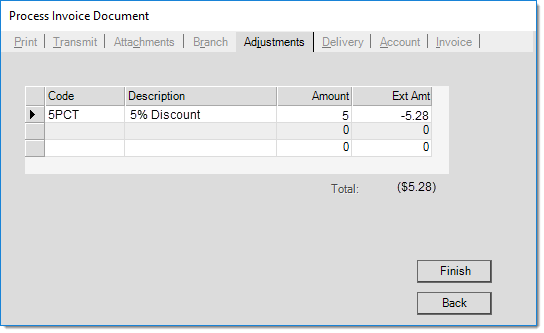

Adjustments (Sales)

Adjustments are used for entering miscellaneous charges (fuel, tarping, etc.) to be applied to the sale. Up to 3 adjustments may be entered per transaction. Adjustment codes must be defined before use and may be applied to pricing based on a number of both methods and apply choices (determined when codes are set up). This is done from the Adjustment Code option listed on the Database application menu. For more information about adding, modifying, or deleting adjustment codes from the Database see the topic Adjustment Code.

Adjustment codes can be designated for Manufacturing, Point of Sale,Purchasing, or Receiving use. "Point of Sale" types may be designated as either taxable or non-taxable. Check with your tax department or a tax professional to determine whether sales tax should or should not be charged on the adjustments your company uses.

Branch totals reflect adjustment totals and cost (if any) for the branch receiving credit for the sale (which may be different from the branch supplying the goods). Financially, the ledger also records adjustment income and expenses for the same branch (where the sale was credited). Inventory totals by item don't reflect adder amounts or costs. This is important to realize when comparing total inventory sales and cost for a period with branch totals.

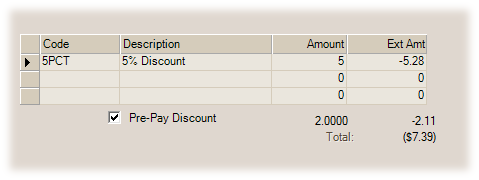

Pre-pay Discounts

An option exists to allow customers who have receivables accounts to receive their statement discount on cash-type transactions. A parameter enables (or disables) this feature. When enabled and if a receivable's customer is paying cash,1 the sales clerk can choose to discount the sale by the customer's statement discount percentage. A customer is only eligible for this when they have a discount percentage above zero, no overdue balances, and no unpaid finance charges. Only the discountable total of the sale is eligible, so if the sale contains NET items, those would not be used in the calculation of any discount.

Pre-pay Discount Applied

If all required conditions are met, the sales clerk can optionally choose the "pre-pay discount" check box to calculate and apply the statement discount to the cash sale.

1A "cash" sale is considered any cash-type payment method other than a receivable "charge," and therefore includes checks, bank cards, etc.