Commissions Inquiry

This inquiry provides the ability to calculate and view prospective commission amounts for a user, document, and specified date range. System Administrator and Point of Sale Administrator type users have the ability to view commission calculations for any user and document. Users who are enabled for commissions and not an administrator are only allowed to view commissions for documents where their user is associated with the transaction as the assigned, order entry, or cashier user. In addition, when viewing the details for a specific transaction, any other users information will be hidden (unless the current user is also and administrator). Access to this inquiry may be limited by user security as is the case with all transactions and forms. Administrator users can select disabled users for inquiry (available with release 12.0.25 and later).

|

All commissions figures are calculated "on the fly" by the inquiry and are not maintained as data. This means that if a user's commission parameters are modified, it can change the commission amounts shown. Furthermore, actions such as cost corrections, do change commission amounts or adjustment calculations that are based on margin rather than gross sales. This may result in a higher or lower commission depending upon the direction costs are adjusted. Commissions figures are estimates only based on the current status of the invoices and users involved. Each company decides if, how, and when commissions are to be paid. No tracking of paid vs. not paid commissions is provided. |

In addition, the payment status of an open-item invoice, C.O.D. invoice, and Installed Sale contract may be considered when commissions are calculated. Commission amounts may be reduced or eliminated for open items that are not paid in timely manner. Your company may base its commissions (if any) on other factors not considered by this inquiry. Any rules regarding if, how, and when commissions are paid are made entirely at the discretion of your company's management.

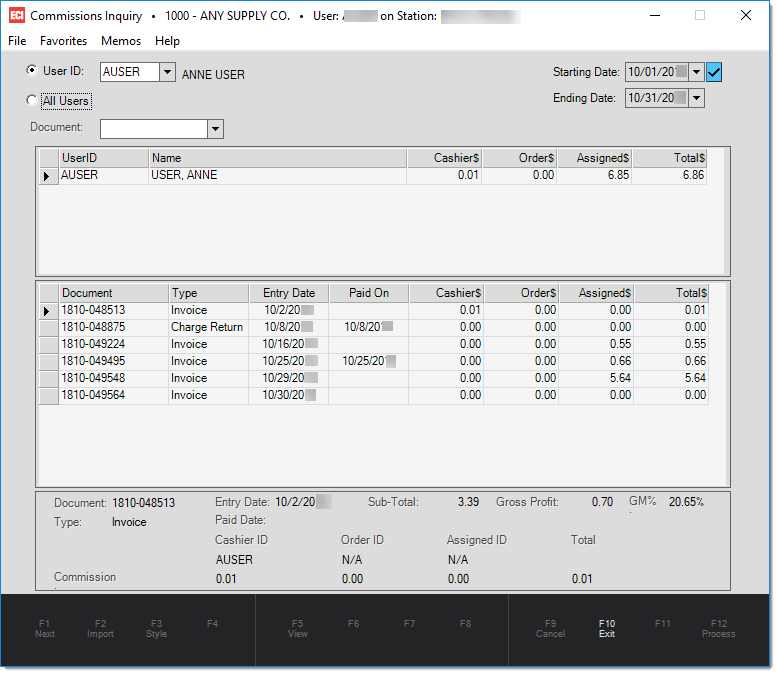

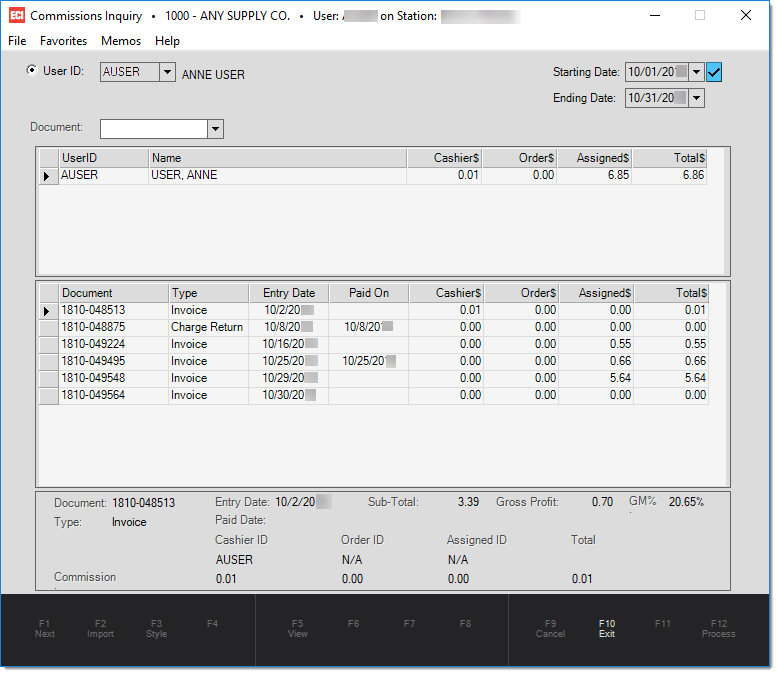

When a user isn't an administrator type, they won't be allowed to change the user or be provided with the "all users" selection. Furthermore, although all applicable document types are available for selection, once selected, only those documents where the user is eligible for commission on will provide any details (the user must be at least one of the following: assigned, order entry, and/or cashier user). Below is an example of what a non-administrator type user would see (for their own user):

*If the current user is not allowed to view costs and margins, the gross profit and GM% will not be displayed in the bottom "details" panel. Additionally, the calculation details pop-up (explained more below) won't be available.

