Credit Limit Override Utility

This utility provides a way to approve or deny a remote credit override while at the same time reviewing a customer's account. For a remote override to be done, the user who receives the override warning notifies the Credit Manager, who locates the override request and either approves or denies it.

The determination as to whether or not an override is produced (and how) is based upon a number of factors. For more detailed information about if, when, and how credit overrides are triggered, please click here.

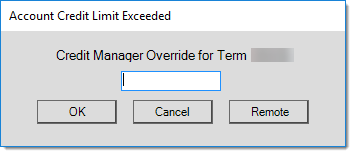

Credit OverridesCredit overrides are used to prevent an account or job from either charging or committing to purchases above some threshold amount determined by your company. This threshold is the "credit limit" assigned to either the account or job. The customer (account) or job balances and override settings determine if, when, and how an override is produced. Prompts for an override may appear when processing a number of Point of Sale transactions. A calculation is done to determine if the account or job requires an override. This calculation will be done at the "account" level for any account that does not maintain job balances. If the account is set up for "job" level billing, the job's balances will be used in place of the account's. (Outstanding Balance + Finance Charges - Credit Balance) + Charge Amount + Order Balance) > Credit Limit This calculation (above) is done for both the account and job (job balances only exist if the account is "job" level billing). Order Balance is always considered since an order is considered a commitment to purchase goods. Even if the account or job passes the initial test (see the calculation above), the account or job can optionally produce an override based upon a particular aged balance. For example, if the account or job is set to prompt for an override when there is a 60+ Balance, the software calculates the total balance past the 60-day period less any unapplied credits to determine whether or not an override is warranted. You might notice that this calculation doesn't consider either the charge amount or the order balance. This type of override is produced any time the indicated customer (or job) aged balance (less credits) is above zero. The intention here is to require an override when a customer who hasn't paid their bill in a while attempts to make additional purchases. (60-Day Balance + 90-Day Balance + 120-Day Balance) - Credit Balance > 0 It's important to point out that the customer may still have credit available on their account or job when a balance trigger produces a warning. In addition, these balance messages don't bypass the more general check of the account or job balances, so if the customer is charging more than their overall limit allows, a credit override will still be produced even though they may not have a "60-Day" balance, for example. Messages produced at Point of Sale will vary based upon the exact reason for the override. Here are some of the messages that a user might see... "Account/Job Credit Limit Exceeded" "Job Credit Limit Exceeded" "Account Credit Limit Exceeded" "Job 60+ day Balance Exceeded" "Account 120+ day Balance Exceeded" When an override prompt appears during Point of Sale processing, the following form is shown to the user:

This dialog contains a label ("Credit Manager Override for Term..." or "Store Manager Override for Term...") which explains the type of password required, a text area for optional entry of the override password, and includes three buttons: OK, Cancel, and Remote. There are several ways a company might choose to utilize this feature: •Manual Entry of the Password at Point of Sale

