aggregator charge.

Note: You can change this value to arrive at the amount you want display.

5. When you import a quote or an order into the data grid, the application preserves the original quantities and amounts from the Point of Sale record.

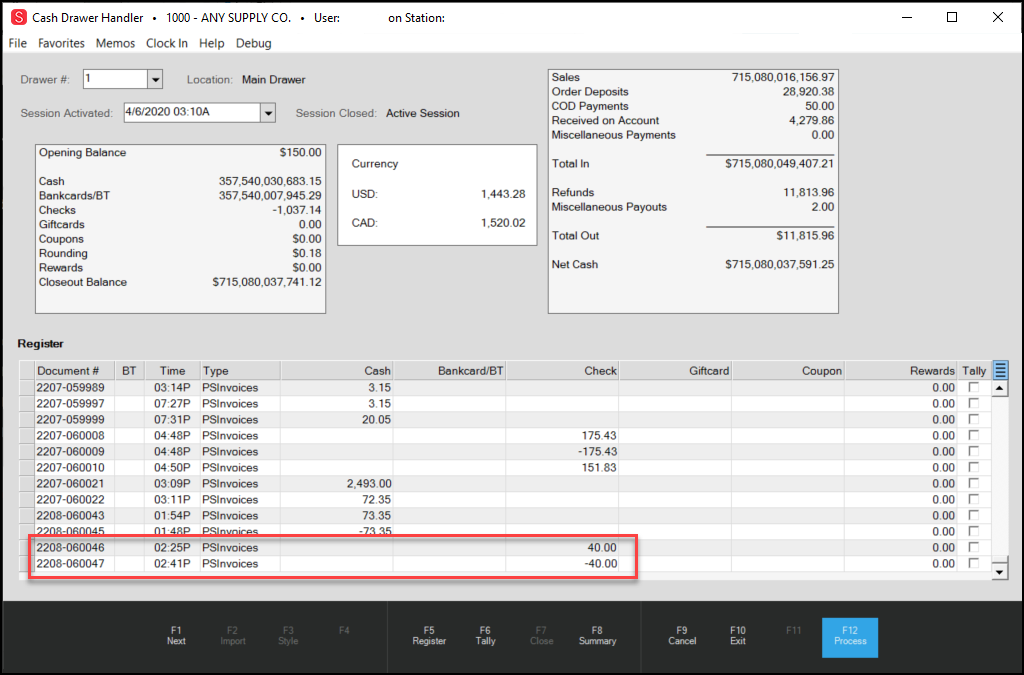

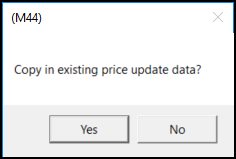

If you reprice the SKU entries in the data grid (that is, you change the SKU price from the amount listed in the order or quote) or change the quantities of the items in the data grid, the application will prompt you to choose whether to update the aggregator SKU.

-

If you choose Yes, the application updates the aggregator SKU with any new values that apply.

-

If you choose No, the application leaves the imported quantities and items as they are.

6. When you are happy with the Delivery (Cartage) amount, select Process (F12) to process the transaction. If the aggregator SKU(s) are not at the bottom of the list, the application moves them there.

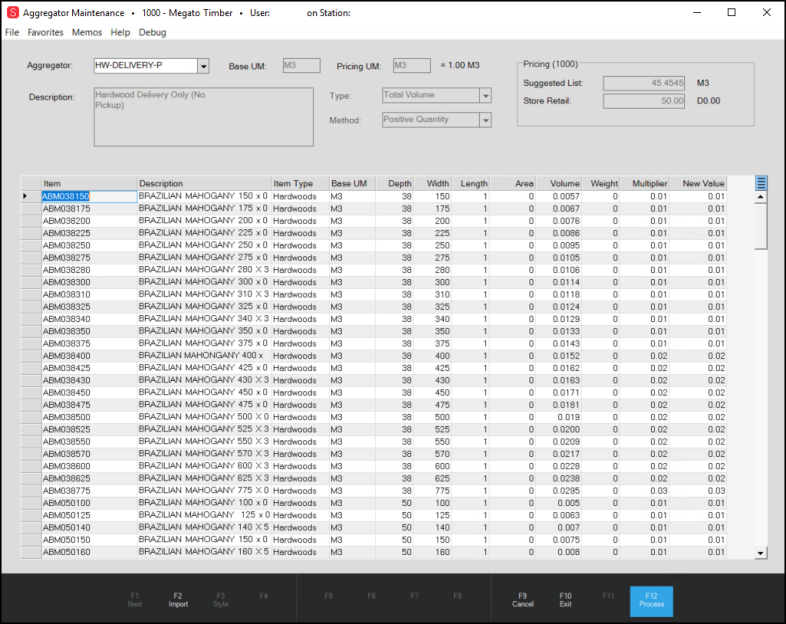

The application evaluates the items in the data grid to determine whether there are duplicate items, duplicate aggregator SKUs, or to check if there are deliverable items not listed in the aggregator SKUs. When the application finds any of these conditions, a task list displays, listing each issue based upon the severity. The application shows an icon in the data grid beside the items you need to correct / remove.

Sale Entry Form with Aggregator Error and Warning Messages

Note: Sometimes, you cannot tell that items in material lists (BOM) are part of an aggregator calculation. The Aggregator still considers them part of the delivery and includes these items in its calculation, even if, due to Bill of Materials setup, the items do not display individually in the data grid.

7. After you correct any errors and the transaction can proceed, select Process (F12) to display the Process Invoice Document form, which displays the transaction total, including tax.

8. When applicable, complete the Delivery tab tasks and select Finish (F12) to process.

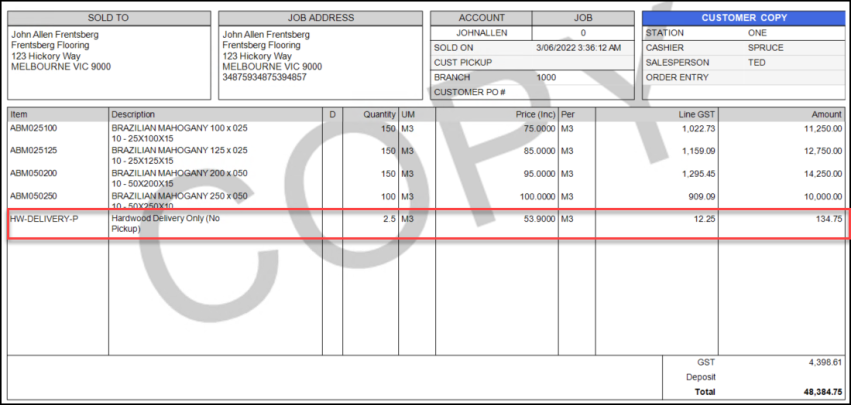

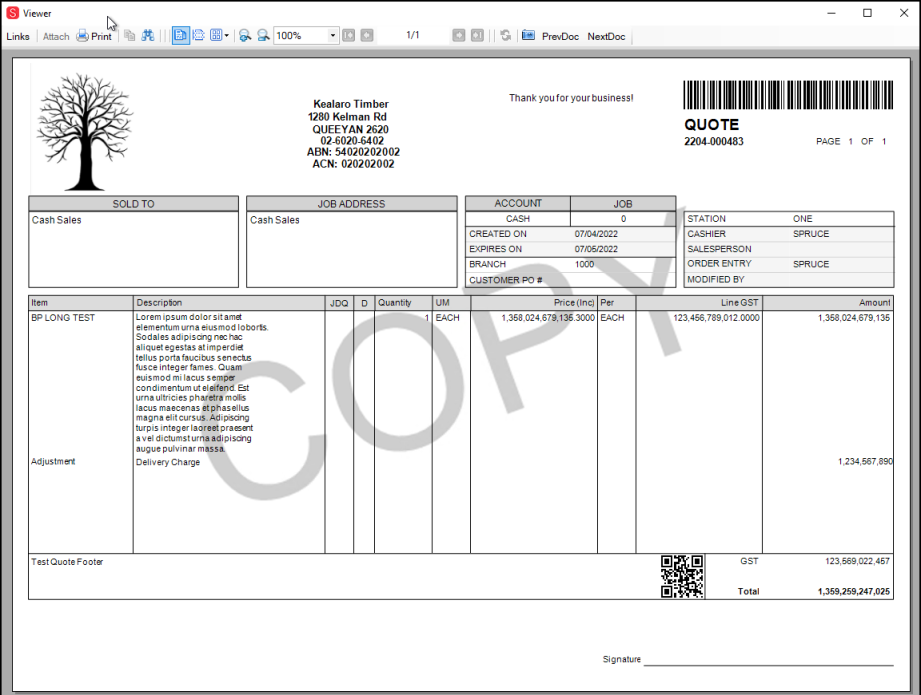

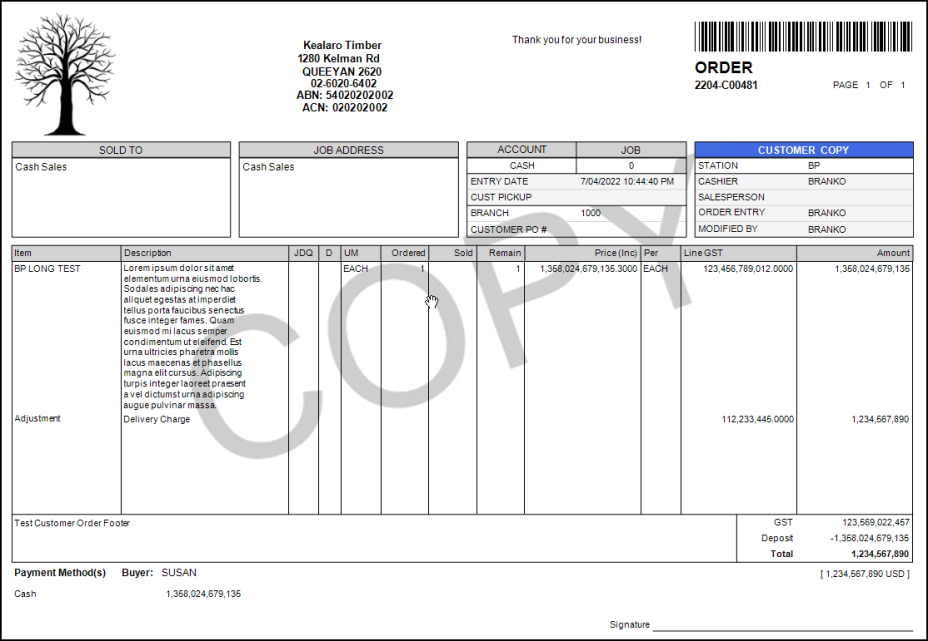

9. Check the printed document or go to Documents and look up the transaction to view the itemized delivery information.

Invoice with Delivery Charge Highlighted

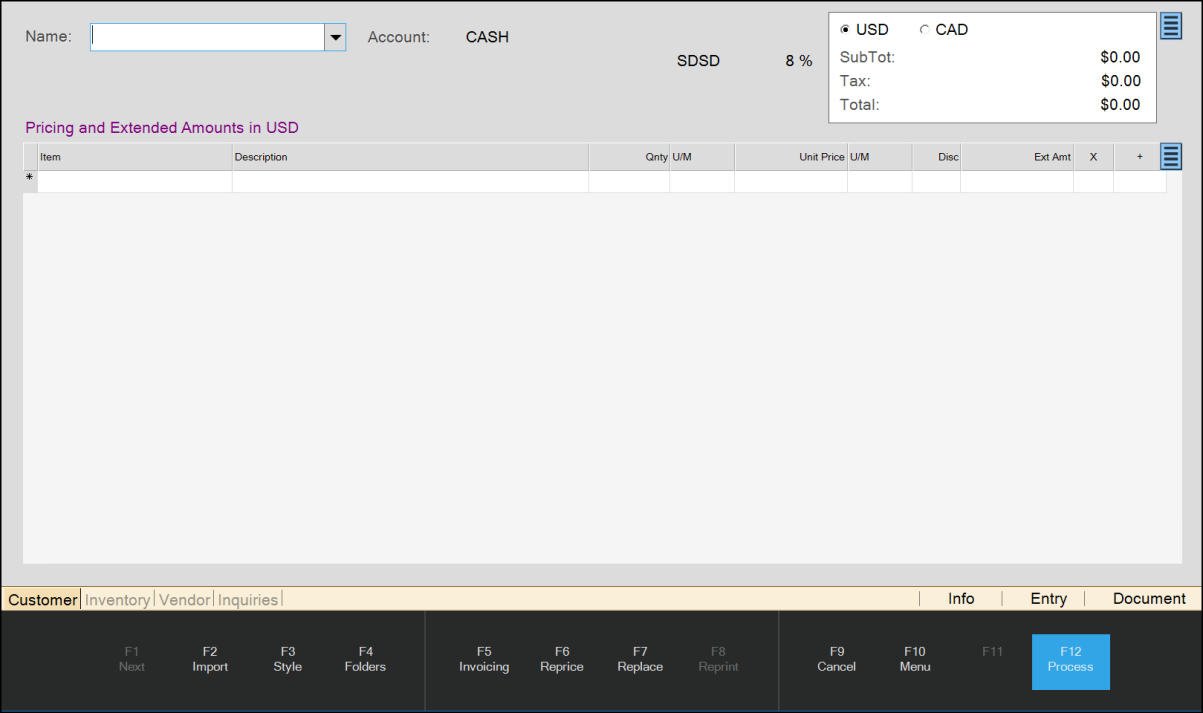

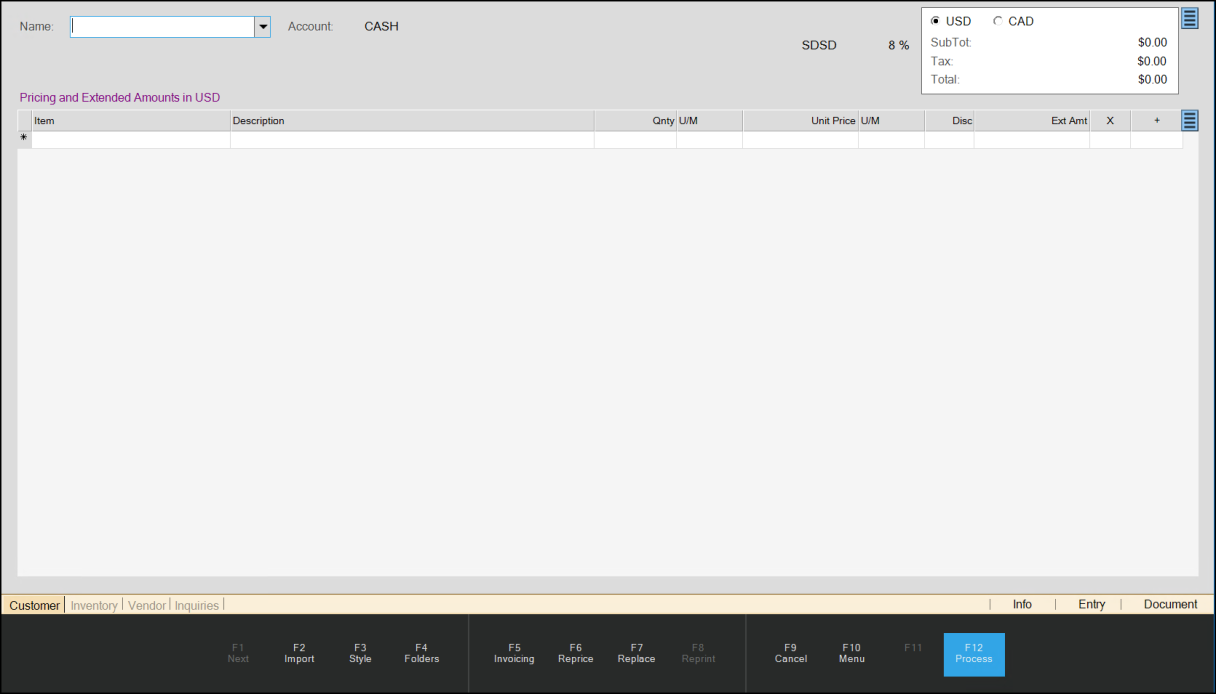

Application Resize Focuses on POS and Utility Forms

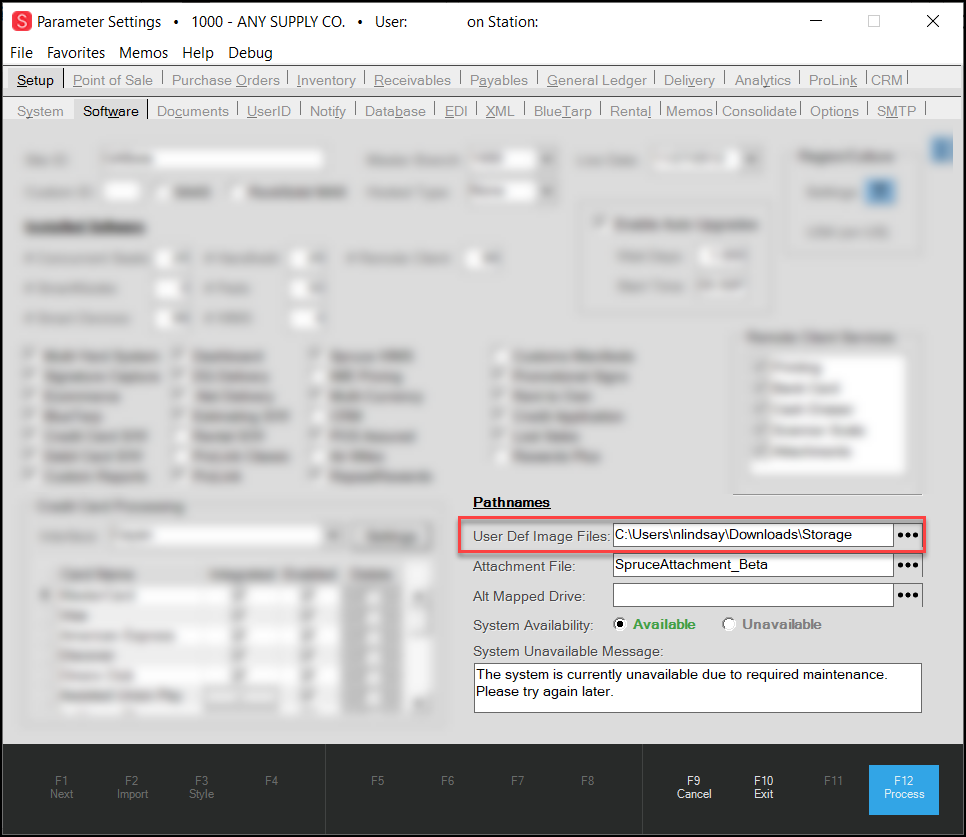

B-95903, B-95904, B-95906, B-96899, B-96902, B-96904, B-96912, B-96915, B-96917, B-96918, B-96919, B-96921, B-96925, B-97867, B-97868, B-97869, B-97870, B-97878, B-97880, B-97881, B-101235 – In this release, we have completed work on the forms in Point of Sale, the Delivery Utilities, the Accounts Payable Utilities, the General Ledger Utilities, the Miscellaneous Activities, and the Accounts Receivable Utilities. We have updated the amount fields in the folders in Point of Sale, Inventory, Accounts Receivable, Purchasing, Delivery, Accounts Payable, and General Ledger. This meant expanding many of the fields that display cost and other financial amounts to provide enough space for local currency values and labels. In most cases, we expanded the amount fields to 24 characters. In AP Billing, we also expanded amount fields in the Recurring Billing Maintenance form to ensure successful GL accounting management.

General Ledger Updates

New Protections for General Ledger Chart of Accounts

B-56535, B-100644 – When you are looking at the Chart of Accounts, you want to make sure that someone is not deleting an account, even if the account only has a beginning balance. We have added new protection for General Ledger accounts that prevents the deletion of any account that contains a beginning balance.

The criteria for this protection include the following General Ledger account types:

-

All accounts included in the System Journal Mapping

-

All accounts included in the System Journal Mapping

-

All accounts in the Detail Mapping

-

All accounts in the Branch Detail Mapping

-

Any account that has a BEA year

-

Any account that has any journal entries, regardless of posting status that are linked to journals

When you attempt to delete an account that matches these criteria, the application displays an error message:

-

Account may not be deleted - Detail mapping contains account

We have also added additional task list validation for Manual Journals to warn users when they are adding journal entries to "protected" accounts. The application expects these accounts to match other detailed data maintained by your ECI application. Making changes to these account balances outside of normal application activity can cause discrepancies between the recorded activity and the expected ledger balances. These types of problems can be difficult to track down later.

In General Ledger, when you make journal entry changes to any of the following accounts and select Process, a task list displays to allow you to assess whether to make those changes:

-

Payables: A/P Accrual Account (Billing), Accounts Payable (Billing), and Accounts Payable (Disbursement)

-

Receivables: Credit Adjustments, Debit Adjustment, Payments Applied (Posting), Adjustments Applied (Posting), Memos Applied (Posting), Charges Paid (Posting), Finance Charges Paid (Posting), and AR/Finance Charges

-

Inventory: Inventory Adjustment, Inventory (Transfer Out), Inventory (Transfer In), Inventory – Sales (Cost Corrections), Inventory – Returns (Cost Corrections), Finished Goods (Manufacturing), and Raw Materials (Manufacturing)

-

Point of Sale: A/R Charges (Sales), Inventory (Sales), A/R Credit Memos (Returns), Inventory (Returns), A/R Credit Payments (Misc. Payments), Charge (Misc. Payments), Charge-Deposit Refund (Payouts), and A/R Charges (Direct Sales)

-

Receiving: Received Inventory (Purchases) and A/P Accrual Account (Purchases)

Note: The entries in (parentheses) are the category settings for these journal entries.

