Tax Surcharge Feature (State of California)

On January 1, 2013, the State of California implemented a 1% tax surcharge on the sales of lumber and engineered wood products (Assembly Bill 1492). This tax was selectively applied to only certain products, so it wasn’t possible to use the current sales tax methodology in the software. To accommodate the law, we added an “additional tax” feature to the application. This feature allows a company to create a separate sales tax location for the “additional tax,” the lumber tax in this case, and link that location to other existing sales tax locations.

"This bill would, on and after January 1, 2013, in addition to any other sales and use taxes imposed by law, impose an assessment on a person who purchases a lumber product, as defined, or an engineered wood product, as defined, in this state, at the rate of 1% of the sales price. This bill would require the tax to be administered by the State Board of Equalization, as prescribed, and would require a retailer to collect the assessment from the person and remit the amounts collected pursuant to the procedures set forth in the Fee Collection Procedures Law. By expanding the application of the Fee Collection Procedures Law, a violation of which is a crime, this bill would impose a state-mandated local program."1

Any references in this document to the specifics of the law should be verified independently by your company at time of implementation since there may be changes or inaccuracies in the information we have received regarding the law.

The following points summarize information we have gathered about the law as it applies to our users:2

•The tax is administered by and submitted to the California Board of Equalization along with your sales and use tax returns. The lumber assessment schedule is only being included when using eFile, so companies who are required to collect the tax will have to use eFile to file their returns if they aren’t already.

•The lumber tax must be separately listed on printed receipts and “must not be combined with the separately stated sales/use tax or any other fees charged by the retailer.”

•The tax applies to “lumber” and “engineered” wood products with some exclusions. See the “Definitions” section for more information.

•“Deck packages (and similar packages and/or kits) are not subject to the assessment because the additional labor added (for example, to pre-cut or pre-drill lumber) removes them from the category of products typically regarded as lumber products.”

•There are four (4) exceptions to the tax surcharge (quoted from the BOE):

1. "Sales for resale when the purchaser (reseller) is not the consumer of the product."

2. "Sales in interstate commerce where the purchaser will use or consume the product outside of California."

3. "Sales to the U.S. Government."

4. "Sales involving American Indians, following the same rules as sales and use tax law as explained in Sales and Use Tax Regulation 1616, Federal Areas."

1Quote from the State of California Assembly Bill No. 1492 approved on September 11, 2012.

2Quotations in this section are taken from an Email received from the California BOE on 9/26/2012 in response to questions about the implementation of the tax.

Definitions

Additional information about which products either are or are not considered “lumber” or “engineered wood” are listed on the Board of Equalization’s web site. Please refer to the latest information provided by the State of California.

https://www.boe.ca.gov/formspubs/pub256/index.html

Setup

To use the "tax surcharge" feature, support must enable the option for your company. Other than the enabling the feature, all setup, future maintenance, compliance with the law, and reporting is solely your company’s responsibility.

To record the lumber tax surcharge financially and separate this tax from the sales and use taxes that you currently collect, add new ledger accounts for mapping cash sales tax, charge sales tax, cash returns sales tax, and charge returns sales tax (these may each be a separate account or one shared account based upon your accountant’s preference). Any accounts that you want to use for the surcharge tax can be set up at any time but should be mapped to the “additional tax."

This feature requires one (1) new sales tax location for the lumber tax surcharge. This is done from the Sales Tax Maintenance form available from the Database menu in Point of Sale. The rate is currently 1%; however, if it should change in the future, you would need to adjust it at that time. The "tax" code can be anything your company chooses; however, it will be printed on Point of Sale documents.

For existing sales tax locations (codes) already used for the State of California, modify each sales tax location and designate the new lumber tax location as the “additional tax” location.

Set the "tax surcharge" flag (check box) on all lumber and engineered wood products as required by the law (a check box will be provided on the Common, Codes tab of Item Maintenance). A global modify option for setting this flag by group/section is provided; however, your company will still need to carefully review your inventory to make sure that all required items are flagged for the tax surcharge. Some degree of manual checking and file maintenance changes will be necessary.