•Remote Override from the Credit Override Utility

If the override requires a "Credit" Manager type override an immediate notification is sent. If the designated credit manager user has a cell phone and provider (carrier) designated, the notification will be sent to their device via email (the credit manager's phone and/or provider account settings must allow text via email). Otherwise (if a cell phone and provider have not been configured), the notification will still be delivered but via either the standard messaging feature (notification queue) or email (if setup for the user). The notification is sent as soon as the dialog opens and is not triggered by clicking the remote button. The text message sent via email requires that your Spruce application be configured to send email to a designated SMTP server (this is commonly done, but not required). Your SMTP server may or may not allow certain types of messages. You may need to adjust settings to allow "text message" type email messages. "Store Manager" password type overrides can still be processed remotely; however, no immediate notification is sent. It may still be necessary for a sales clerk to contact the credit manager or another manager independently of the notification such as if the party who would receive the notification isn't available, for example. 1The same security settings apply to both the Spruce application and the Anyware app. 2The user must be logged into the software in order to receive standard notifications (does not apply to text messages or email). Account Settings vs. Job SettingsJobs offer a variety of "override" options that determine whether to use the job's settings or the main account's. These "overrides" including options about when to trigger a credit override. It's important to point out that even if you choose to "override" the account's override settings on a particular job that the account is always checked for an over limit situation. If the account is over its limit (using the calculation shown above), its override settings are used in place of the job's in ALL situations. Only in cases where the account does not require an override but the job does indicate an override will the job's settings potentially be used. Another thing to consider is that jobs don't necessarily maintain independent balances. Account level billing customers won't have individual job balances, so any credit limit check is done at the account level in these cases. Conceptually, the account's credit limit should either match or exceed the total credit limit for all of the jobs assigned to the account. This is not enforced by code when assigning credit limits to jobs or the account since the status of jobs and number of jobs used with an account can change at any time; however, the override logic effectively does enforce this limitation. Even if a job's limit is set to an amount higher than its linked account's limit, any transaction that exceeds the account's limit will still produce an override using the account's settings. It is also not possible to have a job with the "no override" setting and a credit limit when the account has a zero limit and always requires an override, for example. Draw Down JobsIf the transaction's job is a "Draw Down PO" type job, the override calculation is done a bit differently: (Credit Limit - Charge Amount - Job Order Balance) < 0 *The "Draw Down PO" type job automatically reduces the job credit limit each time a transaction is processed. Payments don't increase the job's available credit in this case. The credit limit is used as a maximum cap on total purchases by the job. Override TypesThere are a number of situations and factors that determine when an override is produced; however, once an override is indicated, there are two types: Store Manager and Credit Manager. Each is typically assigned a different password. Credit Manager is typically considered a "higher" level override than the "store manager" and often would be reviewed remotely using the Credit Override utility. Store manager passwords are generally treated as a "lower" level override and often would be typed in during Point of Sale processing by a designated manager at the Point of Sale station. Either type of override can be reviewed and optionally issued remotely using the utility, however. Just as with other aspects of the override logic, anytime the account triggers an override, its settings (such as the "type" of override) will be used instead of the job's. Disabling the OverrideAccounts or jobs can be set to "No Password Required." This effectively disables any overrides when applied at the account level. This might be done in cases where the account owner is completely trusted but is not suggested otherwise. If used, this setting will allow the customer to charge beyond any credit limit you have established. Once again, this setting is only applied at the job level when the main account does not meet the criteria for requiring an override. For example, setting the "No Password Required" on a job won't allow the job to charge beyond the account's credit limit if the account's override type is something other than "No Password Required." |

Overrides at Point of Sale

When a Point of Sale user receives an override prompt, the following message window appears:

At this point, the Point of Sale user should stop and contact the credit manager for a remote override. They should remain in contact with the credit manager until the override is issued because no on-screen notice is given when an override has been sent. If the override window is closed after the credit manager selects the override record, the override can still be sent as long as the process form is not also closed. If the process form is closed or the override prompt is closed before the credit manager selects it, the process won't work.

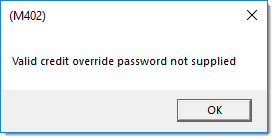

Instead of sending the password remotely (using this function), the override code can be typed in directly at Point of Sale by either the credit manager or the person processing the sale (if they know the override password). Once a remote override is processed by the credit manager, the sales clerk should click on the "remote" button. The charge sale or customer order should then process. If the user enters an invalid password or the remote override is denied by the credit manager, the following message will appear:

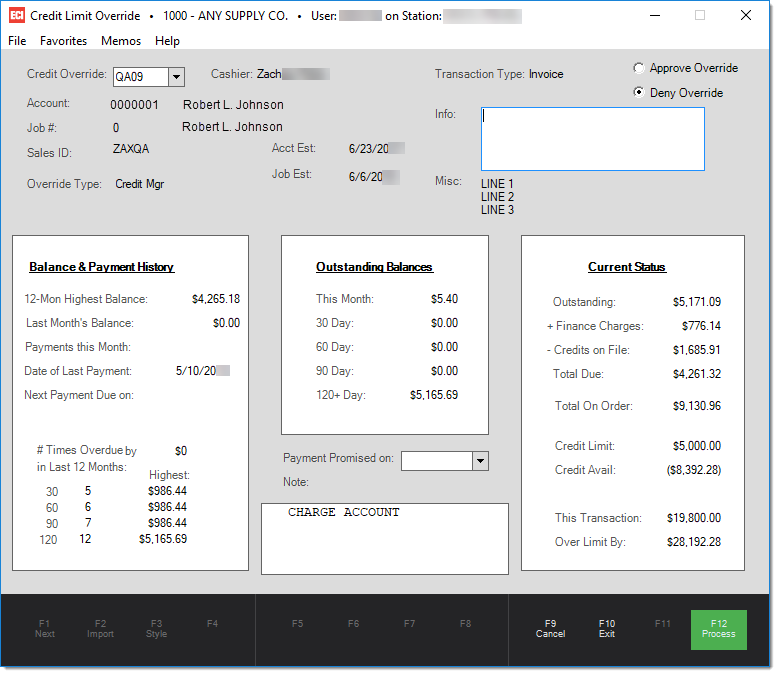

Using the Credit Override Utility

The Credit Manager can use the override utility to either approve or deny an override for the customer based on their credit history. This are also allows a note to be attached to the override and if payment is promised by the customer, the "promised payment" and "payment note" fields can be updated directly from the utility. Promised payment dates are used by the Past Due report located under Receivables. Mark the "Approve Override" radio button and press F12 to process the override and allow the Point of Sale user to complete the sale. If you choose "Deny Override," the Point of Sale user won't be able to complete a sale as charge, but can still process the sale using another payment method.

Balance & Payment History

This section lists historical information about the account such as how many times they've been overdue over the past 12 months, for example. The year-to-date (YTD) highest balance is the highest balance at the close of a billing period over the past year (not necessarily their highest balance at any given time). The Last Month's Balance is the balance as of the customer's last statement. Payments this Month is the total of payments made so far this month. Date of Last Payment is the date of the most recent payment (doesn't include credits or adjustments).

At the bottom of this form panel is an overdue table. A system-wide parameter exists for the minimum overdue dollar amount. The dollar amount of this parameter, in place at the time of billing, determines whether or not an overdue balance is recorded as such. If an account is overdue, but below the parameter's dollar setting, no overdue balance will be recorded.

For example, if at billing time, customer ABC has a 60-day balance of $75, but the overdue minimum is $100, the 60-day overdue counter will not be incremented. If the same customer's 60-day balance was $125, the 60+ overdue counter would be increased by 1 and the "highest" balance for the 60-day overdue record would be updated if the $125 is the largest dollar amount in the 60-day balance during a billing period in the past 12 months.

Overdue tables represent a "rolling" 12-month period.

Outstanding Balances

Outstanding balances take all of the job's A/R activity and break it down into aging periods. Balances don't represent what the entire account owes, just the project. "This month" represents the current cycle (activity since the last billing only), 30-days is the prior billing period (really this is A/R activity that is between 1 and 30 days old), 60-days (A/R activity between 31 and 60 days), 90-days (between 61 to 90 days), and 120+ days (anything older than 91 days).

Accounts are aged immediately after statement documents are generated. This means that charges that were printed as current on the statement will now appear in the 30-day figure, but may not be 30 days old yet. They will be 30-days only if these charges aren't paid by the close of the next billing period. It's important to understand this distinction... balances are reported as they would be if the future billing period were being closed now and are not based on the actual age of the balance.

Current Status

This lists the overall status of the job and lists the overall balance, plus finance charges, less open credits (credits not yet applied), and the net total due. The order balance for the job is listed. Order balances The job's credit limit and credit available is listed. Negative figures are shown in parentheses, so if the available credit appears enclosed in parentheses, the job or account has passed its limit.

This area also displays the current sale or order total and the amount over the limit this transaction would place the customer.