Please note that the application also restricts branch accounts that match the account in the mapping.

The application will check for system and detailed mapping when you process manual journals. The application will display a message when any restricted accounts are included in the ledger entries.

For existing customers, the application displays the validation messages as warnings.

For new customers, the application displays the messages as errors based on the recommendations of the ECI Implementation and Training team. If you see a "restricted" message during Manual Journal processing, regardless of the severity, you should carefully consider whether it is appropriate to continue. In most cases, you can use software operations that affect these accounts independently.

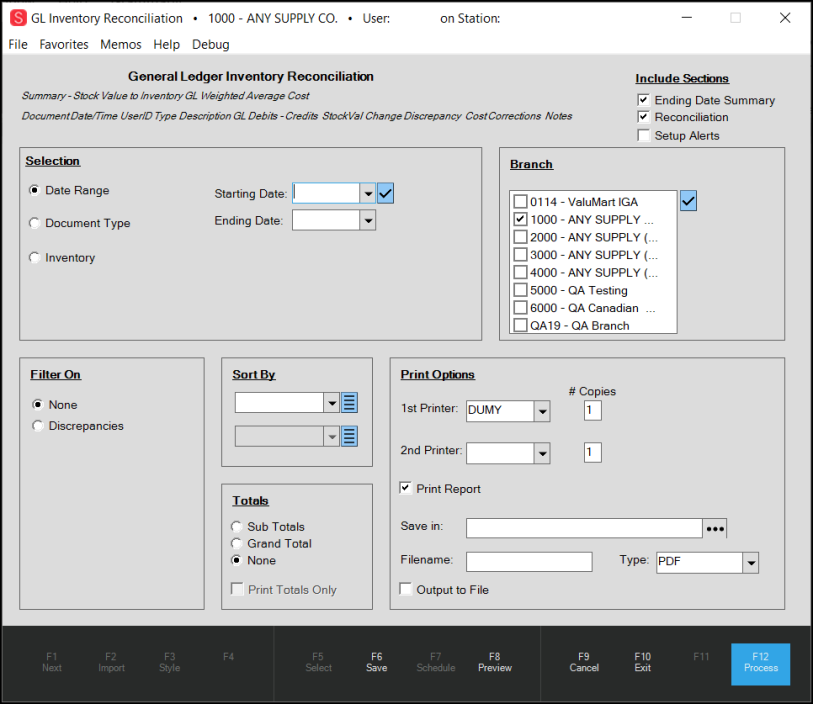

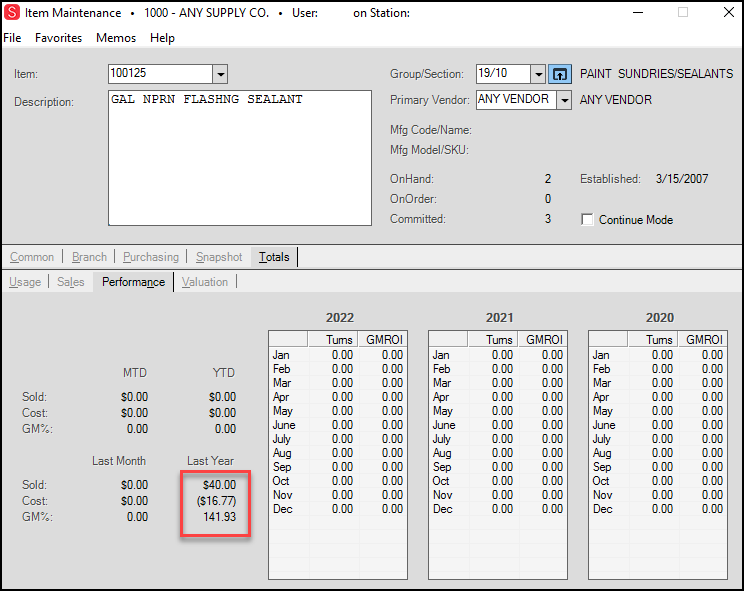

GL Inventory Reconciliation Report: A Snapshot of Inventory Valuation

B-100645 – Many customers have asked us to give them a way to see their inventory on hand reconciled with the stock’s GL value. We have created the General Ledger Inventory Reconciliation report to accomplish this request. This report shows the inventory activity for a date range that highlights potential discrepancies between the ledger asset value of the inventory and the real value of the inventory on hand. While using an average cost valuation does not provide an exact match between the ledger amount and inventory in stock, the differences between the two valuations should be small and remain relatively consistent over time.

In general, this report is broken down into three sections (as you choose):

-

The first section contains a comparison of the perpetual inventory value compared to the GL inventory value as of the close of business on the last day of the report (as selected).

-

The second section lists the transactions for the report period where there is a difference between the stock value and the GL inventory account balance change.

-

The third section contains a listing of any specific alerts the application has found based on the challenges associated with the inventory reconciliation itself. This section can provide coaching to your business about the specific reconciliation issues in their inventory calculation and reconciliation process

Note: It may be useful to produce this report outside of normal business operation times, as generating it will use many resources.

Creating the GL Inventory Reconciliation Report

To run the General Ledger Inventory Reconciliation report:

1. From the Main Menu, go to General Ledger > Reports > GL Inventory Reconciliation to display the General Ledger Inventory Reconciliation Report form.

General Ledger Inventory Reconciliation Report (Empty)

2. As with all reports, we give you a variety of criteria to use to generate the report.

The Selection Options list allows you to begin by selecting the report’s overarching criteria:

-

Select the Date Range button and enter the beginning and ending dates of the report in the fields provided. The date or date range is required.

-

Select the Document Type button to select the type of GL-based records to use for evaluating the inventory stock. Options include existing reports available in the application: PS Sale Invoices, PS Charge Returns, IN Receipt Cost Corrections, IN Inventory Adjustments, IN Item Cost Corrections, IN Physical Counts, Yard Transfers In, Yard Transfers Out, and PO Inventory Receipts.

Choose Select All to include each of these report sources, or select the check box beside each source you want to include. The application does not select any options by default. -

Select the Inventory button to display the inventory options and choose Select Inventory to display the Inventory Selection list. Options include: All Inventory Items, particular inventory groups and sections, a particular vendor or group of vendors, inventory at a particular location, inventory classification (by Product ID, Range, Department, Class, and /or Subclass), or even a particular item.

3. In the Filter On section, you can choose None (for no filter) or you can filter on Discrepancies.

If you choose Discrepancies, you can specify a discrepancy threshold amount. The report would then highlight discrepancies above that threshold.

Note: In the Discrepancies Threshold field, the application defaults to the local currency set for the region.

4. In the Sort By section, you can sort in ascending or descending order by Branch, Transaction Type, Date/Time, Discrepancy Amount, or Group Section.

5. In the Totals section, you can organize the results of the report using Sub Totals, Grand Total, or None, and you can choose Print Totals Only to display the totals in the print version of the report alone.

6. In the Branch section, choose the branches you want to include in the report by selecting the check box beside each branch you want to include.

7. In the Print Options section, you can choose to print or save the report locally, based on your preferences. You can save the report in various formats as a document or a spreadsheet. These settings are no different from any other report.

8. In the upper right hand corner, there is an Include Sections list. These are the sections of the GL Inventory Reconciliation report, which you can include (by checking the option check box) or exclude (by leaving the check box unchecked).

-

Check the Ending Date Summary check box to summarize the value of the inventory stock based on the weighted average cost as of the last date of the report.

-

Check the Reconciliation check box to document the date/time/user ID, type description, and GL debits and credits showing the stock value changes in the discrepancy cost and correction notes.

-

Check the Setup Alerts check box to notify you of anything the application thinks you left out of the report that may be useful before you execute the report.

9. When you have completed your selections, you have several options:

-

Select Save (F6) to save the report. When you choose Save, the Save Report Settings box displays.

Enter the Report name, a description, and indicate whether the report is Public or Private. Then, select Accept. -

Select Preview (F8) to display the results of the report visually, but not print or save yet.

-

Select Process (F12) to display and process (print or save) the report locally.

The option to schedule the report also displays and that is covered in the next section.

Note: As with any report of this size and scope, this will take some time to generate.

Scheduling the GL Inventory Reconciliation Report

B-100646 – After you have crafted this report the way you want it, you can schedule it so that it runs at a specific time each day, week, month, or yearly. You can schedule it to run off hours, so it does not interfere with other application or business processes.

To schedule the GL Inventory Reconciliation Report:

1. Before you get started, you need to know the Schedule Report Directory path, which authorized users can find in Maintenance > Database > Parameters on the Setup > System tab. Copy and paste the path listed in the Scheduled Report Directory field somewhere nearby, because you will need it later.

2. Follow the instructions in Creating the GL Inventory Reconciliation Report to create the report parameters you want. In the Print Options section, choose the Output to File check box and choose a file location, a report name, and format type for the new report in the fields provided.

3. Select the Save (F6) option in step 9.

4. Select Cancel (F9). The application resets the page.

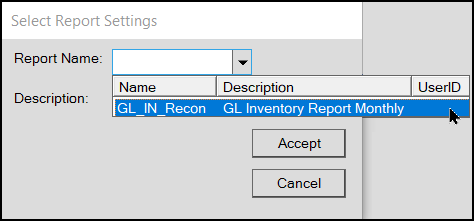

5. Choose Select (F5). The Select Report Settings box displays.

GL Inventory Reconciliation Report > Select Report Settings

6. From the Report Name list, choose the name of the report you want to run and select Accept.

The application updates the report fields with the choices you saved in the report.

7. Select Schedule (F7) to display the Schedule this Task list.

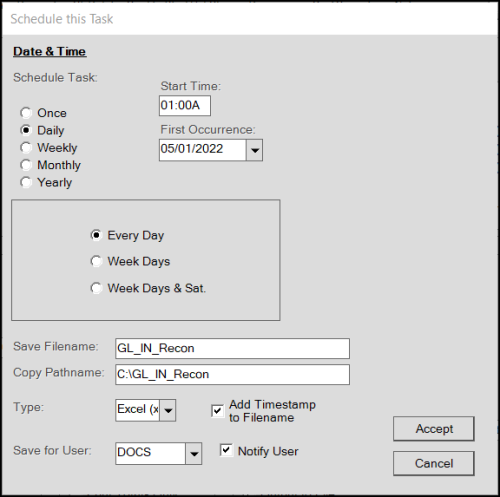

General Ledger Inventory Reconciliation Report > Schedule this Task Box

8. Consider when you want to run this report, how frequently, the time of day, and the file-specific settings in this box:

-

Schedule Task: Choose one of the following: Once, Daily, Weekly, Monthly, or Yearly.

-

Start Time: Enter the hour you want the report to run. Note: Typically, you may want to schedule this report when the location is closed, so it doesn’t interrupt other normal business operations.

-

First Occurrence: Choose the date of the first report from this list. The entries in the box are specific to the Daily, Weekly, Monthly, Yearly selection you made above.

-

Select Year/Month/Weeks/Days details: Use these fields and buttons to specify the recurring details for running the report. When you select Monthly, make sure you specify all of the months you want the report to run.

-

Save Filename: Choose the filename for the report.

-

Copy Pathname: Enter/paste the path to the Scheduled Report Directory folder, which you found in step 1.

-

Type: Select the report type (PDF, Excel, etc.) and check the Add Timestamp to Filename box to put the date and time stamp on the file after it has been generated. This will help you keep track of the reports by date in the same folder.

-

Save for User: To restrict access to this report, choose the user ID of the person for whom the application is generating the report. Select the Notify User check box to send an email message to this user after the report is complete. The application uses the email address stored in the user’s User ID Maintenance form.

9. When you have completed these entries and selections, select Accept to save them.

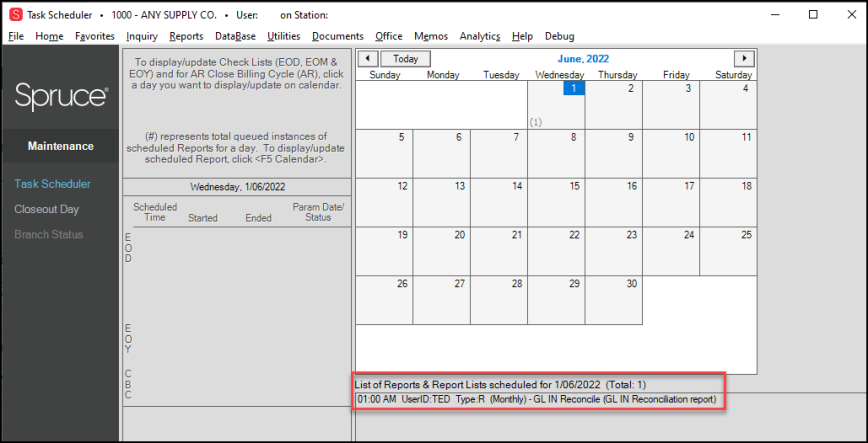

After you schedule this report, you can view it in the Task Scheduler.

Go to Maintenance > Task Scheduler and look up the day the report is scheduled.

Task Scheduler with GL Inventory Reconciliation Report Scheduled

See Also: General Ledger Inventory Reconciliation Report

Price Management Updates

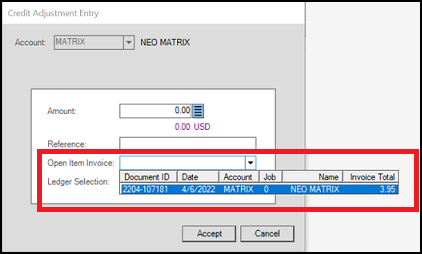

Account Payment Convenience Fees Made Easy

B-94094, B-94295, B-94335, B-99541, B-99542, B-100106 – When you need to process a credit card payment for a Receivables account, that costs you money. Adding a convenience fee allows your customer to pay their account their way and helps you maintain your profit margin. After the Convenience Fee setup and mapping are complete, the application will apply Convenience Fees automatically to any account that pays all or part of their balance using a credit card. Before you implement a Convenience Fee policy, we recommend that you add a note to your customer statements alerting them of this new policy and when you will be implementing it.

Disclaimer: When you apply Convenience Fees to account payments paid by credit or debit card, there may be legal, tax liability, and/or contractual restrictions that may apply in your area. Further, adding this charge may affect the terms of your card merchant or other contractual agreements. Your company is responsible for researching these legal regulations, liabilities, and restrictions to determine whether you can comply with them when applying the convenience fees in this application. ECI and the software applications we provide are not responsible for making these determinations on your behalf, nor do we claim this feature is suitable for your company. You are not required to use the Convenience Fee feature; only you can determine whether a convenience fee is appropriate for your business. Before enabling this feature, we recommend you work with your local legal and financial counselors to ensure you can apply Convenience Fees where you are.

A Note about Tax Liability: The Convenience Fee feature has no automatic consumer tax impact and does not include a tax component. Specifically, existing tax reports and transaction details at the time of sale do not include convenience fees because they are applied to payments afterward. If convenience fees are considered taxable in your area (when charged at the time of payment (VAT/GST, etc.), you need to report and pay these taxes manually. Convenience fees are recorded as income (based on your GL mapping in the application) and impact your company’s financial reporting. We also recommend you track any convenience fee taxes using the appropriate GL accounts.

You can also completely prevent bank card payments for Receivables accounts by updating the severity on a task list to an error. This prevents credit card payments during the processing step in the Point of Sale > Payments transaction. Managers or employees with administrative rights can override this setting, if needed.

Convenience Fee Setup

There are two steps required to set up and implement the Convenience Fee feature:

-

Setting the Convenience Fee Parameters

Allows you to set the default convenience fee percentage by branch for each credit card your business accepts.

-

Mapping the Convenience Fees to the Appropriate Journal Account

Allows you to specify which journal account to apply the Convenience Fees to. Once this mapping is established, the application will manage this for you.

Setting the Convenience Fee Parameters

B-94295, B-99535 – To set the Convenience Fee parameters, you must have administrative rights to the application. When you set these parameters, we recommend setting them for each branch that uses the feature. You can set separate rates for various credit cards, based on their charges, if you wish, or you can set one percentage for all cards. You can include or exclude debit cards from this fee.

To set the Convenience Fee parameter:

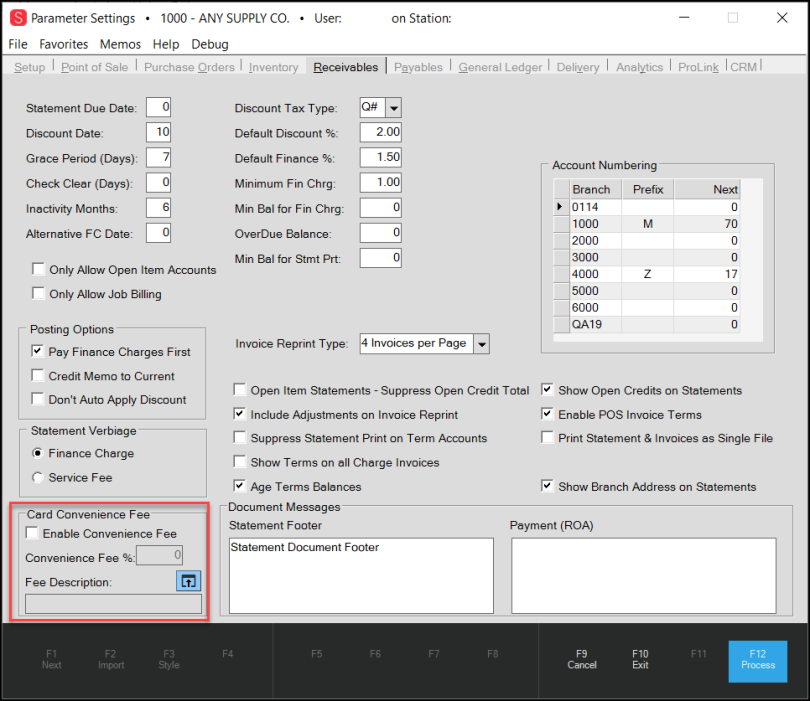

1. From the Main Menu, go to Maintenance > Database > Parameters to display the Parameter Settings form.

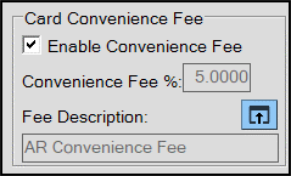

2. Select the Receivables tab to display the Card Convenience Fee options.

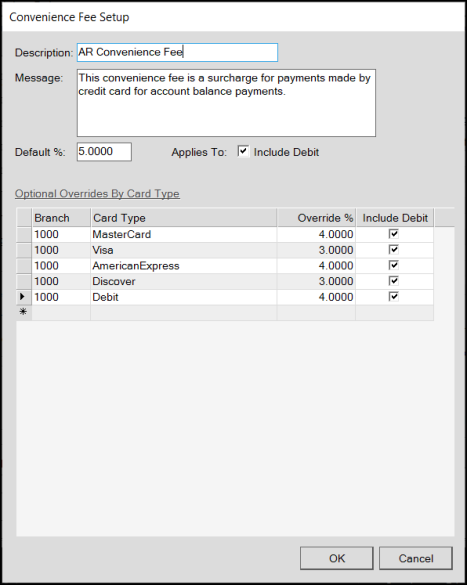

Parameter Settings > Receivables > Card Convenience Fees Options

3. In the Card Convenience Fee box, select the Enable Convenience Fee check box.

4. Select the Fee Description Settings ![]() icon to display the Convenience Fee Setup box.

icon to display the Convenience Fee Setup box.

If you choose to set different rates for different cards, the Card Type list displays the list of cards from the Parameters > Setup > Software tab. Only cards in that list are configurable in this feature.

Convenience Fee Setup

In the data grid, you cannot enter duplicate records for the same branch.

5. Complete the settings in this box for each card you accept at each Branch.

-

Description

Enter a description for the Convenience Fee. This is the text that displays beside the convenience fee transaction amount in the customer’s invoice document. (Required). -

Message

Enter the message you want to display on the customer’s invoice explaining the convenience fee when the customer pays their balance by credit card. This message only displays when the application applies a Convenience Fee to an account payment. -

Default Percent

Enter the default percentage for any card you accept that you do not explicitly list in this box. This percentage is the default for all cards and branches.

This entry must be a positive number, and it cannot exceed 99.9999%. The application applies the default convenience fee percentage to any debit cards you do not list specifically in the data grid. -

Include Debit

Select this check box if you intend to include convenience fees for debit card payments by default for all card types. -

Data Grid Entries

For each branch, enter records for any credit card type that requires a different convenience fee percentage from the setting in the Default Percent field. The application applies the percentage you set in this list whenever an account payment uses this card type. You can sort this list by selecting the Branch heading.

Note: If you leave out any branch/card combinations, the application displays a warning message to allow you to verify you want to apply the default settings to these cards -

Debit check box

Select the Debit check box if the Include Debit check box is not selected and you want to apply the same convenience fee percentage entered for a particular card type to the associated debit card account payments.

You can include or exclude Debit cards by default (check box at the top) or include debit cards by card type if you prefer by selecting the appropriate check box(es).

Note: When you add a new branch location, you need to add any necessary Convenience Fee settings if you want to add specific fees to apply for that branch in this table. This is not completed automatically. If you do not add new entries, the application applies the default percent to transactions that incur convenience fees.