Here are a few points regarding this inquiry:

•Invoice Types that are included for commissions inquiry and calculation are: Invoice, Charge Return, Direct Ship Invoice, and Installed Sale Invoice. Unpaid COD's, canceled invoices, and in-progress transactions are either not allowed for selection or included in the grid.

•Date selection is based on the entry date of the document, not the paid date.

•Commissions are calculated for the selected range of dates and user(s) as configured at the current date and time. Commission amounts are neither saved nor recorded, so the figures shown here may change at any time. Changes to a user's commissions parameters, cost corrections, charge backs, merges, and late payments can all possibly affect the commission calculation.

•An adjusted sub-total and adjusted total cost is used for commissions calculations. The subtotal does not include sales tax. The subtotal and total cost are also both adjusted for any item types that are considered "adjustment items." These include gift cards, labor, freight, rental, stored value, deposit, and delivery. Positive adjustments (adders, etc.) are also removed from the subtotal and total cost (when the adjustment has a cost). Document cost corrections also adjust the total cost either up or down.

•Commissions are based on either gross sales (a percentage of the adjusted sub-total) or gross profit (a percentage of the profit only which is calculated from the adjusted subtotal less the adjusted total cost). Only the base commission is determined this way. If a user is assigned a basis of "gross sales," their commission can still be reduced based on profit if you also assign a commissions code with a defined gross margin range.

•Commissions may be adjusted based on the margin (percentage of profit) of the sale. Lower margin transactions may receive less commission than those with higher margins. It is possible for this to result in no commission, a commission that's lower than your base amount, or a commission that's the same or higher than your base amount.

•Commissions may be adjusted based on the payment status of the invoice. This only applies to open-item charge invoices, installed sales, and C.O.D. sales. The paid date is used to determine the payment period in days. Paid date is automatically set to the entry date when no paid date is set and it is determined that the paid date cannot be determined or does not apply to the transaction.

•The "not paid" aging on invoices that have not yet been paid is done based on the current date. The actual payment time frame cannot be predicted, so the commission amounts calculated are likely to change and should be considered "pending" if your company only pays commissions on "paid" items.

•Paid Date is only set for invoices certain circumstances. When set, the paid date is sometimes used to determine the age of the invoice and may be used to adjust the amount of commission calculated. Most transactions that don't involve a "charge" amount won't have aging considered. Here are some situations where the paid date may be set:

▪Paid date is set when an invoice for an open item account is paid (meaning either a payment or a credit is applied to the charge in Receivables, Posting).

▪Paid date is set immediately for charge returns when they are processed.

▪Paid date is set when a C.O.D. (Cash on Delivery) transaction is paid in full.

▪Paid date may be set automatically to the current date during processing for balance forward and cash-only customers in some cases; however, this is not usually done. The inquiry treats these items as paid on the Entry Date.

▪The inquiry treats any invoices for open-item customers that don't involve an "account" charge amount as paid immediately (cash, bankcard, check, and other non-receivable payment methods).

•The "assigned" user associated with a Point of Sale transaction (invoice) can now be modified during processing in some cases (if user security permits this). If done, the Assigned User associated with the transaction may not match with the user assigned to the account or job.

•Negative margins result in no commission rather than a negative commission. A negative margin is only calculated when the total cost exceeds the subtotal (after adjustments). This is possible with both credits (returns) and invoices. A negative margin would happen if you sold an item (having some cost) with a zero price, for one example.

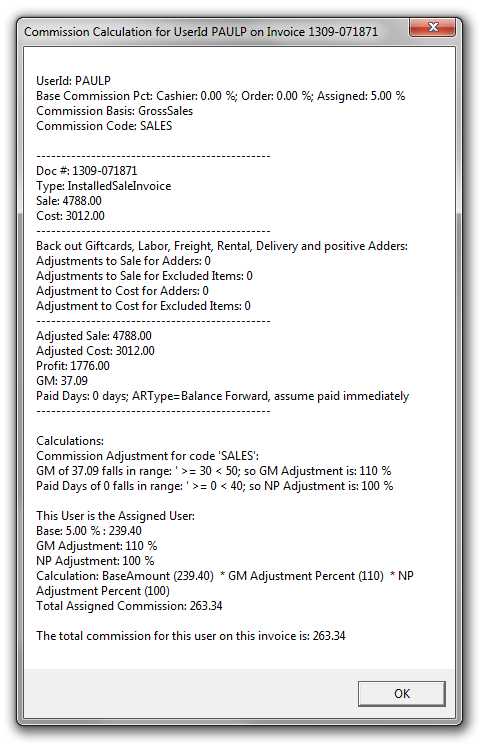

Calculation Details

An especially helpful aspect of the inquiry that is not obvious at first glace it the ability to view the details regarding how a particular document's commission was calculated. This is done by double-clicking on the selection row (far left-hand column) in the grid displaying documents. If done, a separate window is opened displaying detailed information about how the calculation was done. Users who do not have access to view margins and/or costs will not be able to access this feature.

Commissions Inquiry: Calculation Details (for a Selected Document)