Cost Reserves

Companies may want to reserve or set aside funds for future projects, emergencies, cost of doing business, anticipated shrinkage, or to simply build up retained earnings or equity. This is also sometimes referred to as building a “war chest.” Beyond basic budgeting, there is a way to use the Adjustments feature in the SpruceWare.NET software to automatically allocate amounts to your company’s cash reserve, surplus, or “war chest.”

If used, this process will inflate the cost recorded for some or most received goods depending upon how you choose to apply it. This essentially “reserves” a portion of the expected profit from the future sale of those products. This temporarily increases your inventory valuation since the weighted average costs and asset inventory value of the goods are increased. It also lowers your reported profit/margin when and if those goods are eventually sold.

The reserve would still be reflected on financial statements as net income and retained earnings. Mapping, as well as any tax considerations, should be discussed with your company’s accountant before using the option. It is your company’s responsibility to meet all legal requirements related to reporting your income. This document provides some examples, but there are several possible ways you might choose to use/apply this feature.

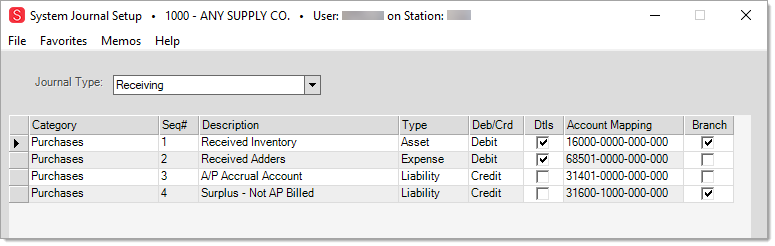

There are currently 5 standard or “system” journals which are used to generate ledger entries on a daily basis as long as software activity requires their use. One of these system journals, named “Receiving,” provides the mapping used when goods are received into inventory. Typically, this causes ledger entries for your asset inventory and accrual accounts as well as any applied adjustments (aka. adders) which are typically mapped as expenses. A fourth (4th) option is presented in the mapping for the Receiving journal named “Surplus – Not AP Billed” (see below):

The account mapped to this 4th category is only used with a particular type of “adjustment” and is intended for any “reserve” applied to the cost of goods we receive. To use this feature, you need to create one or more adjustment codes specifically for this usage.

There are currently 4 categories of adjustments found in the SpruceWare.NET application: Point of Sale, Manufacturing, Purchasing, and Receiving. The last category, “Receiving,” is only available and applied when goods are received. This is used to adjust the costs of products you receive and optionally bypass the billing process in Payables (by checking the “Do Not AP Bill” check box). “Receiving” type adjustments can be associated with one or more vendors if you want the adjustment to automatically be added; otherwise, it must be manually specified. This adjustment type is neither applied nor available for use on purchase orders; however, it operates in a very similar fashion to Purchase Order adjustments.