6. When you have completed these entries, select OK to save them. The application updates the parameter settings based on your entries.

Card Convenience Fee Entries Complete

7. Choose Process (F12) to save these settings. An error message displays, reminding you to set the mapping for this fee in the Journal Account.

Note: When you create this fee, you need to complete the journal mapping so the company can track this asset appropriately.

8. Complete the steps in Mapping the Convenience Fees to the Appropriate Journal Account and then return to these instructions.

9. Choose Process (F12) again to clear the error message and complete the setup process.

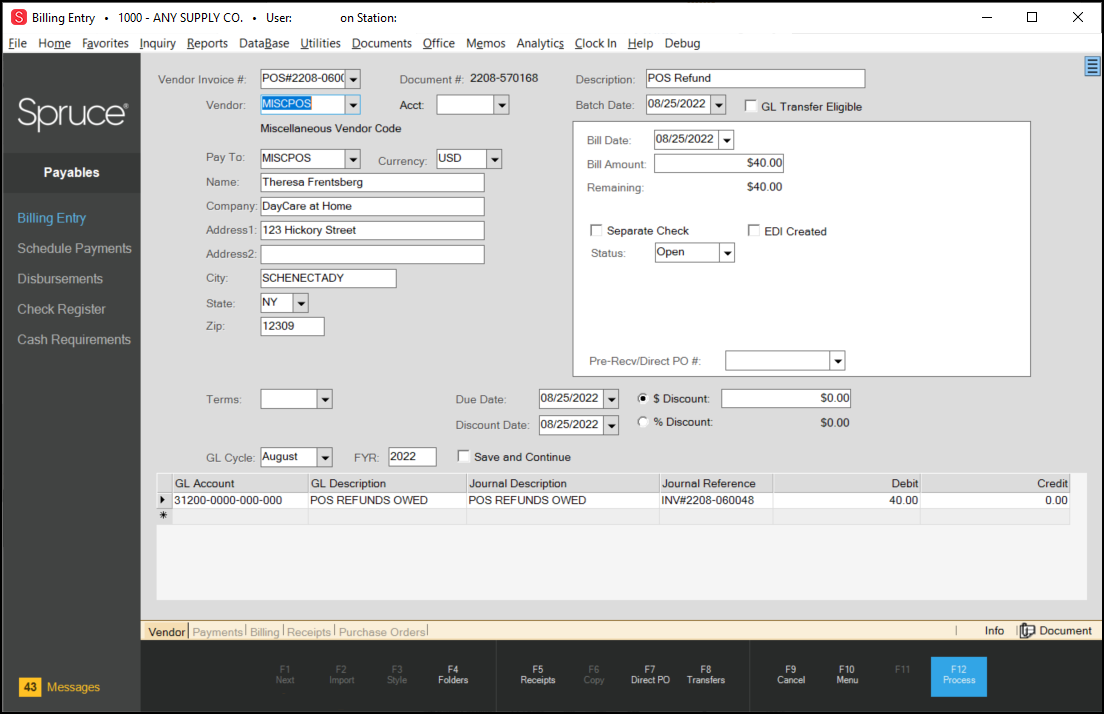

Mapping the Convenience Fees to the Appropriate Journal Account

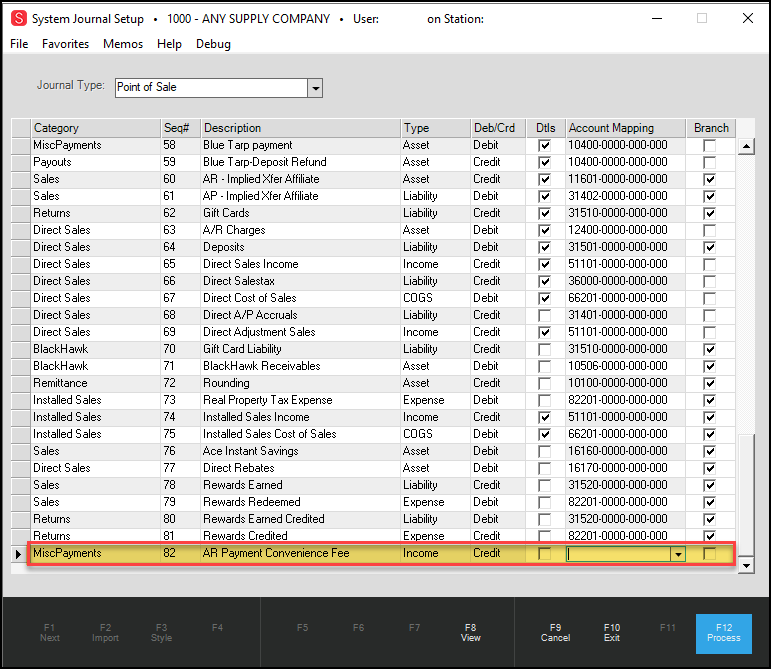

After you set the Convenience Fee parameters, it is important to map these payments to an appropriate journal account. A default script adds a new AR Convenience Fee entry in the System Journal Setup form, but you need to add the appropriate journal account to track these incoming funds.

To map the convenience fees to a journal account:

1. From the Main Menu, go to General Ledger > Database > System Journals to display the System Journal Setup form.

2. In the Journal Type list, choose Point of Sale.

System Journal Setup with MiscPayments Entry for Convenience Fee Payments

3. Scroll down to find the AR convenience fee entry you created in the Description field in Step 5 of the Setting the Convenience Fee Parameters.

4. From the Account Mapping list, choose the appropriate business's account to track this payment amount and select the Branch check box. Checking the Branch box ensures that the application records these payments by branch.

5. When you have completed your mapping settings, select Process (F12) to save the change.

6. Return to the Parameter Settings > Receivables tab and select Process (F12) to update the journal mapping.

Applying a Convenience Fee to an Account Payment

B-94099, B-94295, B-100101, B-100102 - In the Point of Sale > Receive on Account task, when you select the bankcard option (and the Convenience Fee settings are in place), the application applies the convenience fees by default. You can override Convenience Fees at Point of Sale if you need to, with the proper permissions. In regions with currency rounding rules, these rules also apply to Convenience Fees.

Note: If the customer’s bankcard cannot authorize the entire payment amount, they cannot use the card for the payment. When the payment fails, the following message displays to explain the issue:

-

Partial payment not available when convenience fees are active; card transaction voided.

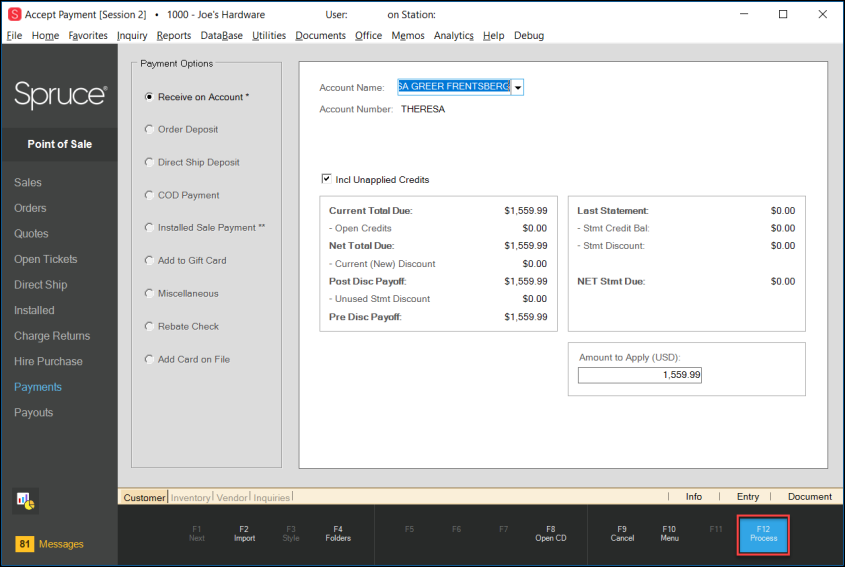

To see the Convenience Fee to be applied at Receive on Account:

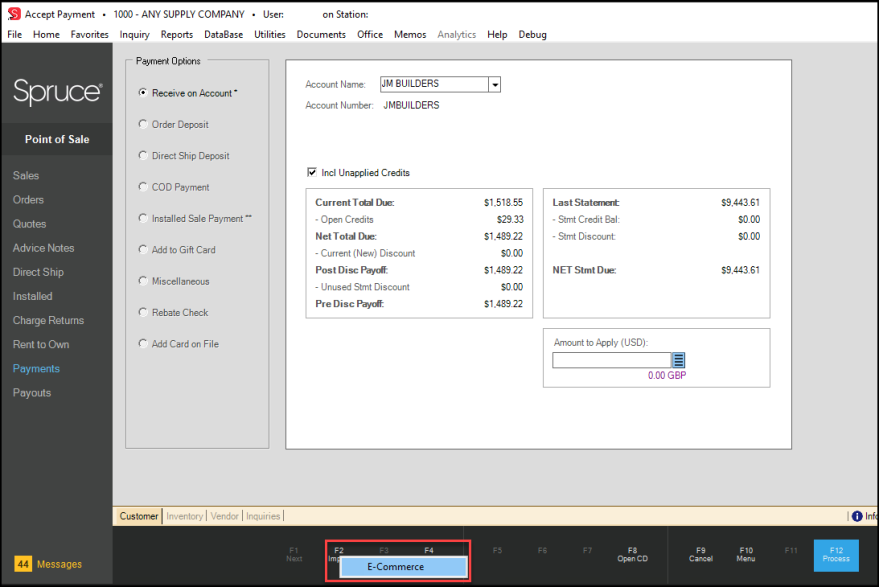

1. From the Main Menu, choose Point of Sale > Payments > Receive on Account to display the Accept Payment form.

2. From the Account Name field, select the account you want to process the payment for.

3. In the Amount to Apply field, enter the amount the customer is paying.

Accept Payment Form with Receive On Account Amount Applied

4. Select Process (F12) to display the Process Payment Document.

5. Select BankCard (F2) to display the debit and credit card options for the account.

Note: The application does not select a default credit card when Convenience Fees apply. Since the fee rate may vary and depend upon the card you choose, the application cannot apply the convenience fee until you complete the credit card entries.

6. Select the Credit or Debit button and choose the credit card type.

Note: The percentage set for the Mastercard credit card in this case is 4%.

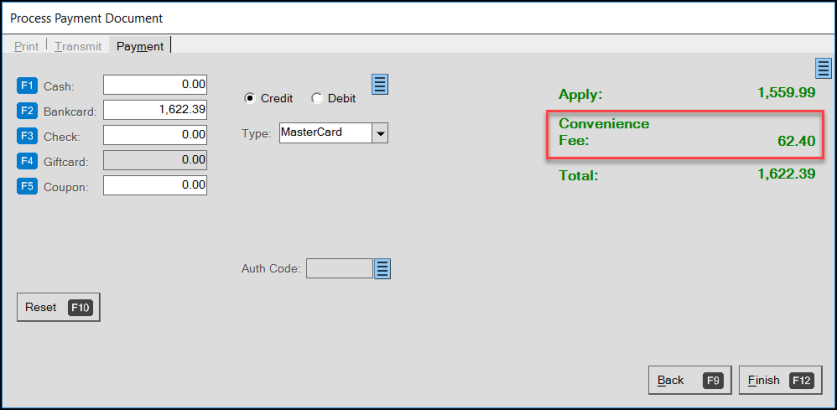

Process Payment Document for Receive on Account Payment with Credit Card

Note: If the customer wants to make a partial payment using another tender type (such as cash, coupon, gift card, etc.) and it affects the bankcard balance, the application adjusts the convenience fee using the new Bankcard amount.

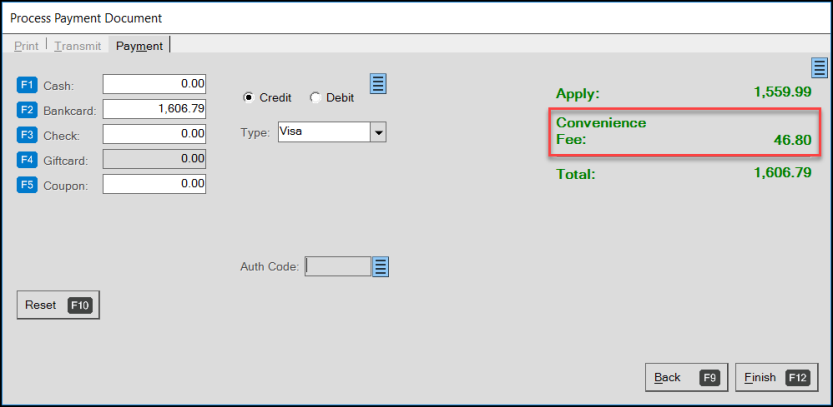

7. If you change the credit card type, and the percentage setting is different, the Convenience Fee updates.

Process Payment Document for Receive on Account Payment with Different Card Percentage

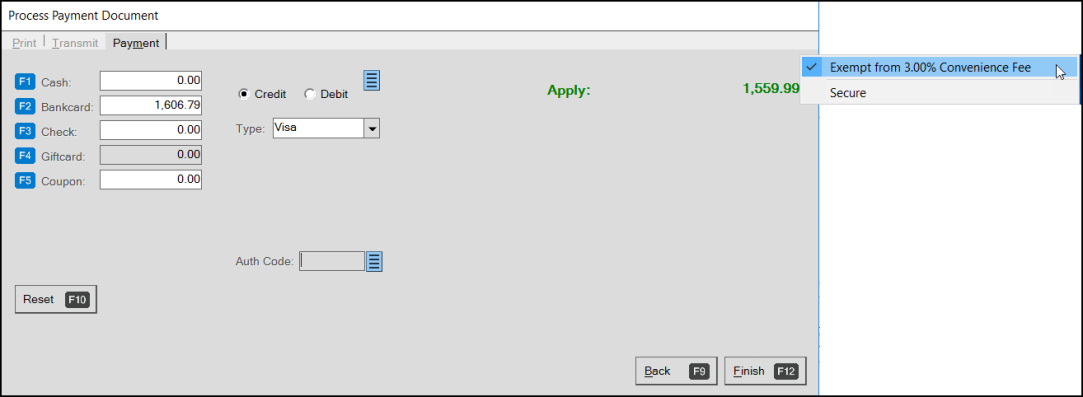

To override the convenience fee in the Process Payment Document box, select the blue Menu Marker  to display the override option.

to display the override option.

Process Payment Document with Override Message

Select the Exempt from X.XX% Convenience Fee option. The application removes the convenience fee from the transaction. Uncheck the option to redisplay the Convenience Fee.

Note: If you override the convenience fee, re-enter the original amount in the Bankcard field to reflect the total without the convenience fee.

8. Complete the credit card entries and select Finish (F12).

When you pay with a credit card or override the payment with a credit card, a warning message displays:

-

Bankcard payment type specified for Received on Account

9. Select the Accept Warnings option to continue.

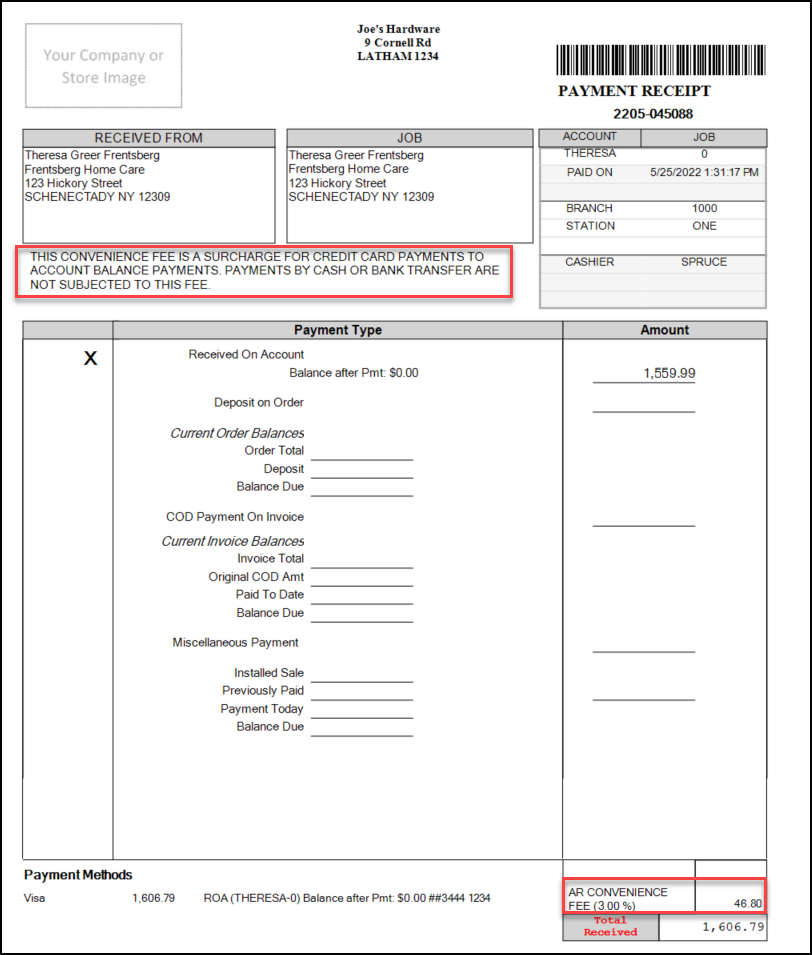

10. To review the Payment document, go to Documents > PS Sales Invoices (Account Name).

The customer copy of the invoice displays. The message at the top is the message entered in the parameter settings. The AR Convenience Fee (Percentage) reflects the Convenience Fee percentage charged.

Invoice Document with Convenience Fee Message and Entry Highlighted

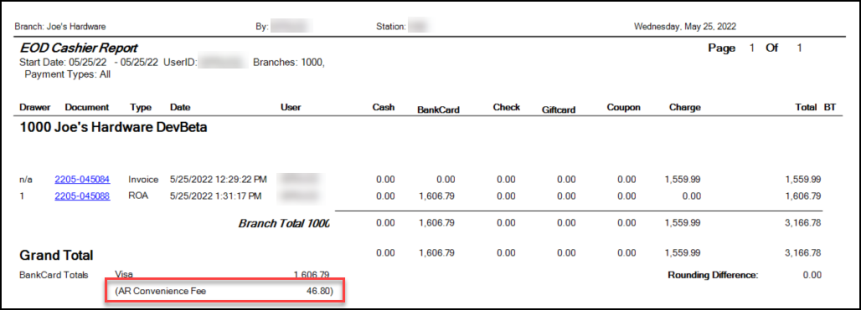

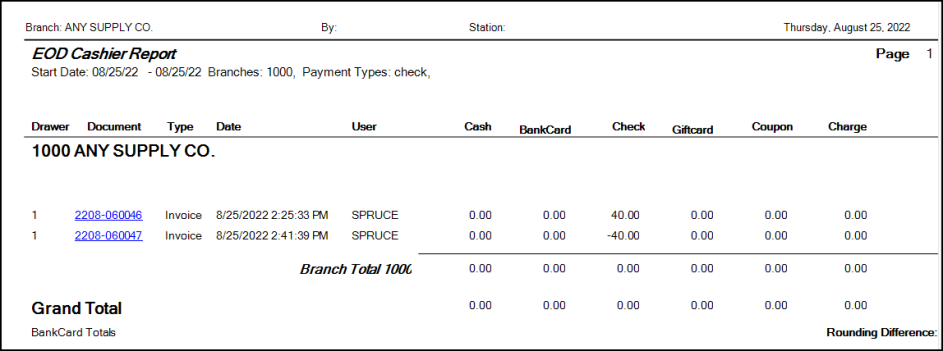

B-94102 – When you complete a transaction with a convenience fee, the application updates the appropriate general ledger account for the End of Day report and the EOD Cashier’s Report. Convenience fees display as separate line items.

Convenience Fee on EOD Cashier Report

Using Moneris Devices to Process Payments with Convenience Fees

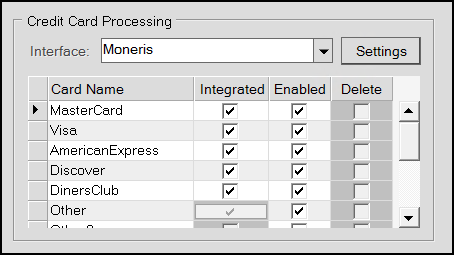

For businesses that use Moneris devices for bankcard processing, the Process Payment Document form does not display a list of card options by default, except when cards are not integrated. Since selecting the debit and credit options and choosing the card type are required for the Convenience Fee feature, we have made some changes to how bankcard processing works for Moneris-paired devices in the application.

For Moneris devices with integrated cards, we have added the Card Type list and the Credit and Debit buttons to the Process Payment Document form; these features now display by default. The Card Type list also displays non-integrated cards, but the Moneris system will not process these payments automatically. You still need to process those payments manually outside of the application.

We have renamed the Type field, Trans Type, which displays the Credit/Debit option when you choose Bankcard payment options.