On the Customer Portal on the Reports Library Inventory page, there is an ActiveReports Inventory report called Items Not Flagged for Additional Tax. This report contains those items flagged (or not) for the tax surcharge. Use this report to review the items your company has flagged and to identify any products you may need to update either manually or globally.

Implementation

Branch/Company totals, standard reports, sales tax inquires, and other figures that normally include sales tax will be a combined sales tax figures that include the lumber tax surcharge. Standard inquires and reports are not modified to report the tax surcharge as a separate item, so your company will have to use ActiveReports to view the State/County sales tax separately from the lumber tax surcharge collected. The Items Not Flagged for Additional Tax ActiveReport in the Customer Portal (described above) is available to assist you.

Once implemented, applicable Point of Sale documents will list the lumber tax surcharge as a separate item from sales tax in the totals. Once again, sales tax and lumber tax surcharges are only being split out on applicable Point of Sale documents. Additionally, a plus (+) symbol will be added as the first character of the item description when the item has been marked as eligible for the lumber tax surcharge.

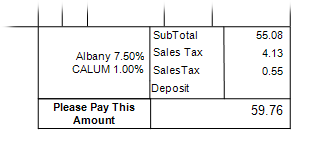

The lumber tax amount will be listed separately on invoice-style documents (not cash-tickets):

Since some transactions may not be eligible for the lumber tax surcharge, we have provided an override at Point of Sale. The override is located on the Account tab of applicable Process (F12) forms. A check box allows a user to optionally not charge the lumber tax on a transaction. We have also added the ability to manually override the taxable status of an item from the Entry tab in Point of Sale transaction folders (F4).

Security permission must be granted to those users who should have the ability to modify an item’s taxable status at Point of Sale. New security options are not enabled by default.

Based upon the schedule upon which your company is required to file your sales and use tax return, we recommend you run the Items Not Flagged for Additional Tax (California Only) report available from the Customer Portal (Reports Library Inventory page) to list the total tax surcharge assessed as well as to provide figures for the State/County taxes separately from the total tax amount (which includes the surcharge). This report will be run by branch and for a range of dates you provide. It allows item details to be optionally included.

A few points about the application of the Lumber Tax Surcharge…

There is functionality in the software that can change the sales tax calculated for a transaction. As necessary, companies may need to adjust procedures or do additional file maintenance to comply with the law.

•The lumber tax surcharge will be calculated for any taxable items which are sold and also flagged in Item Maintenance for the tax surcharge. The "tax surcharge" check box cannot be set (checked) for items that are not taxable.

•Customers who are assigned a Tax Exempt ID or transactions that are linked with a Tax Exempt ID on the “Account” tab of the Process (F12) form won’t be assessed either sales tax or the lumber tax surcharge.

•Both positive and negative adjustments (Adders) that are "taxable" affect the lumber tax surcharge calculated for an item as well as standard sales tax. Non-taxable adjustments don't change the sales tax whether the price goods are sold with is reduced or increased (only “taxable” adjustments change sales tax in either direction). According to the California Board of Equalization’s FAQ on the Lumber Tax Surcharge, "the 'sale price' does not include delivery charges, handling charges, or sales tax."

•Additionally, coupons that are applied to a purchase can be "taxable" (manufacturers) or "non-taxable" (store). Coupons that are taxable do affect the lumber tax surcharge as well as standard sales tax.

•Returns involving sales of surcharge eligible products that were sold prior to the implementation of the law will use the original sales tax as long as the item’s return is linked to an original invoice (when "enhanced" returns are enabled). Unless an “original” invoice is linked to the item’s return (again, only when using “enhanced” item returns), the tax surcharge will default to be credited to the customer. During a sale or return, users can always override just the tax surcharge from the Account tab of the Process (F12) form for any cases when just the tax surcharge shouldn’t be applied. In addition, the reversal of an invoice that does not include the tax surcharge will produce a reversal matching the tax situation of the original sale or return.

In Conclusion…

Any concerns arising that might require additional development should be reported to ECI Software Solutions, Inc. Support as soon as possible. We are not notified by the State of California of any changes, so please let us know if you become aware of any new information.

Questions regarding aspects of the law should be directed to the California Board of Equalization directly. Information included here may change at any time. The link below provides the State of California Board of Equalization web site.

https://www.boe.ca.gov