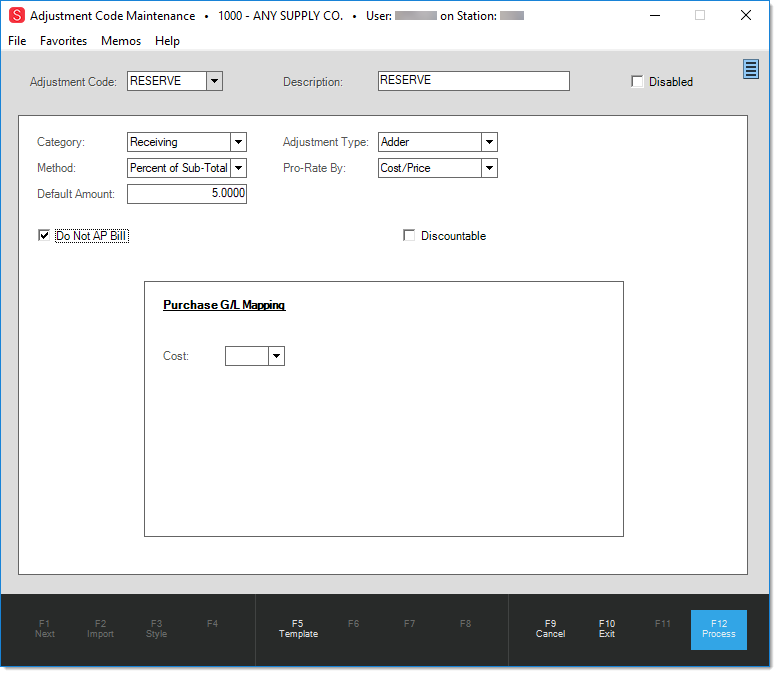

The Adjustment Code Maintenance form is used for adding, modifying, and deleting or disabling adjustments. This is available from the Purchasing, Inventory, and Point of Sale areas’ Database menus.

Here are some suggestions to help you set up the adjustment code(s):

•The category must be “Receiving.”

•The “type” of the adjustment will be an “adder.”

•You can choose whichever “method” meets your company’s needs (see the “Possible Applications” section that follows).

•The “pro-rate” choice is subjective as well, but most companies would likely choose to prorate by Cost/Price (the “do not apply” would negate any benefit from the adjustment in this particular case, so it wouldn’t make sense to use that option).

•“Default Amount” can be left $0.0000 for manual entry or a percentage if your method is based upon that (remember, you can create more than one adjustment code that can be used in different situations as necessary).

•The “Do Not AP Bill” must be selected to use the “reserve” or “surplus” mapping. The “Purchase G/L Mapping” is not used if the “Do Not AP Bill” is checked, so no selection is necessary.

Receipt adjustments can be linked automatically with receipts by assigning the adjustment as a default for one or more vendors, or the adjustment may be manually added during receipt processing. It is possible for a user to remove any adjustment prior to processing. Default adjustments can be assigned to vendors from the Vendor Maintenance form individually or globally using the “Vendor Global Modify” utility found under the Purchasing area’s Utilities menu.

Possible Applications

Some companies only use the adjustment to retain cost savings in their “reserve” when they’ve received a special price but don’t want that price to be reflected in the items’ new weighted average cost, for example. This use would require a “manual” amount method of entry. Amounts would have to be designated by the user during the receiving process. Adjustments are applied overall and not by item and are typically prorated by cost or some other method. For this reason, you might have to individually receive certain products unless there’s a known “total savings” for a group of products you’ve purchased.

It’s also possible for the adjustments to be used more frequently in order to artificially lower margins in order to reserve a portion of the profit for business expenses, future purchases, or equity, etc. In this case, your company would probably use a percentage calculation for the adjustment and possibly assign the adjustment to some or all vendors as the default (so that it wouldn’t have to be manually specified for each receipt).

It’s up to your company’s management to decide how and whether to apply such adjustments.

Example

Here is one example illustrating how the reserve might be used. In our example, we are using a special Cost of Goods Sold (COGS) account for the reserve. This makes sense since Cost of Sales would be inflated by any “reserve” adjusted items we sell; however, it’s not necessarily the only way to do this. The default mapping for the “surplus” account is a liability.

As mentioned, we strongly suggest that your company consult with your accountant prior to implementing this feature. Our example deals with a specific item, with the intention being to keep the illustration as simply stated as possible. We leave out sales tax and other aspects that would normally be in the mix intentionally for this reason.

1.A new item, SKYHOOK, is received from a vendor free of charge as part of a promotion. The SKYHOOK normally retails for $19.99 and would cost your company $10.47 to purchase it in the future.

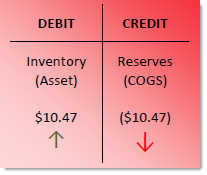

2.The SKYHOOK is received individually, and a manual amount “reserve” adjustment is applied to adjust the cost from zero to $10.47. Inventory value is increased by $10.47.

3.That evening, the automated journals record the change in inventory value. No accrual entry is created because the item had no cost as far as Payables is concerned.