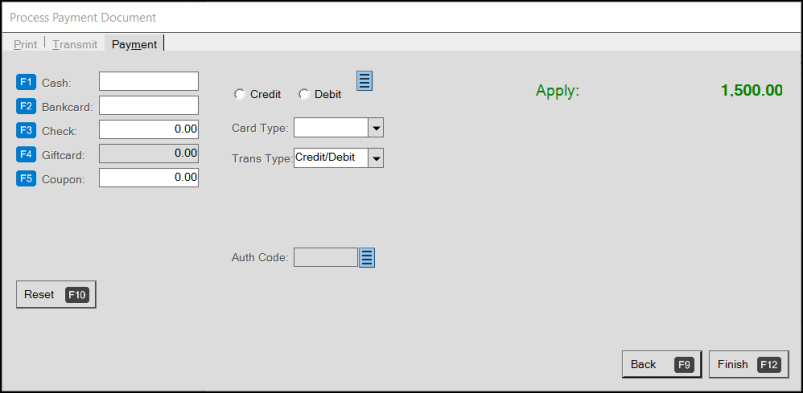

When you process the account payment using the Receive on Account feature, you enter the customer’s requested payment in the Amount to Apply field and choose Process (F12) to display the Process Payment Document. When the customer asks to pay using credit or debit options, follow the process below.

Process Payment Document (Initial)

To process a convenience fee with a payment using Moneris devices:

1. In the Process Payment Document form, in the Bankcard field, enter the amount the customer wants to apply to their account balance.

2. Choose the Credit or Debit button depending upon the customers requested transaction type.

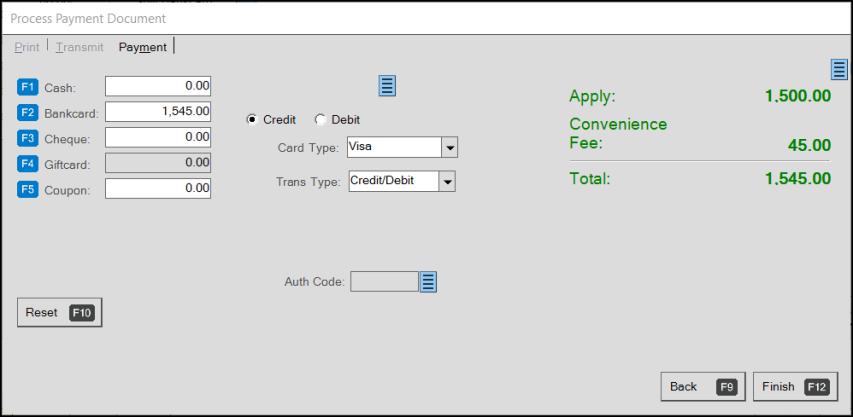

3. From the Card Type list choose the bankcard the customer wants to apply the payment to. The appropriate Convenience Fee amount displays and updates the Bankcard field amount.

Process Payment Document with Convenience Fee Options Displaying

Note: The application still uses the entry in the Trans Type list to signal the type of payment you are processing to the Moneris device. If you select a non-integrated card type from the Card Type list, the application expects you to process that payment using a different device or method. If you select an integrated card from the Card Type list, the Moneris device processes the payment as it normally would. If you leave the Card Type list entry blank, the device assumes you are paying using the Mastercard bankcard type.

4. To process the payment, choose Finish (F12). One of these things occur:

-

If you chose an integrated bankcard or debit card, the Moneris device processes the payment with the Convenience Fee.

-

If you chose a non-integrated bankcard or debit card, the transaction completes with the convenience fee, but the application assumes you are using another payment validation method.

Integrated or non-integrated Moneris card settings are defined in the Parameter Settings > Setup > Software subtab. You must have administrative rights to set or modify these entries.

Parameter Settings Form > Setup > Software Subtab > Credit Card Processing Settings Sample

Processing a Convenience Fee using ProLink

B-100108 – You can also use ProLink to apply convenience fees to accounts with balance forward settings, when you have completed the Convenience Fee setup. No additional configuration is required for this to work on ProLink.

To process a payment with a convenience fee for a customer in ProLink:

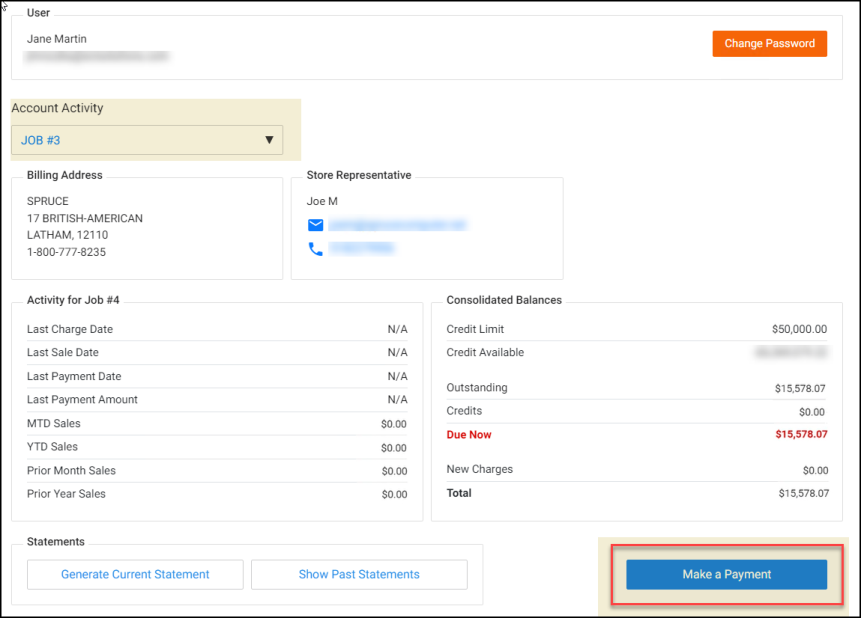

1. Log into ProLink and access an account with a balance forward amount.

ProLink with Account Activity to be Paid

2. Select Make a Payment. The Make a Payment page displays.

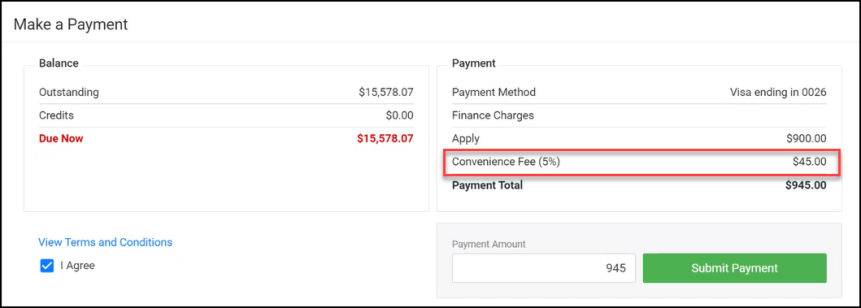

3. Enter a credit card payment amount (such as 45) and the Convenience Fee amount displays (updating the total).

ProLink – Make a Payment with Convenience Fee Highlighted

4. Select Submit Payment. The confirmation message displays confirming the Payment total amount.

5. Do one of the following:

-

Click OK to accept the payment change.

-

Click Cancel to return to the Make a Payment options and change the payment method.

Applying a Convenience Fee to a Specific Invoice

You can also see the Convenience Fee applied to a specific invoice if the customer wants to pay that way.

To see the convenience fee applied to a specific invoice in ProLink:

1. Login to ProLink with the same account as above.

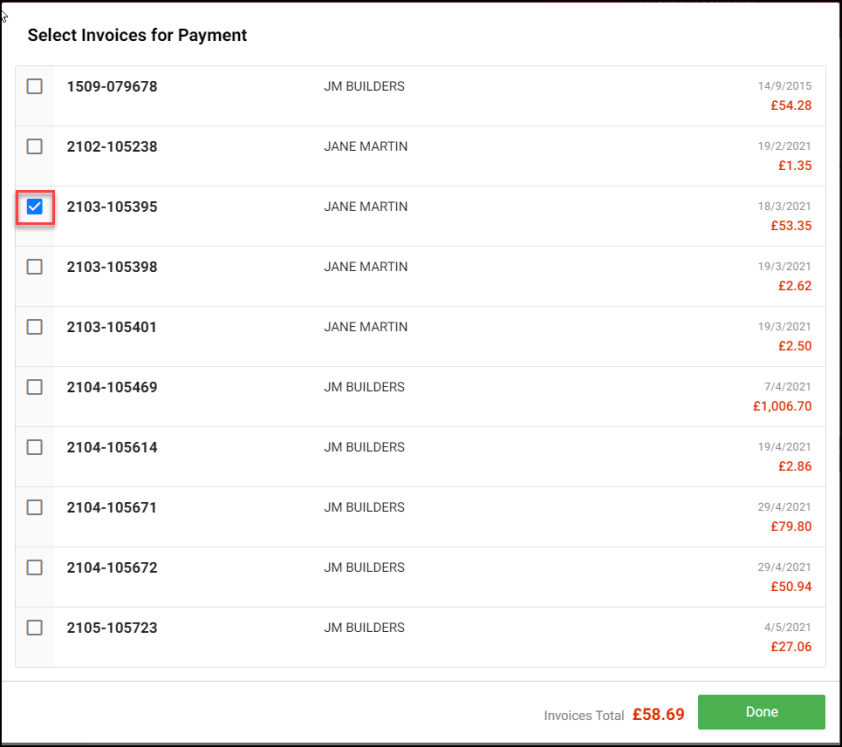

2. Select the Select Invoices button to display the list of open invoices.

ProLink – List of Open Invoices

3. Select the check box beside the invoice you want to pay and choose Done. The Make a Payment page displays.

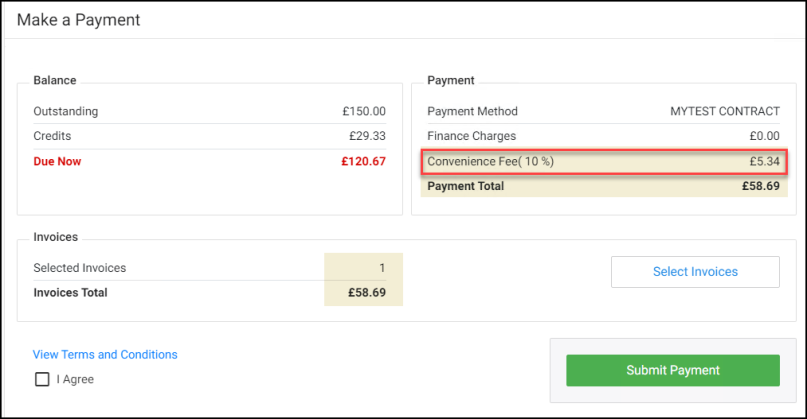

4. Enter a credit card payment amount for the full amount and the convenience fee field updates.

ProLink – Make a Payment with Convenience Fee Amount Highlighted

5. Select Submit Payment. The confirmation message displays confirming the Payment total amount.

6. Do one of the following:

-

Click OK to accept the payment change.

-

Click Cancel to return to the Make a Payment options and change the payment method.

Importing E-Commerce Payments and Applying Convenience Fee

B-94100, B-94101 – When you import a customer’s on-line purchase, you can apply a convenience fee for using a credit card. You can select the account in ProLink to make the payment request as well.

To import an e-commerce payment:

1. From the Main Menu, go to Point of Sale > Payments > Receive on Account to display the Accept Payment form.

2. In the Account Name field, choose the account you want to process the payment for.

3. Select Import (F2) and choose the E-Commerce option.

Accept Payment Form with Import E-Commerce Option Highlighted

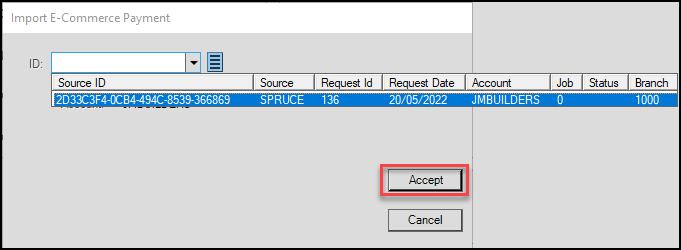

The Import E-Commerce Payment box displays.

Import E-Commerce Payment Box

4. Select the payment ID from the list and select Accept.

The application adds the payment amount in the Amount to Apply field. The entered amount is read-only.

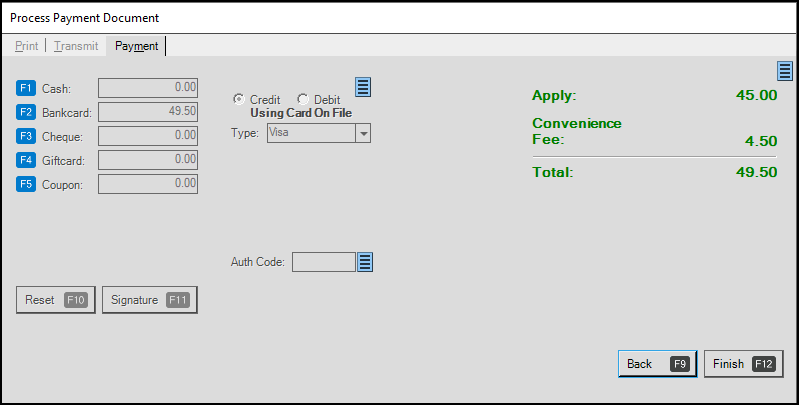

5. Select Process (F12) to process the payment. The Process Payment Document box displays.

The application applies the convenience fee automatically based on the e-commerce record.

Process Payment Document with Convenience Fee Applied Automatically

6. Select Finish (F12) to complete the transaction.

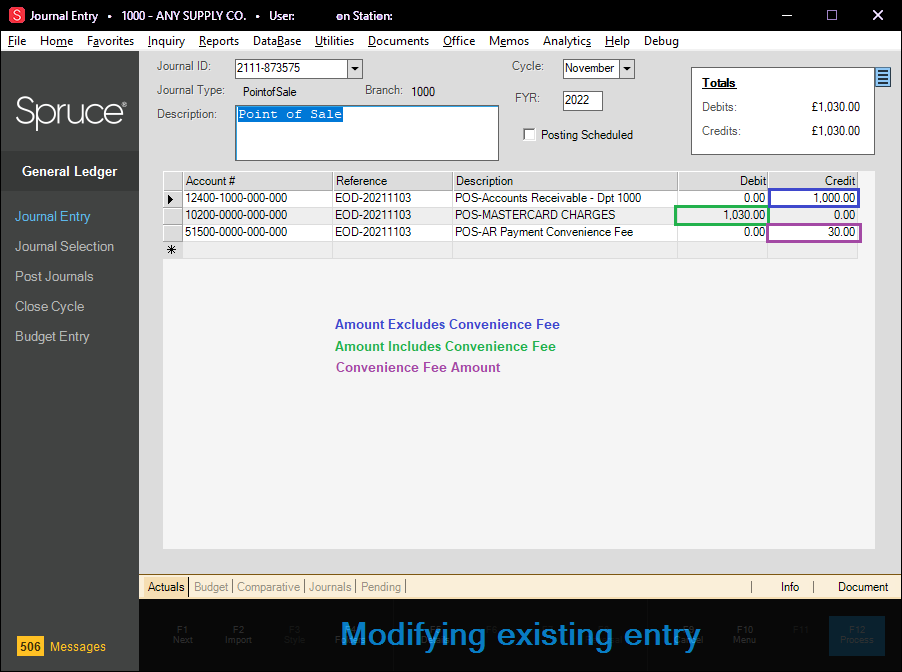

When you review the convenience fees in your general ledger accounts, you notice that they display like this:

Journal Entry Form with Convenience Fee Mapping Shown

Creating Job-Level Price Groups to Manage Competitive Bids

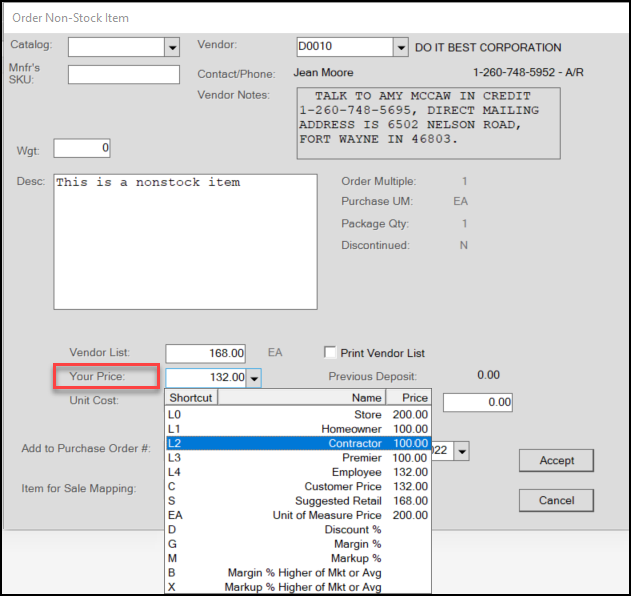

Job-level price groups allow you to define a pricing strategy for a specific job and maintain that strategy as the job is executed. It is a lot easier to keep track of the profitability of a job when you can manage the costs in one place over time. Using job-level pricing, you can change the price strategy for a category that may have taken many hours before but can now be implemented in a few minutes, with few mistakes, and for only one job.

Job-level pricing takes precedence over account-level pricing, sale pricing, volume discounts, POS quantity U/M, U/M price, or price levels for the account. Job-level price groups are valid for Sales, Orders, Quotes, Open Tickets, Direct Shipment, Installed, and Charge Return transactions. Job-level pricing is applied to contract pricing, if an account contract exists.

Note: When you choose the Ignore Price Groups option for a particular item, the application ignores job-level pricing too.

To create a job-level price group for an account with an existing account-level price group:

1. Begin by creating a price group that contains the job-level pricing you want to apply to the job. Instructions for creating a price group are here. The instructions for creating a job-level price group are no different from creating an account-based price group.

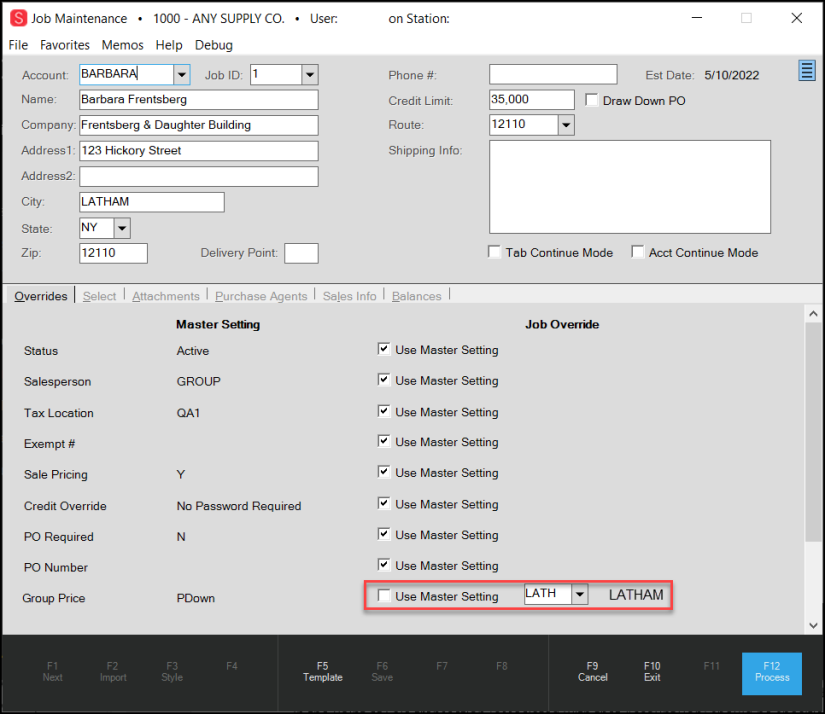

2. From the Main Menu, go to Point of Sale > Database > Job to display the Job Maintenance form.

3. In the Account field, choose the account associated with the job you want to apply the job-level price group to.

4. In the Job ID field, select New. The account record displays with the existing account details.

5. In the Overrides tab, scroll down to the Price Group entry.

6. Uncheck the Use Master Setting check box to display a new list box.

Job Maintenance Form with Price Group Entry Highlighted

7. From the Price Group list box, choose the job-level price group you created in step 1.

Note: If you do not select an entry from the list, an error displays.

8. Choose Process (F12) to save this change.

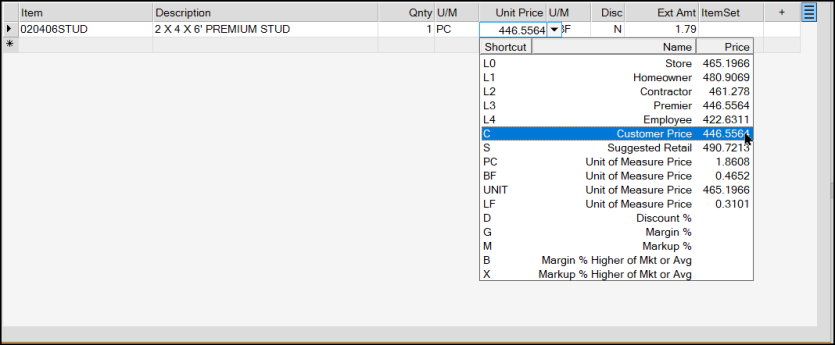

After you create the job-level price group and associate it with the account-based job, the default pricing in the Point of Sale transaction (associated with that Account/Job) should be specific to the job price group. When you add an item you specified in the inventory list in the data grid, the default price is the one specified by the job-level pricing. This amount is the Customer Price in the UM drop down list.

-

If you change the job after you enter the items in the data grid, the application prompts you to reprice the entries in the grid so you don’t apply the job-level price to another job.

-

If you change the account after entering the items in the data grid, the application also prompts you to reprice the entries in the data grid.

