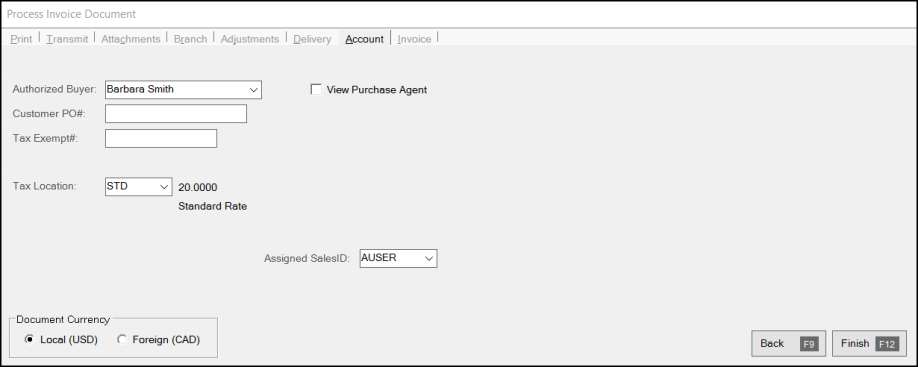

Process Document > Account Tab (Sales)

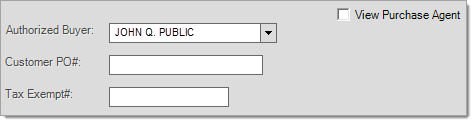

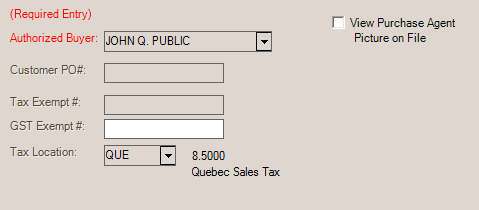

The Account tab lets users select or view authorized buyers, enter the customer's purchase order or tax exempt numbers (if both or either), and view or change the tax location.

Sales: Process Invoice Document > Account Tab

Modifying the sales tax location on this tab also changes the tax location used by the Invoice

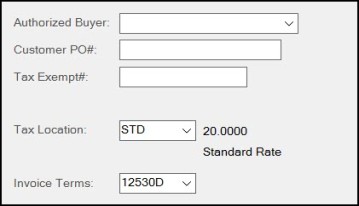

Point of Sale (POS) Invoice Terms

If your user's security permission allows, you may be able to modify the "assigned" user associated with the current transaction. This may be done for reporting or commissions reasons. Changes to the user do not affect either the "cashier" or "order entry" (if any) user associated with the sale. If this feature is enabled, invoices or sales totals for accounts assigned to a particular user may no longer match the totals shown in inquiries or compared on reports.

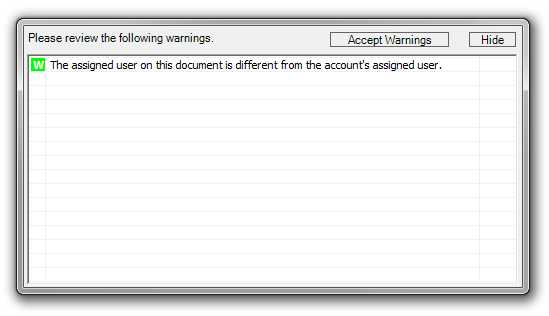

Changing the Assigned User

If the assigned user is changed, a new task list warning will be generated. This can be downgraded to "hidden" or increased in severity to an "error" at the discretion of your company's system or application administrator.

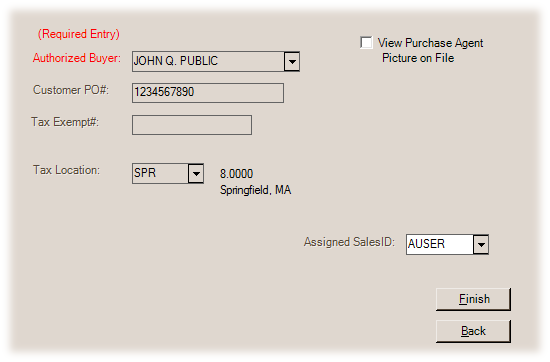

Authorized Buyer

"Authorized Buyer" refers to the "purchase agents" assigned to either an account or job. If either the customer's account or job has purchase agents defined, the selection (or entry) of a purchase will be required. If an "Enter Name" purchase agent exists on the account or job, manual entry of a name will be allowed; however, if not, you must pick an existing name from the drop down list.

