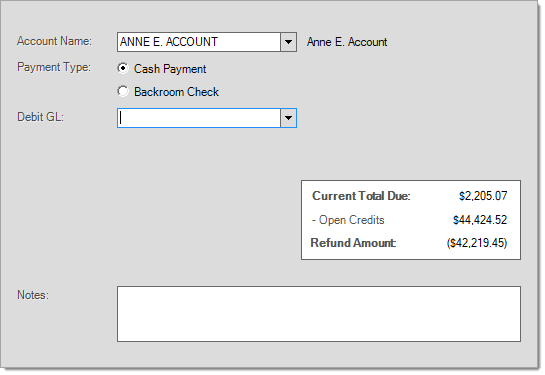

Refund Acct Balance

The purpose of this feature is to provide an easier way to refund a credit balance from a receivables account. Customer (account) selection is only allowed for customers with a credit balance, and no changes to the refund amount are permitted. If used, the entire credit balance is refunded. Users can choose between two (2) methods of refund: cash payment or backroom check. Select of a "debit GL" account is required. A debit adjustment document is generated by processing as well as a payout document if returning cash. Adjustments are not automatically posted at time of processing; however, the net due would immediately reflect the debit.

Payouts, Refund Acct Balance

Account Name

This control is used for selection of the customer's receivables account. This can be done by name or using the account ID (or alternate selection methods). No job selection is provided here even for job billed customers. To post the credit balance to the debit adjustment or balance, use the "consolidated" option provided in the Posting form (Main Menu > Receivables).

Payment Type (Refund Method)

Choose either the "Cash Payment" or "Backroom Check" method for the credit balance refund. "Cash refunds" affect the current station's or user's assigned cash drawer whereas "backroom check" does not. A "backroom check" is meant to be used when your company plans on issuing a refund by check to the customer in place of any refund from the drawer ("backroom check" refunds don't alter the cash drawer balance). A vendor with a code of MISCPOS must exist if you plan on using the "backroom check" option. Debit GL selection is not required and is hidden when choosing the "backroom check" refund method.

Debit GL

A selection is required only if choosing the "Cash Payment" selection. No debit selection is required in the case of "backroom check" as the default mapping for refund checks is used. The account selected provides the "credit" offset to the debit made to the accounts receivables asset account. Detailed mapping for receivable "debit" adjustments must be done prior to using this feature (

Notes

Notes are optional. If used, they will be associated with the debit adjustment document generated by processing. Notes are not included on the Payout document (cash refunds only).

Process (F12)

To complete the refund, choose Process (F12) and Finish once the form appears. Please note: no payment options are provided; this is intentional. The return method is based on the radio button selection in the main form (either "cash" or "backroom check").

General Ledger Considerations

Processing a credit balance refund impacts GL in different ways depending upon the refund method. Two (2) documents are always generated by processing; however, the type of document varies based on the refund method chosen.

•For cash refunds only, a payout document is generated. This debits the cash refund account (Point of Sale system journal, sequence #28) and credits sales revenue for cash or cash exempt returns (#20 or #25).

•For backroom refund checks, no payout document is created. Instead, a payable is generated with an expense offset of the refund checks account (Point of Sale system journal sequence #28).

In both cases, an additional debit adjustment document is generated. For a cash refund, debit adjustment mapping (Accounts Receivable system journal sequence #5) provides the debit side of the adjustment while your selection in the Payouts form provides the other (credit) side. For a backroom check refund, the debit adjustment offset for Accounts Payable is the Refund Checks account mapped in the Point of Sale system journal (sequence #28).