Transfer A/P

To record a purchase (accrual) or expense prior to payment, you can transfer payable invoices to the ledger (optionally). This utility allows you to select the Payables invoices and credits for transfer, but does not immediately generate any account entries unless you select the Transfer Now check box. The term "transfer" is used to describe the process of creating ledger entries that affect the Account Payables (A/P) liability account balance on one side and either an expense or accrual balance on the other. This AP transfer records the purchase (accrual) or expense financially and adjusts the liability balance representing what your company owes. Transferring neither records nor processes any invoice payments. Payment is separate process; however, payment will also trigger a "transfer" for recording the expense or purchase (accrual).

If you transfer a Payable prior to payment, payment would then be a separate transaction involving solely the Accounts Payable liability account and your bank account. Expense or accrual (inventory purchases) are included in the ledger entries when a Payable invoice or credit is marked "paid" if the expense or accrual ledger entries were not already made.

Transfer Now

Use the Transfer Now option to generate journal entries immediately for the transferred payables. This is a bit different operationally because it will result in a manual journal rather than a "Payables" journal. In addition, a separate journal is created for each invoice you transfer. Normally, there is one "payables" journal created for each cycle-year needed. In this case, we don't combine invoices (and credits) together for cycles, and just create a separate manual journal for each. The journal's description includes the payable's document ID (not the invoice number):

Manual move of AP Bill 1606-633832

The intention of this feature addition is to provide a way for a company to move all their Payables to the ledger without having to wait for nightly processing when comparing their ledger payables to the open payables (or comparing accrual to inventory). Reversal of any immediately transferred payable does not eliminate or automatically undo the manual journal that resulted from the original payable's transfer.

|

Users who want to match their open payables with the Accounts Payable liability in the ledger (or accrual to open inventory receipts) should transfer all open A/P prior to balancing (and post all entries affecting the A/P liability account in the ledger). |

Payables invoices can be transferred using any of three methods:

1.Whenever an invoice is marked paid, the resulting ledger entries recording the expense or purchase (accrual) are generated at the same time.

2.Open invoices can be selected for early transfer by using the GL Transfer Eligible check box from the Billing Entry activity in Payables.

3.This utility represents the third method and uses a grid for selection of invoices for transfer.

Statuses can be modified back and forth at any point before daily processing. Journal entries are generated by daily processing which is usually scheduled in the Task Scheduler (Maintenance > Task Scheduler) to occur sometime between business days (when your business is closed).

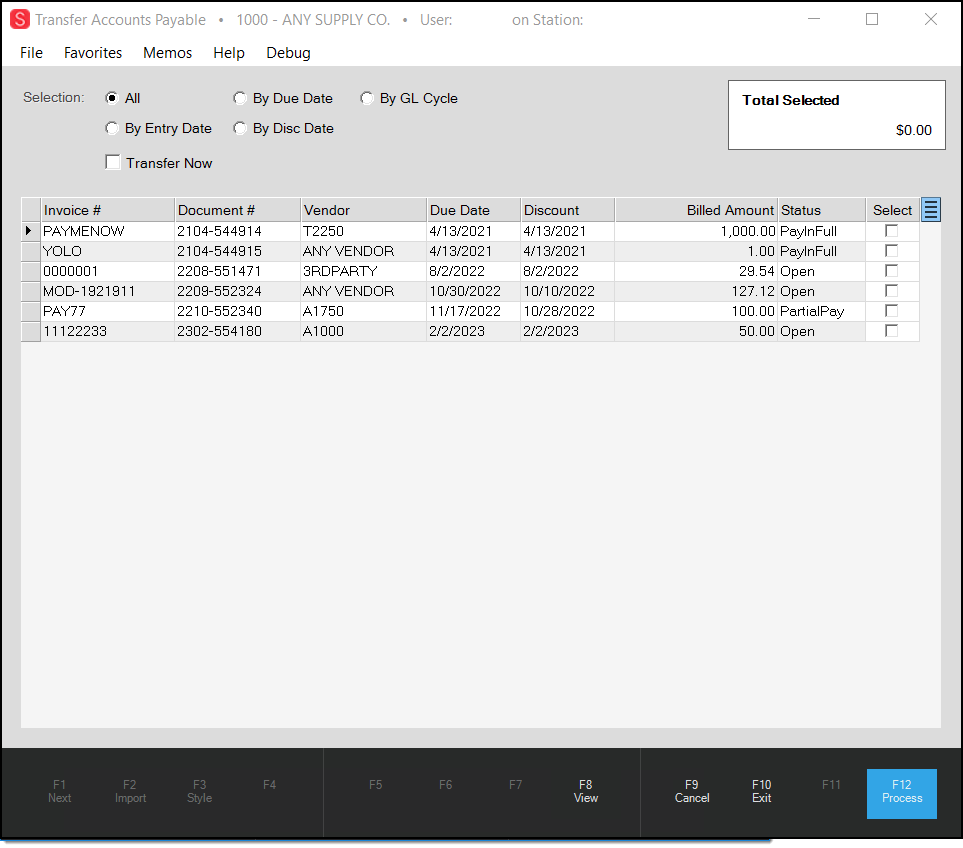

Begin by choosing a selection method. The five choices include: all, entry date, due date, discount date, and by cycle. When selecting by date, use the "through date" control to enter or select the ending date for invoice display. Usually, only invoices that have not yet been paid appear in the listing (except those that have been paid during the current business day).

Reversing an AP Transfer

You can "undo" an AP transfer of a specific open payable by choosing the "reverse and close" option available from the Billing Entry transaction in Payables.

This does not automatically transfer the "reversal" payable to the ledger. If you used the Transfer Now option on the original payable, you'd need to do the same after reversing that same payable for the "reversal" payable generated.

For paid items, use the Check Backout utility in the Payables area first and then "reverse and close" the payable.

Functions

The following functions are provided for this utility:

View (F8)

This function populates the data grid used for payables selection. Choose "view" any time changes are made to the selection criteria located at the top of the form (radio buttons, dates, etc.).

Cancel (F9)

This function cancels the current transaction if any (usually after the user responds to a dialog), clearing the form, and resetting the transaction back to its default state. The menu is not activated in this case.

Menu (F10)

This function cancels the current transaction if any (usually after the user responds to a dialog) and activates the navigation menu (on the left-hand side of the application window).

Process (F12)

Processing either updates the "transfer" selection status for payables listed in the current data grid, or immediately generates manual journal entries for each selected payable in the data grid when you select the Transfer Now check box and the payable is also selected. Journals that aren't listed won't be updated. No document is generated by selection; however, the audit information on the documents is updated when changes are made.