Sales Tax Handling on Point of Sale Transactions

The assignment of the sales tax location for Point of Sale transactions can be confusing because the rules that define taxes are different in different regions (U.S., CA, and U.K) and also depend on delivery settngs for those regions.

This topic applies primarily to how sales tax is handled in the United States. Taxes in Canada and the United Kingdom (UK) have a value added tax (VAT) which is paid on purchases and credited by any tax collected at Point of Sale.

Does the transaction include a delivery?

The delivery status of a transaction may change the sales tax location used. Why? In most cases, sales tax is determined by the location where the taxable goods are exchanged, not the location of the company selling those goods. Here is an example of the typical scenario:

Your company is located in "ABC" County and the sales tax is 7% and a customer is located in "XYZ" County where the tax location is 6%. When you deliver taxable goods to the "XYZ" County customer, you would charge the customer the "XYZ" County tax, not your company's "ABC" County tax. However, if the customer from "XYZ" County came to your company's location in "ABC" County to purchase their goods, they would be required to pay the 7% "ABC" County sales tax.*

*There can be cases where these rules are different. Consult your local government or a tax professional to verify the rules for your area.

Tax locations may be assigned to branches, accounts, jobs, and zip/postal codes.

Assigned tax locations are considered when a Point of Sale transaction is designated for delivery... except for cases when a tax exempt ID is present on the customer's account and/or job. The hierarchy of how assigned tax locations are usually applied (when delivery is designated) is listed below:

Tax Exempt ID/# overrides Zip Code...

Zip Code overrides Job...

Job overrides Account...*

Account overrides Branch...

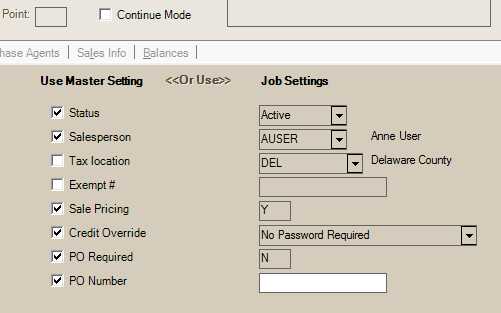

*The job overrides the accounts settings only if the "Use Master Setting" is not checked in Job Maintenance (see below):

There are exceptions to this rule...

•Some areas or companies may be provided special tax statuses for development reasons. In these cases, the customer's tax location may be used regardless of where goods are exchanged and may apply to in-store as well as delivery sales (see the Empire Zone setting in Sales Tax Maintenance). In the case of an "empire" zone tax location assigned to a customer's account or job, the empire zone code will be used for both deliveries and non-delivered sales. In the case of a delivery and the delivery zip code is assigned to another location, the account/job's assigned empire zone tax code will be used.

•In cases where the account (or job) is assigned to an Always Exempt tax location OR has a tax exempt ID assigned, the transaction's delivery status may or may not affect the tax location used. Here are six different combinations for assigned locations and/or tax exempt IDs and how they would affect sales tax at Point of Sale:

➢ Always Exempt Tax Location with a Tax Exempt ID

The Point of Sale tax calculation is not affected by the transaction's delivery status. The account/job's assigned exempt location and tax ID are used for all sales. Delivery zip codes associated with tax locations don't change the tax location or rate.

➢ Always Exempt Tax Location without any Tax Exempt ID

The Point of Sale tax calculation is not affected by delivery status. The account/job's assigned "always" exempt location is used for all sales. Delivery zip codes associated with tax locations don't change the tax location or rate.

➢"Use for Delivery" Taxable Location with a Tax Exempt ID

The Point of Sale tax location will be set to the account/job's tax location for all sales regardless of delivery status. The taxable location, although used, will not charge any sales tax due to the presence of the tax exempt ID. This sale will be classified for sales tax reporting as "exempt sales" for the taxable location. If the transaction is a delivery and the delivery zip code is assigned to a specific tax location, the zip code's tax location will be used; however, the sales tax calculated will still be a zero amount and treated as "exempt sales" for that location (even though the location is normally taxable).

➢"Use for Delivery" Taxable Location without any Tax Exempt ID

The Point of Sale tax location will default to the branch's assigned tax location. If the transaction is designated for delivery, the tax location will be changed to the tax location assigned to the account/job (unless the delivery zip code is assigned a different tax location which would override this).

➢Non-delivery Taxable Location with a Tax Exempt ID

Due to the tax exempt ID, the taxable tax location is used as the default for Point of Sale transactions but will calculate no sales tax and will be recorded as "exempt sales" for the tax code. If a delivery is specified, the tax location may change if the zip code is assigned to another location; otherwise, the tax code remains the same.

➢Non-delivery Taxable Location without any Tax Exempt ID

The assigned job or account tax location will not be used even if delivery is specified. If designated for delivery and the delivery zip code is mapped to a specific zip/postal code, the zip code's assigned tax location would be used.

Sales Tax and Item Settings

Items can have a tax status as well. In the United States, items are assigned a taxable status of either Yes, No, or Always. In Canada, items have these same options but additional ones for GST taxable (Goods & Services Tax) and a provincial tax exemptions.

•Products assigned a taxable status of Y (Yes) are included in the taxable total for a Point of Sale transaction and will be charged sales tax as long as the sale is not considered exempt.

•If the inventory item is assigned a taxable status of N (No), the item will not be included in the taxable total and no tax will be charged on that item's portion of the sale total. Depending upon your location, some products are not taxed. Some potential examples of non-taxable items are food/grocery products, bottle deposits, US flags, and clothing.

• Always taxable products are items that don't qualify for any sales tax exemption. This may include luxury, vice, and other excluded type items (jewelry, candy, cigarettes, and alcoholic beverages, are possible examples). These items be assessed sales tax even if a tax exempt ID is associated with the transaction (Note: No tax would be calculated if the tax location is also "exempt" or has a zero tax rate).

Sales of non-taxable items are separately categorized as "non-taxable" on sales tax reports and in inquiries.

*Tax rules regarding the taxable status of various products can vary based upon your region, so always check with your local government or tax professional if you have questions.