Manual entry of a name is allowed if no purchase agents are defined for either the account or job; however, the names entered are not saved with the account or job for future use. Any name entered is retained with and displayed on the document.

The check box labeled "View Purchase Agent" can be used to display a photograph of the buyer (if available). If a picture is available, the text "Picture on File" appears below the check box (unless a photo is already being displayed). Using photographs helps verify the identity of purchasers.

Customer PO#

This is used for designating a purchase order number that is supplied by the customer. Companies and government agencies you do business with may required that all transactions have a purchase order. If so, this field may be required based upon either the account or job settings (see the Require PO setting).

Tax Exempt #

If an account is exempt from paying sales tax, they typically supply some sort of documentation/certificate that contains a tax exempt ID number. You can save this tax exempt ID with either the account or job, or both, or you can enter it manually during a Point of Sale transaction. When a tax exempt ID number is specified, the application does not apply sales tax to the transaction (except when the transaction includes "always" taxable items). Tax won't be charged on taxable items regardless of the "taxable" status of the location is indicated. This is why "exempt" sales totals may appear with taxable locations on sales tax reports. Always taxable items are charged sales tax regardless of the account's exempt status (as the transaction may include "luxury" type items such as candy, soda, etc.).

In cases where an account is tax exempt, but assigned to a taxable sales tax location, we formerly used the account’s tax location regardless of delivery status. Due to the possibility that “always” taxable items could be involved in a transaction that is not being delivered, we have changed this logic. Now, if the account is tax exempt and the transaction does not include a delivery, we use the branch’s default tax location and not the account’s/job's. In the case of a transaction's delivery, the account/job’s tax location would still be used. This helps to ensure that “always” taxable items are being taxed at the proper rate and for the correct jurisdiction. If the account is assigned to an exempt tax location as well as an exempt ID number, both will be used for the Point of Sale transaction regardless of the delivery status.

Having a tax exempt number does not necessarily change the tax location automatically. In some areas, it will be best to assign exempt customers to a tax exempt location for tracking purposes. In others, having a mix of taxable and exempt sales for the same location is acceptable. This may be a requirement or just a preference depending upon your location.

Tax exempt numbers are printed/displayed on most Point of Sale documents and can be assigned to an account or job so that they don't need to be manually entered during Point of Sale transactions.

GST Exempt #

GST Exempt #

One additional field is supplied for Canadian users: GST Exempt #. This field is used to designate an tax ID number used for exemption from the GST or "Goods & Services Tax." The GST is a federal tax. In some cases, the provincial tax includes the GST, in others it does not.

Tax Location

This is the tax location used for calculating sales tax. Tax locations are assigned a percentage which is used to calculate sales tax amounts based upon the taxable total of the transaction. In the case of customer orders, the tax is an estimate and may change due to later modifications. If a tax exempt number is also specified, the sales tax percentage will be set to zero regardless of the normal percentage assigned.

The tax location is changed automatically in some cases. Tax locations may be assigned to accounts and jobs; however, these are usually only used in cases when a delivery is designated, a tax exempt number is also linked with the account and/or job, the tax location is always exempt, or the tax location is for a designated development (empire) zone.

For delivery orders, the tax location can be linked with a zip (or postal) code. If the delivery zip/postal code is different from the current tax location and the sale is not exempt, the tax location will change to match the zip/postal code's assigned tax code.

Note: modifying the sales tax location on this tab also changes the tax location used by the Order

If shown, this drop down field defaults to either the job or customer's default terms code. This code can be modified prior to processing the sale. Terms code determine the period for discount eligibility as well as the percentage and also determine when a particular invoice will be assessed finance charges. Invoice terms are only available for open item type charge accounts. Terms invoices are not aged any differently than other invoices. This is an optional feature that must be enabled via a parameter before using. The "Invoice Terms" and "Discountable" fields will only appear on this tab if the customer is eligible and has been assigned a default terms code.

Discountable

This field is only shown if the customer is eligible and has been assigned to a default invoice terms code. The "discountable" amount determines the dollar amount that a discount (if any) will be based upon. To receive a discount, the invoice must be paid by the discount date determined by the terms code assigned to the invoice. The discountable amount cannot be set higher than the transaction's discountable total (the non-net total of all items) and defaults to this figure whenever the discountable amount changes. The discountable amount may or may not include sales tax (whether it does is determined by a parameter).