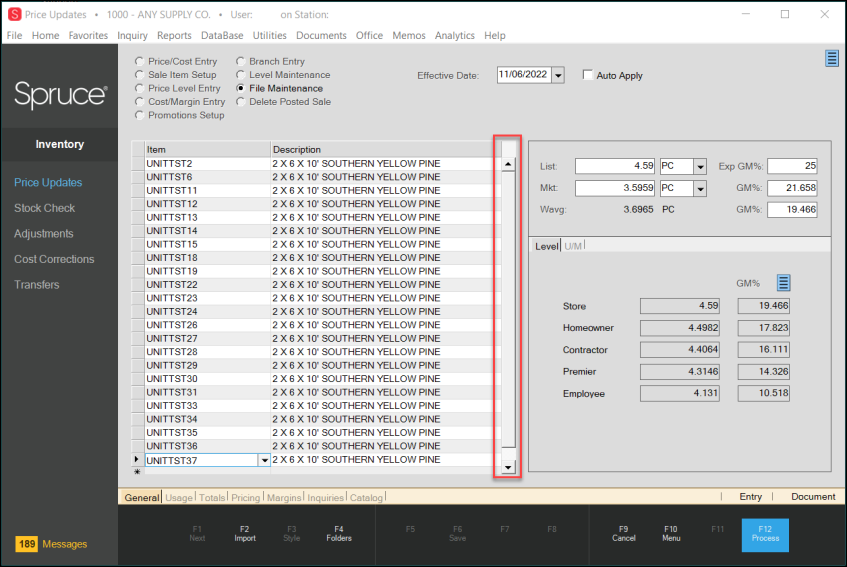

Order Entry Form with Customer Price Highlighted (Job-Level Pricing)

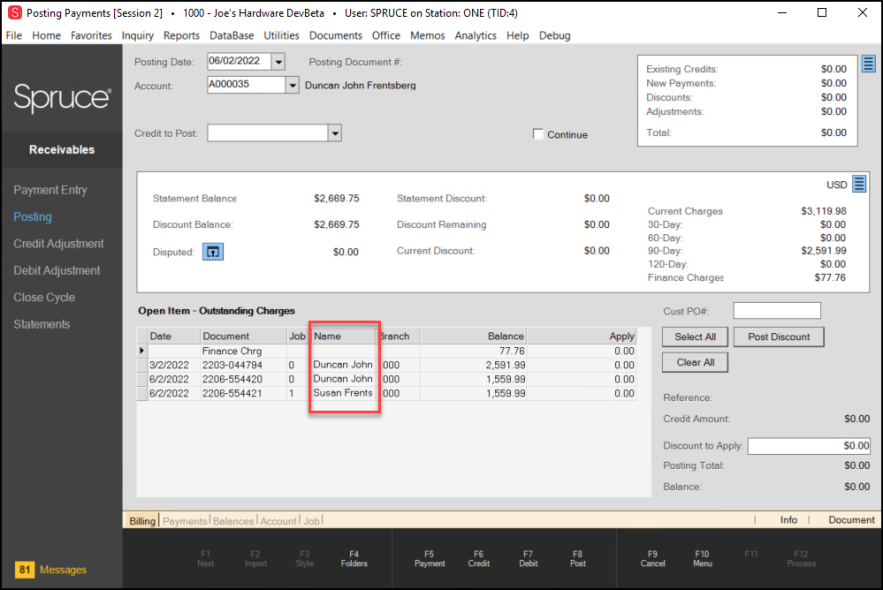

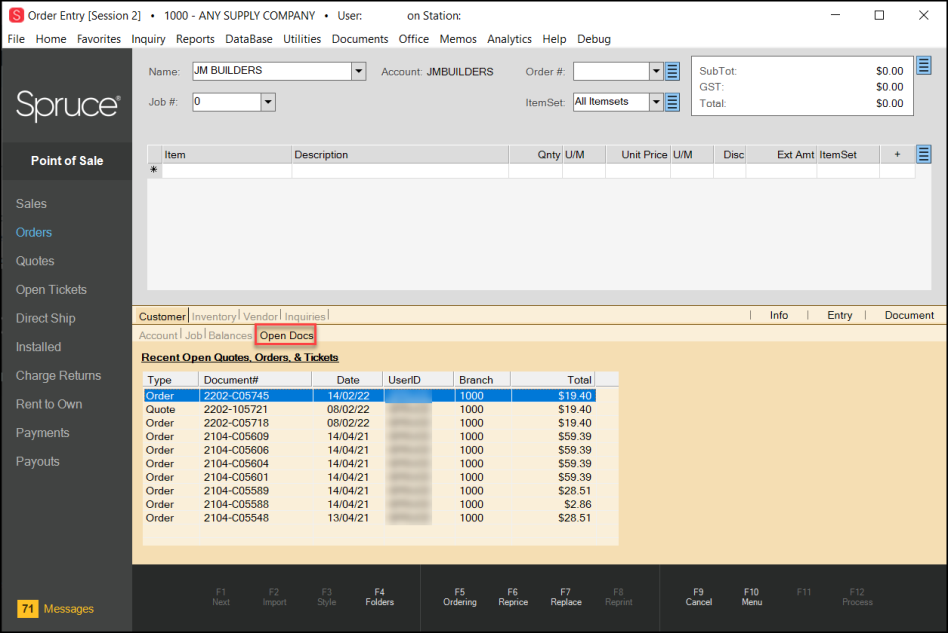

Added Job Name to Posting Payments Form

B-103546 – When you are posting a payment to an account record that has multiple jobs, it can be confusing to differentiate the jobs so you can apply the payment to the right one. We have added the name of the person associated with the job to the Posting Payments form to help you post incoming payments correctly. You can set the name of the person responsible for the job in the Job Maintenance window in the Name field. To see this change, the account has to have the following settings:

-

Posting Type: Open Item

-

Billing Level: Account

To see this change:

1. From the Main Menu, go to Receivables > Posting to display the Posting Payments form.

2. Choose an account that has multiple jobs associated with it and different names associated with the job. The account details display in the data grid:

Posting Payments Form with Job Name Field Highlighted

Inventory Updates

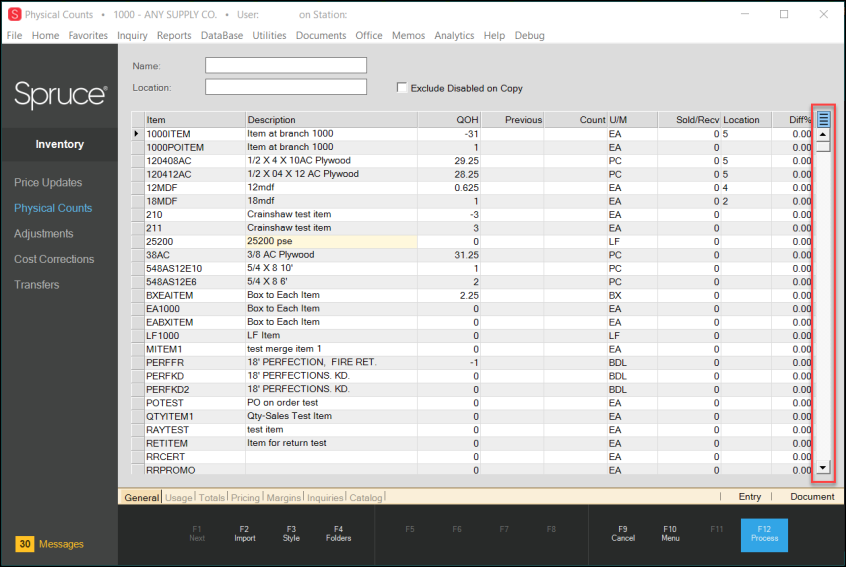

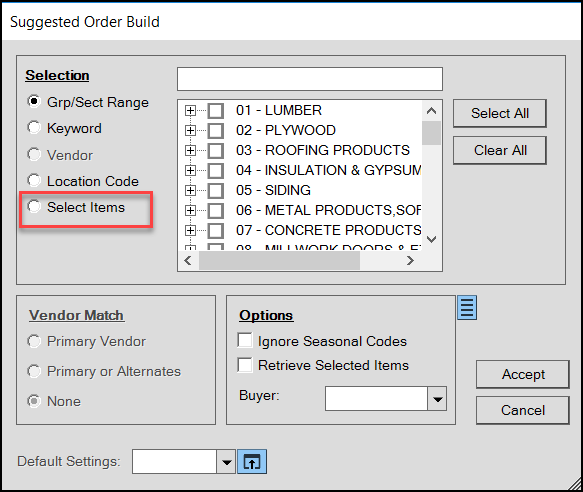

Using the Aggregator to Quantify Inventory (Spruce Only)

You can use the Aggregator feature to quantify your inventory for many different purposes. In this section, we cover how to use it to set up delivery charges only.

To use the Aggregator to calculate delivery charges, you create Aggregator Types that combine the way inventory is quantified with the method your business uses to charge for delivery and pickup. By adding your inventory to these aggregator types, you create Aggregator SKUs that define the multipliers the application will use in Point of Sale transactions to calculate the delivery charges for the materials your customers are purchasing. This section describes how to use the Aggregator to create those Types and SKUs.

The Aggregator setup requires additional security. To specify the user(s) who will create and support this feature, follow the instructions in Granting User Permission for Creating Aggregator Records. Then, these are the Aggregator tasks:

-

Create the aggregator types for each branch that combine the type and method settings, the item measures, and the delivery prices for the materials you need to transport. See Creating the Aggregator Type.

-

To keep track of the inventory and delivery accounting, create a new Group/Section type and add the appropriate GL mapping for the delivery/cartage amounts and asset values. See Setting the GL Mapping for the Delivery Group/Section.

-

Use the Aggregator Maintenance Utility to tie the aggregator types to specific inventory items. See Adding Inventory to the Aggregator Type.

-

Educate the Point of Sale team on the use and rules associated with delivery charges (cartage) and show them how to add the appropriate aggregator SKUs to the data grid. See Using the Aggregator SKU to Calculate Delivery (Cartage) Charges for these instructions.

Warning: In the Point of Sale data grid, if you set the Aggregator's quantity to LF (linear feet), but the multipliers on the products associated with the Aggregator are based on MLF (thousand linear feet), the application does not correct for that. The application will calculate the quantity based on MLF, not LF, and the wrong unit of measure will display. There is no fixed or direct relationship between the Aggregator's units of measure and the linked items; it's just a multiplier associated with the base unit of measure on the linked items only.

To learn more about how the application uses the Aggregator in Point of Sale, see Adding Delivery/Cartage Fees to Point of Sale Transactions.

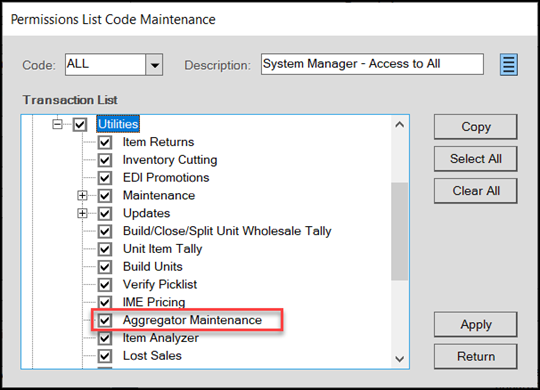

Granting User Permission for Creating Aggregator Records

Users must have specific permissions for creating and modifying Aggregator records. You must complete the steps below to see the Aggregator Maintenance option in the Inventory > Utilities list.

To update a user’s permission to create and manage Aggregator records:

1. From the Main Menu, choose Maintenance > Database > User IDs. The User ID Maintenance form displays.

2. In the User ID list, choose the User ID of the person or group you want to grant the Aggregator creation/management rights to.

3. In the Security Options tab, choose the Settings ![]() icon next to the Permissions List option. The Permissions List Code Maintenance pop up box displays.

icon next to the Permissions List option. The Permissions List Code Maintenance pop up box displays.

Permissions List Code Maintenance (Aggregator Maintenance Checked)

4. Navigate to Inventory > Utilities > and choose the Aggregator Maintenance check box and choose Apply. The database updates.

5. Choose Return to return to the User ID Maintenance form.

6. Choose Process (F12) to save this change.

Understanding Aggregator Types

B-98723, B-98724, B-98772, B-98773, B-98774, B-98775 - You create Aggregator Types in the Item Maintenance form to quantify the inventory you need to deliver and establish pricing for these deliveries and pickups. Aggregator types are a combination of aggregator item types, which define the how the items are measured (by length, area, volume, weight, or by piece) and aggregator methods, which define how your business charges for the transportation of those items. You create as many aggregator types as you need to cover the inventory you need to deliver.

Aggregator item types, such as Lumber, Sheet Goods, and Hardwoods, for example, have different units of measure, which you quantify by length, area, volume, weight, or by piece in inventory. Consider how you quantify delivery charges for these materials and choose one of these aggregator item Types. If you charge for delivery based on the items’:

-

Number, choose Total Quantity. The Aggregator will use the number of items purchased as the multiplier.

-

Length, choose Total Lineal. The Aggregator will use the items’ length as the multiplier.

-

Area, choose Total Area. The Aggregator will use the items’ length x width calculation as the multiplier.

-

Volume, choose Total Volume. The Aggregator will use the items’ length x width x depth calculation as the multiplier.

-

Weight, choose Total Weight. The Aggregator will use the items’ weight as the multiplier.

The multiplier times the number of each item the customer purchases, gives you a way to quantify the amount of material you are transporting. Each aggregator type should be associated with a base unit of measure so the quantity calculation is consistent.

After you choose how to quantify your items, you pair this with the Method of delivery so, at Point of Sale, you can choose the delivery calculation method that is appropriate for the circumstances. If you:

-

Charge for items’ delivery only, choose Positive Quantity

-

Charge for items’ pick up only, choose Negative Quantity

-

Charge for items’ delivery and for pick up, choose Absolute Quantity

-

Charge for items’ delivery and credit for items’ pick up, choose Net Quantity

Keep track of these two pieces of information, as you will need them in step 7 in the instructions below. You only need to create aggregator types for your chosen delivery methods and materials.

Creating Aggregator Types

B-98713, B-98714 – When you create an aggregator type, it remains in inventory for any transaction you need to process. Though aggregator types are saved globally, these types are specific to a branch based on the branch’s tax settings. They form the basis for the Aggregator SKU, which pairs the type with the actual inventory covered by the SKU.

If you are using this feature for delivery, and you have a charges group already, we recommend that you create a new section for Delivery Charges (Cartage) to track the income/payments associated with this service. A new section can help you manage and track this income and inventory assets (sold and returned) separately.

Note: There are many different ways you can use Aggregators. Depending on how you use this Aggregator, you will want to map this appropriately to your general ledger accounts.

To create an aggregator type:

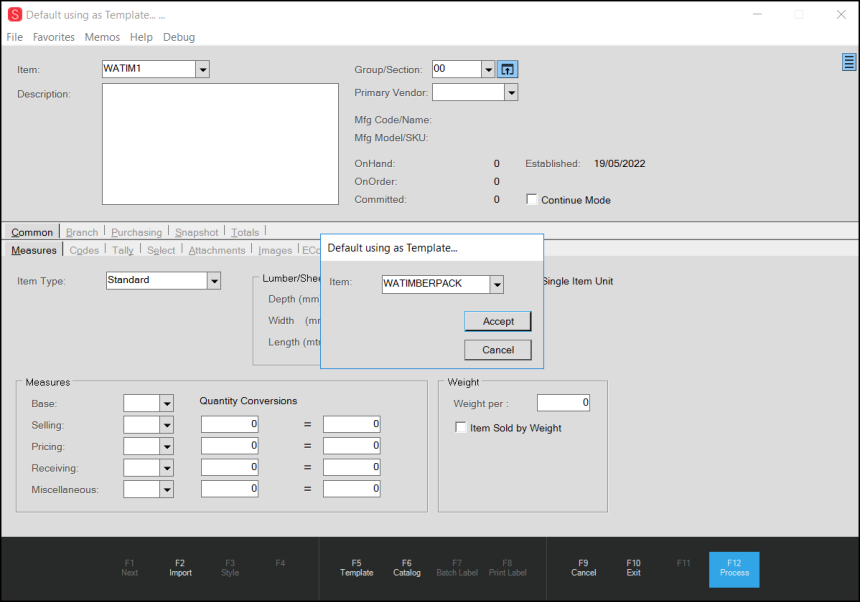

1. From the Main Menu, choose Inventory > Database > Item to display the Item Maintenance form.

2. In the Item field, type the name of the Aggregator item and press Enter.

This will be used at Point of Sale to identify the items and type of delivery that is occurring, so consider that when you choose a name.

3. In the Description field, enter a description for this aggregator type:

-

You may want to enter the type of material used for this type

-

You might want to include the Type and Method values

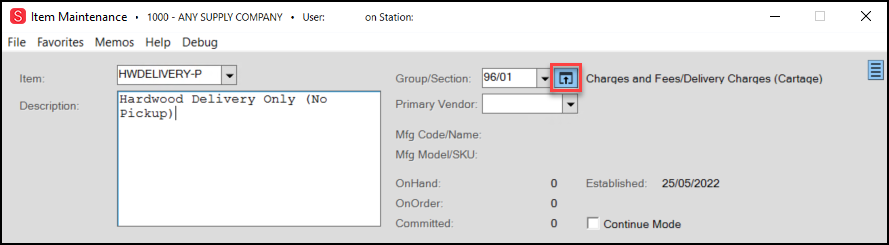

Item Maintenance Form with Aggregator Item Name, Description, and Group/Section

4. Beside the Group/Section field, choose the Settings ![]() icon to display the Group/Section Maintenance box.

icon to display the Group/Section Maintenance box.

Group/Section Maintenance with Entries

You only need to create this Group/Section entry the first time you use these instructions. Next time, you can just select the defined delivery charges entry.

5. In the Group/Section Maintenance box, add a new entry for Delivery Charges (Cartage) and leave the E-Commerce Enabled and Estimating Enabled check boxes unselected. Then, choose Apply. The Item Maintenance form redisplays.

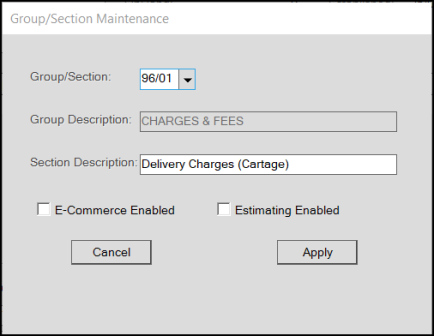

6. In the Common > Measures tab, select Aggregator from the Item Type list. A new Aggregator section displays.

Item Maintenance with Aggregator Type and Method Displaying

7. In the Aggregator box, select the appropriate Type and Method for this aggregator type.

Type options. To measure the delivery of these items by:

-

Number of Items, choose Total Quantity.

-

Length, choose Total Lineal.

-

Area, choose Total Area.

-

Volume, choose Total Volume.

-

Weight, choose Total Weight.

Method options. If you want to:

-

Charge for delivery of these items only, choose Positive Quantity

-

Charge for pickup of these items only, choose Negative Quantity

-

Charge for delivery and for pickup of these items, choose Absolute Quantity

-

Charge for delivery of these items and credit for pickup of these items, choose Net Quantity

8. In the Measures section, enter the measurements you want to associate with this aggregator type. This measurement should be the type associated with the type of items you want to deliver.

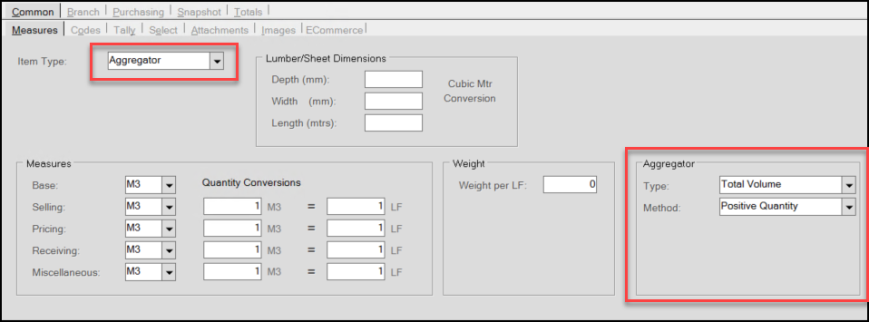

9. When you have completed these entries, choose the Codes tab.

Item Maintenance > Common > Codes Tab with Settings

The settings in this tab may be different, depending upon your region.

10. Select the appropriate tax options for this aggregator type and enter N in the Track Qty On Hand field. Sometimes, the taxable setting is branch-specific.