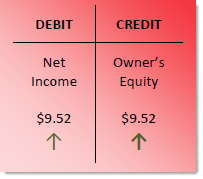

4.All ledger entries must balance between debits and credits; however, a balance is also maintained for Balance Sheet accounts (assets & liabilities) using the Owner’s Equity (aka. “Retained Earnings”) account as well as for Income Statement accounts (expense, Cost of Sales, income, etc.) using the Net Income account. These accounts are automatically affected when there is a net difference between the total asset entries vs. liabilities –or—when there’s a net difference between the income statement accounts. If differences exist, the Net Income and Owner’s Equity account reflect the differences once the journal entries are posted.

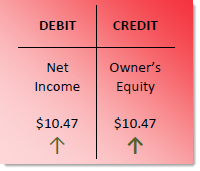

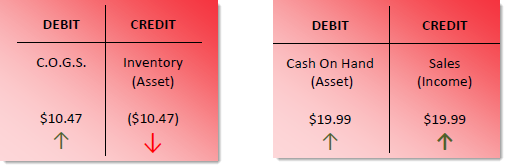

5.The next day, a customer purchases the SKYHOOK. Due to the adjustment, the item has a weighted average cost of $10.47. The customer pays $19.99. A profit of $9.52 is recorded for the sale. Cost of Goods sold is increased by $10.47 and inventory is reduced by $10.47. Income is recorded for $19.99 as well as Cash On Hand by the same amount.

6.At this time, the net increase to our income is the full $19.99 since we didn’t actually pay anything for the promotional product. The ledger value of inventory no longer reflects the item’s cost and our overall cost of goods sold is now a net of zero (taking the “surplus” account into consideration). Once these entries are posted, it results in another automatic entry to both the Owner’s Equity (Retained Earnings) and Net Income accounts increasing each by $ 9.52 (see below).

Our example is now complete; we have recorded a net increase in both “net income” and “owner’s equity” for $19.99 (each). Because our “reserve” account is a Cost of Goods Sold type account (functions the same as an “expense” type), the balance will automatically be cleared to zero once the last cycle of the fiscal year is closed; therefore, there is no need to adjust the amount. If you were to instead use a liability account for the “surplus” mapping, some type of adjustment, or a payable that uses the “surplus” account as an offset, would be necessary. Once again, the mapping and method you choose to apply this feature is at your company’s discretion, but can change the process from what we’ve described here.

It’s important to point out that the balance of the “surplus” account only represents the amount you hope to reserve, not any actual savings. Actual savings are not realized until the “surplus” adjusted goods are actually sold, and these sales do not affect the surplus account’s balance. The savings would only be reflected in Net Income for the fiscal year and Retained Earnings. Again, the surplus balance does not reflect any income earned.

Ultimately, any “reserve” is on paper and won’t be much use if your company decreases its equity and net income by other actions. The surplus merely represents a difference between the actual or real cost of purchased goods and the cost value recorded financially for those goods. Basically, you are pre-allocating future profit from the sale of the goods to which the reserve adjustment was applied.

Using the Reserve

After the fiscal year is over, your retained earnings balance is carried over to the next fiscal year. The beginning balances for the Net Income account and all other accounts that don’t appear on a “balance sheet” financial statement are cleared for the new fiscal year.

At this point (or anytime), it is possible to reduce retained earnings via a manual adjustment to take an “owner’s draw” or profit shared distribution/dividend. A manual journal would be required which would involve a debit to the owner’s equity (aka. Retained earnings) and require creating a temporary expense account to be the credit offset for the reduction in owner’s equity. If you were to issue a Payables check for the owner’s draw, it would then debit the temporary expense and credit your bank account (usually mapped to an asset account).

Assuming that all banking activity is recorded in the SpruceWare.NET ledger, your bank account (asset), or receivables, will reflect the additional income earned as a result of your reserve. You could instead take the savings and use it for other expenses or purchases which could then potentially lower your owner’s equity (aka. retained earnings).

It’s important to realize that any profit realized via the “surplus” adjustment is immediately reflected in either cash or receivables once the goods are sold, so any time your company draws from that “cash,” it reduces your surplus. In other words, if your company spends too much money, there won’t be any surplus.