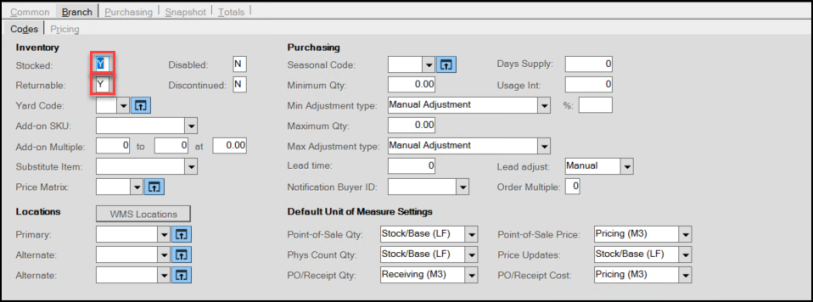

11. Next, choose the Branch tab and a new Branch Codes tab displays.

Item Maintenance > Branch > Codes Tab with Settings

12. Make sure that the Stocked and Returnable fields contain a Y. You can leave the quantity amounts untouched.

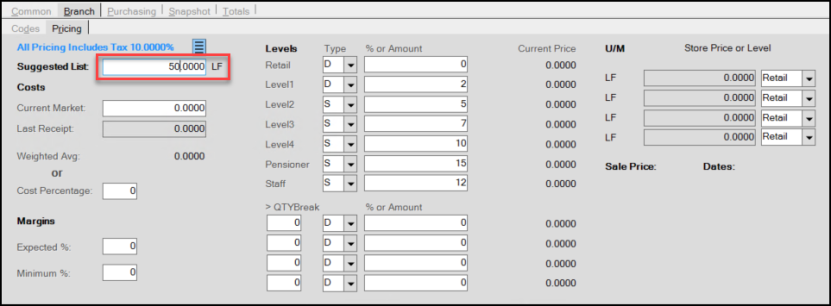

13. Choose the Branch > Pricing tab.

Item Maintenance Form with Branch > Pricing Tab

14. In the Suggested List field, consider what you normally charge for delivering these items and enter that amount in this field. You may want to consider labor costs for this type of delivery.

15. When these entries and selections are complete, choose Process (F12). The Warnings Popup displays.

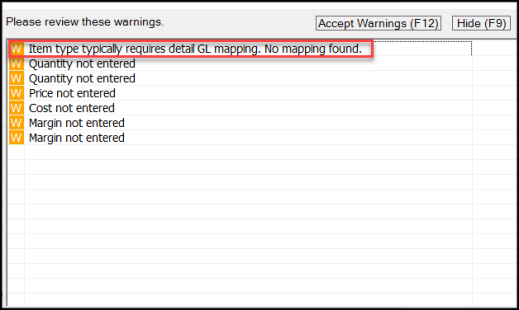

Item Maintenance > Warning Messages

Most of the warning in this list are not needed for the Aggregator, but take note of the first entry:

-

Item type typically requires detail GL mapping. No mapping found.

This entry reminds you to set up the GL mapping for the new Group/Section entry. See Setting the GL Mapping for the Aggregator Group/Section for these instructions.

16. Select Accept Warnings. The Branch List displays.

17. Choose the branch(es) for this aggregator type and select Accept.

18. Repeat this process to create any additional aggregator items for different delivery methods and for any additional branches that have deliveries.

You won’t have to create the Group/Section entry again, you just need to select it from the list.

Setting the GL Mapping for the Delivery Group/Section

It makes sense to create detailed GL maps for the new group/section record for each type of Inventory Mapping type that applies to these delivery and asset transactions.

Note: Typically, users map non-inventory items to non-inventory accounts such as income or expense accounts (or both) and sometimes liabilities (gift cards, deposits), etc. If you don’t set the appropriate GL mapping, the aggregator type might appear as inventory in the general ledger but not show up on inventory subledger reports. This could cause discrepancies when assessing sales and performing inventory GL reconciliations.

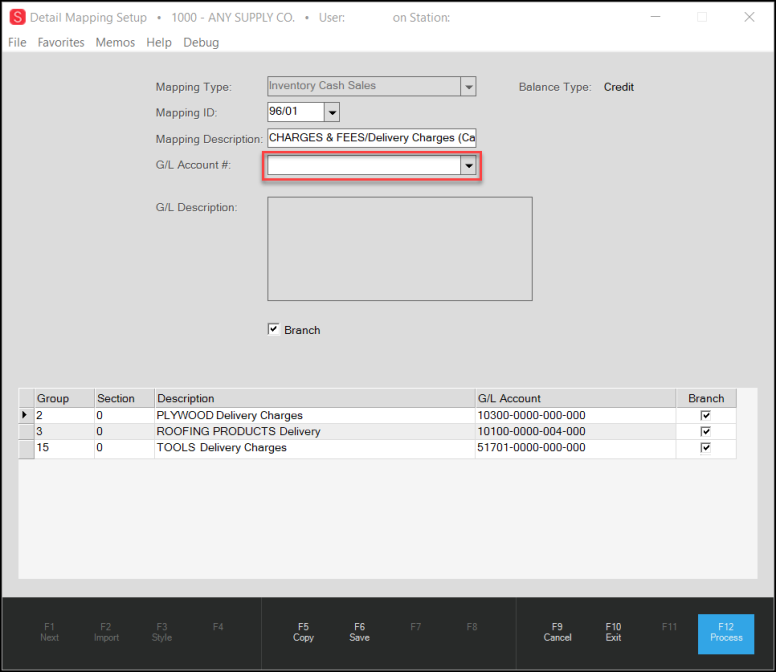

To assign the GL mappings for the new Aggregator Group/Section:

1. From the Main Menu, choose General Ledger > Database > Detail Mapping to display the Detail Mapping Setup form.

2. In the Mapping Type list, choose the first mapping type you want to add.

3. In the Mapping ID list, choose the Group/Section entry combination you added in the first Aggregator Item Maintenance form.

Detailed Mapping Setup Form with Entries

4. In the GL Account # field, select the appropriate GL account number for this aggregator item.

5. Check the Branch check box if the mapping of this entry is department (branch)-specific for your business.

6. Choose Save (F6) to save the Group/Section record to the data grid.

7. Choose Process (F12) to process the GL mapping type for the Group/Section.

8. Repeat steps 2 – 7 to add other Group/Section GL mapping types that apply to the aggregator SKUs for your business:

-

Inventory Cash Returns

-

Inventory Charge Sales

-

Inventory Charge Returns

-

Inventory Exempt Cash Sales

-

Inventory Exempt Cash Returns

-

Inventory Exempt Charge Sales

-

Inventory Exempt Charge Returns

-

Inventory Issues

-

Inventory Cost

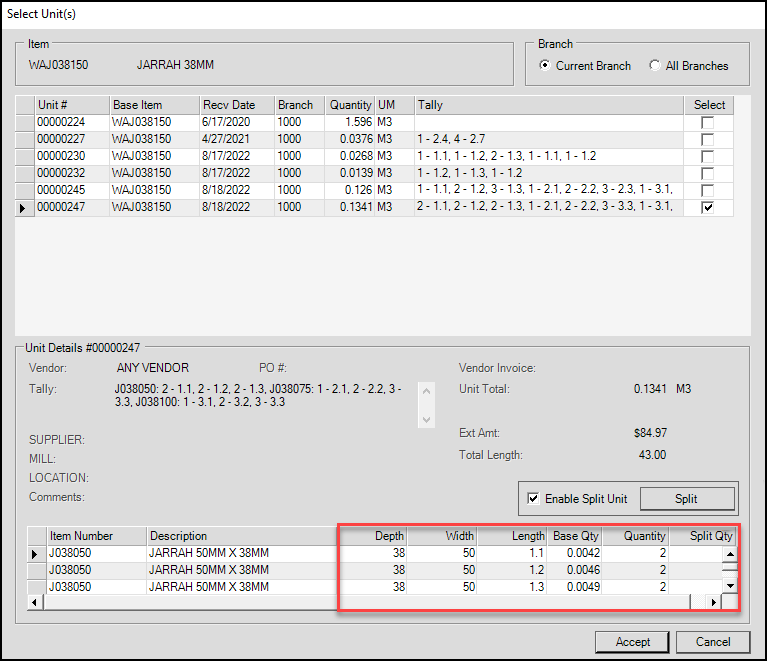

Assigning Inventory to Create Aggregator SKUs

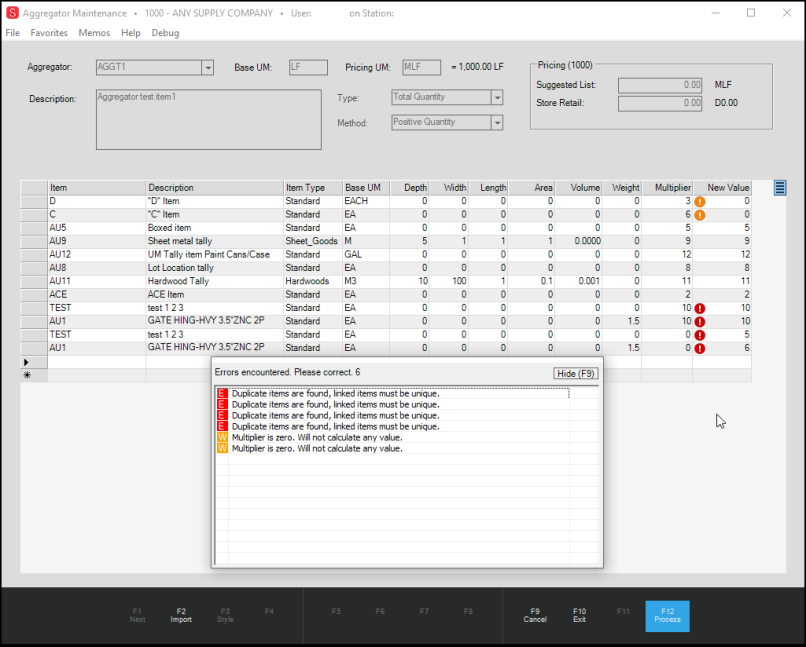

By associating your inventory with one or more aggregator types, the application can use the item’s default unit of measure to calculate the delivery cost (or other Aggregator uses). The Aggregator Maintenance Utility helps you create this link between the aggregator types and your inventory. When you add inventory to the aggregator item, the application uses the default unit of measure you choose to create a multiplier for each item. In the Point of Sale data grid, these multipliers, times the quantity of units to be delivered, determine the delivery price.

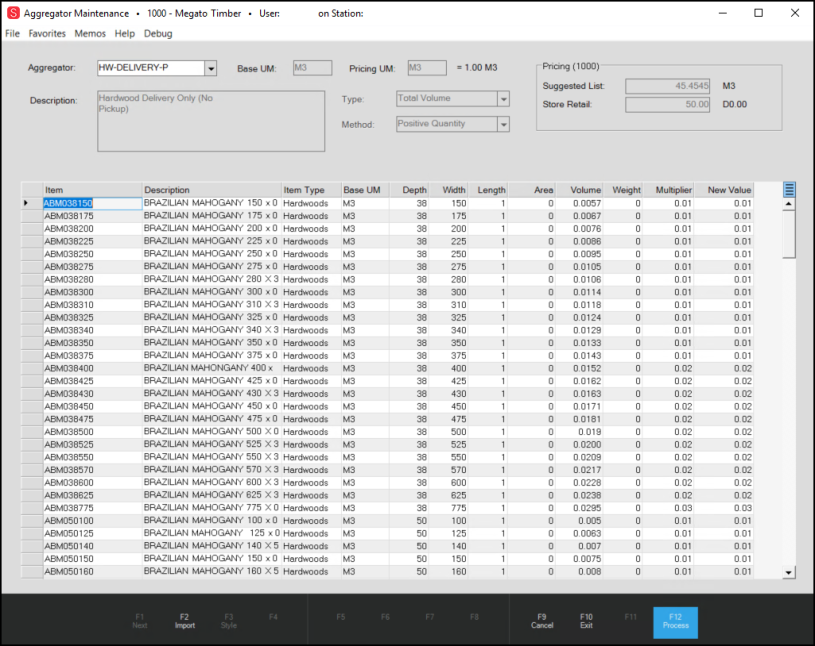

Aggregator Maintenance Form with Entries

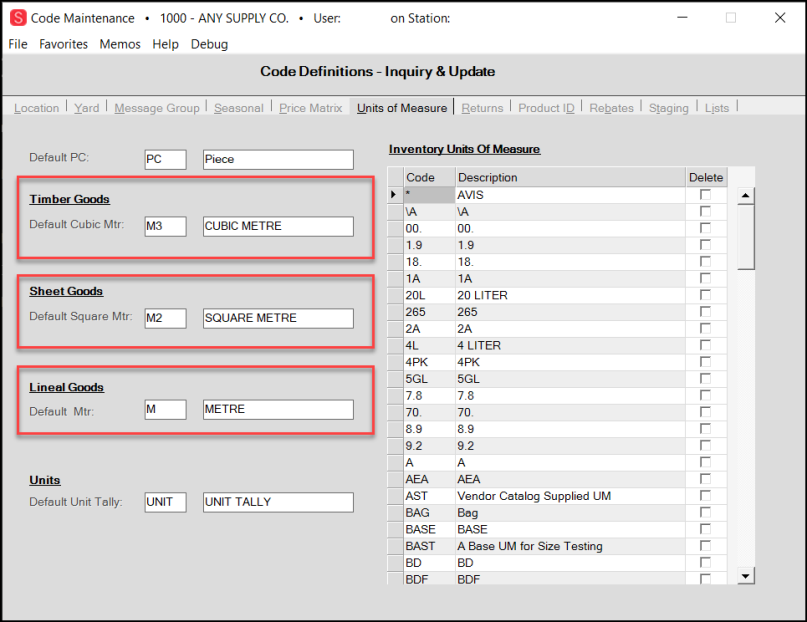

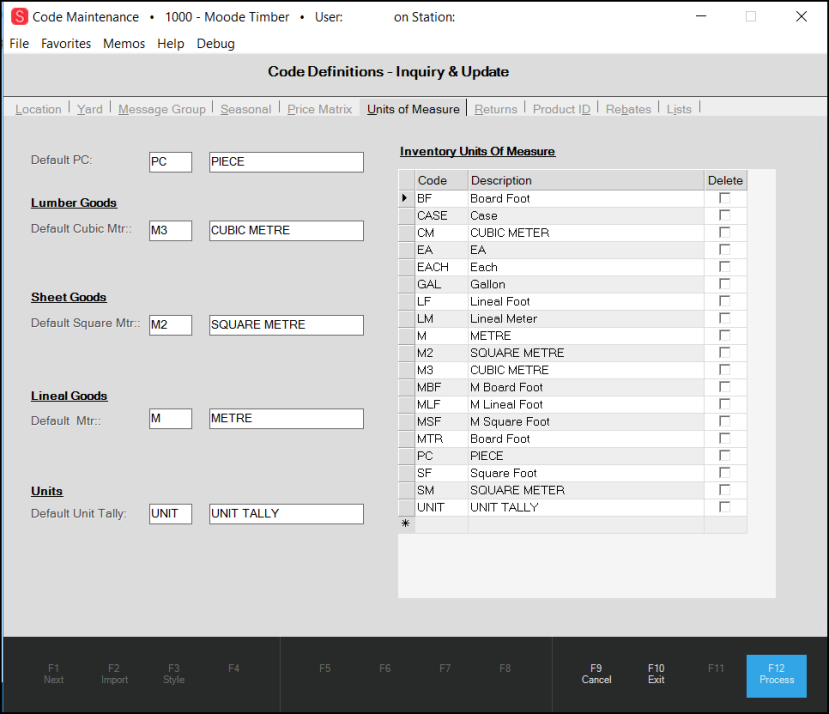

Keep in mind that you set the default units of measure for lumber/timber (volume), sheet goods (area), and lineal (length-based) goods in the Code Definitions table (Inventory > Database > Code Definitions); these entries vary based on whether you use a metric or imperial system of measurement.

Code Maintenance Form with Lineal, Sheet Goods, and Timber/Lumber Goods Default Settings

So how are the item’s multipliers determined?

In general, the multiplier is determined by the base unit(s) of measure of the item, as follows:

-

Number of Items: For items that are sold by the piece, each, or box, the multiplier is always 1.

-

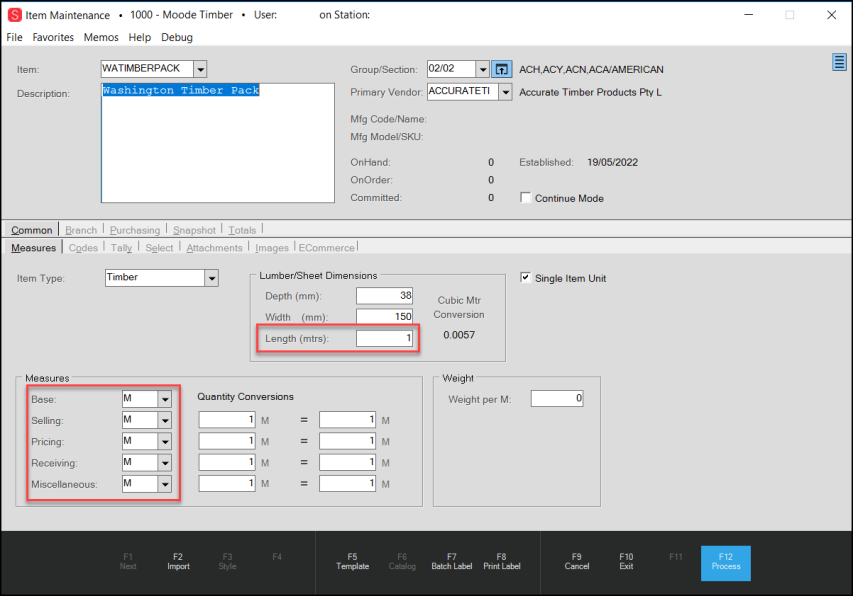

Lineal/Length: Typically, Lumber, Timber, or Hardwood Items

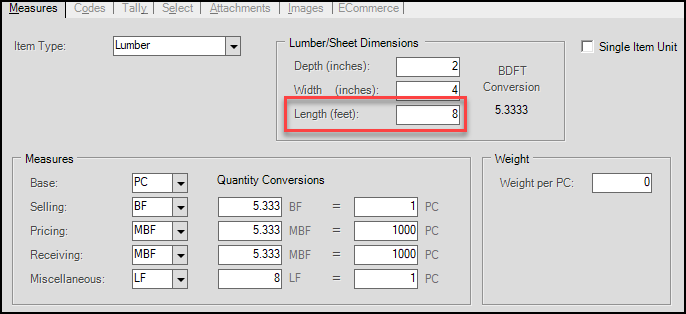

For lineal (length)-based aggregator types, the length value defined in the Item Maintenance form determines the multiplier. In the next figure, the length is 8, which would be the default multiplier for this item.

Note: If you add this item to the data grid, but the unit of measure is thousand board feet/meter instead, the application uses the quantity conversion listed (5.333) x the default length (8) and the multiplier would be 42.664.

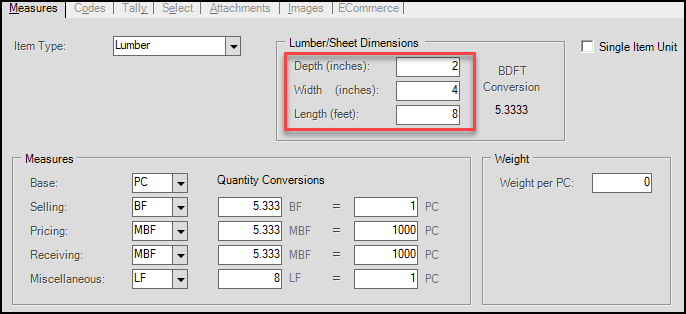

Lineal/Length Measures in Item Maintenance Form

-

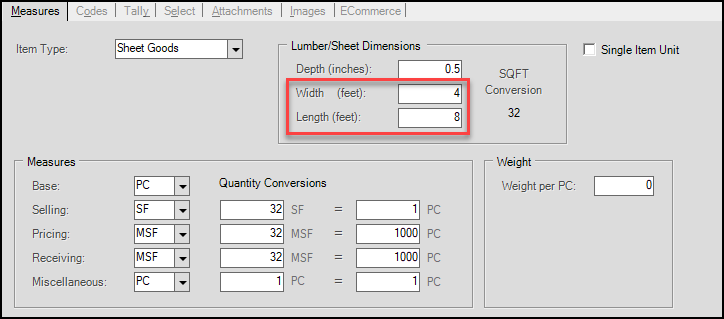

Area: Typically Sheet Goods

For area-based aggregator types, the items’ length x the width values in the Item Maintenance form determine the multiplier. In the next figure, the length is 8 x the width, 4, so the default multiplier for this item would be 32.

Note: If this item is added to the data grid with a square foot or thousand square foot measurement, the calculation becomes length x width (32) times the multiplier, which in this case is also 32 to equal a multiplier of 1024.

Area Measures in Item Maintenance Form

-

Volume: Typically, Lumber, Timber, Hardwood, Liquids

For volume-based aggregator types, the length x the width x depth values in the Item Maintenance form determine the multiplier. In the next figure, the length is 8 x the width, 4 x the depth, which is 2, so the default multiplier for this item would be 128.

Note: If this item is added to the data grid with a unit of measure other than the base unit of measure, the calculation becomes length x width x height (128) times the quantity conversion, which is 5.333 to equal a multiplier of 682.624.

-

Weight:

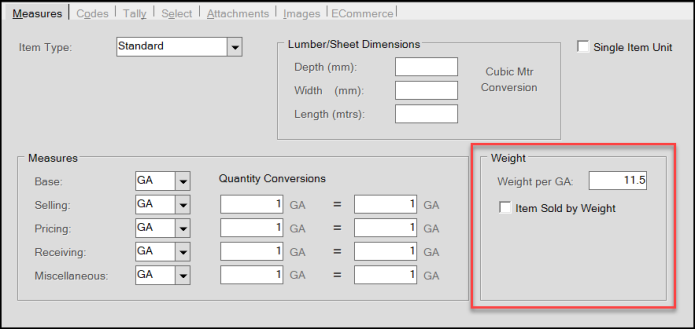

For weight-based aggregator types, the weight value is the multiplier. In the next figure, the weight is 11.5 per gallon, so the default multiplier for this item would be 11.5.

Weight Measurement in Item Maintenance Form

IMPORTANT: For any item where the default unit of measure cannot be reconciled with the aggregator type’s unit of measure, the multiplier is 0. You either have to assign these multipliers manually, or remove them from the aggregator type list.

Items to Add to Aggregator Types

The aggregator types are designed for these types of items:

-

Standard Items, Lumber/Timber, Sheet Goods, Clothing, Rental Charges, Hardwoods, Food, Resale Items, Renumbered Items, Manufactured Items, and Variable Weight Items

-

Tally types included:

Lineal Tally Items

Lot-Location Tally Items

Sheet Metal Tally Items

Random Length Tally Items

Unit of Measure Tally Items

Unit Tally Items (Single Item Units only)

A Note About Non-Stocked Items

B-98810 – If you sell and need to deliver items that are non-stock, you want to include them in the aggregator SKU so you can charge for their delivery. Often when you add these items, the Item ID changes (to reflect the non-stocked status). When that occurs, the aggregator SKU keeps track of these renamed item types to preserve the Aggregator linkage for the renumbered/renamed item.

Items You Cannot Add to Aggregator Types

The aggregator type may not be appropriate for all items in your inventory. You cannot add the following items to an aggregator type:

-

Labor, Freight, Deposit, Gift Cards, Rewards Coupons, Repeat Rewards Types, Stored Value Cards, Comments, Credit SKUs, and ACE Types

-

Tally types excluded:

Fixed Tally Item (Parent SKUs)

Pull to Length Tally Items (Parent SKUs)

Adding Inventory to the Aggregator Type

B-98723, B-98724, B-98773, B-98774, B-98775 – Now that you have created the aggregator items, it’s time to populate these records with inventory and generate the aggregator multipliers.

To add inventory to the aggregator item:

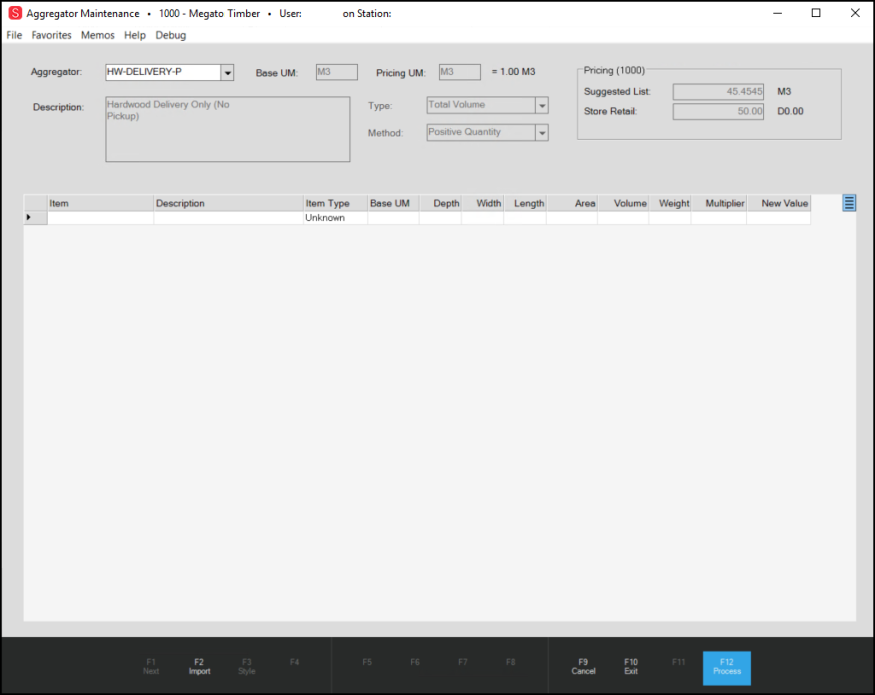

1. From the Main Menu, choose Inventory > Utilities > Aggregator Maintenance. The Aggregator Maintenance form displays.

2. In the Aggregator list, choose the aggregator type you want to add items to and press Enter. The Aggregator Maintenance fields update with the information added earlier.

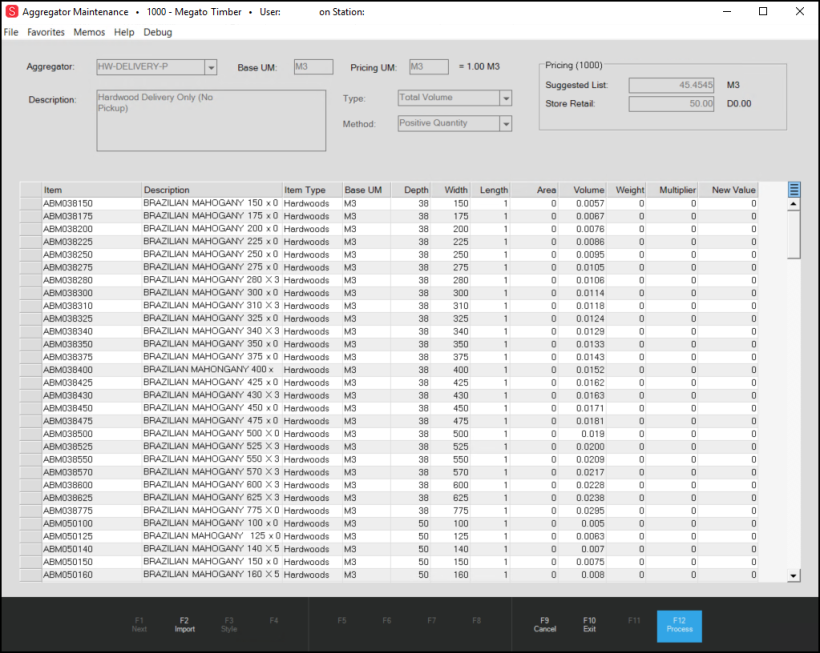

Aggregator Maintenance Form with Aggregator Type Loaded

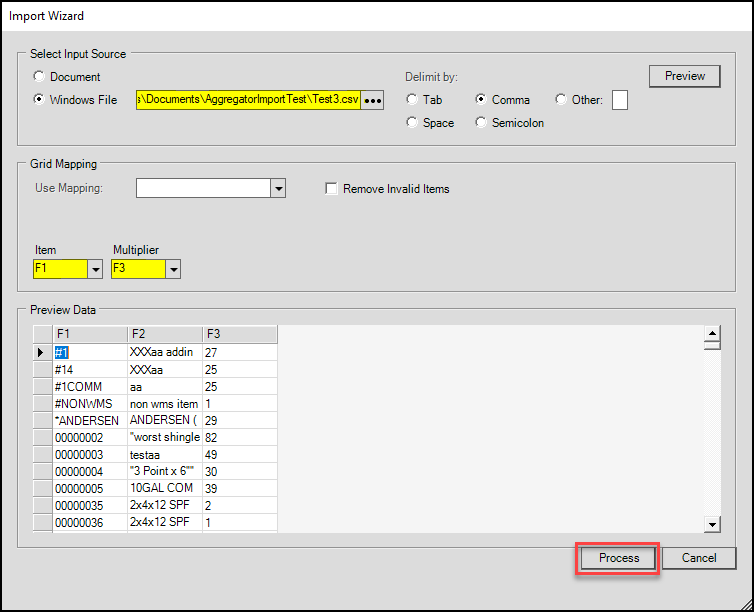

You can add items manually, but it probably more efficient to use the import feature.

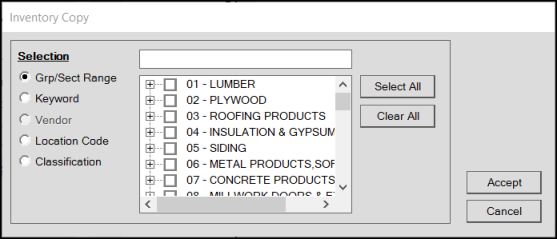

3. Choose Import (F2) and from the local menu, choose Inventory to display the Inventory Copy box. Choose the criteria for importing the items that match the selected aggregator type.

Note: You can also import from a document by selecting the Import Wizard option, see Using the Template Feature to Add Inventory to the Aggregator Type.

Inventory Copy Box

4. Consider the Inventory Item Type measurement value (piece, weight, area, etc.) and select the check box beside the inventory that applies to that type in the list.

5. Choose Accept to import the items you selected. The data grid fills up with the inventory items you imported. When you import more than 1000 items, a confirmation message displays. Choose Yes to continue.

Aggregator Maintenance Form with Entries

A message may display after the import is complete to display the number of items (usually duplicates) that were ignored and not imported, if any. Choose OK to clear this message.

After the import is complete, you cannot change the Item identifier in the first column of the data grid. You can delete an item and re-enter it if you need to. The application does not import any disabled items from inventory, nor does it allow you to enter them. If you decide to disable an item, you should delete it from the Aggregator first, to avoid errors.

6. Review the items in the data grid and add or remove items that do not fit the Aggregator SKU criteria:

-

To organize the list, right-click the row header and click Sort to sort by that type. It might be useful to sort by Base UM so you can ensure these item entries match the default for the aggregator item.

-

Delete any items that you want to measure a different way by highlighting the record and pressing the Delete key on your computer.

-

Repeat steps 4 and 5 (or use the Import Wizard) to add any new items that belong in the list.

-

Press <Ctrl Insert> to add a blank line to the data grid and enter an item manually.

After you have finalized the list of items you want to associate with this aggregator type, you are ready to calculate the Multipliers.

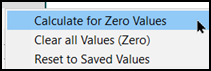

Aggregator Maintenance > Menu Marker Options

7. When you are sure you have the list you want, you are ready to calculate the multipliers.

In the upper right corner of the data grid, choose the Menu Marker to display three options:

-

Calculate for Zero Values

Select this option to calculate the Multiplier for all items that have a zero value in the New Value field. The application takes into account the Aggregator Type (length, area, volume, weight, quantity) when making this calculation. -

Clear All Values (Zero)

Select this option when you need to reset the Multiplier for all items in the list to zero. -

Reset to Saved Values

Select this option to reset the New Value entry to the value in the Multiplier column.

8. Select the Calculate for Zero Values option to generate the New Value for each item in the data grid. The application calculates the New Value based on the following:

-

If the Type = Total Quantity, the New Value = 1.

-

If the Type = Total Length (Lineal), the New Value = item’s length.

-

If the Type = Total Area, the New Value = item’s length x width.

-

If the Type = Total Volume, the New Value = item’s length x width x depth.

-

If the Type = Total Weight, the New Value = item’s weight.

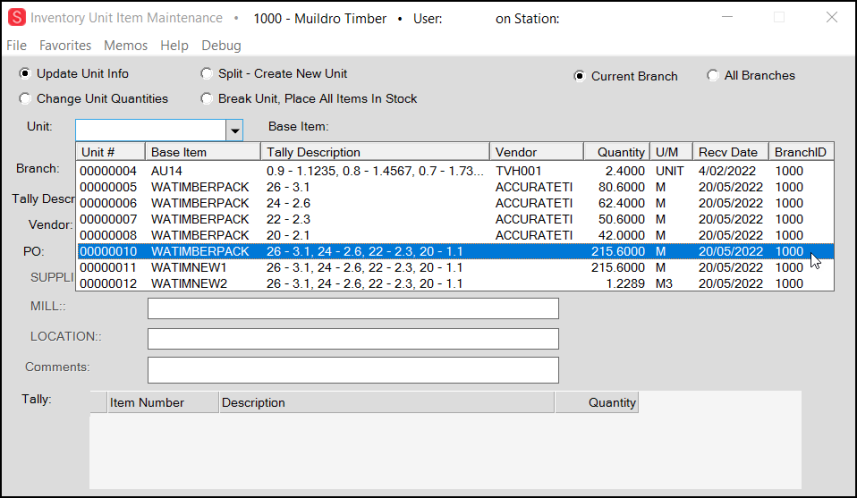

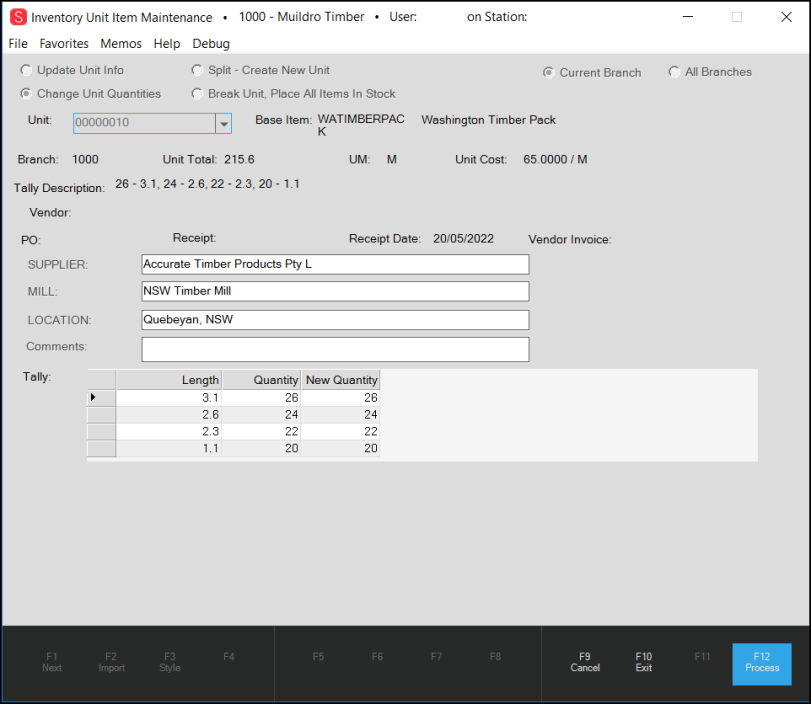

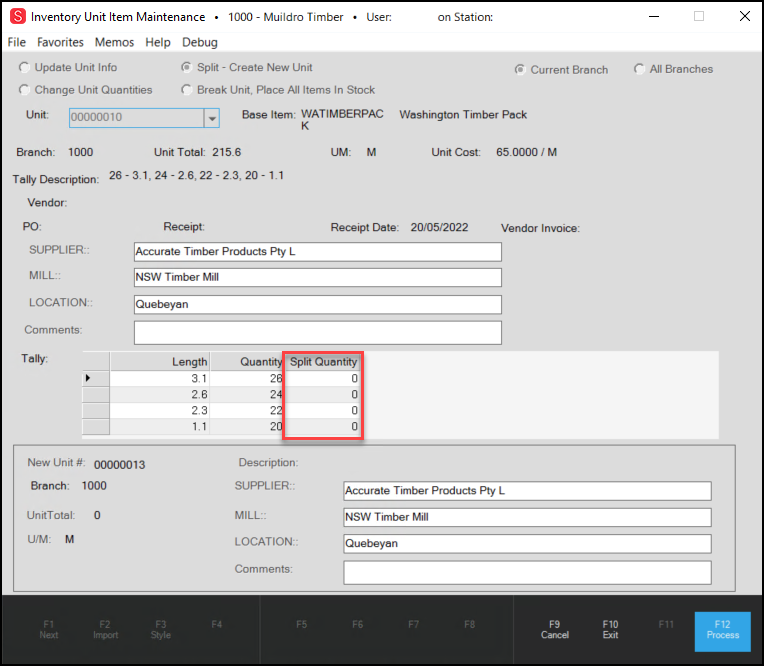

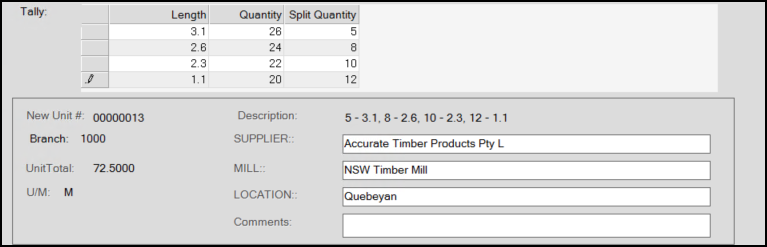

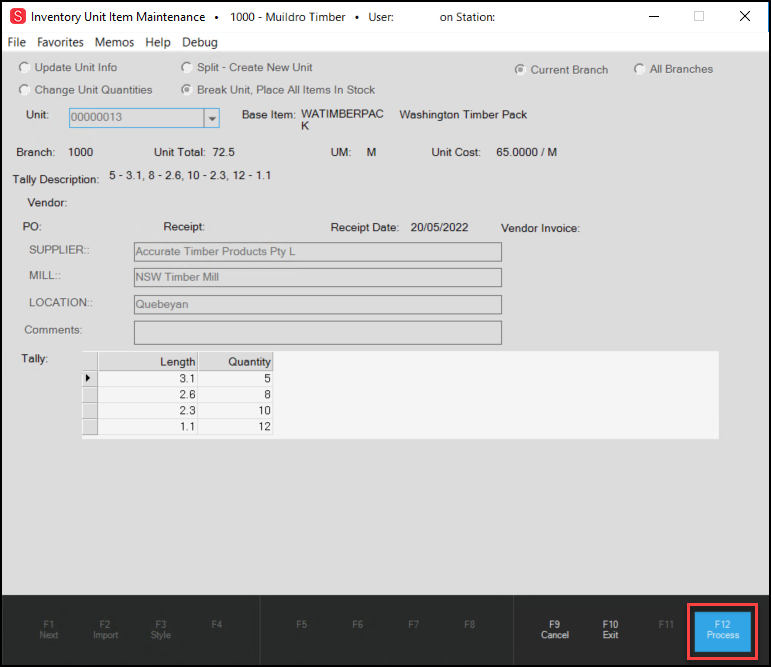

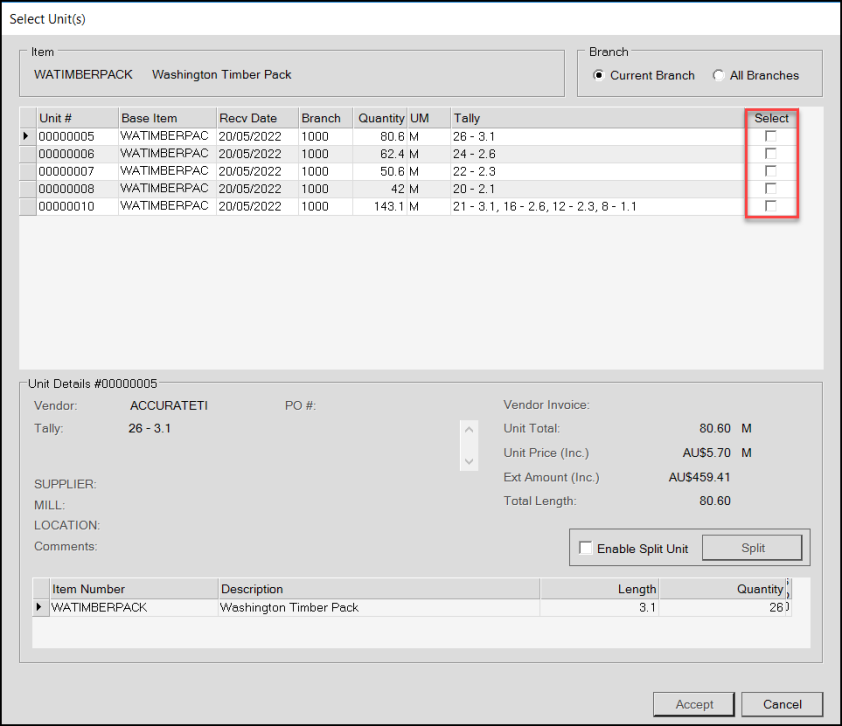

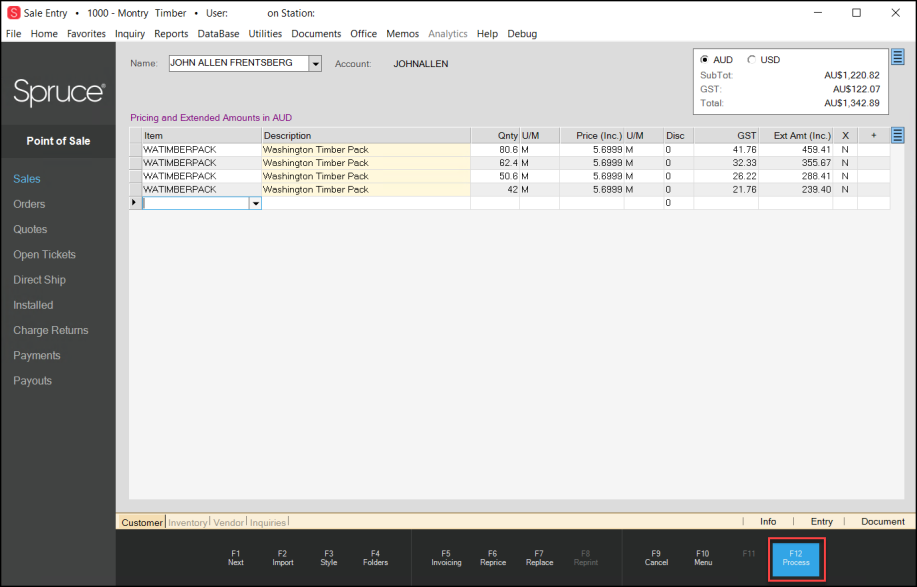

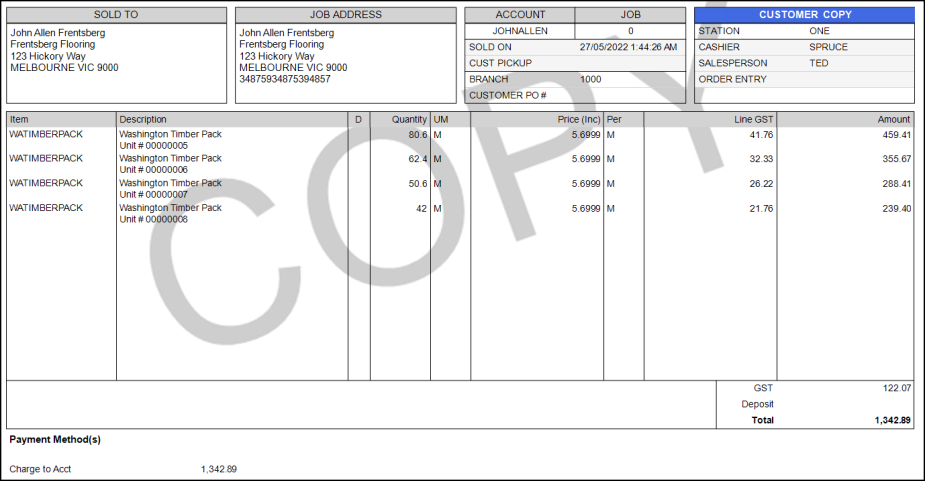

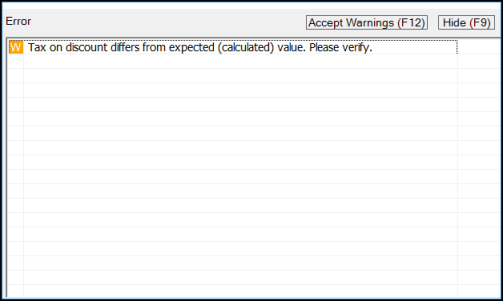

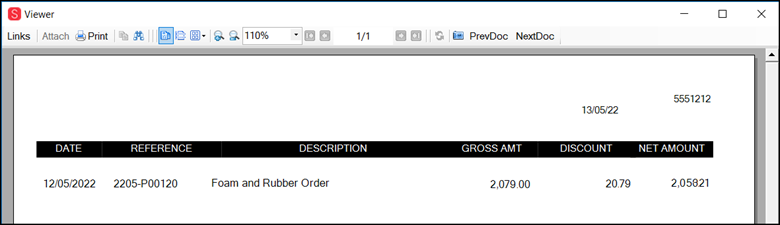

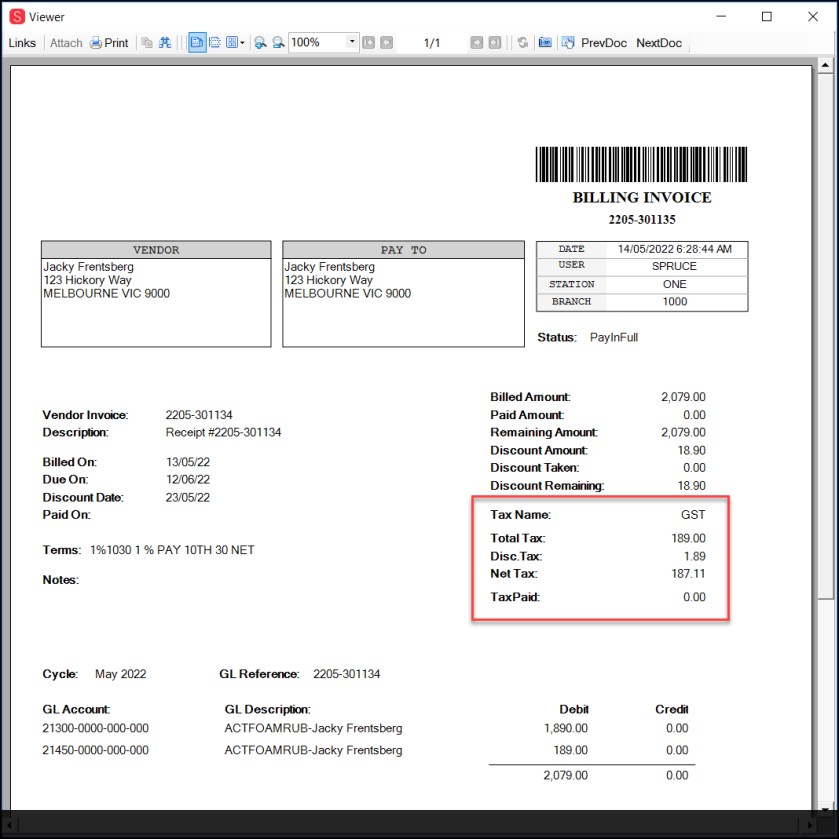

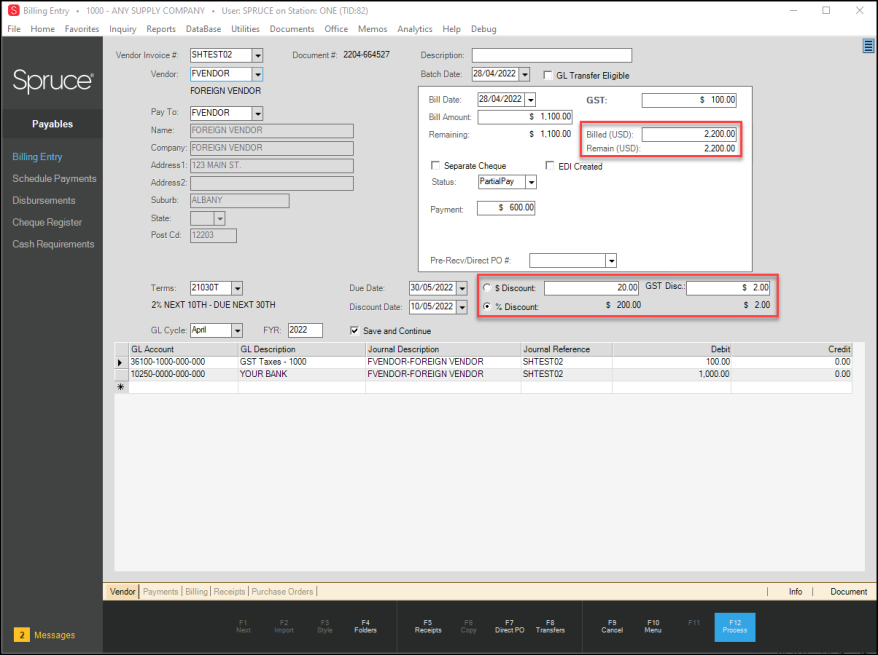

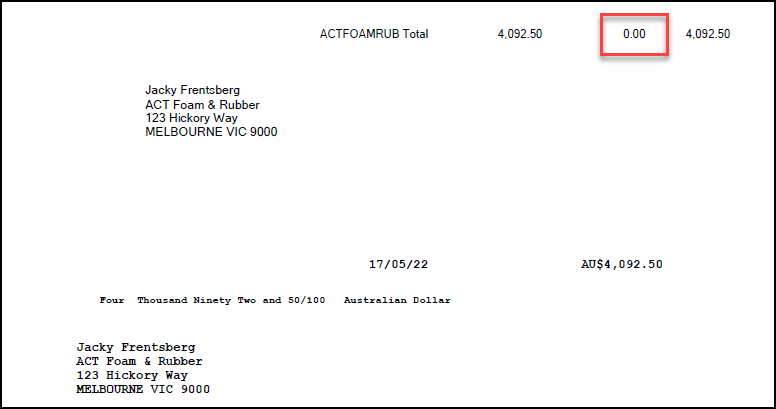

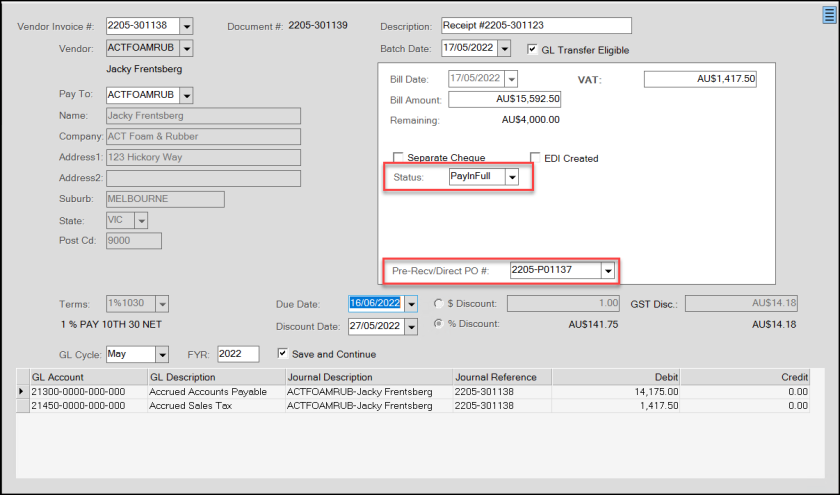

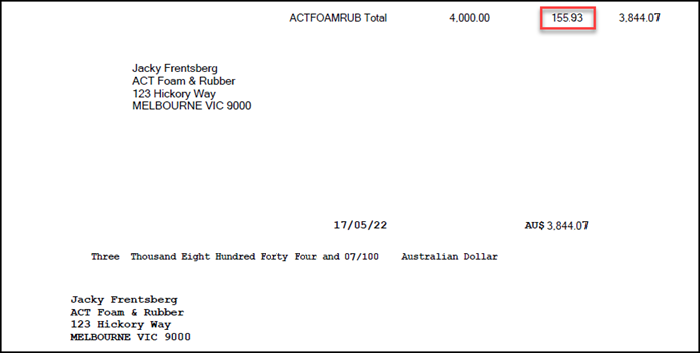

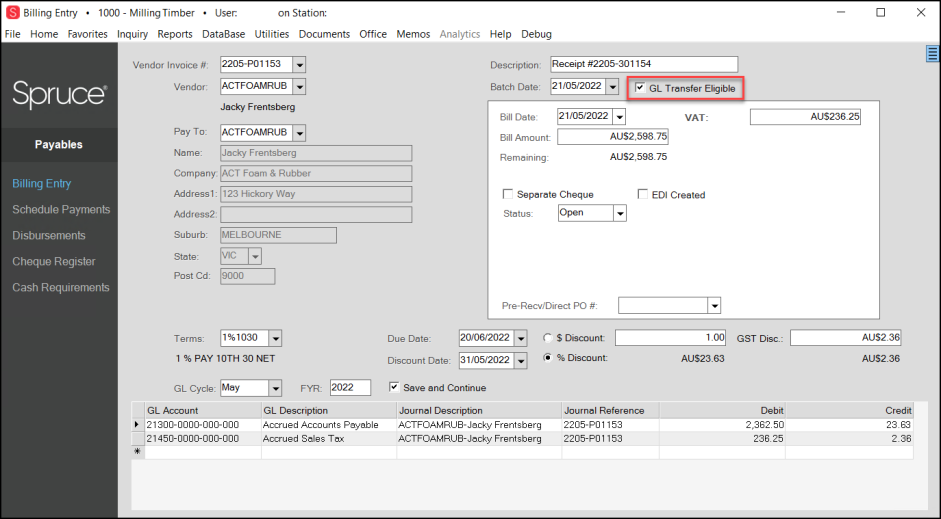

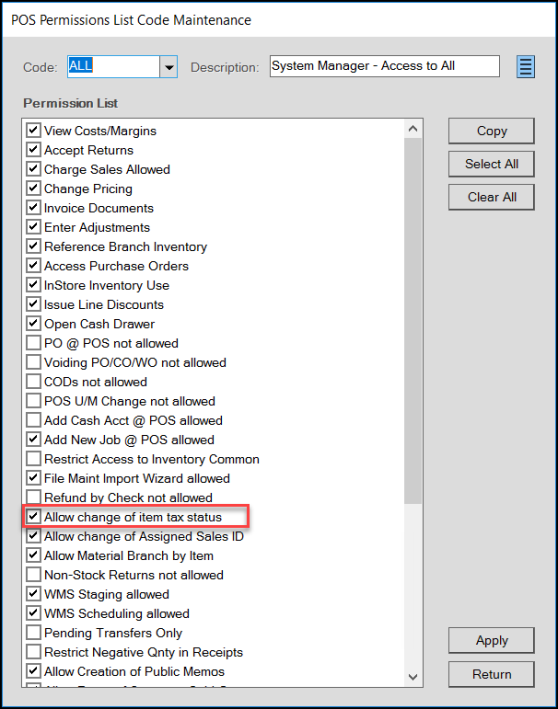

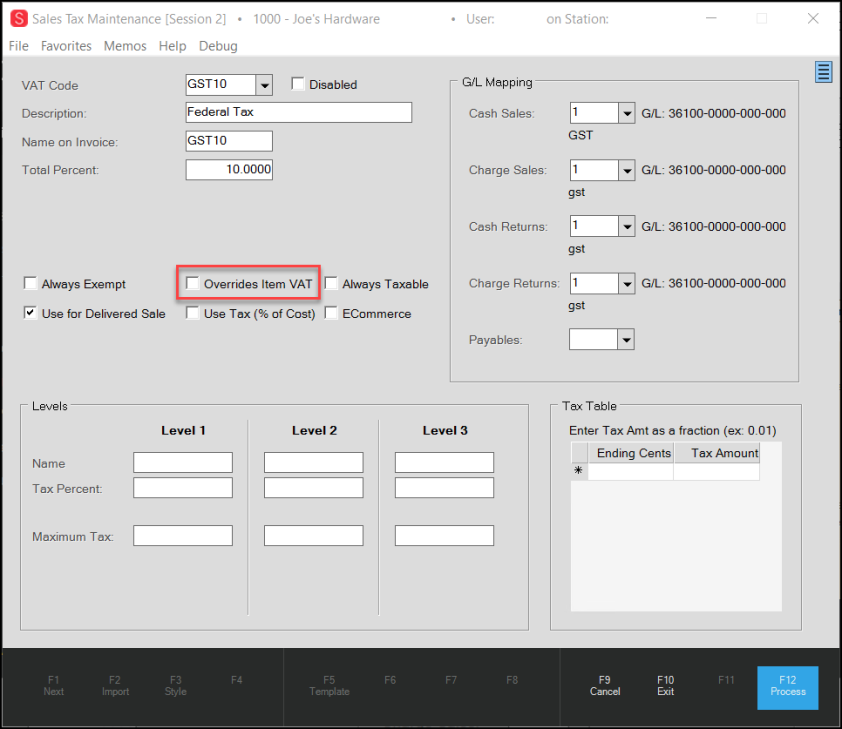

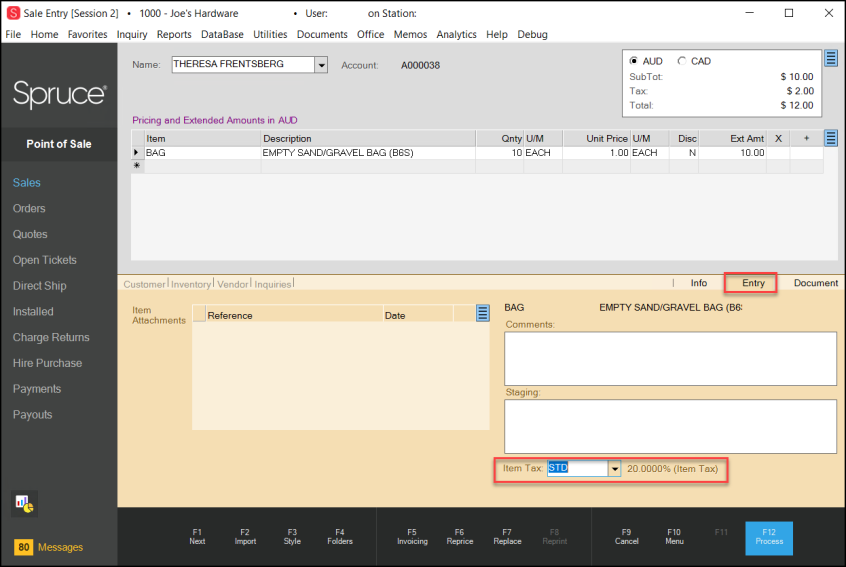

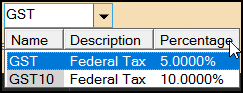

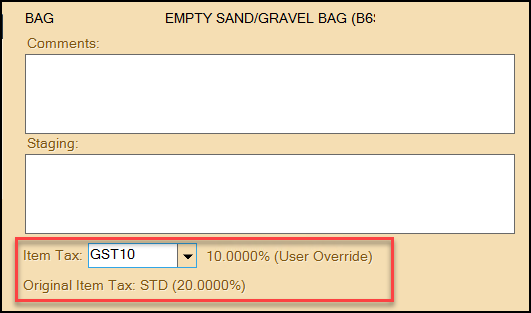

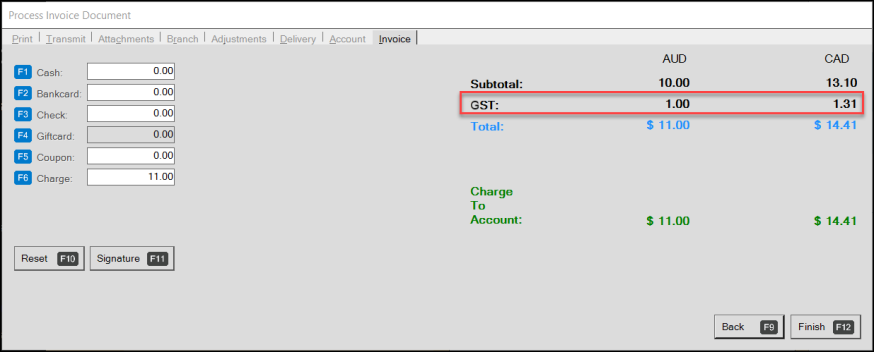

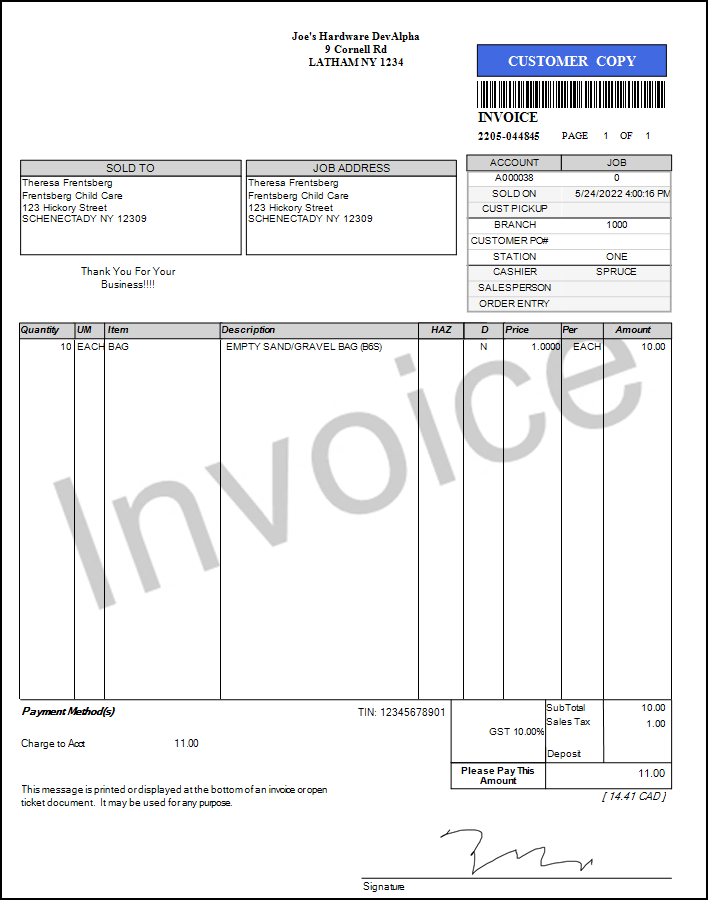

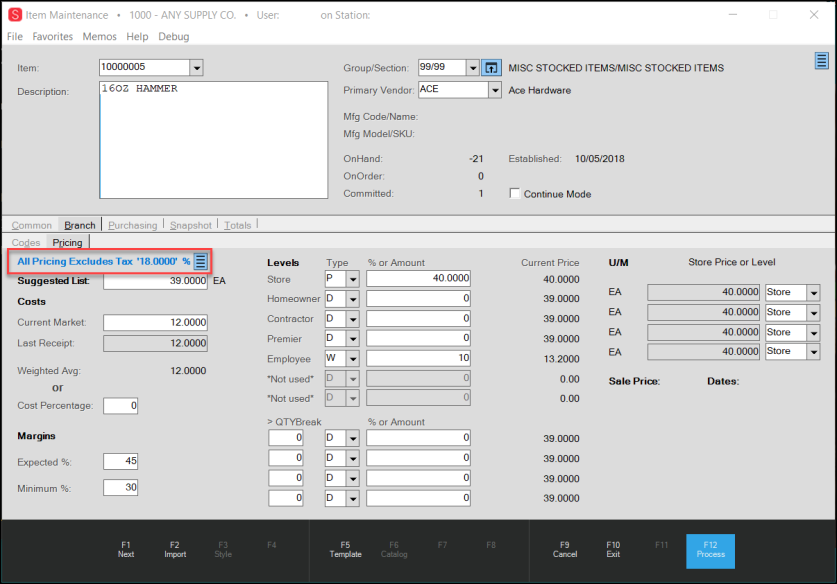

-